Meituan Hotel and Travel, the “winning” side of the coin

![]() 09/11 2024

09/11 2024

![]() 508

508

Room rates were altered again by Meituan without consent.

Lin Jing, who works in the hotel industry in Sichuan, vividly remembers a day in August this year when the room rates on Meituan for her hotel suddenly dropped from 238 yuan to 130 yuan, the lowest price the hotel had ever offered. After confirming that no hotel staff had made the change, she urgently called the Meituan account manager only to be told that it was the result of the price adjustment assistant, a tool that the account manager couldn't reverse. Frustrated, she filed a complaint with Meituan headquarters via the merchant service hotline, only to be informed that it was a normal operation by the account manager and that the merchant had failed to maintain price uniformity from the user's perspective.

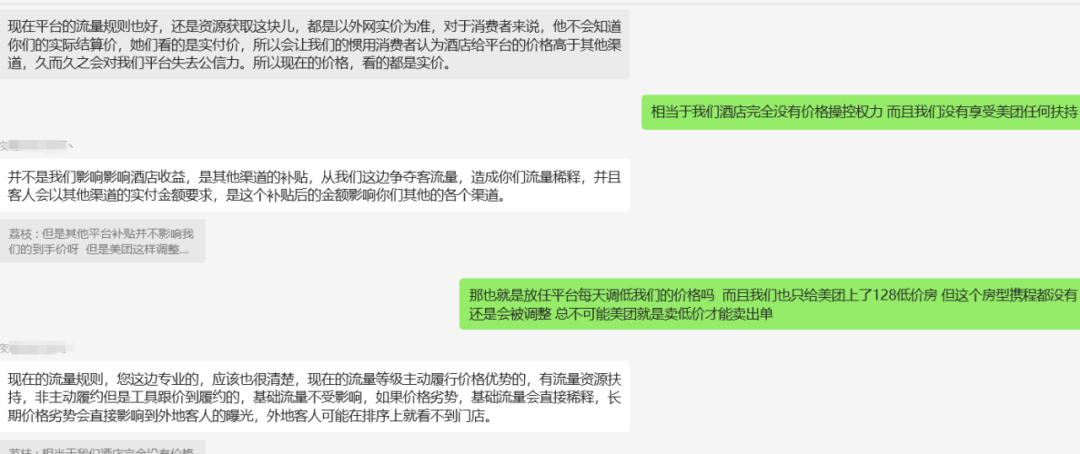

The tool behind the manipulation is called the Price Adjustment Assistant, a dreaded backend price-tracking system in the hotel industry nationwide. "No hotel listed on Meituan can opt out of the price-tracking system," which automatically adjusts prices to the lowest across all platforms, such as Ctrip, whenever it detects that Meituan's prices are higher.

According to industry insiders, the adjustments often result in prices that are around 0.8% lower than those on Ctrip and other platforms. The Price Adjustment Assistant is primarily operated by account managers, and while it can be temporarily disabled, it often reactivates after some time.

Lin Jing's account manager explained that the drastic price reduction was due to the system detecting substantial subsidies for the hotel on Qunar. Lin Jing wondered why Meituan, which seeks the lowest prices across all platforms, didn't offer subsidies itself instead of forcibly altering the merchant's prices.

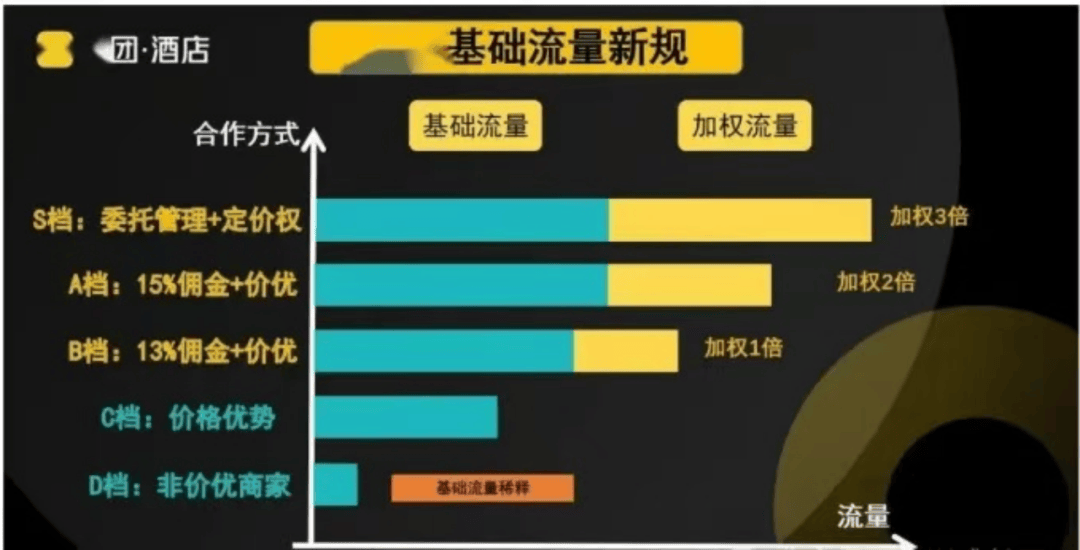

In principle, merchant consent is required to activate the Price Adjustment Assistant, but most hotels have little leverage to resist and must comply with optimal pricing to maintain traffic flow. On August 4, Meituan introduced new rules for basic traffic, dividing merchants into five categories, with most required to offer optimal pricing to maintain traffic. Refusal could lead to diluted traffic. However, even before this policy, merchants were already struggling with Meituan's price-tracking system and account managers, earning the platform the title of the "best contributor" behind its Q2 financial report.

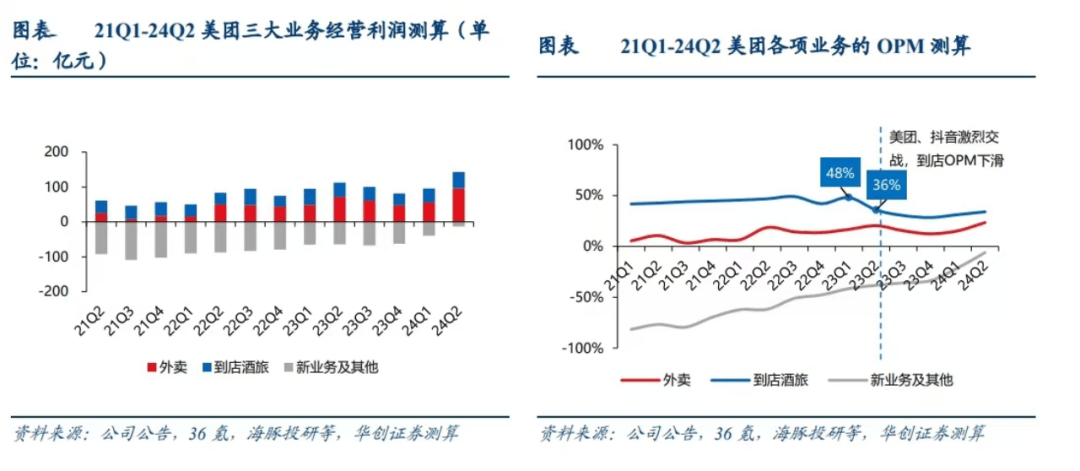

While food delivery contributes significantly to Meituan's revenue, its in-store hotel and travel business is the main source of profit for its core local commerce division. As the anchor of Meituan's business, core local commerce contributed approximately 75% of its revenue in 2023. Despite easing competition in the food delivery sector, the in-store business remains a crucial arena. In Q2 2024, the in-store hotel and travel business excelled, with order volume surging 60% year-on-year, solidifying its position as Meituan's cash cow.

However, an increasing number of hotels are losing control over their pricing amid platform price wars.

01 Hoteliers Trapped in the Platform Ecosystem

Countless hoteliers have vented their frustrations on social media platforms this summer.

Qin Wan, who owns a hotel and homestay in Inner Mongolia, discovered that Meituan was unilaterally lowering her room rates and enrolling her in promotional activities without her consent. Initially, she tolerated small price reductions of a few dozen yuan, but the adjustments became increasingly outrageous, with off-season rates slashed from over 120 yuan to just 60-70 yuan, and peak-season rates from 150 yuan to barely over 100 yuan. After deducting platform commissions and costs, she found it unprofitable to sell rooms on Meituan during peak seasons.

She contacted her regional account manager, threatening to terminate their partnership if the prices weren't restored. However, the account manager insisted that she must delist from all other platforms first. "They maliciously altered our backend prices, yet we don't even have the power to close our own store," she lamented. Unable to directly close her store, Qin Wan attempted to set all rooms to full occupancy, only to find that the status was silently changed overnight.

Lin Chao, a former Meituan account manager in Meizhou, Sichuan, revealed that while account managers once focused on encouraging merchants to participate in various promotions, the current strategy revolves around offering optimal pricing and exclusivity. "Price tracking between Ctrip and Meituan has intensified since last November, with Meituan making even more adjustments recently," he said.

Examining Meituan's operating profits across various business segments, food delivery maintains positive growth in operating profit margin (OPM), while new businesses continue to reduce losses. However, the OPM for in-store businesses remains volatile, likely influenced by intense competition.

(Image source: Huachuang Securities)

Two years ago, Li Jing, who worked as a Meituan account manager, recalled that frontline account managers were bound by three red lines, one of which was "unilaterally adjusting merchant prices," a severe violation punishable by dismissal. The other two red lines involved financial transactions with merchants and listing inactive stores without permission.

After leaving Meituan, Li Jing transitioned into hotel operations and found that current account managers wield significant power. When she discovered unauthorized price adjustments, she immediately requested compensation for the price difference from the platform, which was denied. However, the platform agreed to replace the account manager.

Unfortunately, the new account manager was even more aggressive, altering the merchant's entire annual pricing structure within the Tianlang system. Li Jing filed a complaint with Meituan headquarters, only to be told that the adjustments were necessary to ensure optimal pricing across all platforms, and that Meituan would not interfere. Subsequent complaints to municipal authorities yielded no results, as Meituan's headquarters in Beijing fell outside their jurisdiction.

Frustrated, Li Jing chose to close her Meituan online store during the peak tourist season in August.

She and her hotel industry peers tried various tactics, initially taking to Weibo and Xiaohongshu (a popular social media platform in China) and filing complaints with Meituan headquarters. While some account managers assisted in blacklisting the Price Adjustment Assistant in the backend, the effect lasted only one to two months before it reappeared.

The logic behind the price adjustments is straightforward: whenever a lower price is detected on another platform, Meituan aims to undercut it. Ctrip and Qunar sometimes offer substantial subsidies to hotels during holidays, reaching hundreds of yuan. However, Meituan's subsidies are generally meager, rarely exceeding 10 yuan for 90% of the time. Despite knowing about subsidies on other platforms, Meituan still insists on optimal pricing from merchants this year.

Encountering more aggressive account managers, merchants have reported instances where their entire pricing structure was unilaterally altered, and additional price audits were implemented. Every price adjustment, no matter how minor, required account manager approval before going live. Merchants found themselves at the mercy of account managers, forced to accept the changes or abandon the platform.

In today's highly informatized society and duopoly business environment, merchants, like food delivery workers, are increasingly trapped within platform systems. Individuals or merchants in structurally disadvantaged positions not only lack channels for voicing their concerns but also gradually lose their right to set prices autonomously.

02 'Worker Bees' Under the Machine's Operation

Wang Puzhong's first major initiative as the new leader of Meituan was the launch of the S-level project, the "God Member" program. Starting in May, the program was rolled out city by city, gradually bridging the gap between home delivery and in-store services. By July 4 this year, over 5 million merchants had participated in the God Member activity, accounting for roughly one-fifth of Meituan's total merchant base of approximately 25 to 28 million.

Reaching these 5 million merchants would ideally require 5 million outreach efforts by business development managers (BDMs). The God Member benefits encompass a wide range of services, including food delivery, in-store dining, hotel and travel, and beauty, essentially covering all consumption scenarios within the Meituan ecosystem. This poses a formidable challenge, testing Meituan's organizational capabilities on an unprecedented scale.

The tight timeline and heavy workload translate into an overwhelming schedule for Meituan's BDMs. Le Ran, a former BDM in Chengdu, described her daily routine as relentless: morning meetings, performance reviews, and endless spreadsheets, often with new tasks piling up before the previous ones are completed. The work environment resembled that of an insurance company, with constant testing and target-driven performance expectations.

On one occasion, while visiting a merchant with an account manager, Le Ran received a surprise test call from her supervisor, forcing her to recite a sales pitch on the spot, an awkward experience she likened to "digging her toes into the ground with embarrassment." The job also entailed relentless sales competitions, handling countless exceptions, distributing promotional materials, scanning QR codes, and striving to meet unattainable targets.

In principle, BDMs are required to fully explain all rules and procedures to merchants and respect their autonomy. However, faced with regional targets set by their superiors, BDMs sometimes resort to unethical practices. Merchants have reported instances where activities were activated without their consent, leading to unwelcome promotions that could not be easily canceled, even after heated exchanges with customer service representatives.

"Dare to be extreme" is a basic expectation for Meituan employees. Some have described the workload in certain departments as overwhelming, consuming all their time and energy without achieving satisfactory results. "Eight hours are not enough. You're even questioned about working remotely during leave, and expected to promote packages and contribute to team and regional KPIs during breaks," lamented one new BDM on Xiaohongshu, drawing comments urging them to take care of their health and well-being.

Xiaoxiao, who left Meituan two years ago, emphasized the ruthless pursuit of targets. "If you want to climb the corporate ladder at Meituan, you must be ruthless and avoid emotional involvement with merchants," she said. "Complete every platform indicator to the best of your ability, as we're always aware that the interests of the platform and merchants can sometimes conflict. Those who truly succeed are ruthless."

Xiaoxiao recounted instances where she was pressured to convince struggling hotels to lower their prices, even when doing so would barely cover costs. "I'm easily empathetic, and sometimes find it difficult to go against my principles," she admitted.

She believes that Meituan's current policies, when implemented at the grassroots level, are distorted, pushing employees into difficult positions where they must constantly pressure merchants to lower prices, straining relationships and threatening the very foundation of their jobs. When she first joined Meituan, she expected respect from merchants but found them generally indifferent, often parting ways before any meaningful connection could be forged. Today, BDMs are often criticized for being unable to please anyone ("saying anything is wrong").

03 Nobody Wants to Play a Fair Game

This summer, as Meituan aggressively pushed its market share, Ctrip found itself in a defensive position.

In the past, merchants listed on Ctrip were required to offer price advantages. However, many merchants like Li Jing have noticed that while Ctrip still engages in price wars, its overall approach and price tracking are less aggressive than Meituan's. Ctrip categorizes its listed hotels into three tiers: special, gold, and silver. According to the rules, special and gold hotels must offer Ctrip a 5% price advantage. However, Li Jing noted that Ctrip has been more lenient this year, allowing some hotels to maintain slightly higher prices than Meituan without penalty. Instead, Ctrip has often subsidized merchants to participate in price wars, ensuring low prices at its own expense.

Industry analysts suggest that Ctrip's reluctance to fully engage in price wars is strategic, as it does not want to be led by Meituan. Excessive involvement in low-price competition could harm either hotel merchants or the platform itself, potentially leading high-end hotel merchants to abandon Ctrip and further erode its competitive advantage.

Nevertheless, Meituan's aggressive God Member program has posed a significant challenge to Ctrip. Meituan's strategy has leveraged its user base and conversion capabilities across food, accommodation, and transportation to great effect. Industry insiders predict that over the next three to five years, Meituan's user base will continue to upgrade, attracting more high-net-worth individuals, and that its hotel and travel business will steadily erode Ctrip's market share in 2024.

In contrast to Meituan, Douyin (TikTok's Chinese version) has undergone multiple structural adjustments since late 2023 to accelerate its local lifestyle commercialization. However, due to frequent leadership changes, its expansion has been more cautious. Some argue that without its algorithmic advantage and trending topics, Douyin lacks significant competitiveness, while Meituan triumphs through superior organizational capabilities.

Wang Xing is clear about Meituan's strengths, particularly its global leading instant delivery network and robust offline delivery capabilities. Last year, Meituan facilitated 21.9 billion instant delivery orders, supported by a vast network of couriers, merchants, and users, forming a deep-rooted online and offline empire.

On the other hand, Douyin is known for its strategic flexibility and tactical maneuvers but avoids direct confrontations. According to reports, Meituan insiders have even nicknamed Douyin the "nomadic people," a reference to its agile and adaptable approach. After facing setbacks from Douyin's tactics, Meituan has refocused on improving internal operational efficiency.

Currently, Meituan has unified its senior reporting lines under Wang Puzhong. According to recent reports, the company is undergoing organizational and personnel adjustments, particularly by reassigning personnel from the food delivery sector to mid-level positions in the restaurant sector, and significant changes are expected in loss-making divisions such as preferred businesses.

"The essence of business competition is exploitation," as Kissinger aptly put it, reflecting both the brutality and frustration of the battle. While formal armies (like Meituan) are not necessarily inferior to guerrilla forces, the latter only need to avoid defeat to claim victory, whereas the former must secure a clear win. Meituan's campaign has been both impressive and ruthless, focusing on capturing consumer hearts. Whether it can achieve a win-win situation with the merchants it parasitizes remains the next challenge for its leadership.

Today, merchants trapped in Meituan's rigorous system face a difficult choice: endure or flee. Most find themselves in a prisoner's dilemma, wondering whether they are truly entrepreneurs or merely working for the platform.

(Lin Jing, Lin Chao, Qin Wan, Li Jing, and Xiaoxiao are pseudonyms.)