Behind the "Market Protection War" Launched by Executives of Transsion Holdings

![]() 09/11 2024

09/11 2024

![]() 491

491

On September 9, Transsion Holdings (688036.SH) opened significantly lower by 6.29% and fell by more than 7% in the morning session. Amid the share price decline, company executives took action to rescue the situation by increasing their shareholdings. Following these market protection efforts, the company's share price decline narrowed in the afternoon, closing at 77.05 yuan per share, down 4.99%, with a total market value of 87 billion yuan, a decline of over 4.5 billion yuan from the previous trading day.

On September 10, the company's share price fluctuated downward and fell by more than 2% at one point.

In fact, Transsion Holdings disclosed its shareholding increase plan as early as July, but the intended buyers had not taken action until now. The recent sharp decline in Transsion Holdings' share price and the "forced" shareholding increase by executives are related to the fact that the company's Chief Financial Officer, Xiao Yonghui, is under investigation. Securities Star notes that Xiao Yonghui is a veteran of Transsion Holdings, having served the company for over a decade and holding a small stake in its controlling shareholder, indicating a deep connection with the company. Although it is not yet clear whether Xiao Yonghui's investigation is related to the company's business, the negative news has still impacted the share price.

Currently, Transsion Holdings is facing challenges on multiple fronts, with negative news surrounding its Chief Financial Officer and a significant slowdown in shipments from its key African market in Q2, putting pressure on the company's quarterly performance.

01. Executives Under Investigation, Company Takes Emergency Measures to Support Share Price

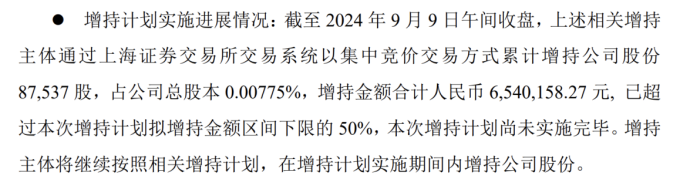

During the lunch break on September 9, Transsion Holdings suddenly issued an announcement on the progress of shareholding increases by directors and senior management, announcing that company directors and senior executives, including Zhang Qi, Vice President; Yang Hong, Vice President; and Zeng Chun, Secretary of the Board, had collectively increased their shareholdings in the company by 87,537 shares through centralized bidding on the Shanghai Stock Exchange trading system, representing 0.00775% of the company's total share capital and a total investment of 6.5402 million yuan.

In fact, Transsion Holdings disclosed its shareholding increase plan as early as July, but the intended buyers only took action now.

The collective shareholding increase by Transsion Holdings' executives was in response to the decline in the company's share price, which opened significantly lower by 6.29% on September 9 and fell by more than 7% in the morning session.

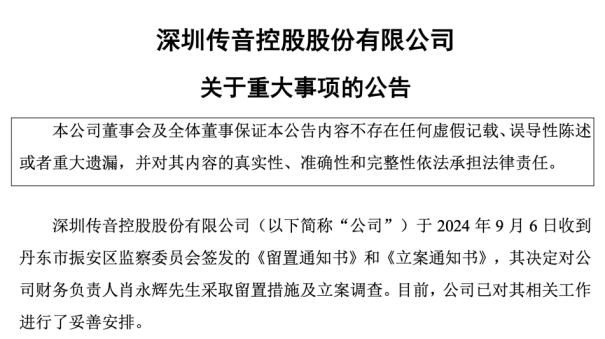

In terms of news, Transsion Holdings announced after the close of trading on the previous trading day (September 6) that it had received a detention notice and case filing notice from the Zhen'an District Supervisory Committee in Dandong City, deciding to detain and investigate the company's Chief Financial Officer, Xiao Yonghui. The company has made appropriate arrangements for Xiao Yonghui's related work.

Transsion Holdings stated that as of the date of the announcement, it had not been informed of the progress or conclusion of the investigation. The company will continue to monitor subsequent developments in these matters and fulfill its information disclosure obligations in a timely manner. Relevant media outlets subsequently inquired about the matter with Transsion Holdings, but did not receive a direct response. The company stated, "Please refer to the company's announcement for relevant information."

Securities Star notes that Xiao Yonghui is a veteran of the company, having served for over a decade. Transsion Holdings was established in Shenzhen in 2013, and Xiao Yonghui has served as the Chief Financial Officer since January 2014. According to the company's 2023 annual report, Xiao Yonghui's annual salary was 3.8556 million yuan.

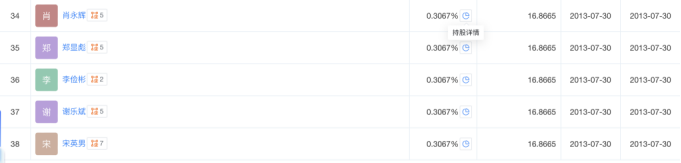

In addition to his role as Chief Financial Officer, Xiao Yonghui also indirectly holds shares in the company through Transsion Investment, the controlling shareholder of Transsion Holdings. According to Tianyancha, Xiao Yonghui holds a 0.3067% stake in Transsion Investment.

Prior to this, Xiao Yonghui had gained considerable benefits through share reductions by Transsion Investment, the controlling shareholder, and dividend distributions by Transsion Holdings over the years.

In May of this year, during the latest round of share reductions by Transsion Holdings' controlling shareholder, Transsion Investment cashed out a total of 1.012 billion yuan through inquiry-based transfers. Among them, Xiao Yonghui benefited by approximately 3.1 million yuan.

Furthermore, since its listing in 2019, Transsion Holdings has distributed dividends annually. In the first half of this year, the company announced an interim dividend plan, proposing to distribute 15 yuan per 10 shares to all shareholders, with a total dividend amount of 1.694 billion yuan.

Since its listing, Transsion Holdings has distributed a cumulative total of 10.591 billion yuan in dividends. As of the end of June 2024, Transsion Investment held a 49.64% stake in the company. Based on this, approximately 5.257 billion yuan of the aforementioned dividend amount went to the controlling shareholder, with Xiao Yonghui benefiting by approximately 16 million yuan in total.

It is worth noting that following the announcement of the shareholding increase progress, Transsion Holdings' share price decline narrowed in the afternoon. By the close, the company's share price was 77.05 yuan per share, down 4.99%, with a total market value of 87 billion yuan, a decline of over 4.5 billion yuan from the previous trading day.

Looking back at the share price trend over the past six months, Transsion Holdings' share price peaked at 125.84 yuan per share on April 18 before declining. It hit a low of 71 yuan per share during the intraday trading on July 15. According to statistics, the company's share price fell by a cumulative 35.66% (adjusted for splits and dividends) between April 18 and September 9, with a total market value decline of over 48.2 billion yuan.

02. Slowdown in Q2 Shipments, Pressure on Quarterly Performance

Public information shows that Transsion Holdings is primarily engaged in the design, research and development, production, sales, and branding of smart devices centered on mobile phones. As the largest mobile phone supplier in Africa, the company is known as the "King of African Mobile Phones."

In terms of performance, Transsion Holdings achieved revenue of 34.558 billion yuan in the first half of 2024, representing a year-on-year growth of 38.07%, and net profit attributable to shareholders of 2.852 billion yuan, up 35.7% year-on-year, marking a double-digit growth in both revenue and profit.

Securities Star notes that the company's growth is primarily attributable to its strong performance in Q1, which outperformed Q2 in both revenue and profitability.

Firstly, in terms of revenue, Transsion Holdings generated 17.443 billion yuan in revenue in Q1 2024, representing an 88.1% year-on-year increase. However, in Q2 2024, revenue amounted to 17.115 billion yuan, up 8.63% year-on-year but with a significant slowdown in growth and a 1.88% decline quarter-on-quarter.

Securities Star notes that the slowdown in shipments during Q2 affected the company's revenue performance to some extent.

According to Canalys data, Transsion Holdings shipped 28.6 million units in Q1 2024, up 86% year-on-year, ranking fourth with a 10% market share. In Q2, shipments totaled 25.5 million units, up 12% year-on-year, ranking fifth with a 9% market share. Overall, the company's performance in Q2 was weaker than that in Q1.

In its key African market, Transsion Holdings shipped 9.5 million smartphones in Q1 2024, up 36% year-on-year, ranking first with a 52% market share. In Q2, shipments totaled 9.2 million units, up 1% year-on-year, with a 51% market share, down from 54% in the same period last year.

There are two main reasons for Transsion Holdings' underperformance in the African market in Q2. Firstly, the African smartphone market faced increased inflationary risks and currency pressures, leading to fragile external economic activities and a slowdown in Q2 growth, resulting in single-digit growth rates. According to Manish Pravinkumar, Senior Analyst at Canalys, "Although Transsion continues to dominate with a 51% market share, even as a leading player, it feels the pressure of the slowing market, with growth rates of just 1%."

Secondly, competition in the high-cost-performance smartphone segment in Africa is intensifying. As living costs rise, consumers increasingly prefer devices with higher cost-performance ratios. Data shows that the average selling price (ASP) in Q2 2024 was the lowest in the past 11 quarters. Shipments in the ultra-low-end market (below $100) surged 42% year-on-year, accounting for one-third of total shipments.

Against this backdrop, Xiaomi has achieved good results in the ultra-low-end market in Africa by promoting its Redmi series and other mid-to-low-end models due to their high cost-performance ratios. Realme has also gained significant attention in the African market with products such as the Note 50 and C53. Although Xiaomi, OPPO, and Realme have lower market shares than Transsion Holdings in the African market in Q2 2024, they all achieved double-digit or triple-digit growth rates. These figures reflect intense competition among Chinese mobile phone manufacturers in the African smartphone market.

Secondly, in terms of profitability, Transsion Holdings' net profit in Q2 declined both year-on-year and quarter-on-quarter.

In Q1 2024, the company's net profit attributable to shareholders was 1.626 billion yuan, up 210.3% year-on-year. However, in Q2 2024, net profit attributable to shareholders was 1.226 billion yuan, down 22.31% year-on-year and 24.65% quarter-on-quarter.

The decline in Transsion Holdings' net profit is related to changes in gross margin. In Q2 2024, the company's sales gross margin was 20.89%, down 4.34 percentage points year-on-year and 1.26 percentage points quarter-on-quarter, with a net profit attributable to shareholders of 1.226 billion yuan, down 22.31% year-on-year and 24.65% quarter-on-quarter.

Regarding the quarter-on-quarter decline in gross margin, Transsion Holdings has stated that the company adopted new accounting standards in its semi-annual report, adjusting the accrual of warranty expenses from selling expenses to operating costs, which affected the gross margin. Additionally, the company's quarterly performance can fluctuate due to various factors such as upstream costs, business strategies, and competitive landscapes.

It is worth noting that in the first half of this year, Transsion Holdings' net profit deviated from its net cash flow from operating activities. During the reporting period, the company's net cash flow from operating activities turned negative at -1.392 billion yuan. The company explained that this was primarily due to an increase in cash payments for purchasing goods and receiving services compared to the same period last year, which was attributed to the company's procurement payment schedule and the larger amount of procurement payments due in the first half of 2024. (This article was originally published on Securities Star, written by Li Ruohan)

- End -