After independent operation, Ant Digital played three cards

![]() 09/11 2024

09/11 2024

![]() 598

598

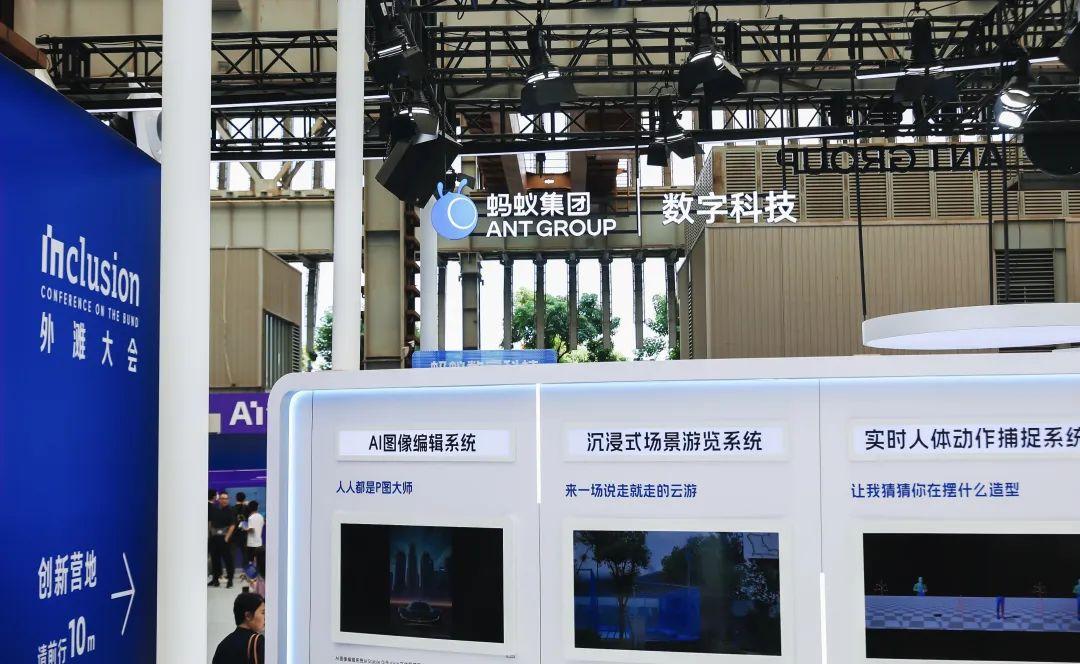

Focusing on the diverse needs of industrial digitization, Ant Digital has formed three major business segments after its independence: AI services, cloud services, and blockchain services.

"I haven't been at Ant Digital for long, just over 170 days. During this time, I've been learning and thinking about how to better support enterprises in their digital transformation journey," said Zhao Wenbiao, CEO of Ant Digital, candidly sharing his feelings upon taking up the new role in an interview with the media on September 5.

Zhao Wenbiao's role has undergone significant changes in recent days. In March this year, Ant Group announced a business restructuring, with the digital technology segment becoming an independent entity. With nearly eight years at Ant Group, Zhao transitioned from President of Ant Group's Greater Security Business Group to the inaugural CEO of Ant Digital.

An authority in intelligent risk control and security technology, Zhao previously oversaw the establishment of the intelligent risk control system for Alipay and Ant Group. Now, he leads Ant Digital to face market challenges and commercial competition independently.

As the technology business segment, Ant Digital bears the mission of exporting Ant Group's experience and technological accumulations from the past one or two decades. The outside world is curious about the role Ant Digital will play in the current digital technology wave, now that it has just become an independent company after five years of operation, and how it will respond to market competition.

Recently, Zhao Wenbiao addressed various questions from the outside world at the Bund Summit. He pointed out that Ant Digital has formed a strategic layout across AI, Blockchain, and Cloud (ABC) services to cater to diverse customer needs. The systematic solutions capabilities, ranging from cloud-native to AI-native and then to blockchain-native, constitute different growth trajectories for the company's future development and differentiate Ant Digital in the wave of industrial digitization.

01

The ABC Strategy Amid the Wave of Industrial Digitization

Since taking over Ant Digital, Zhao Wenbiao has primarily focused on two aspects: adjusting the organizational structure for greater efficiency and sharpening the business strategy.

"I consider Ant Digital's strengths and advantages. Our original aspiration is to serve enterprises' digital transformation through technological innovation. Therefore, we will increase investments in areas related to this endeavor and reduce those unrelated," said Zhao Wenbiao, emphasizing that Ant Digital's commitment to technology and product development remains unchanged despite its independence.

Prior to its independence, Ant Digital had already established strengths in blockchain, privacy computation, and trusted AI technologies. The real challenge lies in upgrading these technological advantages into product strengths to serve industrial customers with long-term solutions.

As a technology commercialization segment of Ant Group, Ant Digital has evolved through different stages. Originating from Ant's Blockchain Lab in 2015, it began commercial operations in 2019 and officially became an independent entity this year. Despite these changes, its core mission remains unchanged: leveraging technological innovation to support enterprises' digital transformation and facilitate their digital survival and growth.

Looking back at the past decade or so of domestic enterprises' digital development and demand characteristics, Zhao Wenbiao divides the wave of industrial digitization into three stages:

The first stage involves traditional enterprises embarking on digital transformation, leveraging technologies like cloud computing to enhance IoT efficiency, optimize user experiences, and digitize business operations. In the second stage, as data generation explodes, collaboration across upstream and downstream players in the industrial chain intensifies, prompting enterprises to seek ways to enhance industrial digitization efficiency. In the third stage, as data becomes a crucial production factor and core asset, there is a consensus among enterprises that data assets must circulate efficiently to boost IoT operational and transactional efficiency, ushering in a new phase of industrial digitization and unlocking significant benefits.

Addressing enterprises' needs for cloud adoption, industrial collaboration, and data asset circulation, Ant Digital's business layout revolves around the ABC strategy. Drawing on Ant Group's years of technological accumulations, these three business segments cater to diverse demands, ranging from institutional digitization to industrial collaboration digitization to digital asset circulation network construction.

Specifically, Cloud+ services primarily help enterprises embark on their digital journey by adopting cloud technologies, empowering them with a robust technological engine tailored to their cloud usage needs. AI+ services leverage AI technologies to restructure and upgrade efficiency in risk control, marketing, and other scenarios, enabling enterprises to establish competitive advantages in the era of large models. Blockchain+ services, on the other hand, foster industrial trust through technology, enhance digital collaboration efficiency, and accelerate data asset circulation.

A few years ago, Ant Group's BASIC technology strategy prioritized investments in blockchain, AI, security, IoT, and cloud technologies. Compared to this, Ant Digital's ABC strategy is more concise, focused, and business-oriented. Zhao Wenbiao explained that while investments in security and IoT technologies persist, the emphasis has shifted from technology to business scenarios, aligning resources to better serve the diverse needs of various industries.

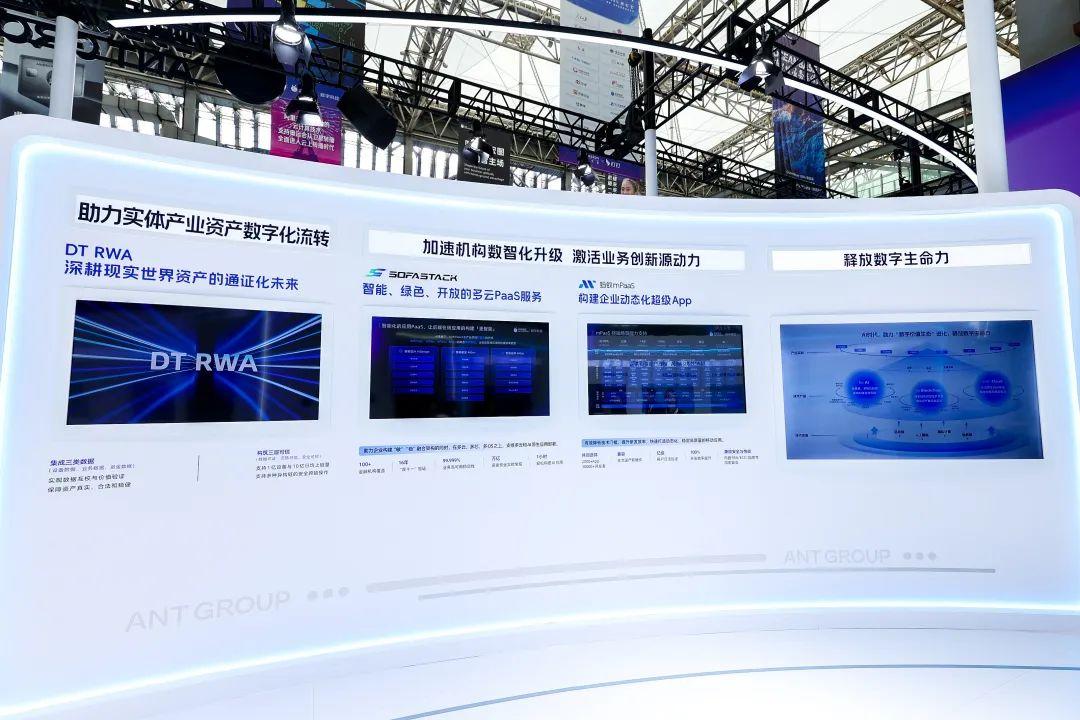

For instance, they've observed that security services are now inseparable from AI and constitute a vital part of AI application scenarios. In the context of digital technologies serving the real economy, IoT technologies are being integrated with blockchain technologies. Ant Digital's recent Real World Asset (RWA) initiative, which combines IoT and blockchain technologies, digitizes physical assets and uploads them onto the blockchain, opening up new financing channels for SMEs and presenting more development opportunities.

Industry insiders believe that it's common for companies to export internal products, technologies, and tools. In the history of China's internet development, tech giants like Tencent, Alibaba, JD.com, and ByteDance have all precedents of transforming internal tools into commercial products. In this process, technologies must be honed in specific scenarios to develop products that can scale across different industries, posing challenges in understanding and anticipating market demands.

Zhao Wenbiao also emphasized that as an independently operated company, Ant Digital would prioritize long-term product development rather than a broad scope of services. "We'll devote more effort to leveraging technology to create product advantages and serve our customers better," he said.

02

Accelerating Commercialization with Diverse Growth Trajectories

Ant Digital's commercialization progress has garnered considerable attention from the outside world.

Ant Digital's management revealed that the company's revenue scale is on par with leading domestic software firms, and its customer base has grown by 35% over the past year, earning recognition across various industries and sectors. Going forward, Ant Digital aims to accelerate its commercialization process and strive for revenue balance within this year.

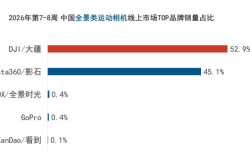

Objectively speaking, Ant Digital's three major business segments vary in maturity. Cloud-related services are the most mature, while AI+ services are rapidly developing amidst the generative AI wave. Blockchain-related services, on the other hand, are still in their nascent stages.

To address these varying growth trajectories, Ant Digital employs diverse strategies tailored to market demands while pursuing commercialization and growth objectives.

For instance, addressing enterprises' cloud adoption needs, Ant Digital boasts two flagship products: mPaaS and SOFAStack. Integrating Ant Group's extensive technological capabilities and practices, these products have transitioned from technologies to products and achieved multi-industry compatibility, leading the way in commercialization. Notably, mPaaS has achieved large-scale applications across finance, government services, the internet, retail, and other industries.

Yu Bin, Vice President of Ant Digital, noted that as AI technologies increasingly drive software development, the cloud business will prioritize leveraging AI to restructure past cloud-native products, enhancing application development and runtime intelligence. "Previously, Ant's cloud-related businesses helped enterprises reduce cloud adoption costs; now, they're focused on reducing AI adoption costs, marking an evolutionary shift in infrastructure," he explained.

Last year's generative AI wave garnered significant industry attention, and this year's accelerated adoption of large models in various industries presents new growth opportunities for Ant Digital's AI+ segment. Ant Digital is integrating mature products with industrial demands while exploring new business avenues based on market requirements.

For instance, building upon Ant's previous strengths in AI security, products like AntShield, AntSkyEye, and Zoloz are being rapidly integrated with industrial demands amidst growing demands for trusted AI, contributing to revenue growth.

Ant Digital's new business layout also encompasses AI high-quality data annotation services. As the intelligence of large models is closely tied to the data used to train them, there's a universal demand for data processing and annotation. A CEO of a data service firm told Digital Intelligence Frontline that in the past six months, the surge in demand for multi-modal large model training has further ignited the industry, leading to a tenfold increase in demand for data annotation services. Against this backdrop, Ant Digital unveiled its AI data annotation service product at the Bund Summit.

Blockchain technology is a distinctive feature of Ant Group and is considered a core competency of Ant Digital. The company has established a comprehensive layout in this area, encompassing infrastructure components like the BaaS platform and privacy computation technologies, as well as data factor-related products that have garnered widespread attention in recent years.

Thanks to years of investments, Ant Digital now ranks among the industry leaders in technological prowess. For instance, Ant Digital holds over 5,000 blockchain technology patents, ranking first globally for several consecutive years. Meanwhile, its AntChain platform supports over 12 million physical devices for trusted on-chain operations. Yan Ying, Chief Scientist of Ant Digital, shared that Ant's blockchain technology has long surpassed the 100 million transaction and data volume milestones. Recently, the issuance of RWA assets on the chain marked a significant step forward in on-chain asset financing.

However, it's undeniable that the exploration of business models in this segment is still in its early stages. Taking the recent issuance of RWA assets on the chain as an example, Yan Ying mentioned that Ant Digital is collaborating with experts from various fields to explore compliant and controlled asset issuance and circulation in a globally open environment.

An industry veteran observed that during the market cultivation phase, Ant Digital's strategy is pragmatic, focusing on solving specific problems and accelerating blockchain technology adoption based on concrete cases. "We've taken the first few steps, but it might take many more to truly scale the market," he noted.

Zhao Wenbiao also provided a positioning for Ant Digital's three major business segments: "AI services that don't lose money, a promising B+, and a C+ with unlimited imagination."

It's worth mentioning that going global is a crucial part of Ant Digital's overall strategy. In terms of revenue, Ant Digital achieved a 300% growth overseas last year and aims for 20% to 40% of its revenue to come from international markets in the future.

"We have great confidence in our overseas segment," Yu Bin told Digital Intelligence Frontline. Over the past one or two decades, China's internet technology and digital economy have evolved significantly, and Ant Digital's products have been thoroughly validated in the domestic market. Upon entering overseas markets, these products have been further refined to better serve local customer scenarios and pain points.

"Many solutions are no longer straightforward imports of domestic technologies. We're now creating overseas-specific products tailored to local demands," Yu Bin explained.

03

Differentiated Capabilities and Solutions

Industrial digitization is a vast arena with numerous players. As both a seasoned and new entrant, Ant Digital's ability to establish a foothold amidst this wave with its ABC strategic layout has garnered widespread market attention.

Zhao Wenbiao believes that amidst the current wave of industrial digitization, the popular large model technology is not the only solution. This stance isn't related to the developmental stage or illusions associated with large models. "Customer needs are highly diverse, and no single large model can address all issues," he explained.

Wang Wei, CTO of Ant Digital, also observed that enterprises' needs have become increasingly complex and multifaceted. He noticed that while some enterprises use SOFAStack to address distributed computing challenges in the cloud-native era, deeper application reveals notable pain points in data governance.

This reflects the current state of enterprises amidst the industrial digitization wave.

On one hand, enterprises in different industries have diverse digitization needs, progress, and priorities. For instance, while some enterprises have already transitioned to cloud-based operations, others still seek to adopt cloud technologies, achieve cloud-native status, and leverage AI effectively. In industries like renewable energy, enterprises also face more advanced needs for industrial collaboration digitization and digital asset circulation.

Even within the same enterprise, needs can become increasingly complex and diverse. For example, an employee from a company specializing in digital perception of equipment shared with Digital Intelligence Frontline that they've received diverse demands from a leading coal industry player. The enterprise seeks multi-scenario digital product services across safety production in coal mining, coal quality analysis during processing, and explosion-proof equipment in conversion processes.

A report by the China Academy of Information and Communications Technology (CAICT) noted that in recent years, as the regularity of industrial development has weakened significantly, various complex, random, and sudden issues have emerged. Simple overlays of digital technologies and traditional enterprises can no longer meet the needs of traditional vertical industries, and digital transformation is entering deeper waters.

This poses higher demands on the capabilities and layouts of technology and solution providers. Some enterprises are leveraging their accumulated resources and extensive product portfolios to address these changes. For instance, a digital giant has positioned itself as a comprehensive provider of scenario-based digital solutions, offering a myriad of products and combinations to meet customer needs.

Industry veterans also recognize the importance of building systemic capabilities. Yan Liang, General Manager of Inspur Cloud, recently remarked that the next decade will be the battleground for systemic intelligence, as enterprises' demand for intelligence evolves from single to multi-scenario and ultimately into systemic intelligence.

Ant Digital's ABC layout, rooted in its own accumulations, aligns with the diverse and multidimensional needs prevalent in the market, ranging from cloud adoption to AI utilization and enhancing industrial collaboration efficiency. Zhao Wenbiao believes, "Just as system integration was crucial two or three decades ago, today's industrial digitization also necessitates a combination of multiple technologies to address issues."

Wang Wei observed that the integration of cloud computing and AI, AI risk control and privacy computation, and privacy computation with data governance and processing is becoming increasingly prevalent in the industry. For instance, a financial institution developing AI applications found that algorithmic intelligence heightens data requirements. However, upon addressing data issues, they discovered that it involves not only data governance technologies but also substantial privacy computation demands.

As one of the few companies that have mature products in blockchain, AI, and cloud computing technologies, Ant Group's technology has been refined over nearly two decades through its business operations with Ant Group and Alibaba, placing it at the forefront of the industry.

Wang Wei believes that just as one can provide tie matching after selling a suit to a customer, technology can also be combined to enhance the interconnection between different businesses. For example, large model technology can be integrated with IoT, blockchain, privacy computing, security technology, and cloud technology.

This interconnection will also help Ant Group develop differentiated capabilities for the market. "We believe that under the diverse needs of customers, only through a combination of multiple products can we truly solve the problems faced by the real economy and enterprises," said Zhao Wenbiao.