Meizu mobile phone sales are dismal, AR glasses may be the last straw but it is difficult to succeed

![]() 09/17 2024

09/17 2024

![]() 445

445

Once upon a time, Meizu mobile phones won the favor of many consumers with their unique design and excellent system experience, and were hailed as a refreshing force in the mobile phone industry. However, today, Meizu mobile phones have fallen into a predicament of continuous dismal sales, and their brand influence and market share are gradually being eroded by other brands. Even after being acquired by Geely, Meizu seems unable to shake off its declining fate.

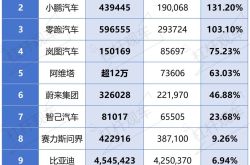

Meizu's market performance in recent years has been worrying. Despite the successive launches of new models such as the Meizu 20 and 21 series, and the expansion of the custom machine business with Lynk & Co, sales have not improved, remaining in the lower-middle reaches of the second-tier mobile phone market, and possibly even worse than established brands such as Samsung. Even more embarrassing is that the specific market share of Meizu mobile phones in China is no longer verifiable, which is undoubtedly a profound irony of its brand status quo.

In an attempt to revitalize its brand, Meizu tried to break through with AI phone marketing, announcing that it would stop new projects for traditional smartphones and fully invest in AI technology research and development. However, six months later, Meizu's AI capabilities have not significantly improved as expected, and compared to brands like OPPO, Lenovo, and Huawei, they remain on the same level. This strategic indecision and lack of a clear technological advantage make it difficult for Meizu to boost sales through AI technology in the short term.

In terms of product line layout and pricing strategy, Meizu also faces many challenges. The Meizu 21 series is priced relatively high among models with the same configuration processor, resulting in no significant sales surge during its initial launch. As mobile phone market competition intensifies, Meizu has had to reduce prices to enhance its competitiveness, but this undoubtedly exacerbates consumers' doubts about the value of the Meizu brand. Meizu's attempt to enter the mid-range market with models priced around 2000 yuan also faces fierce competition from brands like Redmi, Honor, and OnePlus. In terms of system, design, and cost control, Meizu still lags behind these top brands, putting it at a disadvantage in price wars.

The upcoming Meizu Lucky 08 phone continues to use Meizu's traditional marketing strategy, emphasizing flagship design and feel as its selling points. However, for consumers in this price range, price is their primary concern. If Meizu cannot offer a competitive price, it will be difficult to attract their attention. At the same time, Meizu's shortcomings in its imaging system further affect its phone sales. As photography technology increasingly becomes an important selling point in the mobile phone market, Meizu still relies on third-party ArcSoft solutions, which undoubtedly puts its phones at a disadvantage in competition.

In addition to its mobile phone business, Meizu also pins its hopes on the emerging market of AR glasses. However, the market performance of Meizu AR glasses has been disappointing. Priced at a high 2499 yuan, they have not achieved significant sales or word-of-mouth success. Compared to competing brands like LeTV and XREAL, Meizu AR glasses lag behind in sales. Furthermore, users have encountered issues such as glare, rapid battery drain, and unstable Bluetooth connections, which undoubtedly affect consumers' willingness to purchase.

More seriously, the overall outlook for the AR/VR market is not optimistic. In 2024, the total sales volume in the Chinese market was only 261,000 units, a year-on-year decrease of 20.4%. Many well-known vendors, including Pico and iQIYI, have reduced their investment in VR/AR businesses or even closed them down. In such a market environment, Meizu's entry into the AR market undoubtedly faces enormous challenges and risks.

Facing difficulties, Meizu has completed a change in leadership. The new CEO, Su Jing, vowed to fully promote the development of both mobile phone and automotive businesses after taking over Meizu. However, both the mobile phone business and the AR glasses business face many difficulties and challenges for Meizu. Whether Meizu can find new growth points and successfully break through in the fierce market competition remains to be seen. What is certain is that Meizu needs a clearer development strategy, more advanced technological capabilities, and products that are closer to consumer needs to win market recognition and trust.