"Broadcom's Acquisition Strategy: Paving the Way to Trillions? Tencent and Alibaba Take Note!"

![]() 09/14 2024

09/14 2024

![]() 511

511

Among the leading technology companies in the United States, Broadcom has always been a "special" player. Companies like Apple, NVIDIA, and AMD rely heavily on in-house research and development, growing through internal innovation and expansion. In contrast, Broadcom has taken a unique path, embarking on a spree of acquisitions that have transformed it from a relatively obscure player into a global giant with a market capitalization of over $800 billion.

Virtually all of Broadcom's core business capabilities today have been acquired through mergers and acquisitions, encompassing networking, wireless, ASIC, and software businesses. While many companies struggle to integrate and optimize newly acquired businesses, Broadcom has consistently demonstrated remarkable operational improvements and growth. In this regard, Alibaba may serve as a cautionary tale, while Tencent's investments, though substantial, have not proven as efficient as Broadcom's approach.

Broadcom's acquisition strategy has consistently involved partnering with top private equity firms to conduct rigorous financial and operational due diligence. This has positioned Broadcom as an outstanding platform for growth and value creation.

Broadcom's acquisitions often exhibit distinct characteristics:

1) Target businesses must possess leading technology or market share, serving as industry leaders in their respective fields.

2) The targets typically exhibit inefficiencies in operations, particularly high expenses that impact profitability.

3) Funding for acquisitions comes from a combination of internal cash, stock, and debt financing, leveraging financial resources to maximize returns.

4) Post-acquisition, Broadcom retains core businesses while divesting non-core assets. This strategy reduces overall operating expenses, enhances profitability, and generates cash flows to repay debt.

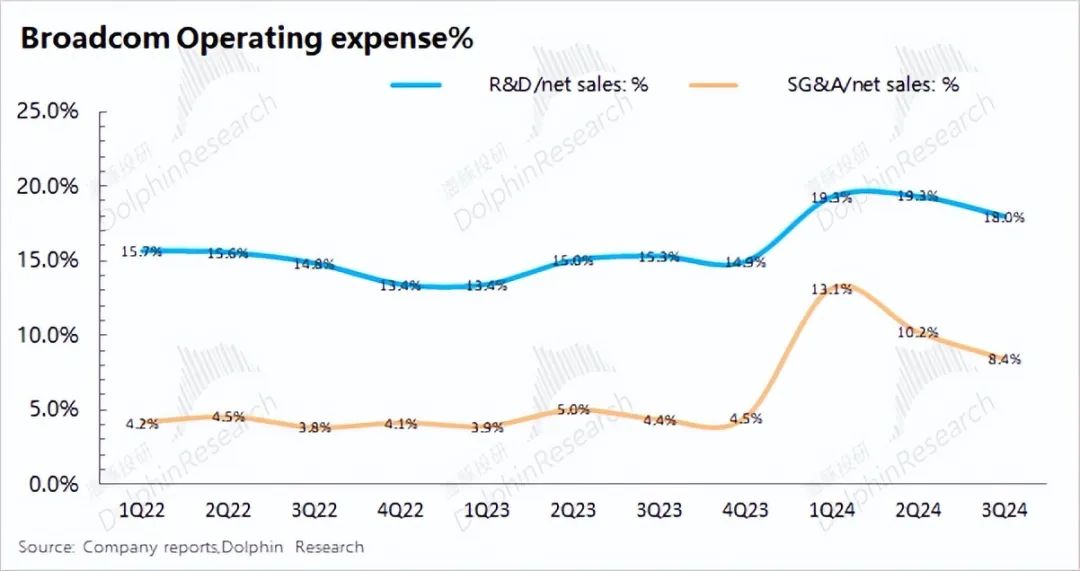

The ongoing acquisition of VMware is a prime example of Broadcom's acquisition strategy. Following the merger, Broadcom's overall operating expenses have declined, with gross margins expected to rebound to around 70%.

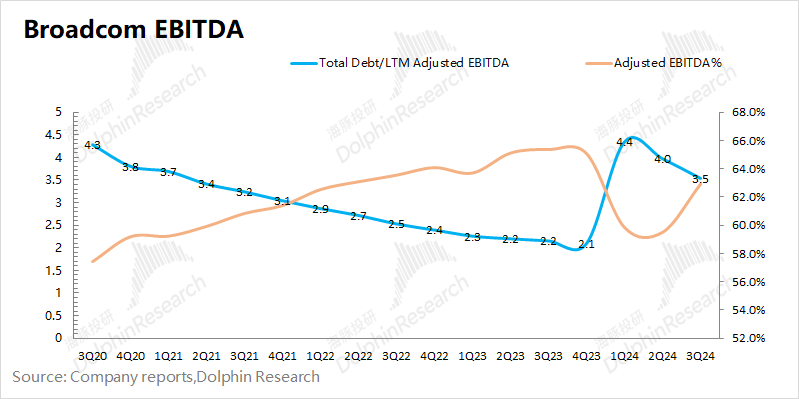

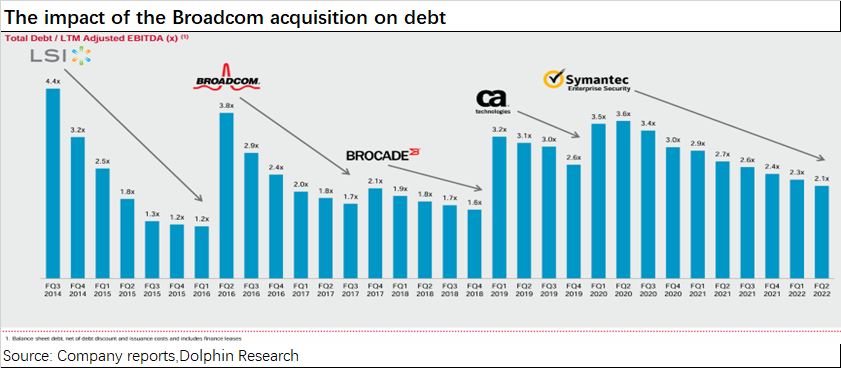

Broadcom's history is a testament to the power of strategic acquisitions. The company prioritizes EBITDA as a key performance metric, with the debt-to-adjusted EBITDA ratio serving as an important indicator of financial health. Historically, Broadcom has initiated significant acquisitions when this ratio approaches 2x, and the recent VMware acquisition has pushed this ratio above 4x, prompting a renewed focus on business integration. As the ratio falls back towards 2x, Broadcom may embark on another round of acquisitions.

Unlike traditional tech companies that grow through internal innovation, Broadcom's core growth strategy revolves around external acquisitions. This article focuses on Broadcom's acquisition tactics, while the following article will delve into the company's business operations and investment value.

Detailed Analysis

I. Broadcom: The King of Mergers and Acquisitions

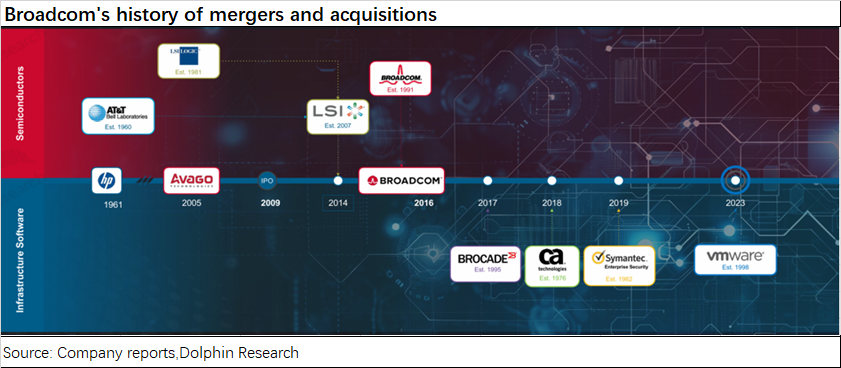

Broadcom's growth has primarily stemmed from a series of strategic acquisitions, rather than internal research and development. Starting from HP's semiconductor division, Broadcom has transformed into a technology giant spanning both hardware and software through a series of well-executed mergers and acquisitions.

After being spun off from Agilent (itself spun off from HP), KKR and Silver Lake Capital renamed the company Avago and embarked on its first acquisition – the BAW business from Infineon – in 2006. Since then, Avago (later renamed Broadcom) has continued its acquisition spree, including CyOptics, LSI, and eventually, the original Broadcom Corporation. Within a decade, Avago grew from a semiconductor division to one of the top five semiconductor companies globally, with acquisitions occurring roughly every two years. Plans to acquire Qualcomm in 2017 were ultimately thwarted by the US government.

Following this setback, Broadcom shifted its acquisition focus towards software businesses, acquiring CA Technologies and Symantec, among others. With the recent addition of VMware, Broadcom's software revenue is rapidly approaching parity with its hardware business.

Through these acquisitions, Broadcom has transformed from a purely hardware-focused semiconductor company into a technology giant with a balanced portfolio of hardware and software capabilities.

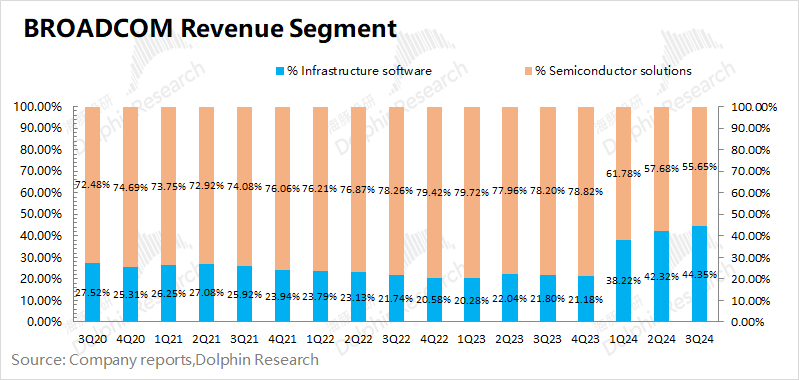

Broadcom's business is currently divided into two main segments: Semiconductor Solutions and Infrastructure Software. With the inclusion of VMware, the software segment's contribution has increased significantly, approaching a 1:1 ratio with the hardware segment.

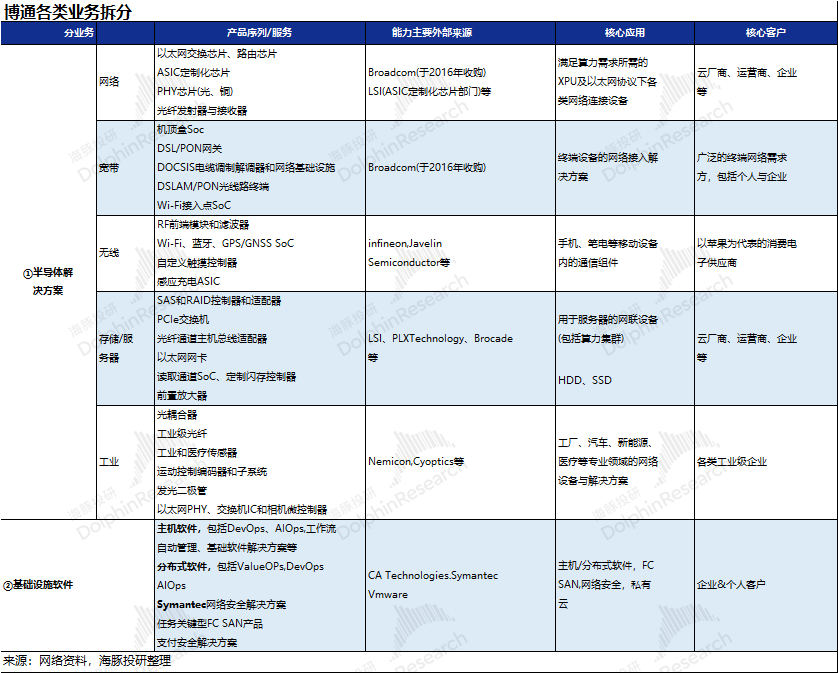

As Broadcom has grown through acquisitions, virtually all of its current business capabilities have been acquired. The two main segments encompass various sub-areas:

1) Semiconductor Solutions (over 50% of revenue):

- Networking (30%): Products include Ethernet switching chips, routing chips, and ASICs, primarily acquired through the Broadcom and LSI mergers.

- Broadband (6%): Products such as set-top box SoCs and gateways, primarily acquired from Broadcom.

- Wireless (13%): Products include RF modules, filters, WiFi, and Bluetooth SoCs, acquired through Infineon-related businesses and Javelin Semiconductor.

- Storage/Servers (7%): Products like SAS and RAID controllers, PCIe switches, acquired and integrated from LSI.

- Industrial & Other (2%): Products such as optocouplers and industrial-grade fibers, acquired from Nemicon and CyOptics.

2) Infrastructure Software (42%): Since 2017, Broadcom has expanded into software through acquisitions of CA, Symantec, and VMware, with products including mainframe software, distributed software, and cybersecurity solutions.

II. Avago's Past Acquisitions and Integrations

Avago's development can be broadly divided into three phases: independent operations, acquisition of LSI, and merger with Broadcom. Each of these phases played a crucial role in shaping Broadcom's subsequent growth.

Overall, Broadcom's acquisitions share common traits: targeting companies with leading technology or market share; leveraging financial leverage; retaining and developing core businesses; integrating operations to reduce expenses and boost profitability; and divesting non-core assets to repay debt.

2.1 Establishment of Avago

Avago originated from Agilent, which was spun off from HP. Agilent's primary businesses were T&M (Test & Measurement) and LS&CA (Life Sciences & Chemical Analysis), with semiconductor operations accounting for a relatively small portion and being highly cyclical. Seeking to focus on its core businesses, Agilent decided to divest its semiconductor division.

KKR and Silver Lake Capital acquired Agilent's semiconductor division for $2.66 billion and renamed it Avago.

From an operational and financial perspective:

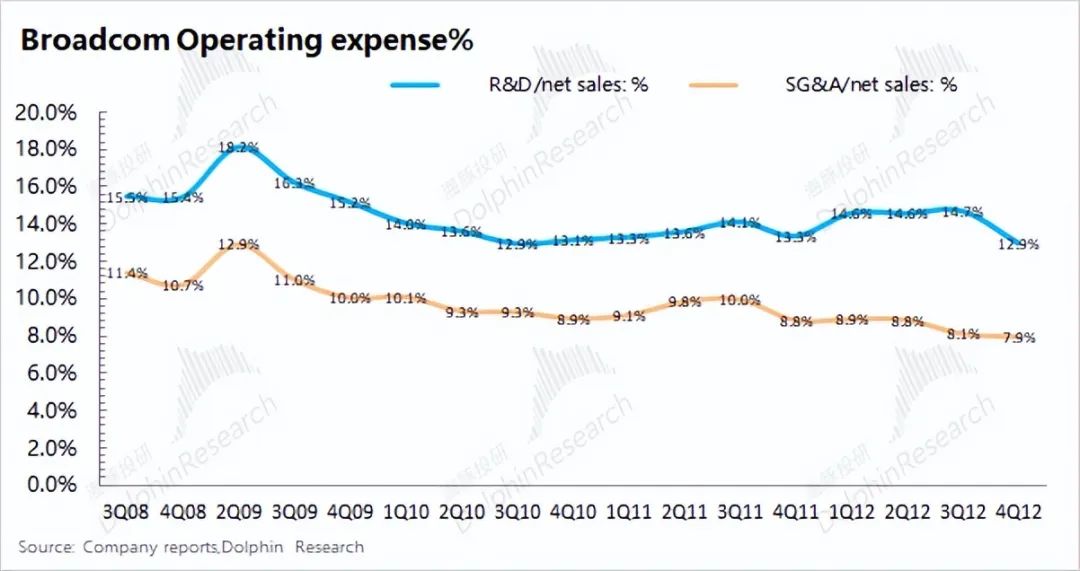

- Operational: Avago focused on high-margin, high-growth products like filters and RF modules, divesting non-core assets. By relocating its headquarters to Singapore, Avago enjoyed a 5% corporate tax rate. Additionally, it outsourced some IT and back-office functions to India, reducing R&D expenses from around 16% to 14% and sales & administrative expenses from 11% to around 8%. During this period, revenue grew by $800 million, while total expenses remained relatively flat.

- Financial: The acquisition required $2.775 billion, including $2.66 billion for the target and related transaction costs. KKR and Silver Lake funded half of this through high-interest debt (around $1.4 billion). Avago subsequently divested non-core assets like PMC-Sierra and Imaging Solutions, generating $700 million to repay half of its debt. In 2009, Avago went public with a valuation of $4 billion, a near-50% increase from its acquisition price four years earlier. Improved operations drove share price gains, allowing shareholders to repay debt and realize returns.

2.2 Acquisition of LSI

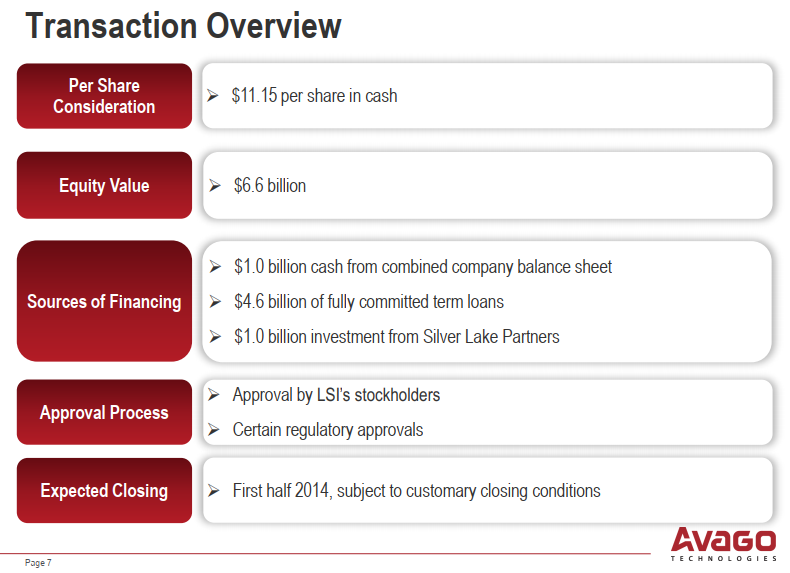

After becoming an independent company, Avago grew into a semiconductor industry leader through its wireless businesses, particularly in the filter market. Riding the wave of 4G smartphones, Avago's market value soared from $4 billion to over $10 billion. Seeking further growth, Avago targeted LSI's HDD and SSD storage businesses, which were comparable in revenue scale to Avago's at the time.

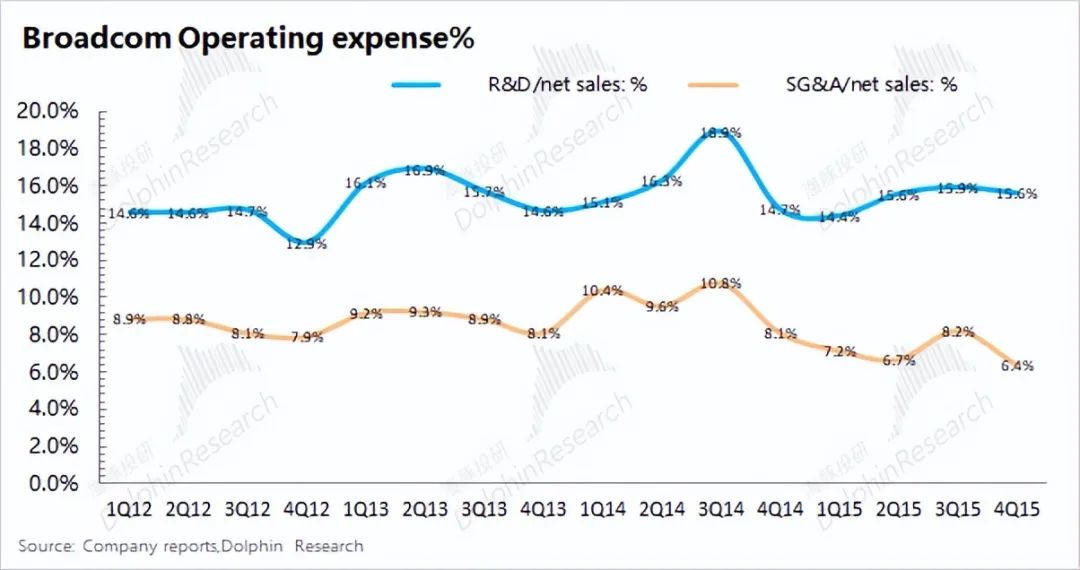

Despite market skepticism, Avago believed it could improve LSI's profitability by reducing expenses. While Avago's combined R&D and sales & marketing expenses stood at 21%, LSI's were a staggering 39%.

- Operational: 78% of LSI's revenue came from storage, with little overlap or synergy with Avago's existing businesses. The acquisition focused on LSI's high-quality storage assets and financial integration. Avago retained LSI's core HDD business while divesting SSD and Axxia businesses to reduce losses and repay debt. Integration with Avago's R&D and sales resources significantly reduced expenses.

After the acquisition, combined expenses peaked at around 30% before falling back below 25% through cost-cutting and integration efforts. By the end of 2015, both revenue and profits had doubled.

- Financial: Similar to previous acquisitions, funding came primarily from debt. The $6.6 billion acquisition was financed with $4.6 billion in bank loans, $1 billion from the merged entity, and $1 billion from Silver Lake Capital. Within a year, Avago divested SSD and Axxia businesses for $450 million and $650 million, respectively, repaying a portion of its bank loans and reducing interest expenses. By the end of the year, Avago's share price had doubled again, exceeding $40 billion.

2.3 Merger with Broadcom

After acquiring LSI, Avago became one of the world's top ten semiconductor companies. However, its ambitions did not stop there. Less than two years later, Avago set its sights on Broadcom, then the world's fifth-largest semiconductor company. This was a true "David and Goliath" acquisition.

Similar to LSI, Broadcom's business had limited overlap with Avago's, with wireless revenues accounting for just one-fifth of Broadcom's total. Prior to the acquisition, Avago's annual revenue was around $6.6 billion, while Broadcom's was $8.5 billion. Despite its smaller size, Avago boasted higher operational efficiency, with an operating margin of 38% compared to Broadcom's 24% in Q1 2025.

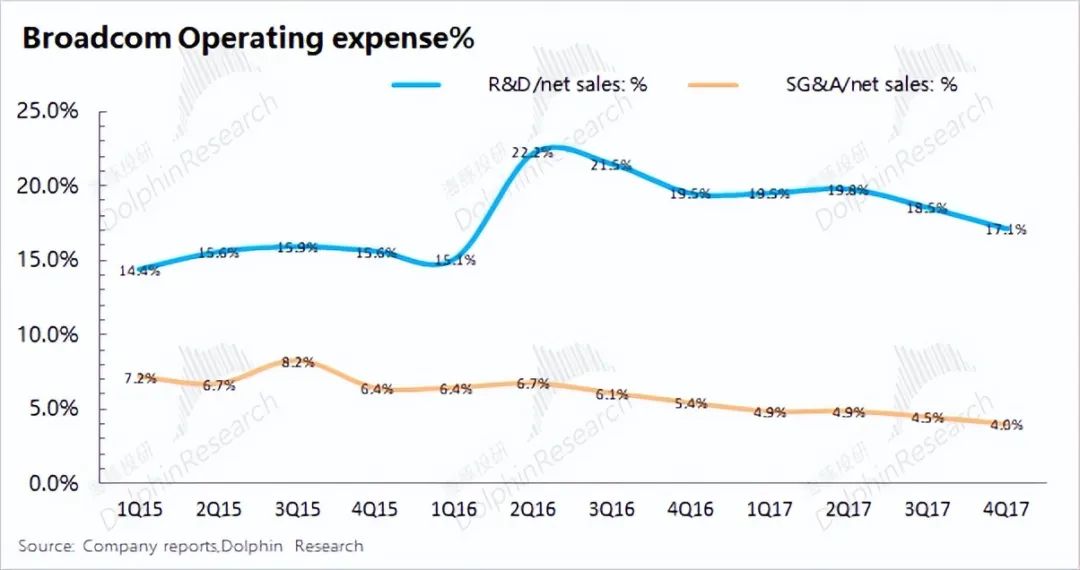

- Operational: The merger significantly expanded Broadcom's wired infrastructure and wireless communications businesses, becoming the core revenue drivers for the new entity. While retaining core operations, Broadcom divested unprofitable IoT businesses, reducing interest costs. Further integration of R&D and sales resources reduced expenses from nearly 30% to around 20% within 1-2 years, driving significant revenue and profit growth.

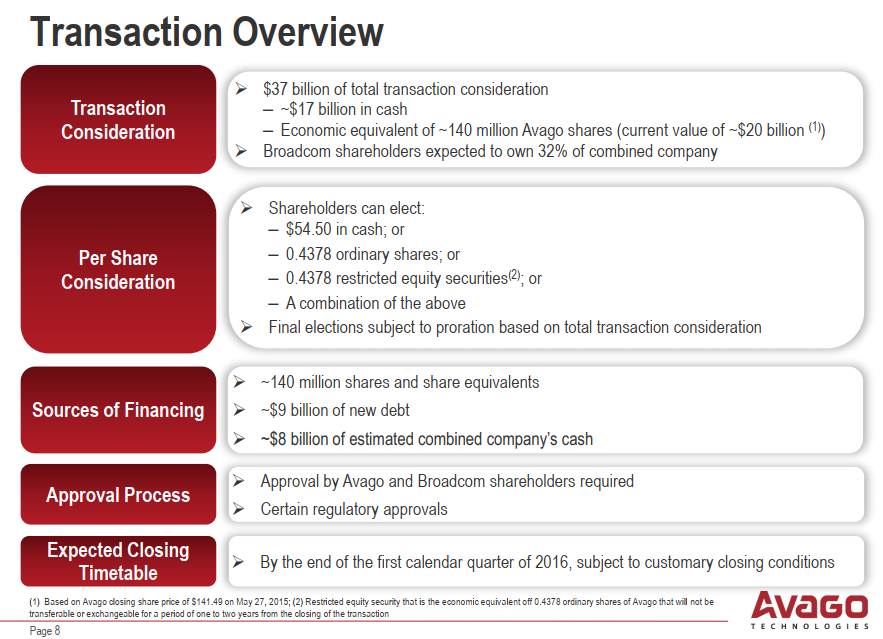

2) Capital aspect: As Avago's acquisition scale grows larger, the acquisition price for Broadcom has reached $37 billion. For funding arrangements, the company adopts a "cash + shares" approach, consisting of $17 billion in cash and $14 billion in share consideration. The $17 billion in cash primarily comprises $9 billion in new debt and $8 billion in cash on hand.

Subsequently, the company divested its IoT business, generating $550 million, which can also be used to repay some of its debts. With the company's business integration, quarterly net profit increased from $400 million to $600 million in less than two years. The company's share price also doubled again, exceeding $80 billion.

III. Current acquisition of VMware and Broadcom's objectives

After completing the acquisition of Broadcom, the company began seeking new directions. By this time, Broadcom had firmly established itself as one of the top five global semiconductor companies, but the company aimed for another major acquisition. In 2017, the company proposed acquiring Qualcomm, a company still larger than itself. However, this blockbuster merger was ultimately halted by the US government.

After encountering obstacles in its acquisition plans, Broadcom reevaluated and redirected its strategy, halting its expansion in the semiconductor sector and turning to the software sector. It subsequently acquired companies such as CA and Symantec, boosting its software business revenue to 20%.

In the past two years, the company has also acquired VMware, another publicly traded software company. Broadcom acquired VMware for $61 billion and assumed $8 billion in debt. This substantial acquisition brought revenue growth to the company while also imposing new pressures.

3.1 Regarding the VMware acquisition

1) Operational aspect: With the acquisition and consolidation, the company's related expense ratios increased significantly again. The combined R&D% and SG&A% increased from around 20% to 32%. Based on past experiences, Dolphin Insights believes that these two expense ratios are also expected to decline, potentially falling below 25% again. With integration progressing, the company's profit margin is also expected to improve significantly.

2) Capital aspect: The $61 billion transaction was primarily funded through a "cash + stock" arrangement. Former VMware shareholders could choose to receive $142.5 per share in cash or an equivalent number of Broadcom shares. Additionally, Broadcom and a banking consortium prepared $32 billion in new borrowings.

Regarding the acquisition, Broadcom measures its debt repayment capability using the ratio of total debt to LTM adjusted EBITDA. Historically, after each major acquisition, this ratio increases significantly. However, through divestitures and business integration, the company repays some loans and increases profits, thereby enhancing its repayment capability. When this ratio falls to around 2, the company initiates a new round of acquisitions and consolidations.

3.2 Broadcom's vision and objectives

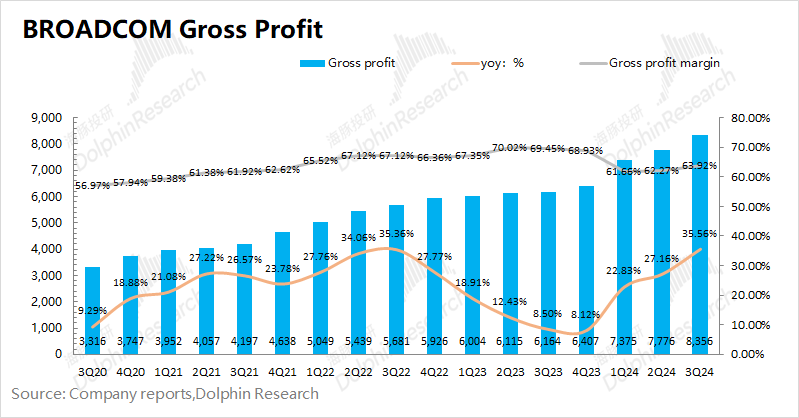

With the successive acquisitions of software companies like CA, Symantec, and VMware in recent years, Broadcom's gross margin has steadily improved. This is primarily because the gross margin of software businesses is generally higher than that of semiconductor operations, lifting Broadcom's gross margin from around 50% to over 60%.

Currently, due to the integration of the VMware acquisition, gross margin has declined slightly in the short term. As VMware's gross margin exceeds 80%, with integration progressing, Broadcom's overall gross margin is expected to return above 70%. Combined with the company's reduction in operating expenses, its operating profit margin is projected to exceed 40% again.

Apart from revenue, the company has also set EBITDA% targets on the operational side, aligning with its strategy of "leveraged buyouts for growth." Adjusted EBITDA, which reflects profit after non-cash expenses, serves as a rough indicator of a company's cash profits. It not only reflects operational efficiency and management capabilities but also gauges the company's debt repayment ability. The company consistently aims for an EBITDA% above 60%, ensuring both high-margin operations and debt repayment capabilities post-acquisitions.

With the consolidation of VMware, Broadcom's ratio of total debt to LTM adjusted EBITDA rose to 4.4. As operational improvements led to increased adjusted EBITDA and a reduction in total debt, this ratio gradually declined to 3.5, which is still relatively high in the company's historical context.

Therefore, Dolphin Insights believes that the company will not proceed with further acquisitions for the time being and will instead focus on integrating VMware. When the relevant ratio declines to around 2 again, the company may commence searching for new acquisition opportunities.