"Zhuan Zhuan" Strives to Surpass "Xianyu", But Second-hand Luxury Goods Cannot Support Its Ambition

![]() 10/08 2024

10/08 2024

![]() 466

466

In the multi-category arena, "Zhuan Zhuan" cannot avoid its formidable rival, "Xianyu".

@Original by TechXplorer

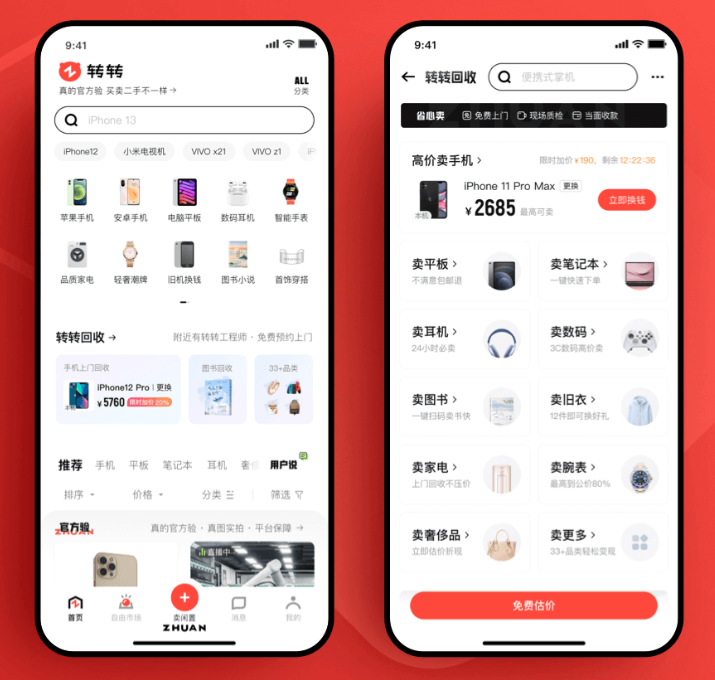

In today's society where circular economy is prevalent, what are the keys to success for idle goods trading platforms? Among the three major players, "Xianyu" chooses a "model-winning strategy," "Aihuishou" shelters under JD.com, while "Zhuan Zhuan" aims to stand out through category expansion.

On September 23, "Zhuan Zhuan" and second-hand fashion trading platform "Hongbulin" jointly announced that "Zhuan Zhuan" has fully acquired "Hongbulin." In the future, the two will be fully integrated, with "Hongbulin's" second-hand luxury goods authentication capabilities being incorporated into "Zhuan Zhuan's" "Official Authentication" multi-category authentication capabilities.

After the integration, the "Hongbulin" brand and app will continue to operate independently, but the back-end systems and fulfillment capabilities of "Zhuan Zhuan" and "Hongbulin" will be fully integrated. At the same time, "Hongbulin" will also reuse "Zhuan Zhuan's" on-site services and store systems.

A mutually beneficial acquisition.

With "Zhuan Zhuan's" second-largest domestic market share and scale advantage, "Hongbulin," which is facing a funding winter and desperately needs a strong backer, finds security.

For "Zhuan Zhuan," the domestic circulation rate of second-hand luxury goods is less than 5%, exposing a huge untapped market space. "Hongbulin's" unique barriers in authentication, grading, and pricing in the second-hand luxury goods sector also help fill gaps in this category and enrich female user profiles.

In fact, in recent years, with declining consumption levels and increasing environmental awareness, the idle goods trading market has expanded rapidly. A QuestMobile report pointed out that the active user base of idle goods trading apps grew by nearly 30% year-on-year in 2023.

Against the backdrop of industry prosperity, competition among established second-hand trading platforms has intensified, and social platforms such as Douyin, Kuaishou, and Xiaohongshu have further captured user markets.

Although "Zhuan Zhuan" currently ranks second in domestic market share after "Xianyu," with numerous competitors surrounding it, its confidence in maintaining its position and striving for first place remains somewhat lacking.

Part.1

Competing for the Second-hand Luxury Goods Market

Regarding this acquisition, Hu Weikun, co-founder and COO of "Zhuan Zhuan" Group and concurrently CEO of "Hongbulin," said in a media interview: "The overall volume of luxury goods is similar to that of consumer electronics, so the second-hand market should be comparable, and the stock of second-hand luxury goods is even higher than that of consumer electronics."

Indeed, the luxury goods market occupies a significant share of the consumer market due to its high unit prices. The resulting commercial value of the second-hand luxury goods market should not be underestimated. A luxury goods market insight report released by PwC predicts that the global second-hand luxury goods market will grow at a compound annual growth rate of nearly 13% from 2021 to 2027.

However, due to their high unit prices and low circulation, the second-hand luxury goods trading market is destined not to be a top-tier category among numerous second-hand trading categories.

According to Dianshubao's e-commerce big data database, the transaction scale of second-hand e-commerce reached 548.65 billion yuan in 2023, an increase of 14.25% year-on-year. HeadBull Research predicts that China's second-hand luxury goods market will reach 34.8 billion yuan by 2025.

Beyond market size limitations, the downfall of "Secoo," once known as the "first luxury goods e-commerce stock," may also have inspired "Zhuan Zhuan" and "Hongbulin" to join forces.

Secoo, which went public on NASDAQ in September 2017, has been delisted and its stock trading halted on April 25th of this year.

Secoo's downfall was a result of multiple factors, but undoubtedly, the singularity of its product category played a role. Apart from Secoo, Jumei International, once a popular beauty e-commerce platform, also suffered from the same issue of a single product category.

With recent examples like Secoo and Jumei International in mind, "Zhuan Zhuan" has long understood that a multi-category approach is fundamental for e-commerce platforms, including second-hand ones.

From integrating "Zhao Liangji" in 2020 to acquiring "Hongbulin" this time, "Zhuan Zhuan" Group's current second-hand e-commerce platforms include "Zhuan Zhuan," "Zhao Liangji," "Caihuoxia," and "Hongbulin," with a focus on consumer electronics and second-hand luxury goods, as well as involvement in other categories such as second-hand books and household items.

However, in the multi-category arena, "Zhuan Zhuan" cannot avoid its formidable rival, "Xianyu."

By providing "Official Authentication" to endorse users' second-hand transactions, "Zhuan Zhuan" once differentiated itself from "Xianyu" through its C2B2C model. However, as "Xianyu" also began to emphasize the platform's role in the transaction process, "Zhuan Zhuan's" model advantage is fading.

Recently, "Xianyu" launched the "Worry-Free Shopping" service in four areas: luxury goods, mobile phones and digital products, sneakers and toys, and beauty products, offering a triple guarantee of "authenticity, return policy, and free shipping."

"Aihuishou," which has a similar positioning to "Zhuan Zhuan," has also explored the possibility of second-hand luxury goods beyond its second-hand mobile phone business. In the App Store, "Aihuishou" is positioned as a "second-hand mobile phone & luxury goods recycling platform."

Part.2

Traffic Dilemma Remains Unsolved

In recent years, "Zhuan Zhuan" has been dedicated to expanding its business categories through mergers and acquisitions, with the underlying logic being the competition for traffic among second-hand trading platforms.

Compared to "Zhuan Zhuan," "Xianyu" has an inherent advantage in traffic.

As a platform under Alibaba, "Xianyu" originated from Taobao's "Taobao Second-hand" channel. After launching its independent app, "Xianyu" never had to worry about traffic due to its deep integration with Taobao, Alipay, Tmall, and others.

Opening the "Xianyu" app reveals that users can log in using their phone numbers or quickly log in with their Taobao or Alipay accounts. Alipay's guaranteed transaction provides security for the circulation of funds between buyers and sellers through its escrow account. Additionally, "Xianyu's" "One-Click Resell" function offers a convenient channel for sellers to sell items they purchased on Taobao.

In November 2023, "Xianyu" became a strategic innovation business alongside 1688, DingTalk, and Quark, with Alibaba committing to continuous investment in strategic innovation businesses over a 3-5 year period. In December of the same year, "Xianyu" was elevated to a first-tier business within Taobao Group.

The enhanced priority has continually fortified "Xianyu's" market position, while its community-centric approach maximizes the retention of traffic directed from Taobao Group. Despite recent scandals involving pornography and loan-related issues, competitors like "Zhuan Zhuan" still struggle to catch up.

Data shows that as of April 2024, "Xianyu's" monthly active user base reached 162 million, ranking first in the idle goods trading industry with a year-on-year growth of 19.1%. "Zhuan Zhuan" ranked second with 22.48 million monthly active users, a year-on-year growth of 3.7%.

As a platform with a similar C2B2C business model to "Zhuan Zhuan," "Aihuishou" is deeply integrated with JD.com.

It is understood that "Aihuishou" has been in partnership with JD.com since 2014. In 2019, JD.com merged its subsidiary PaiPai with "Aihuishou" and led a US$500 million financing round for "Aihuishou." Industry insiders have admitted that most of "Aihuishou's" traffic comes from JD.com, with convenient user redirection through the JD.com app's "Aihuishou" entry.

It's comforting to have a strong backer. "Aihuishou's" parent company, Wuxin Limited, reported a 27.4% year-on-year revenue growth in the second quarter of this year, marking the company's eighth consecutive quarter of operating profitability.

Although "Zhuan Zhuan's" investors include 58.com, Tencent, and Xiaomi, it is well known that 58.com has also been on the decline in recent years. While Tencent's WeChat boasts a massive user base, unlike payment platforms like Taobao and JD.com, its usage scenarios do not easily translate into high traffic conversion rates for "Zhuan Zhuan."

To maintain its presence, "Zhuan Zhuan" has been active on multiple platforms in recent years. On Douyin, in addition to frequently appearing in popular short video comments, the company's ads with the catchphrase "Have you changed your phone recently?" have become synonymous with "Zhuan Zhuan."

In April this year, Douyin's top streamer Crazy Brother Xiao Yang live-streamed the sale of Apple 15 Pro Max refurbished phones at a price of 8,888 yuan, generating over 100 million yuan in sales for that model alone during the live stream. In the broadcast, Xiao Yang introduced that refurbished phones are products returned by customers within seven days of purchase and "selected from 'Zhuan Zhuan' and Foxconn."

Earlier in 2020, Luo Yonghao also endorsed "Zhuan Zhuan" during an "old phone launch event." However, whether it's Luo Yonghao or Crazy Brother Xiao Yang, the sales booms seem more like one-time deals. After the heat subsides, "Zhuan Zhuan's" traffic dilemma persists.

Part.3

Mired in a Trust Crisis

On January 28, 2023, a Douyin blogger posted two videos accusing "Zhuan Zhuan" of issuing conflicting inspection reports during the sale and purchase of second-hand mobile phones. The videos sparked heated market discussions.

The blogger's videos showed that he purchased four phones from "Zhuan Zhuan" stores for a total of 13,610 yuan but could only resell them for 9,567 yuan, a difference of 4,043 yuan, when sold through other "Zhuan Zhuan" stores within half an hour.

It is understood that mobile phone recycling prices are determined based on "Zhuan Zhuan's" inspection reports, but two inspection reports for the same batch of phones differed significantly within half an hour.

Jiangsu News commented on this incident: "An authentication certificate is not only a passport to gain consumers' trust but also the cornerstone of a platform's own integrity. The word 'trust' determines the upper limit of a second-hand trading platform's development."

Although "Zhuan Zhuan" apologized to the public through social media, the trust gap created is unlikely to be bridged quickly.

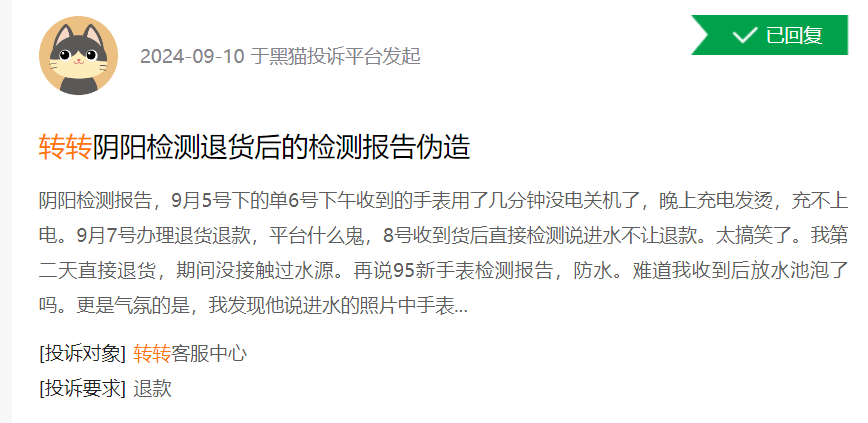

In fact, loose quality control and inconsistent standards have long plagued second-hand trading platforms. A search on Heimao Complaints reveals numerous consumer complaints against second-hand trading platforms, including "Xianyu," "Zhuan Zhuan," and "Aihuishou."

Among them, a consumer complaint against "Zhuan Zhuan" in early September this year also involved conflicting inspection reports.

Image source: Heimao Complaints

With a focus on second-hand mobile phones and digital products, "Zhuan Zhuan" pioneered its official inspection system. While providing transaction guarantees through official inspections benefits both buyers and sellers by controlling risks in second-hand goods transactions, exploiting the lemons market by widening intermediary spreads for profit can erode user trust and ultimately backfire.

Current monetization models for second-hand trading platforms include transaction commission fees, advertising promotions, value-added service charges, and earning spreads. Operational costs to cover include sourcing, assessment system development, inspection technology research and development, traffic acquisition, and information matching.

Due to limited intermediary profits from a single second-hand mobile phone or other digital product, it is understandable for platforms to earn profits through spreads. However, the key lies in constructing a standard to address pricing and information transparency issues for high-value second-hand items.

In fact, inconsistent product quality control and standards have long been pain points for second-hand e-commerce. While "Xianyu's" inherent traffic and community retention advantages make short-term question insufficient to shake its leading position, for "Zhuan Zhuan," which lacks these advantages, finding a way out of the public's doubts is crucial to breaking the stalemate.

Despite operational differences, as a leading second-hand trading platform in the public eye, "Zhuan Zhuan" has always aspired to surpass "Xianyu." However, with inherent disadvantages and a potential loss of user trust, simple category expansion alone cannot be a viable strategy.

At its 2022 brand upgrade conference, "Zhuan Zhuan" announced its transformation into a circular economy company with the grand slogan "Second-hand Saves the World," but in reality, the path to truly realizing circular economy remains long and challenging.