Several characteristics of the development of China's laptop market in 2024

![]() 10/09 2024

10/09 2024

![]() 467

467

Focusing on China's laptop market in 2024, the demand for hybrid work and online education driven by the pandemic is gradually fading, and the scar economy has directly affected national consumption capacity, leading to an overall downturn in the market.

Although AI PC products have begun to enter the era of commercialization, they cannot trigger users' desire to quickly replace high-value electronic products in the short term. In contrast, the demand for more cost-effective and durable tool-type laptops appears relatively rigid.

In fact, with the highly targeted purchasing behavior of end-users in the Chinese market and the further enhancement of the industrial chain advantages accumulated over time, China, as a leading consumer market and manufacturing base for laptops globally, is entering an important cycle of industrial development and change.

Characteristic 1: Chinese brands begin to "precisely segment" their target audience to achieve more accurate purchasing behavior

'Precise segmentation' aims to formulate more personalized marketing strategies by deeply understanding consumers' preferences, behavior patterns, and psychological characteristics, thereby achieving more accurate purchasing behavior.

In China's laptop market, users generally recognize the advantages of online shopping, such as price transparency and clear configurations. As the credibility of e-commerce platforms improves and the financial services and after-sales service guarantee mechanisms they provide continue to improve, the proportion of online purchases is still expanding. Therefore, Chinese brands pay more attention to promoting online marketing methods to increase reach and gain growth.

In addition, Chinese brands collect consumer behavior data through multiple channels such as social media, e-commerce platforms, and video platforms to precisely analyze the demand characteristics, purchase cycles, and budget ranges of different consumer groups for laptops.

In recent years, in contrast to the "straightforward" focus on technological upgrades by overseas brands, Chinese brands have adopted the strategy of "precise segmentation" and launched more segmented products such as "slim laptops for women," "office laptops," and "drawing laptops" in the domestic market to target different consumer needs. Specifically, brands like Huawei, Xiaomi, Apple, and Honor mainly focus on the office segment, while ASUS, including its sub-brand ROG, MECHREVO, and Colorful are primarily focused on the gaming segment, giving them certain advantages in retail sales and average prices.

Characteristic 2: International brands' reserved attitude towards the Chinese market has inspired local brands to strive for surpassing achievements

Laptops, as a symbol of technological prowess, have long been dominated by international giants such as HP, Dell, Apple, and Microsoft globally. In China, Lenovo is the primary Chinese brand, while other local brands have a lower profile.

However, China is the world's factory, accounting for about 90% of global laptop production and processing. With decades of technological and craftsmanship experience, coupled with recent breakthroughs in key technologies such as chips and systems, local brands are riding the wave and actively positioning themselves to capture a larger market share.

Furthermore, as domestic market competition intensifies, many international brands prefer not to engage in price wars and have a reserved attitude towards the future development potential of the Chinese market, resulting in significant downsizing of their Chinese teams. This has inspired local brands to strive for surpassing achievements.

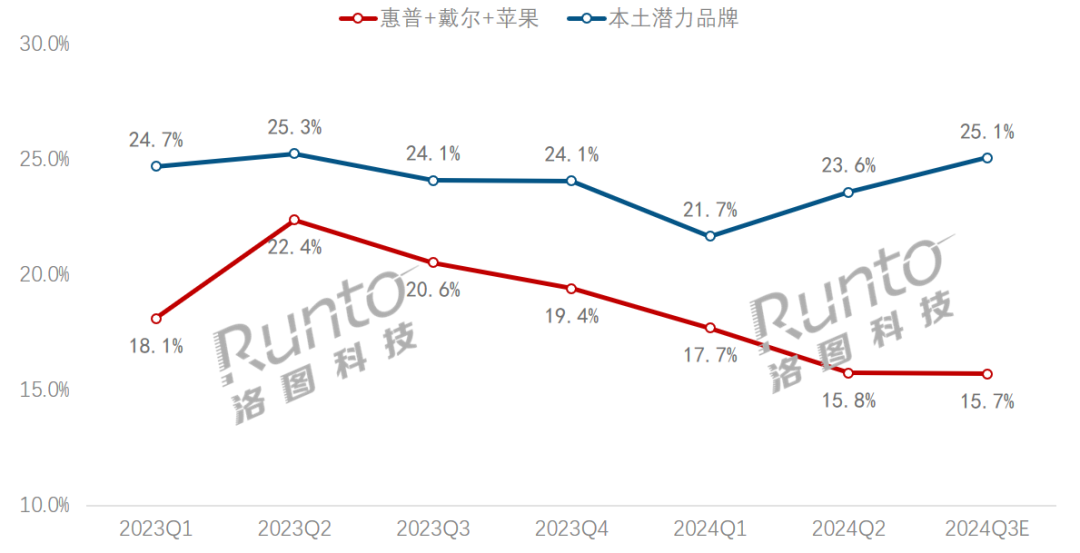

According to online monitoring data from RUNTO, the market share of international brands such as HP, Dell, and Apple in China's online market decreased from a high of 22.4% in Q2 2023 to 15.7% in Q3 2024. While brands like Huawei, MECHREVO, Xiaomi, Honor, Hasee, and Colorful have maintained a stable market share of around 25% since 2023, they are seen as local brands with significant potential beyond Lenovo and ASUS, amid the decline of foreign brands.

Change in Market Share of Mainstream Laptop Brands in China's Online Market from Q1 2023 to Q3 2024E

Data Source: RUNTO online monitoring data, Unit: %

Characteristic 3: Stable demand in China's B+G segment; High enthusiasm for domestic products among C-end consumers

The demand for laptops in China's B+G segment remains relatively stable. Education, state-owned enterprises, institutions, and government departments are key segments where Chinese local brands will focus their efforts, driven by the trend towards paperless operations.

In the C-end market, Generation Alpha and Generation Z, as younger consumer groups, hold a positive and open attitude towards local laptop brands. They appreciate local brands' efforts and achievements in technological innovation, cost-effectiveness, personalized design, and after-sales service. Their enthusiasm and trust in "Made in China" brands continue to rise, with a significant portion willing to try and purchase domestic laptops to support the rise of domestic technology.

At the same time, they interact with brands in their own ways, providing suggestions for product innovation and helping brands launch more products that meet user needs and preferences.

Characteristic 4: China's stable supply capacity and growing exports

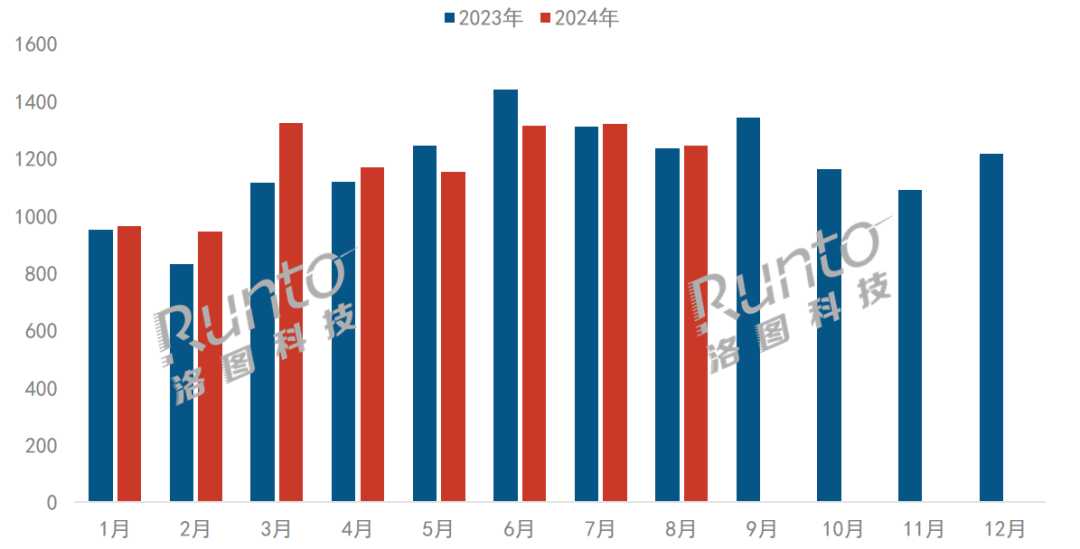

According to RUNTO data, as of August 2024, China's total laptop exports amounted to 94.34 million units, up 2% year-on-year, with exports valued at RMB 360.8 billion, up 4% year-on-year, indicating stable supply capacity, overseas customers, and channel relationships for China's laptop industry.

Monthly Scale and Changes in China's Laptop Export Market in 2024

Data Source: RUNTO, Unit: 10,000 units

Overall, similar to the way brand shifts occur in other electronic products, China's laptop market is entering a critical period of brand development. The rise of local brands is an inevitable trend.

Facing the segmented characteristics and competitive pressures of the domestic market, local brands have mature advantages in demand profiling, technology application, customized services, and online channels, gradually winning more market share and consumer trust.

Meanwhile, as the global market gradually recovers and the local supply chain matures and stabilizes, local brands will further expand into overseas markets.