“The longest battlefront” of Double 11 reveals changes in e-commerce competition logic

![]() 10/16 2024

10/16 2024

![]() 629

629

Double 11's “auspicious start” came earlier than previous years.

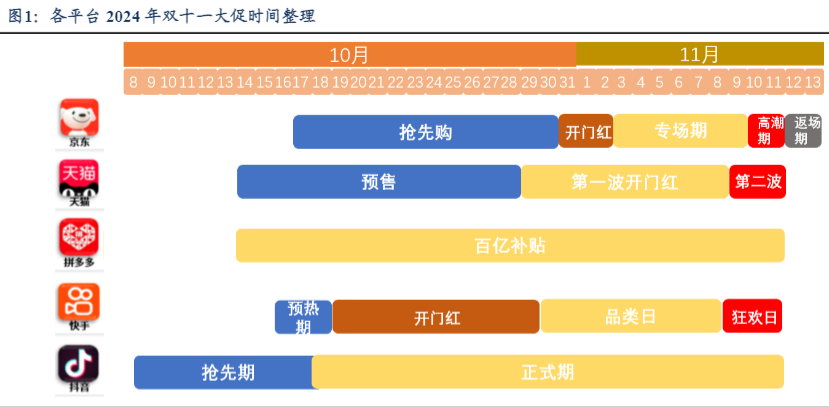

This year, major e-commerce platforms generally extended their preparation period by about a week. From a timing perspective, Douyin advanced the Double 11 Early Access Festival to October 8; Xiaohongshu's “Annual Shopping Frenzy” started on October 12; Tmall and Taobao's Double 11 pre-sales began on October 14, 10 days earlier than last year; JD.com's Double 11 officially kicked off at 8 pm on October 14, 9 days earlier than last year; Pinduoduo's Double 11 event also started on October 14 and will run until November 11.

Image source: Suzhou Securities

In other words, most platforms have launched their Double 11 activities since October 14. The advance in activity timing and the extension of the activity period indicate that platforms are strongly motivated to lock in consumers and stimulate promotional spending through large-scale promotional activities.

More notably, amidst the fanfare of this commercial extravaganza, some strategic adjustments by e-commerce platforms conceal changes in their long-term development strategies.

Amid a longer battlefront, the coexistence of marketing frenzy and rule changes

The fiercer competition among platforms during the 2024 Double 11 is a microcosm of the overall development status of the e-commerce industry.

The declining popularity of Double 11 and the struggle to grow transaction volumes have become a consensus among many practitioners. However, despite the stock competition, the number of players in the e-commerce space continues to increase. Tmall, JD.com, Douyin, Kuaishou, Bilibili, and other platforms have successively held Double 11 merchant conferences, and Xiaohongshu has also joined the Double 11 fray, continuously reshaping China's e-commerce competition landscape.

Against this backdrop, platforms have unanimously extended the Double 11 battlefront, with the primary goal undoubtedly being to expand sales and solidify Q4 performance.

Extending the activity period not only provides consumers with more ample shopping hours and diverse options but also opens up a broader time window for merchants, thereby effectively promoting sales growth. As more consumer demand is concentrated during the promotional period, Double 11 sales have become more significant for e-commerce platforms' Q4 revenue than in previous years.

However, Double 11 is not merely a simple marketing frenzy; it also conceals the value of “war games” among platforms in terms of product cost-effectiveness and service quality.

Therefore, through Double 11, the market can better discern the current direction of each e-commerce platform and a portion of industry consensus. For instance, advancing and extending the preparation period increases financial pressure on merchants for stockpiling and marketing activities. How platforms support merchant development, to a certain extent, reflects changes in the overall strategy of platform merchants in the coming period. Additionally, changes in consumer-side gameplay rules during this Double 11 may also reflect shifts in platform user competition thinking.

So, what changes have occurred on the merchant and consumer sides as a result of e-commerce platforms' strategic adjustments during this year's Double 11?

Easing pressure on merchants and reshaping growth rules

A notable change during this Double 11 is that e-commerce platforms are no longer solely emphasizing low prices but have instead introduced a series of policies to support merchants.

First, they have introduced fee reduction and preferential policies to help merchants reduce costs and increase efficiency in all aspects of transactions.

This year, Pinduoduo launched a “10 Billion Relief” plan for merchants, aiming to exempt high-quality merchants from RMB 10 billion in transaction fees over the next year. At the same time, the platform lowered cash withdrawal thresholds, technical fees for pay-later orders, and basic store deposits. It is evident that Pinduoduo genuinely understands merchants' pain points and is willing to invest real money to address them. For example, the platform will fully bear the logistics transit costs for remote regions such as Xinjiang, Tibet, Gansu, Ningxia, and Inner Mongolia.

Image source: Pinduoduo

Second, they are addressing merchants' concerns about unreasonable “only refund” policies.

Since the implementation of the “only refund” policy, its drawbacks have gradually emerged. For merchants, the policy can be maliciously exploited, leading to losses in payments and products, which may increase their operational burden in the long run. To avoid “bad money driving out good,” optimizing the “only refund” policy is imperative.

Addressing unreasonable “only refund” practices requires a nuanced approach rather than a blanket solution. In this regard, on August 9, Taobao introduced an optimized “only refund” strategy for all merchants, intercepting over 400,000 unreasonable refund requests daily on average within two months.

Meanwhile, Pinduoduo also made service adjustments, allowing merchants to appeal against abnormal or malicious orders. Upon successful appeal, the platform will compensate the relevant orders and will no longer limit the number of merchant appeals.

Third, they are helping more industrial belt merchants grow and fostering a virtuous growth ecosystem for merchants.

In the context of stock competition, small and medium-sized merchants face greater challenges in securing a share of Double 11 compared to well-funded big brands.

Addressing this, at the previous 2024 JD.com Double 11 Merchant Ecosystem Conference, JD.com set a goal of helping the number of micro-merchants with daily sales exceeding RMB 10,000 grow by more than 200% year-on-year during Double 11 and the number of merchants with sales exceeding RMB 5 million increase by more than 50% year-on-year. The platform will support these merchants in the competition through diversified support in traffic, pricing, and logistics.

Image source: JD Merchant Center

From overall burden reduction to rule optimization and merchant growth at different levels, it is evident that compared to last year's increased operational pressure due to the sole focus on low prices, this year's merchant growth environment is gradually improving. This may represent a long-term trend as major e-commerce platforms are forming a consensus to “create an excellent business environment and lay the foundation for high-quality development.”

For instance, Pinduoduo CEO Lei Chen explicitly stated, “Empowering and nurturing merchants is a crucial aspect of building Pinduoduo's high-quality supply and platform ecosystem.”

Similarly, JD.com CEO Ran Xu remarked, “Long-term success does not rely on leveraging our traffic to endlessly squeeze merchants or engage in vicious competition that ultimately drives out good money with bad.”

For merchants, this year's Double 11 could mark a turning point in breaking through difficulties and embracing new development opportunities. In fact, easing the burden on merchants to revitalize production and operational efficiency on the consumer supply side is also a manifestation of a “user experience-centric” mindset.

Guided by consumer experience, returning competition to its commercial essence

This year's Double 11, “guided by consumer experience,” remains the key phrase.

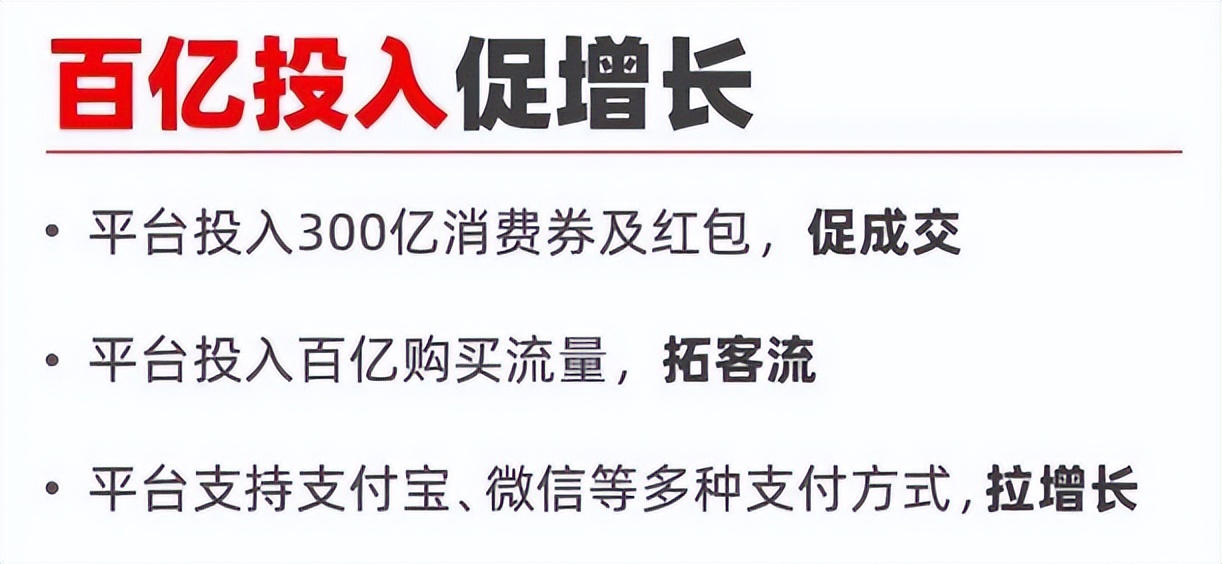

Firstly, there are simplified promotional rules and unprecedented discounts. Giants such as Taobao, JD.com, and Pinduoduo primarily offer full reductions and instant discounts during Double 11, “reducing the burden” on consumers. Simultaneously, platforms offer more substantial consumer coupons and red envelopes.

On Tmall's side, there are only two prices displayed on Double 11 product pages: the pre-discount price and the final price after various discounts are applied. Additionally, based on official discounts of 15% off or cross-store discounts of RMB 50 off every RMB 300 spent, Tmall will invest an additional RMB 30 billion in consumer coupons and red envelopes.

Image source: Taobao

On JD.com's side, throughout the Double 11 event, the platform will offer direct discounts across the board, daily RMB 60 extra subsidies, and cross-store discounts of RMB 50 off every RMB 300 spent.

For Pinduoduo, the platform introduced the “10 Billion Consumer Coupons” campaign for the first time and upgraded its “10 Billion Doubled Subsidies” to “Super Doubled Subsidies.”

Major platforms are striving to avoid the past frustration of making consumers do “math problems.” This reflects a more long-term mindset in the e-commerce industry's low-price strategy: waging a protracted battle for cost-effectiveness and even quality-to-price ratio rather than offering fleeting “super low prices.” Consequently, e-commerce platforms are gradually de-emphasizing low-price strategies and placing greater importance on consumer experience.

On the one hand, platforms are leveraging each other's strengths to provide consumers with more affordable prices and superior experiences.

For instance, Taobao has bolstered its self-operated business by launching the new “Taobao Selection” service, integrated within the Taobao app as an in-app store, aiming to offer consumers cost-effective products through official selection and high-quality services.

Meanwhile, JD.com, with first-line procurement and sales as its foundation, emphasizes its “supply” advantage. In addition to multiple salary increases this year, JD.com CEO Ran Xu announced at the October 14 press conference that the company plans to recruit at least 10,000 procurement and sales personnel over the next three years, who will source products worldwide to bring back more affordable and high-quality goods for users.

Pinduoduo continues to focus on after-sales service for consumers, upgrading its original “Buy Expensive, Get Compensated” service to “Buy Expensive, Get Double Compensation.” This new rule will take effect on October 16, two days after the official start of Double 11 activities. Meanwhile, the platform has further relaxed the time limit for applying for compensation, allowing consumers to provide evidence and apply for double the difference in refund within 48 hours.

On the other hand, the ongoing “tearing down walls” between giants is fundamentally changing competitive thinking.

Platform interoperability represents the biggest change during this Double 11. For example, Ali Group and JD.com have opened up to each other, with Taobao and Tmall integrating JD.com's logistics, while JD.com will integrate Alipay payments, Cainiao Express, and Cainiao Post Stations.

Interoperability signifies a significant shift in the direction of e-commerce platform competition post-Double 11, with greater emphasis on commercial cores such as product quality, pricing, and service. It also indicates that in a stock market, e-commerce giants are achieving complementary advantages and hoping to retain users with more comprehensive services.

Undoubtedly, this represents a new stage of competition and a return to the essence of commerce. A glimpse into this Double 11 reveals that e-commerce platforms are reshaping business thinking on the merchant and consumer sides, fostering industrial value chain upgrades through healthy competition.

This is undoubtedly a long-term approach to promoting high-quality consumption development.

[Source: HKG Research]