Double 11 this year, e-commerce finally welcomes the return of value

![]() 10/18 2024

10/18 2024

![]() 568

568

The annual Double 11 shopping festival has kicked off again. Some say that as the e-commerce market matures, shopping festivals like Double 11 are no longer as important as in previous years and have little analytical value – this perception is incorrect. Many overlook one crucial fact: In reality, Double 11 remains the most definitive growth opportunity for the e-commerce industry throughout the year, with the strongest consumer mindset and a crucial barometer for the consumer market in the coming year. This is why participating brands and merchants continue to set new records every year during Double 11: No one wants to miss out on this “battleground.”

In my view, this year's Double 11 carries a particularly significant meaning: The industry-wide, bottomless competition of the past few years has reached an unsustainable point; regulatory authorities, platforms, and merchants are all aware of this! If we do not start "correcting mistakes" and "fighting against internal competition" now, the e-commerce industry will not achieve sustainable development and will only sink deeper into a vicious cycle of unhealthy competition. Examples of "bottomless internal competition" abound in the e-commerce market, primarily manifested in the following areas:

Disorderly low pricing, where platforms prioritize price as the most crucial factor in traffic allocation, ignoring factors like quality and shopping experience. "Refund only" policies are abused, leaving merchants in dire straits. This is a suboptimal solution adopted by some platforms to address quality issues stemming from disorderly low pricing, effectively shifting the burden of low-price, low-intelligence merchants onto all merchants. Merchants' explicit and implicit costs continue to rise, turning them into tools for platforms to "reduce costs and increase efficiency." To cope with these costs, they often further compromise on quality, creating a vicious cycle.

Such internal competition may seem effective in the short term but is disastrous in the long run. It violates normal economic laws, turning the entire e-commerce industry chain into a zero-sum or even negative-sum game. E-commerce, by nature, is an organic integration of "people-goods-place," with "goods" provided by countless merchants who aim to earn reasonable profits. An environment where merchants are dissatisfied and cannot sustain their operations cannot possibly serve the fundamental interests of consumers.

I believe this is the root cause behind the relevant departments' proposal on July 30th this year to "strengthen industry self-discipline and prevent vicious internal competition." The concept of internal competition is widely accepted as undesirable, but what about actions? Turning this concept into action is no easy feat, as those who pioneer "anti-internal competition" may face short-term pressure on performance and market share. Nevertheless, Taobao has taken the lead in raising the banner of "anti-internal competition" ahead of this year's Double 11, with its actions primarily embodied in three areas:

Unbinding "refund only" policies, with the "refund only" optimization strategy launched in August, subsequently blocking over 400,000 unreasonable "refund only" requests daily over the following two months. For high-quality merchants with store experience scores exceeding 4.8, the platform does not actively intervene in "refund only" scenarios. Simultaneously, through the upgrade of the "refund only" abnormal behavior recognition model, effectively identifying and combating "coupon clippers" and "scalpers." Upgrading shipping insurance, with the launch of "Return Treasure" in September, jointly reducing merchants' return costs with logistics companies and insurance providers. During this year's Double 11, "Return Treasure" will further reduce fees, with the maximum reduction in merchants' return shipping costs reaching 58%. Allocating more traffic support to merchants with high-quality services, rather than solely based on price. Of course, Taobao still highly values "price competitiveness," but this refers to each product category's price being competitive, not solely based on the lowest prices.

At the core of the above strategies lies the comprehensive "Store Experience Score" system launched at the end of July this year. Previously, Taobao's store evaluation system was almost entirely based on subjective evaluations given by users, i.e., "Positive/Neutral/Negative." This system had many limitations – most users may not leave evaluations, and when leaving a negative review, they often fail to specify the specific issue, let alone the fact that merchants can manipulate reviews through tactics like "cashback for positive reviews." In contrast, the "Store Experience Score" is a comprehensive evaluation system based on a series of objective indicators, encompassing "Product Quality," "Logistics Speed," and "Service Guarantee." For example, the "Service Guarantee" score is determined by factors such as the average response time of customer service and the timeliness of returns and exchanges. This fundamentally enables a quantitative assessment of merchants' service levels, allowing consumers to see at a glance and merchants to understand areas for optimization. Merchants with higher "Store Experience Scores" can not only receive more traffic support but also enjoy more lenient and favorable policies regarding "refund only" and other aspects.

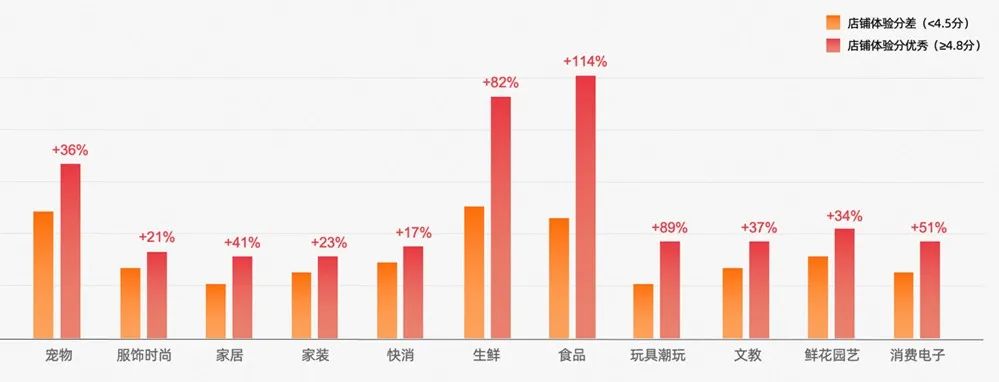

Taobao's emphasis on this evaluation system is clear: Encourage merchants to enhance quality and service levels, not solely compete on price. But what about merchants' attitudes? In essence, merchants' actions are driven by results; besides costs, the most critical result is repeat purchases. According to data released by Taobao ahead of Double 11, stores with excellent experience scores (above 4.8) significantly outperform those with poorer scores (below 4.5) in repeat purchase rates, with categories like food and fresh produce even seeing double the rate! Merchants will undoubtedly respond enthusiastically to such immediate results: When the "Store Experience Score" was launched, roughly 30% of Taobao merchants achieved or exceeded the "excellent" threshold of 4.8; this figure is now 36%.

Regarding unbinding "refund only" policies, some may wonder: While this alleviates merchants' burdens, won't consumers' interests suffer? In practice, merchants and consumers are not in a zero-sum game; most issues can be resolved through negotiation. As long as platforms are willing to invest sufficient resources and provide appropriate technical solutions (rather than shirking responsibility), there's no need for a simplistic "refund only" approach. For instance, Taobao has launched an after-sales negotiation tool that automatically provides personalized negotiation options, supporting proportional refunds while respecting both parties' wishes. Additionally, Taobao has upgraded over ten self-service refund tools to enhance merchants' after-sales efficiency, currently used by over 500,000 merchants and helping them swiftly process 4.8 million refund orders daily. These cases demonstrate that safeguarding consumers' interests and alleviating merchants' burdens can be achieved simultaneously.

Furthermore, Taobao continues to comprehensively and continuously reduce merchants' explicit and implicit burdens through other means, particularly during this year's Double 11:

All merchants participating in Double 11 promotions will enjoy commission-free "try before you buy" services. To my knowledge, Taobao is the first platform to offer "try before you buy" services to merchants free of charge. Providing merchants with over RMB 250 billion in "instant cashback" quotas, the largest in Taobao's promotional history. Starting September 1st, Taobao Live will waive technical service fees for a year, covering all merchants. As mentioned earlier, "Return Treasure" already reduces merchants' average return costs by 20-30%; starting September 27th, "Return Treasure" will reduce fees further, with some merchants seeing reductions of up to 58%.

Some investors may worry about these initiatives' impact on Taobao's revenue and monetization rate – short-term effects may be inevitable, but only by ensuring merchants thrive can the e-commerce ecosystem flourish; sustainable development of e-commerce platforms can only be achieved by serving, not exploiting, merchants. Therefore, regardless of short-term revenue impacts, this path is correct, and I believe other platforms will eventually follow suit.

In fact, the positive effects of these initiatives on Taobao's e-commerce ecosystem are already evident. I'd like to highlight a specific figure: In the third quarter of this year, the number of new brands joining Tmall grew by 70% month-on-month, with September seeing a stunning 239% month-on-month increase, underscoring Tmall's unshakable dominance in branded e-commerce. Taobao remains a top priority for merchants, with their enthusiasm for operating on the platform undiminished.

I recall the head of a new domestic brand stating ahead of Double 11 in 2022: "You can acquire traffic anywhere, but Taobao and Tmall remain the best platforms for conversions, your true stronghold." I heard similar sentiments from brands in 2019; now, in 2024, these views are further validated. I've always believed that among the e-commerce triangle of "people-goods-place," Taobao's understanding and control over "goods" (products, merchants) are unparalleled, even during intense competition.

Incidentally, I believe this year's Double 11 will also witness the return of "shelved e-commerce." In recent years, with the rise of content-driven e-commerce, especially live streaming e-commerce, shelved e-commerce has been viewed as outdated or even obsolete. However, this year has seen a dramatic shift, with live streaming platforms now emphasizing the role of shelves. For instance, Kuaishou reported in its Q2 2024 earnings that "pan-shelf GMV" accounted for over 25% of its total e-commerce GMV; I suspect Douyin's figure may be even higher. Live streaming platform merchants now talk about "omnichannel operations," combining "public and private domains," with private domain conversions ultimately landing on shelves. The notion that "shelved e-commerce is outdated" has long been disproven!

Upon closer inspection of the live streaming e-commerce landscape over the past few years, we can see that its rapid growth is largely a result of deepening internal competition. Firstly, most live streaming sales prioritize low prices, with core competitiveness centered on "lowest price on the web" and "this offer won't last." So-called "content e-commerce" often falls short, with content reduced to an inconsequential gimmick. In contrast, shelved e-commerce, represented by Taobao, when integrated with emerging content formats like videos and achieving "store-account integration," can offer richer and more comprehensive "content attributes."

Secondly, traditional live streaming sales focus on impulse purchases, leading to high return rates and imposing heavy return costs on merchants. Compared to well-established e-commerce platforms like Taobao, live streaming platforms often lack robust technical infrastructure and support systems, making it challenging to effectively help merchants mitigate risks and burdens. On paper, merchants can achieve explosive traffic growth through live streaming e-commerce, but these high-cost, unsustainable traffic surges only encourage merchants to engage in short-lived bursts of activity, failing to facilitate a qualitative shift from vicious to healthy competition.

To truly address these issues, we must rely on "traditional" shelves. Perhaps the ultimate direction for live streaming e-commerce is "live streaming as the stage, shelves as the performers"? This is precisely why platforms like Douyin, Kuaishou, and Xiaohongshu have recently emphasized their "internal shelf" functionalities. Here comes the question: The benchmark for shelved e-commerce was Taobao in the past and remains so today. If merchants must convert live streaming traffic to shelves, Taobao shelves are their best option. As store operations are Taobao's core, and the platform continuously refines its store operation methodologies (e.g., the vigorously developed merchant membership system and shopping credit programs based on merchant memberships), these efforts further tap the potential of the "core shelf." In the first nine months of this year, Taobao's platform-wide merchant membership base grew by 460 million, with repeat purchase orders from merchant members surging 26% year-on-year. Enhancing user stickiness and occupying users' minds is most efficiently achieved through Taobao stores, a top priority for merchants.

Remember the classic quote mentioned earlier? "You can acquire traffic anywhere, but Taobao and Tmall remain the best platforms for conversions." As live streaming platforms' organic traffic growth nears its peak, merchants will place unprecedented importance on Taobao shelves. This is the fundamental reason behind Taobao stores and Tmall branded merchants' sustained high growth this year!

Historical experience teaches us that no industry's development is linear but rather Tortuous , marked by phased changes. The past 4-5 years can be seen as a phase of "internal competition" in the e-commerce industry, characterized by the pursuit of absolute low prices, rapid growth of live streaming e-commerce, and drastic compression of merchants' profit margins. This year's Double 11 may signify the start of a new phase: Anti-internal competition, prioritizing user experience, and emphasizing sustainable operations will become hallmarks of this new era. In this context, not only will Taobao stage a "comeback," but the entire shelved e-commerce landscape will also see a resurgence, marking a turning point for China's e-commerce industry as a whole. Of course, these are merely my personal views.

Regardless, the "internal competition"-driven vicious cycle of the past few years has reached an unsustainable point, crying out for change. Whether in e-commerce or other industries, internal competition cannot open new avenues or create new value; it only drags down the entire industry's ceiling. Those who dare to pioneer the "anti-internal competition" concept deserve respect. Therefore, I eagerly anticipate this year's Double 11 on Taobao will bring some surprises.