Who is the most profitable company in technology restructuring?

![]() 10/18 2024

10/18 2024

![]() 564

564

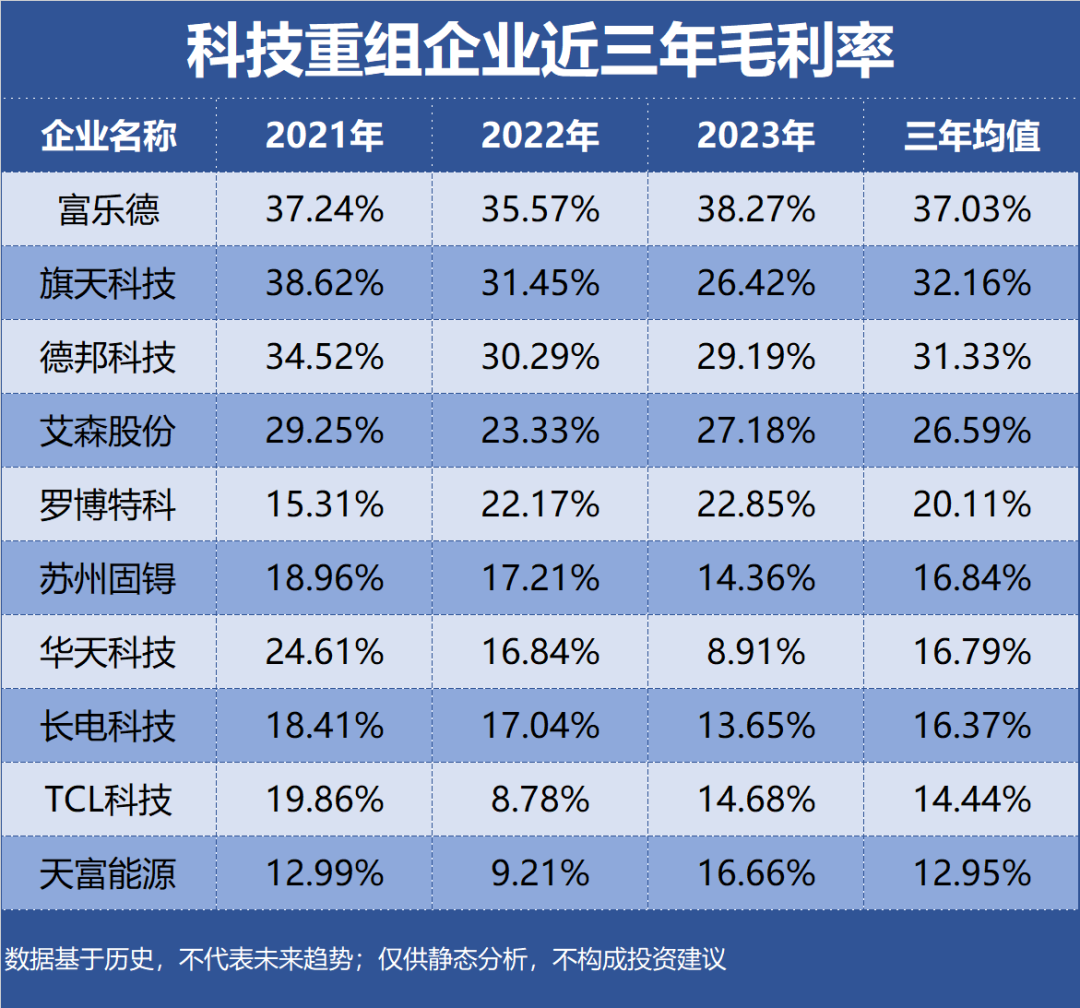

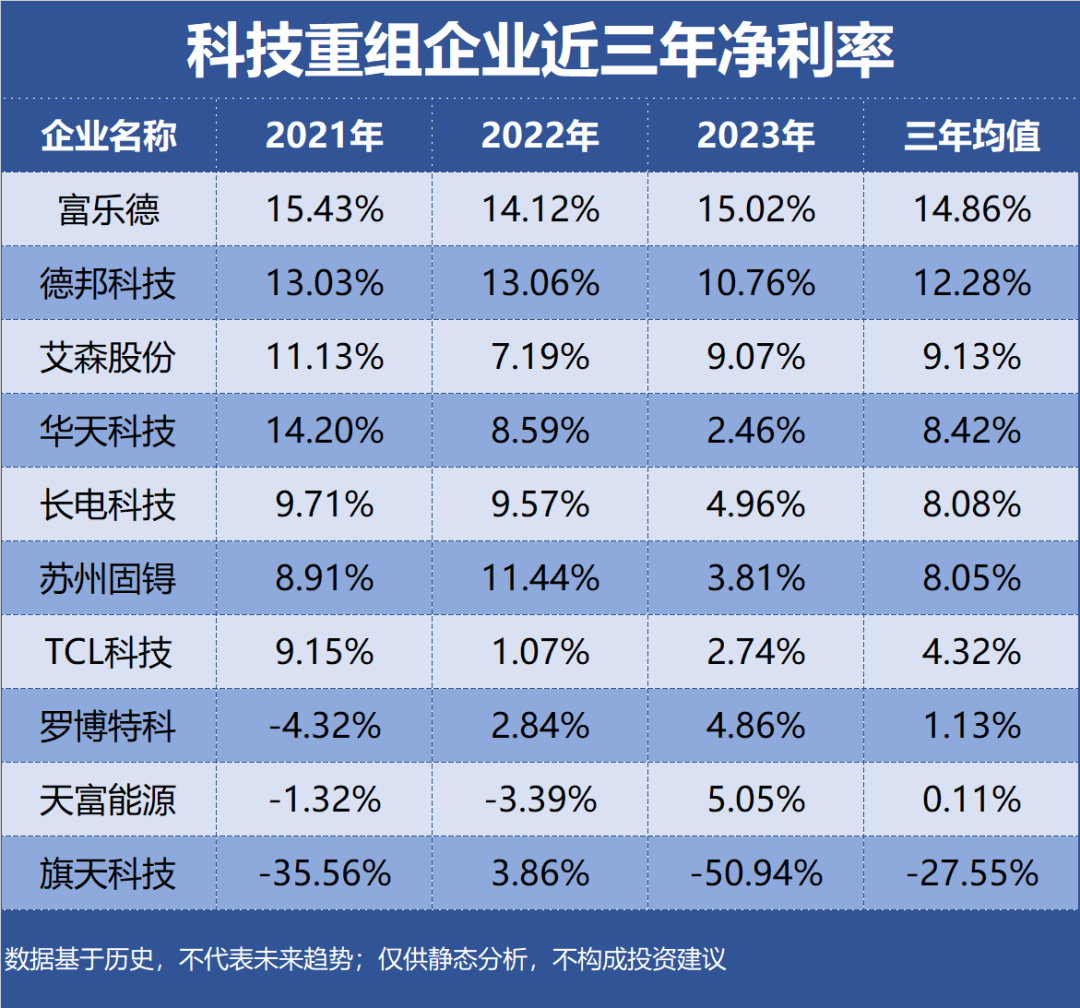

With the rapid development of technology, the market value of technology companies has become increasingly prominent. Through mergers and acquisitions, listed companies can quickly acquire high-quality assets, enhance profitability, and achieve leapfrog development. At the same time, technology restructuring can also promote industrial upgrading and facilitate the optimization and adjustment of the economic structure. Profitability is usually manifested in the amount and level of corporate earnings over a certain period. The analysis of profitability is an in-depth analysis of the company's profit rate. This article is part of the series on corporate value, focusing on [Profitability]. A total of 32 technology restructuring companies were selected as research samples, and return on equity (ROE), gross margin, net profit margin, etc., were used as evaluation indicators. The data is based on historical information and does not represent future trends; it is provided for static analysis only and does not constitute investment advice.

Top 10 most profitable technology restructuring companies:

No. 10 Huatian TechnologyIndustry Segment: Integrated Circuit Packaging and TestingProfitability: ROE 6.79%, Gross Margin 16.79%, Net Profit Margin 8.42%Performance Forecast: ROE has declined continuously to 1.43% in the past three years, with the latest forecast average of 3.86%Main Products: Integrated circuits are the primary source of revenue, accounting for 99.42% of total revenue, with a gross margin of 11.16%Company Highlights: Huatian Technology and Huayi Microelectronics are both controlled subsidiaries of Tianshui Huatian Electronics Group.

No. 9 Qitian TechnologyIndustry Segment: Marketing AgencyProfitability: ROE -23.93%, Gross Margin 32.16%, Net Profit Margin -27.55%Performance Forecast: ROE peaked at 4.28% in the past three years, with the latest forecast average of 0.52%Main Products: Digital lifestyle marketing is the primary source of revenue, accounting for 75.78% of total revenue, with a gross margin of 24.99%Company Highlights: Qitian Technology is a scarce digital lifestyle technology innovation enterprise in the A-share market, and Colorful Group plans to acquire a controlling stake in the company.

No. 8 AisentechIndustry Segment: Semiconductor MaterialsProfitability: ROE 7.69%, Gross Margin 26.59%, Net Profit Margin 9.13%Performance Forecast: ROE has fluctuated between 5% and 11% in the past three years, with the latest forecast average of 4.88%Main Products: Electroplating solutions and supporting reagents are the primary source of revenue, accounting for 49.66% of total revenue, with a gross margin of 40.05%Company Highlights: Aisentech's main business is electronic chemicals, and the company plans to acquire an 80% stake in Malaysia's INOFINE.

No. 7 Depong TechnologyIndustry Segment: Electronic ChemicalsProfitability: ROE 10.33%, Gross Margin 31.33%, Net Profit Margin 12.28%Performance Forecast: ROE has declined continuously to 4.60% in the past three years, with the latest forecast average of 5.39%Main Products: New energy application materials are the primary source of revenue, accounting for 56.07% of total revenue, with a gross margin of 11.98%Company Highlights: Depong Technology plans to acquire a 53% stake in Hengsuo Huawei Electronics Co., Ltd. and obtain control of the target company.

No. 6 Tianfu EnergyIndustry Segment: Thermal Power GenerationProfitability: ROE 0.80%, Gross Margin 12.95%, Net Profit Margin 0.11%Performance Forecast: ROE peaked at 6.57% in the past three years, with the latest forecast average of 7.50%Main Products: Electricity supply is the primary source of revenue, accounting for 76.38% of total revenue, with a gross margin of 22.15%Company Highlights: Tianfu Energy currently holds a 9.0909% stake in Tiankeheda, making it the second-largest shareholder.

No. 5 JCETIndustry Segment: Integrated Circuit Packaging and TestingProfitability: ROE 12.14%, Gross Margin 16.37%, Net Profit Margin 8.08%Performance Forecast: ROE has declined continuously to 5.81% in the past three years, with the latest forecast average of 7.52%Main Products: Chip packaging and testing are the primary source of revenue, accounting for 99.65% of total revenue, with a gross margin of 13.13%Company Highlights: JCET plans to acquire an 80% stake in SanDisk Semiconductor (Shanghai) Co., Ltd. for approximately US$624 million in cash.

No. 4 Suzhou Good-Ark ElectronicsIndustry Segment: Photovoltaic Auxiliary MaterialsProfitability: ROE 10.03%, Gross Margin 16.84%, Net Profit Margin 8.05%Performance Forecast: ROE has fluctuated between 5% and 15% in the past three years, with the latest forecast average of 6.50%Main Products: New energy materials are the primary source of revenue, accounting for 81.77% of total revenue, with a gross margin of 11.73%Company Highlights: Suzhou Good-Ark Electronics' business includes power semiconductor packaging and testing, device and integrated circuit packaging and testing outsourcing, as well as photovoltaic cell silver paste. The company holds a 21.63% stake in Suzhou Minggao Sensor Technology.

No. 3 TCL TechnologyIndustry Segment: Display PanelsProfitability: ROE 10.42%, Gross Margin 14.44%, Net Profit Margin 4.32%Performance Forecast: ROE peaked at 26.46% in the past three years, with the latest forecast average of 7.14%Main Products: Semiconductor display devices are the primary source of revenue, accounting for 62.11% of total revenue, with a gross margin of 18.80%Company Highlights: TCL Technology plans to acquire a 59.5% stake in LG Display (China) Co., Ltd. and a 100% stake in LG Display (Guangzhou) Co., Ltd.

No. 2 FuludeIndustry Segment: Semiconductor EquipmentProfitability: ROE 11.34%, Gross Margin 37.03%, Net Profit Margin 14.86%Performance Forecast: ROE has declined continuously to 6.41% in the past three years, with the latest forecast average of 8.23%Main Products: Precision cleaning is the primary source of revenue, accounting for 76.95% of total revenue, with a gross margin of 42.00%Company Highlights: Fulude plans to acquire semiconductor-related assets from its indirect controlling shareholder, FERROTEC Group.

No. 1 RobotecIndustry Segment: Other Automation EquipmentProfitability: ROE 1.52%, Gross Margin 20.11%, Net Profit Margin 1.13%Performance Forecast: ROE peaked at 8.32% in the past three years, with the latest forecast average of 11.63%Main Products: Automation equipment is the primary source of revenue, accounting for 94.66% of total revenue, with a gross margin of 28.15%Company Highlights: Robotec plans to acquire an 81.18% stake in Feikong Tek and 6.97% stakes in both ficonTEC Service GmbH and ficonTEC Automation GmbH.ROE, Gross Margin, and Net Profit Margin of the Top 10 Most Profitable Technology Restructuring Companies in the Past Three Years: