"Taobao Live Without a General, Li Jiaqi as the Vanguard"

![]() 10/23 2024

10/23 2024

![]() 676

676

As Taobao's current sole super anchor, Li Jiaqi has once again become the centerpiece of Taobao's "Singles' Day" shopping spree.

However, having lost the advantage of offering the lowest prices, Li Jiaqi no longer has a significant edge in the beauty product recommendation space, and despite various promotional tactics, his sales performance has not returned to its former glory.

Just as when Li Jiaqi first rose to prominence, his personal ability to promote beauty products was undoubtedly important, but the key factor behind his success was the rise of live-streaming e-commerce. Today, Li Jiaqi's decline cannot solely be attributed to "not working hard enough"; rather, it is more closely related to profound changes in the beauty industry in recent years and the waning influence of his "base" of Tmall Beauty in the face of aggressive newcomers.

Author | Li Da Ju

This article is originally created by Shangyin Society. Please contact us for reprinting.

In June 2017, Li Jiaqi, who had worked as a cosmetics counter salesperson for many years, arrived in Shanghai, fully committing himself to the nascent world of Taobao live-streaming. His goal was to earn 20 million yuan and then return to Nanchang.

Little did he know that he would quickly rise to prominence through live-streaming sales, not only earning multiple times that amount but also becoming a phenomenon in this new business model.

Even more unexpectedly, he would become Taobao Live's "unmovable leader"—

Viya, who gained fame slightly earlier than him, and later entrant Xue Li, both faded away due to legal issues, leaving Taobao Live's "three kingdoms" with two corners crumbled;

Starting in 2022, Taobao invested heavily in recruiting talent from various platforms, with Luo Yonghao, Li Dan, Dongfang Zhenxuan, Zhang Xiaohui, and others joining the fray, but none of them shook Li Jiaqi's position as the "leader";

Even after sparking a public backlash with the question "Where is it more expensive?" last September, Li Jiaqi did not miss out on this year's 618 or Singles' Day promotions on Taobao, continuing to dominate the rankings.

Over seven years, seasons came and went. Many internet celebrities who debuted around the same time as Li Jiaqi or later have faded away, and batch after batch of new anchors joining Taobao Live have largely made little impact. Even the head of Taobao Live has changed hands several times, with Wen Zhong, Yu Feng, Cheng Daofang, and most recently, Jia Luo, taking the reins. In the meantime, a myriad of super anchors emerged on Douyin and Xiaohongshu, with several generations coming and going.

In the world of live-streaming e-commerce, much has changed, but one constant remains: Taobao's "leader".

Perhaps even Taobao did not anticipate that, having launched live-streaming e-commerce as early as 2016 and introducing the previously purely entertainment-focused live-streaming format into product sales, it would once seem invincible, with no clear competitors in sight. However, today, Taobao Live appears increasingly fatigued compared to Douyin E-commerce, Kuaishou, and the newly rising Xiaohongshu.

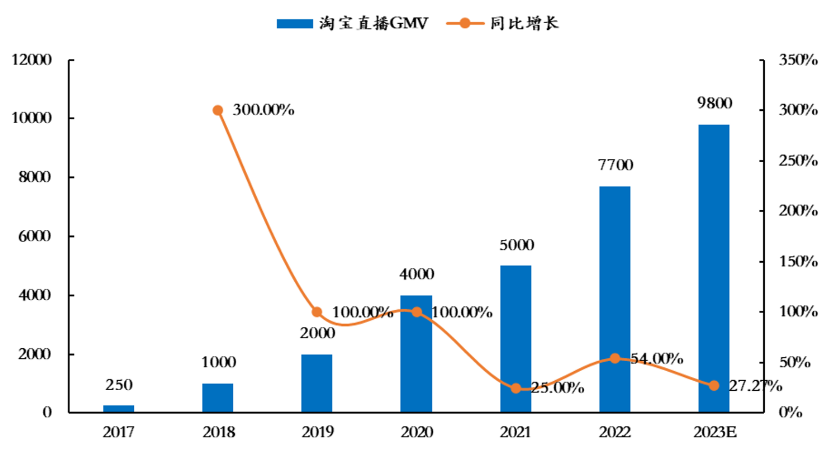

Data shows that Taobao Live's annual GMV in 2023 was approximately 980 billion yuan, not only lagging further behind Douyin E-commerce but also falling behind Kuaishou, which has entered the trillion-yuan mark.

Chart: Taobao Live GMV (in billions) from 2017 to 2023E

(Source: Web Economics Society, Northeast Securities)

Furthermore, Taobao Live struggles to cultivate mid-tier and lower-tier anchors capable of driving sales, relying heavily on Li Jiaqi as the "vanguard" during key promotional periods.

Most users enter live-streaming rooms through the Taobao app's home screen, and during the annual 618 and Singles' Day events, this prime real estate is almost always occupied by Li Jiaqi.

Just a few days ago, major e-commerce platforms ushered in their 16th Singles' Day. On the first day of presales on October 14, Li Jiaqi took to the stage once again, adopting significantly different tactics. In addition to pre-heating through beauty tutorials and variety shows, he also rained down red envelopes totaling 500 million yuan in his live-streaming room, allowing him to maintain his position at the top of Taobao's sales rankings.

However, despite the excitement, media calculations suggest that even with these elaborate promotional tactics, Li Jiaqi's presales performance this year fell far short of the 21.5 billion yuan achieved in 2022, only slightly improving upon last year's 9.5 billion yuan.

At the same time, this reflects Li Jiaqi's desperate attempt to regain consumer trust amidst fierce competition and previous public relations crises, aiming for a comeback. Behind this lies Taobao Live's own desire for a comeback.

But times have changed. While red envelope rain, promotional tactics, and platform traffic support can yield short-term results, the key to success in the second half of the live-streaming e-commerce game is user experience and platform ecology in the long run.

"User experience" is a rational yet emotional term, encompassing measurable aspects like price, quality, and service, as well as intangible emotional factors such as a sense of belonging and immersion. A sense of belonging and immersion relies heavily on the anchor's professionalism, content creation abilities, and personal charm.

To a large extent, a sense of belonging and immersion stems from the platform ecology. On content platforms like Douyin, Kuaishou, and Xiaohongshu, bloggers showcase their professionalism and humor through images, texts, and short videos, piquing consumers' interest and trust, ultimately leading to transactions.

However, compared to Douyin, Kuaishou, and Xiaohongshu, Taobao platforms inherently lack content and have relatively weaker "seeding" capabilities. The meteoric rise of Li Jiaqi in 2019 was largely due to the popularity of his lipstick swatching short videos on Douyin, which garnered over 25 million followers in just six months, driving significant traffic to his Taobao live-streaming room for product purchases, creating a closed loop.

More importantly, Li Jiaqi had a powerful weapon at the time: the lowest prices across the entire network. This was the core factor that made him a "human group-buying machine," attracting numerous consumers to place orders through his live-streaming room.

In his early days, Li Jiaqi candidly admitted that he was able to secure "the lowest prices across the entire network" because merchants sought to rapidly boost sales and gain platform promotions, opting to subsidize prices with advertising budgets.

However, super anchors are inherently scarce and difficult to cultivate, making it easy for oligopolies to emerge. No matter how skilled an anchor is, there's a limit to the number of products they can showcase in a given period. The demand for super anchors outstrips supply, driving up promotion fees and even constraining brands and platforms. This unsustainable sales promotion model was bound to collapse.

Moreover, as major e-commerce platforms have engaged in a race to the bottom on prices in recent years, pricing has become a core factor in platform traffic allocation, gradually shifting the control of lowest prices back to the platforms themselves.

Concurrently, brands have increasingly established their own live-streaming channels in recent years, with store-based live-streaming now accounting for over half of the market, surpassing influencer-driven live-streaming. This allows brands to retain greater control over pricing and brand power, cultivating consumer affinity and trust.

These developments have stripped Li Jiaqi, who once relied on low prices to dominate the market, of his core competitiveness.

Recently, many beauty bloggers have posted videos claiming that if they fail to snag a final payment red envelope, beauty products in Li Jiaqi's live-streaming room are not only uncompetitive in pricing but can even be more expensive than offline channels and duty-free options. Despite seemingly intensified promotions, the promotional mechanisms are actually less generous than in previous years.

While Li Jiaqi's live-streaming room dispensed up to 500 million yuan in red envelopes, those with years of experience snatching red envelopes know that only a fraction of them actually land in users' pockets, and timing is crucial. Considering the time cost, the promotional effect of the "500 million red envelopes" is more of a marketing gimmick than a practical benefit, perhaps even less effective than simply issuing coupons directly.

On social media platforms, many netizens have complained about "red envelopes being snatched up by bots and automated scripts," "waiting for hours without success," and "Li Jiaqi's red envelope favoritism."

After a series of comparisons, several beauty bloggers discovered that popular products like Estee Lauder's Platinum Collection Essence Lotion, Pink Water, even the iconic Advanced Night Repair Synchronized Recovery Complex II, La Mer's The Moisturizing Cream, and Helena Rubinstein's Black Bandage are all cheaper when purchased directly from offline stores or duty-free shops.

Furthermore, products like Lancôme's UV Expert Aquagel Sunscreen, Shu Uemura's Cleansing Oil Intense, and Sisley's All-in-One Emulsion are even more expensive than during this year's 618 promotion.

In fact, since Li Jiaqi and Viya's battle with L'Oréal Paris during the 2021 Singles' Day, exposing the tensions between super anchors and brands, super anchors like Li Jiaqi have downplayed the concept of "the lowest prices across the entire network," opting instead to attract consumers with freebies, samples, and red envelopes.

However, just as Li Jiaqi's rise to prominence was not solely due to his personal ability to promote beauty products but also the historical rise of live-streaming e-commerce, his current decline cannot be solely attributed to "not working hard enough." Rather, it is the profound changes in the beauty industry that are playing a major role.

Li Jiaqi's previous status as "Taobao's leader" and the undisputed "beauty leader" across the entire network was closely tied to Taobao's long-standing dominance in the beauty industry, enabling the platform to rally its forces behind a superstar anchor in the beauty sector.

Beauty products, represented by skincare, makeup, and fragrances, can be considered high-frequency and essential items, with a large user base and high repurchase rates, effectively enhancing platform stickiness and driving consumption in other categories.

According to the "2023 China Cosmetics Yearbook," to this day, Taobao remains the largest beauty e-commerce platform in China, with the GMV of cosmetics on Tmall and Taobao exceeding 200 billion yuan in 2023.

While Taobao still holds the top spot, its growth has been sluggish in recent years. From 2020 to 2023, the GMV of beauty and skincare products on Taobao platforms was approximately 195 billion yuan, 185.8 billion yuan, 201.6 billion yuan, and 186.4 billion yuan, respectively, representing year-on-year growth rates of 42.47%, -4.72%, 8.5%, and -7.53%.

In contrast, as newcomers, Douyin and Kuaishou have shown stronger growth momentum in the beauty industry. Last year, the GMV of cosmetics on Douyin reached 168.37 billion yuan, up 47% year-on-year, while Kuaishou's cosmetics GMV increased by 79% to 40.49 billion yuan.

Despite launching an early start to this year's 618 promotion and offering substantial beauty coupons, Taobao's performance remained lackluster.

According to Qingyan Data, the GMV of beauty products (including skincare, personal care, makeup, and fragrances) on Tmall during June was 12.69 billion yuan, compared to 15 billion yuan on Douyin and 2.3 billion yuan on Kuaishou. Additionally, Xiaohongshu is also working to improve its e-commerce system, potentially further eroding Taobao's beauty sales in the future.

This reflects the fatigue of traditional shelf e-commerce platforms in the face of the stronger appeal of content platforms to consumer minds and attention, as mentioned earlier, highlighting the impact of platform ecology on consumer shopping behavior.

In recent years, Douyin and Kuaishou have established mall and search functions to accommodate traffic from their short video and live-streaming content, creating a more complete transaction chain and greater operational space.

The beauty industry is highly sensitive, with beauty products being fast-moving consumer goods (FMCG) with short life cycles. Consumers are easily swayed by market trends and can quickly lose interest.

This necessitates that beauty brands closely monitor changes in consumer needs and behavior, leveraging the most influential channels to capture their attention.

As a result, beauty has always been one of the fastest-moving segments in exploring new channels among all consumer goods, serving as a barometer of channel fluctuations.

Sensing these channel changes, beauty brands have accelerated their migration from platforms like Taobao and JD.com to content platforms like Douyin, Kuaishou, and Xiaohongshu in recent years.

Compared to international brands, local beauty brands have a deeper understanding of channel changes and have been quicker to seize the benefits of these transformations.

The earliest transformation occurred around 2010, when domestic beauty brands seized the opportunity to shift to online channels. In contrast, international brands with headquarters outside China faced more complex corporate structures, lengthy approval processes, and heavy reliance on traditional CS and supermarket channels, making their transformation slower than domestic brands. However, international giants eventually caught up, with premium beauty brands like Estee Lauder, Shiseido, and P&G entering Tmall, solidifying its position in the beauty market.

Amid the rise of live-streaming e-commerce and social media, domestic beauty brands with significantly enhanced quality and supply chain capabilities were among the first to recognize the benefits of content channels, sparking a wave of domestic beauty brand growth. Brands like Hanshu, Proya, Chantecaille, Curel, and Fangli have all achieved significant sales growth through Douyin.

While international giants have been slower to respond, they have nonetheless made strides on major content platforms in recent years. Brands like Estee Lauder, Chantecaille, La Mer, Helena Rubinstein, and Lancôme have seen their sales on Douyin surge ahead of Tmall in recent months.

Furthermore, the broader economic environment has been challenging in recent years, leading to slower growth in the beauty industry, with no significant recovery this year.

Recently released data from the National Bureau of Statistics showed that retail sales of cosmetics totaled 306.9 billion yuan from January to September, down 1% year-on-year, trailing the overall retail sales growth rate of 3.3%.

In such circumstances, cost reduction and efficiency enhancement have become paramount concerns for beauty brands.

Many brands have chosen to flee from Tmall, which has higher traffic costs.

As Singles' Day approached, American skincare brand 3LAB announced it would close its overseas flagship store on Tmall by the end of the year. In June, Marc Jacobs' official Tmall flagship store for fragrances closed, and in May, NYX, which once ranked first in direct sales on Tmall Global, issued a closure notice for its overseas flagship store. Earlier, Japanese cosmetics brands like Amplitude, Naturaglace, and BBIA also shuttered their Tmall stores.

The industry as a whole has undergone significant changes, with new channels emerging rapidly, leaving limited time for Taobao Live to transform.

More importantly, new channels continue to generate novel marketing approaches. For instance, short films have emerged as a new media tool, gaining popularity on platforms like Douyin and Kuaishou. Perceptive domestic beauty brands have once again picked up on the signal.

For example, Hanshu was among the first to embrace short film placements, releasing five short films on Douyin in 2023, each garnering over 600 million views, with the highest reaching 1.19 billion views, comparable to popular TV dramas, leveraging low costs to drive significant traffic. Subsequently, beauty companies from both domestic and international markets, including Proya, Hanshu, Marubi, SK-II, Estee Lauder, and La Mer, have engaged in a battle for traffic through short films.

When new trends come, new models will emerge endlessly. If we can't adapt to them, we will lag behind step by step, no matter how big the individual or organization is, it will fall into confusion.