Is the hope of domestic 3A games resting on small and medium-sized game developers?

![]() 10/25 2024

10/25 2024

![]() 536

536

As a matter of routine, Tim Cook visits several mobile game developers during his annual trip to China. For instance, he visited Hero Entertainment, headquartered in Shanghai, in 2017, and miHoYo's headquarters in 2020.

Hero Entertainment was an early investor in Game Science, and during Cook's visit, he got to experience "War Art: Red Tide" developed by the latter. At that time, Game Science was still five months away from starting work on the globally popular "Black Myth: Wukong".

In 2020, when Cook visited miHoYo, Game Science released the first trailer for "Black Myth: Wukong." Although Feng Ji's intention was to recruit talent, the trailer's impact was immense, attracting 36 million views on Bilibili within a year and becoming the first domestic 3A game trailer to surpass 10 million views on foreign platforms.

However, while Game Science has been incurring losses for two consecutive years, miHoYo has raked in $1.56 billion from "Genshin Impact."

Although no one has ever said that 3A games and mobile games are incompatible, in the Chinese market, the latter often serves as the key to unlocking wealth.

TF Securities predicts that the Chinese mobile game market will reach approximately RMB 261.39 billion in 2024, while the 3A game market will only be worth RMB 10.2 billion, with "Black Myth: Wukong" accounting for nearly one-fifth of this figure.

Are all the profits being made by mobile games? The data suggests so.

Among the five most profitable mobile games in China in 2023, the least successful, Fantasy Westward Journey, generated RMB 3.01 billion in revenue, while the top game, Honor of Kings, brought in a whopping RMB 15.87 billion. Crucially, these mobile games are virtual evergreens. For instance, Honor of Kings and Game for Peace have consistently alternated at the top of the revenue rankings in recent years. Sensor Tower's September 2024 global revenue rankings for Chinese mobile game publishers still show Tencent, NetEase, and miHoYo topping the list.

However, for small and medium-sized game companies, despite the massive market revenue, there is virtually no chance of breaking through the dominance of the giants.

Before "Black Myth: Wukong," Game Science developed two mobile games: "Hundred Generals" flopped, while "War Art: Red Tide" managed to meet basic expectations. In a sense, Game Science's foray into 3A games represented a strategic overtaking maneuver.

In other words, without Black Myth, Game Science might have gradually faded into obscurity. But now, it has paved the way for successors, especially small and medium-sized game developers who struggle to compete with the big players.

1

Extremely Competitive Mobile Games

Although the Chinese mobile game market generated RMB 256.74 billion in revenue in 2023, a year-on-year increase of 3.2%, the market has yet to fully recover from the previous year's 10.18% decline.

Concurrently, Stock competition and intense internal competition have become the mainstay of the mobile game market.

After undergoing several major market trends, including skin-changing, porting from PC to mobile, big IPs, and anime, the next direction for the Chinese mobile game industry remains unclear, with relying on old products to drive revenue remaining the short-term primary objective.

Competition is no longer limited to content and operations but encompasses a full range of aspects, including update frequency, product pricing, cost-effectiveness, and even game duration, in a comprehensive "internal competition."

However, these are merely the sugar-coated exterior of the "Matthew Effect."

The most profitable games are consistently dominated by Tencent, NetEase, and miHoYo. Even if we broaden the scope to the top ten, only "Sanguo Zhi Strategic Edition," produced by Lingxi Interactive under Alibaba Group, occupies one spot. Tencent and NetEase account for over half of the market share, while the third-ranked listed company, 37 Interactive Entertainment, only holds 5%.

Yet, the oligarchs are not complacent. With their flagship products' moat secure, they actively seek new growth points and secondary growth curves. For small and medium-sized game developers with weaker economic and technological capabilities, the challenge is not merely survival but existential.

An analysis of the 2023 annual reports of 91 listed companies with gaming operations revealed that 55, or 60% of them, experienced a decline in gaming revenue.

They are more eager to find a shortcut to success. While large companies seek secondary growth curves, small companies aim to break through the Matthew Effect. The answer to both questions, following the explosive popularity of "Black Myth: Wukong," points to one goal: 3A games.

One basis for this argument is that most existing domestic 3A games are still struggling to make ends meet.

According to statistics from the third-party team "Guoyou Xiaoliangba" in January this year, among the 525 buy-to-play domestic games on Steam with over 10 player reviews, 95.05% are priced below RMB 70, and 99.24% below RMB 100, with an average price of only RMB 32.

The standard edition of "Black Myth: Wukong" priced at RMB 268 effectively sets a minimum guarantee for domestic 3A games, ensuring that there are sufficient players willing to pay for games within this price range.

For giants like Tencent and NetEase, this could represent a new growth point, generating significant revenue beyond mobile games. For other small and medium-sized game companies, producing 3A games has the potential to become a game-changer, enabling them to stand out among the competition, much like Game Science.

Moreover, before Game Science nurtured its 3A games through mobile games, some companies had already taken a different route, using 3A games to support their mobile game development.

Take-Two Interactive, which owns IPs such as "Grand Theft Auto," "NBA 2K," and "Civilization" for PC and consoles, acquired Zynga, a social and mobile game publisher, for USD 12.7 billion in 2022, gaining access to casual game hits like "FarmVille," "Words With Friends," and "High Heels!"

Before the acquisition, Take-Two's mobile game revenue was only USD 403 million, accounting for 11.5% of total revenue. After completing the acquisition in two fiscal years, mobile game revenue surpassed USD 2.5 billion, accounting for approximately 50% of total revenue.

More importantly, launching mobile game adaptations of popular 3A titles could drive revenue growth for 3A game developers.

Game Science and Take-Two have effectively closed the loop of mutual support between mobile games and 3A games, offering a path to breakthrough for 3A and mobile game developers struggling below the poverty line.

2

Why the Hesitation?

It is said that when Game Science was founded, the team aimed for large-scale games, believing that mobile phones' performance limitations precluded the creation of high-quality games. However, Feng Ji argued, "First, make a product to earn money and survive."

Feng Ji's argument was later validated. On the one hand, after announcing the development of "Black Myth: Wukong" in 2018, Game Science incurred losses for four consecutive years. On the other hand, with a production cost of RMB 300-400 million, survival was indeed a priority.

Shifting from mobile games to 3A games may seem like a perfect solution, but hidden dangers lurk beneath the surface.

Video games, like movies, are among the most expensive entertainment products on the planet. For instance, the total cost of "Grand Theft Auto V" reached USD 270 million, while the two "Destiny" games collectively cost USD 1 billion, equivalent to producing 1.5 "Avengers: Endgame" films.

Moreover, compared to mobile games, 3A games are characterized by high investment and low profits.

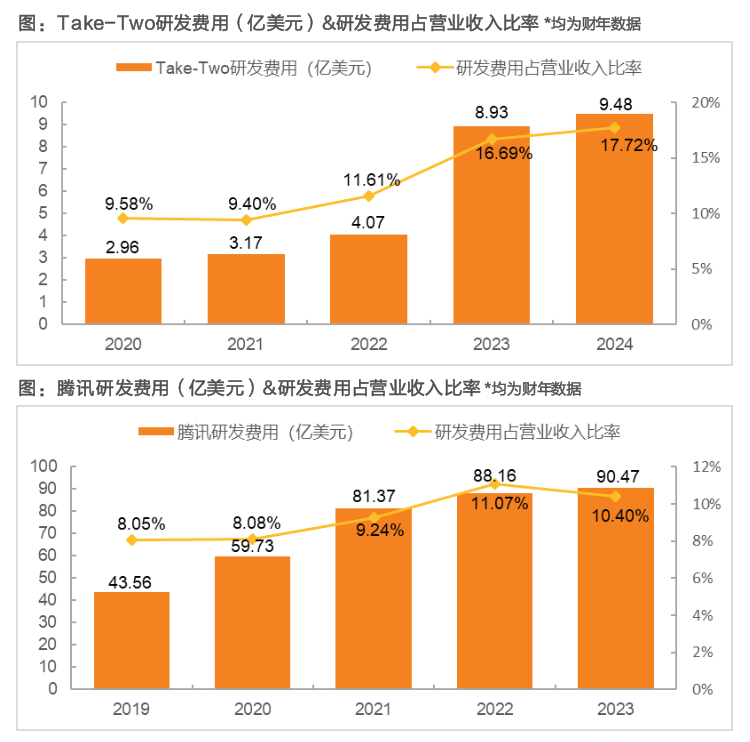

TF Securities analyzed the R&D expenses as a percentage of operating income for Take-Two and Tencent over the past five fiscal years and found that mobile game markets invest relatively less in R&D compared to 3A games.

This trend is also evident in the revenue generated by the representative games of these two companies. From its release in Q4 2013 to the end of March 2024, the cumulative revenue of the "GTA" series reached USD 9.118 billion. In contrast, Honor of Kings, launched in 2015, surpassed USD 10 billion in total revenue by October 2021.

Another reason some developers are cautious about producing 3A games is the high risk associated with high investments. Bohemia Interactive, the developer of "Arma," likens developing 3A games to "gambling," while small teams are uninterested in 3A games, preferring to focus on "service-based games" for long-term stable income.

Despite the high development costs of 3A games, they do have their advantages. Compared to mobile games, 3A games require minimal operational and maintenance considerations.

TF Securities analyzed the financial reports of 23 A-share game companies in Q1 2024 and found that seven companies incurred net losses, primarily due to significant increases in selling expenses.

A typical example is Bingchuan Network, whose selling expenses surged 168.36% year-on-year to RMB 855 million in Q1 2024. In the first half of the year, internet traffic costs for just five of its games totaled RMB 910 million, accounting for 64.95% of selling expenses.

This is not an isolated incident. Among the seven companies that incurred losses in Q1, four experienced increases in selling expenses, with Xinghui Entertainment recording the highest growth of 297% to RMB 102 million.

From a ratio perspective, Bingchuan Network's average selling expenses accounted for 75.61% of operating income from FY2020 to Q1 FY2024, peaking at 152.68% in Q1 FY2024. In contrast, Take-Two's average selling expenses only accounted for 23.77% of operating income from FY2021 to Q1 FY2025, significantly lower than Bingchuan Network's.

Mobile games require substantial investments in promotion, marketing, and maintenance. While Tencent leverages its mobile traffic advantages, such as App Store and WeChat, to drive traffic to Honor of Kings, small and medium-sized mobile game companies may struggle to keep up with the immense post-production costs and manpower demands, risking market elimination.

In contrast, 3A games, as sales-driven products, require minimal post-production work, and each content expansion can be monetized as DLC, offering a new alternative.

3

Is the Barrier to Entry for 3A Game Development Insurmountable?

Beyond feasibility and business models, small and medium-sized game companies face tangible challenges, such as production.

In today's increasingly nationalistic landscape, many are unaware that game engines used in 3A game development have few domestic alternatives.

Game engines are platforms or systems used for game design. They facilitate rapid development by providing pre-written systems and core components for interactive real-time graphics applications. These tools enable game designers to quickly create desired content and effects without wasting time on manual implementation.

In terms of market share, none of the top ten game engines used on Steam are domestically developed; they are all foreign-made.

Developing an in-house game engine typically requires millions of lines of code, organized and systematized within a comprehensive architecture. Time is a significant factor here. Take Unreal Engine, for example, which debuted in 1991 and has been refined through dozens of 3A blockbusters, coupled with numerous acquired film and game assets and tools, accumulating rich experience.

In contrast, China lacks the conditions for sustained accumulation over a decade, as well as the soil and ecosystem for architectural-level talent, posing difficulties for game engine development.

On the bright side, game engine commercialization is maturing. For instance, Unreal Engine, developed by Epic Games and widely used in 3A games, adopts a free + paid business model. During the Unreal Engine 4 era, Epic Games allowed game developers to use the engine for free if their quarterly revenue was below USD 3,000. With Unreal Engine 5, creating linear content, custom projects, and internal projects remains free. For game development, Epic Games only charges a 5% royalty when revenue exceeds USD 1 million.

CryEngine, another popular engine among 3A game developers, employs a similar business model, charging a 5% commercial license fee for full commercial licenses and a fixed monthly fee of EUR 9.90 for standard commercial licenses. It also sells official assets in its marketplace and takes a 30% commission on third-party sales.

The lack of in-house game engines is not the primary obstacle to 3A game development; rather, it's the shortage of relevant gaming industry talent. Game Science's use of trailers as recruitment ads was a desperate move by Feng Ji due to the scarcity of talent.

Game development is more complex than it seems, requiring interdisciplinary talent. In addition to computer software engineering skills, game developers may also need expertise in art, screenwriting, directing, and planning.

Fang Yan, an expert in the game education industry and founder of Hit Academy, once admitted that the entire game industry is severely understaffed. In the relatively mature US and Japanese game markets, a mature industrial system has been established, especially in education, where each profession has become a specialized field.

4

Conclusion

According to IGN, citing foreign media sources, "Black Myth: Wukong" is set to release DLC that will be on par with "Elden Ring's" "Shadow of the Erdtree." In June this year, "Shadow of the Erdtree" sold over 5 million copies within three days of its release. With the launch of "Black Myth's" DLC, it will continue to generate revenue for the game in the coming years, contributing to the expansion of the domestic 3A game industry's market size.

Among the giants that have been most prominently featured in this 3A game boom, Tencent stands out.

Not only does it hold around 5% of Game Science's shares, but it is also involved in several announced 3A games, including Lingyoufang, the developer of "Shadow Blade Zero" and "Star Guardians," and Shanghai Lingxi, the developer of "Lost Soul," both of which have received investment from Tencent.

An increasing number of game companies are entering the 3A game realm, indicating that they are recognizing the potential of the domestic 3A industry. However, for small and medium-sized game companies, this may feel like a return to the mobile game cycle.

Disclaimer: This article is based on publicly available information or information provided by interviewees, but Decode and the author do not guarantee the completeness or accuracy of this information. Under no circumstances should the information or opinions expressed in this article be construed as investment advice to anyone.