Xiaomi's foldable phone sales make a comeback! Thanks to the MIX Flip's heroic efforts?

![]() 10/28 2024

10/28 2024

![]() 579

579

As a rising star in the mobile phone industry, foldable phones have gained recognition from consumers despite their higher prices compared to traditional flagship models.

Market research firm IDC's sales data shows that in the third quarter of this year, total sales of foldable phones in China reached 2.232 million units, an increase of 13.6% year-on-year but a decrease of 13.2% quarter-on-quarter. Compared to the same period last year, the domestic foldable phone market has maintained sales growth of over 10 percentage points.

(Source: IDC)

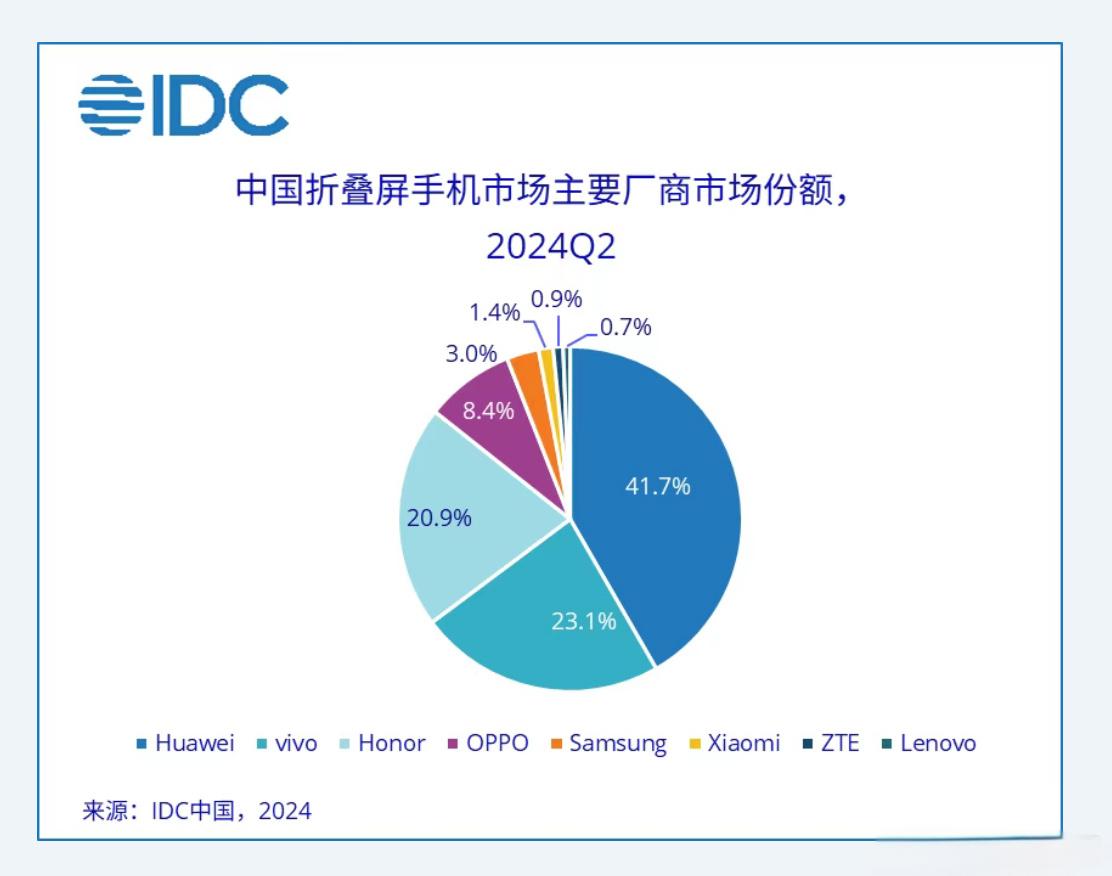

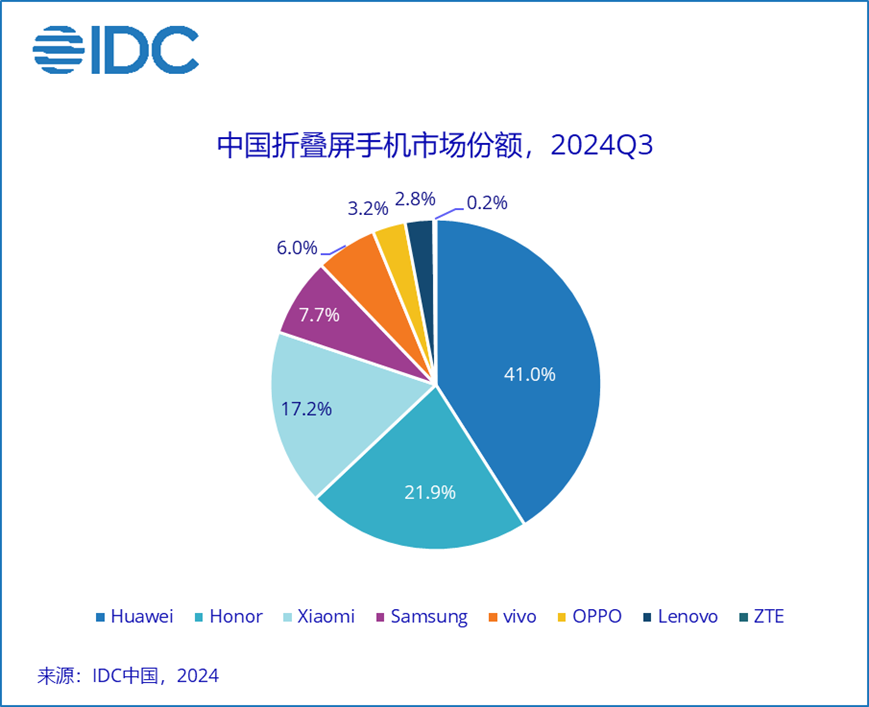

However, a closer look at the market shares of various phone manufacturers reveals significant changes in sales among brands. Some brands have seen a sharp decline in foldable phone sales, while others have seen sales multiply, keeping pace with Huawei, vivo, Honor, OPPO, and Samsung. Xiaomi has finally witnessed a surge in sales.

Since the launch of Huawei's Mate X and Samsung's Galaxy Fold in 2019, over five years have passed, and foldable phone technology has matured. The changes in sales among manufacturers are undoubtedly driven by product quality, and both those experiencing sales growth and decline can identify issues and strategies from these trends.

Xiaomi's Comeback: Climbing the Stairs to Greatness

Comparing the domestic foldable phone sales data for the second and third quarters of this year, it becomes evident that only two manufacturers have maintained stable sales: Huawei and Honor. As the leader in domestic high-end phones, Huawei only faces competition from Apple in this segment, but Apple has yet to launch a foldable phone, leaving the Mate X series with less competitive pressure than the Mate and Pura series.

(Q2 Sales; Source: IDC)

(Q3 Sales; Source: IDC)

The Honor Magic V series serves as an affordable alternative to the Mate X series, offering more reasonable pricing with superior configurations and an uncompromising user experience. Although Samsung's domestic sales are not impressive, its flagship phones still have a dedicated audience, contributing to a higher market share for foldable phones than some domestic manufacturers.

Among the other three major domestic manufacturers, vivo's X Fold 3 series, launched in late March this year, peaked in sales during the second quarter, surpassing Honor to become the second-best-selling foldable phone in China. However, the X Fold 3 series seems to have lost momentum, slipping to fifth place in sales in the third quarter.

As for OPPO, its products are well-designed and much appreciated, but they all suffer from a common issue: outdated processors. In recent years, the OPPO Find N series has been released in the fourth quarter, close to the launch of Qualcomm's Snapdragon and MediaTek's Dimensity flagship chipsets, but OPPO has consistently opted not to use the latest generation of processors, giving off a sense of incompleteness despite its strengths.

(Source: Leitech)

Fortunately, there is not much information yet on OPPO's next-generation foldable phone, which is likely to be released next year, ensuring it will not miss out on the Snapdragon 8 Ultimate or Dimensity 9400 chipsets. With its shortcomings addressed, OPPO's foldable phone stands a chance of a sales explosion.

Among manufacturers offering foldable phones, Xiaomi has seen the most remarkable change, with its market share jumping from just 1.4% in the second quarter to 17.2%, representing a quarter-on-quarter growth of 1128.6%, propelling it into the top three. Notably, the last time Xiaomi ranked among the top three in domestic foldable phone sales was in the second quarter of 2021, shortly after the launch of its first foldable phone, the MIX Fold, when OPPO, vivo, and Honor had yet to release their foldable offerings.

While Xiaomi's digital series and Redmi K series have gradually secured their footing in the flagship phone market, Xiaomi, which entered the foldable phone market earlier than OPPO, vivo, and Honor, has long lagged behind in sales. Its strong entry into the top three this time, while partially aided by strategic timing (with the MIX Fold 4 and MIX Flip launched in July, coinciding with the peak sales period in the third quarter), is a testament to Xiaomi's correct strategic direction with the MIX Fold 4 and MIX Flip.

Xiaomi's significant share growth has naturally impacted other brands' sales, with OPPO and vivo experiencing declines in foldable phone sales in the third quarter. Facing Xiaomi's relentless pursuit, OPPO and vivo must contemplate why Xiaomi has succeeded and how they can catch up.

MIX Flip Saves the Day: Xiaomi Sets a New Record in Foldable Phone Sales

Xiaomi's foldable phone sales grew by over 11 times year-on-year, and the main contributor was not the fully loaded MIX Fold 4 but the compact foldable MIX Flip. Statistics show that about two months after its launch, the MIX Flip surpassed 200,000 activations, indicating that it likely contributed around 60% of Xiaomi's foldable phone sales in the entire third quarter.

To date, the MIX Flip ranks first on both the daily and cumulative charts of JD.com's Double 11 compact foldable phone sales race, demonstrating its sustained popularity beyond its initial sales quarter. In contrast, the MIX Fold 4 ranks only seventh in large foldable phone sales, performing modestly.

(Source: JD.com Screenshot)

The appeal of compact foldable phones is understandable, as large foldables still suffer from issues like weight and cost. Compact foldables, on the other hand, fulfill consumers' desire to experience foldable technology. This is why Huawei not only introduced the high-end Pocket series but also the more affordable nova Flip, adopting a dual-compact foldable strategy.

However, the compact foldable market lacks compelling options. While the OPPO Find N3 Flip design impresses, it lags behind with its MediaTek Dimensity 9200+ chipset. Vivo's X Flip has only had one generation released in 2023, powered by the Qualcomm Snapdragon 8+ Gen 1, while Honor's Magic V Flip, launched in April this year, also uses the Snapdragon 8+ Gen 1. Among the top manufacturers, only the MIX Flip stands out as a well-rounded compact foldable.

(Source: Leitech)

Among non-top manufacturers, Motorola's razr 50 Ultra can compete with the MIX Flip in terms of configuration while offering a more affordable price. The Honor Magic V Flip, though slightly inferior in configuration, wins on price, starting at just CNY 4,999. Both the razr 50 and Magic V Flip have made it into the top three on JD.com's Double 11 compact foldable sales race's daily and cumulative charts, proving the allure of affordable pricing.

Beyond price, Xiaomi has optimized the MIX Flip's cover display for various tasks like watching videos, making calls, ordering food, checking flight information, and reading novels. With a rich selection of customizable widgets, the MIX Flip offers practicality beyond aesthetics.

OPPO and vivo's approach has essentially ceded the compact foldable market to Xiaomi. With its sincere configuration and pricing, as well as a functional cover display that meets the "usable" standard, Xiaomi's MIX Flip has seamlessly captured this market segment.

The arrival of the MIX Flip has dispelled years of gloom for Xiaomi in the foldable phone market, enabling it to catch up with Honor and Huawei. With the popular MIX Flip, Xiaomi's domestic foldable phone sales are expected to surpass Honor in the fourth quarter. Meanwhile, OPPO, vivo, and other manufacturers must adapt to secure their market share.

The Foldable Phone Wave Surges: Can Xiaomi's Model Be Replicated?

IDC predicts that China's foldable phone shipments will reach 10.68 million units in 2024, a year-on-year growth of 52.4%. By 2028, shipments are expected to climb to over 17 million units, with a five-year compound annual growth rate of 19.8%. Undoubtedly, the foldable phone market will maintain high growth rates, with compact foldables emerging as a crucial component.

The success of the MIX Flip proves that usability, practicality, and affordability are key to winning in the compact foldable market. While cost-effectiveness is Xiaomi's inherent strength, and system optimization has been its forte since MIUI, these advantages are easily replicable for major manufacturers.

(Source: Leitech)

With the launch of the Snapdragon 8 Ultimate and Dimensity 9400, phone manufacturers are busy with new flagship launches and sales. While leaks about foldable phones are relatively scarce, manufacturers are expected to unveil their next-generation foldable flagships starting in March next year, including updated compact foldables and possibly even tri-fold models.

OPPO's Find N series, with its shortcomings addressed, vivo's X Fold series reinvigorated, Honor's continuously thriving Magic V series, and Xiaomi's MIX Fold series on the right track will ignite a new round of competition. Huawei's introduction of a tri-fold phone brings fresh ideas to the market, setting the stage for inevitable changes. While Huawei's position is solidified by its brand value and HarmonyOS, making it difficult to displace, the rankings and market landscape for other manufacturers are likely to evolve continuously.

Competition among manufacturers, coupled with technological advancements, will drive down prices and enhance foldable phone specifications. Large foldables have already seen prices drop from the initial CNY 10,000+ range to around CNY 7,000-8,000, while compact foldables have entered the CNY 2,000+ market. In the future, foldable phones will continue to explore lower price points, attracting more consumers. As sales scale up, average costs will decrease, providing room for price promotions and fostering a virtuous cycle.

More refined and portable compact foldables and larger foldables better suited for multitasking, office work, and learning may gradually emerge as the protagonists in the mobile phone industry, challenging the status quo of flagship and mid-to-high-end models from established brands. Perhaps in the near future, the starting prices of domestic compact foldable flagships will be comparable to those of regular flagships, while large foldable flagships will become more affordable for the average consumer, making foldable phones a viable option for everyone.

Source: Leitech