After being banned in multiple countries, OPPO, which has been "diving deep", aims for overseas premiumization

![]() 10/30 2024

10/30 2024

![]() 575

575

This article is the 856th original work of Deep Dive Atom

"Sales continue to decline,

Can OPPO's overseas "deep dive" turn the tide?"

Written by Meng Fanliao | Edited by Deep Dive Atom Studio

After many mobile phone manufacturers converged on AI, OPPO also joined the fray on October 24, 2024, and launched the OPPO Find X8 series. It was also announced that this series of phones defines the future of imaging and will become a new benchmark for smart interaction.

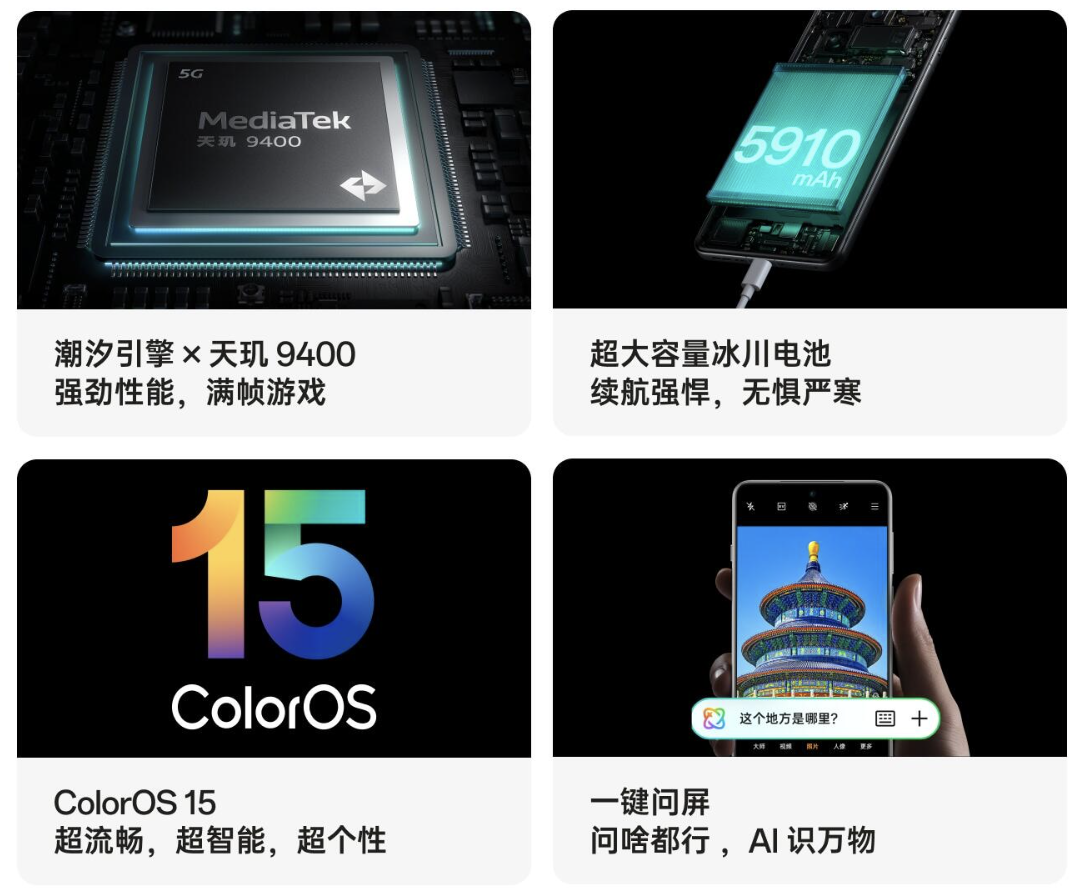

In terms of photography, in addition to the features such as blur-free capture and atmospheric feel that the Find X8 series has always emphasized, its AI image assistant can also automatically perform complex image editing operations such as removing reflections, AI smear removal, AI super resolution, and AI blemish removal; the brand-new ColorOS 15 brings users a smart, system-level AI experience. It is reported that the Find X8 series will go on sale on October 30th.

However, OPPO still hasn't escaped the homogeneity trap of traditional smartphones in terms of imaging, chips, weight, fast charging, etc.; AI features such as voice assistants and intelligent recommendations are also largely similar to other AI phones.

In the era of intelligence, OPPO has failed to stand out, so how can it make a comeback in the similarly homogenized AI phone race? More crucially, OPPO's expectations for the Find X8 lie in its impact on the overseas premium market. It has even resorted to "confronting" Apple, but it remains to be seen whether the Find X8, which is still engaging in hunger marketing, can shoulder the heavy responsibility entrusted to it by OPPO.

OPPO's sales continue to decline, and the Find X8 may struggle to shoulder the heavy responsibility

At one time, offline stores were crucial for enhancing OPPO's brand awareness and market share. The vast number of offline stores provided consumers with an opportunity for intuitive product experience, helping them better understand product functions and features. In addition, offline stores offered after-sales service and repair support, enhancing consumer trust and loyalty in the brand.

With changing consumer habits and the rise of e-commerce platforms, more and more consumers prefer to shop online, leading to a sharp decline in offline store traffic. On the other hand, the operating costs of offline stores are relatively high, including rent, salaries, utilities, etc., which have increased OPPO's operational pressure to a certain extent.

Facing the decline of offline stores, OPPO had to change its strategy. Liu Bo, President of OPPO China, said that the brand needs to focus more on core customers and stores, and OPPO is actively adjusting its strategy to target shopping malls and parks frequented by young people. However, OPPO's reversal of its offline attitude cannot change the objective fact of declining sales.

According to the report of research firm TechInsights, the global smartphone market is showing positive signs of recovery after several years of downturn. Canalys data shows that the total shipments of domestic smartphones in the third quarter were 69.1 million units, an increase of 4% year-on-year. Among them, VIVO, Huawei, Honor, Xiaomi, and Apple took the top five spots.

It is noteworthy that OPPO, which ranked second with 11.3 million shipments in the second quarter, directly fell out of the top five. This is not the first time OPPO has experienced a decline. For the past eleven consecutive quarters, OPPO has maintained an annual decline trend. Of course, OPPO will successively launch the Find X8 series and OnePlus 13 in the fourth quarter, which has increased market expectations for OPPO.

On October 24, 2024, OPPO officially unveiled its all-new annual imaging flagship – the Find X8 series, equipped with the Dimensity 9400 chip and the newly released ColorOS 15 operating system. According to official data, the new Find X8 series has achieved a comprehensive upgrade in terms of performance, battery life, design, etc., bringing users a more exceptional user experience.

Compared to the stable prices and even slight discounts after the launch of this year's new iPhone products, it may come as a surprise to OPPO that while the Find X8 is still engaging in hunger marketing, its price plummeted after launch, with a direct price drop of 900 yuan for a brand-new, unopened 256GB Find X8 on Xianyu (a used goods trading platform). This leaves OPPO, which has high hopes for the Find X8, in an awkward position.

Rome wasn't built in a day, and netizens' indifference towards the Find X8 may stem from long-term accumulation. As early as the launch of the Find X7, there were some issues with the phone's quality control. For example, on Heimao Complaints, some netizens reported that they purchased an OPPO Find X7 on April 7, 2024, and discovered that the phone's SIM card had no signal on September 27, 2024. Upon inspection at an OPPO after-sales service center on September 28, 2024, it was found that the motherboard was faulty. Another example is a netizen who reported that the back glass of their Find X7 cracked during normal use.

Facing market competition, it may be difficult for OPPO to regain its footing with the undersold Find X8.

Can OPPO's overseas "deep dive" succeed without relying on "harvesting" Apple to make up for lost domestic market share?

It is worth noting that the OPPO Find X8 has a striking resemblance to Apple products at first glance. With its ultra-narrow bezels and lightweight straight screen with impeccable touch, it has been praised by many bloggers as an Android flagship with a strong Apple vibe. Compared to innovations in imaging technology and upgrades in performance and battery life, it seems that netizens are more interested in the phone's appearance? This is a marketing tactic employed by OPPO to "confront" Apple. Apart from tech enthusiasts, most consumers are not highly sensitive to technological iterations.

In particular, OPPO's new products have already achieved data transfer compatibility with Apple. Some netizens have joked that since Apple's system is incompatible with them, they will forcibly make it compatible.

Market research firms such as Counterpoint and Canalys have unanimously predicted that global smartphone shipments will reach over 1.2 billion units in 2024, representing a year-on-year growth of 5%. OPPO's expectations for the Find X8 are centered on making a splash overseas. According to OPPO's Chief Product Officer Liu Zuohu, with the launch of the Find X8, OPPO aims to establish the Find series in the global market, which is a key strategy for the company.

For a terminal brand looking to quickly penetrate the premium market, the simplest approach is to benchmark against a premium smartphone. By benchmarking against Apple, the Find X8 may significantly boost OPPO's overseas sales, especially in the premium segment.

After the OPPO press conference, Liu Zuohu said in an interview with China Business News, "The 5,000-6,000 yuan price range is a significant market segment. Why not enter it? We believe OPPO has significant opportunities and potential in this market." Being able to benchmark OPPO's products against Apple is a significant boon for the brand.

OPPO has been in operation for 20 years, with 15 years of overseas expansion. Although its business spans over 70 countries and regions, approximately 60% of its shipments originate from overseas. However, its overseas factories are still concentrated in non-developed countries such as India, Indonesia, Turkey, Pakistan, Bangladesh, Brazil, and Egypt. According to public information, OPPO ranks first in Vietnam, Thailand, and Cambodia in Southeast Asia, second in Indonesia, fifth in mature European markets, second in Portugal and Finland, and fourth in emerging Latin American markets like Mexico.

However, doing business in developing countries does not allow OPPO to earn significant profits. The best soil for OPPO's overseas premiumization aspirations remains developed countries such as Europe and the United States.

While OPPO believes that going overseas requires a "deep dive," the biggest challenge affecting its overseas performance is a lack of depth, especially in technology. This has also led to poor reputation and treatment for OPPO in Europe.

In Germany, OPPO has been banned from selling its products. Firstly, OPPO was accused by Nokia of infringing on its 5G and 4G patents and was ordered to pay patent royalties. Furthermore, OPPO, once renowned for its signal enhancement feature, was penalized in Germany for violating local laws regarding this functionality. In the UK, the High Court of London issued judgments related to infringement and cellular standard-essential patents against OPPO in cases involving Nokia. After a comprehensive assessment, OPPO received an injunction and withdrew from the UK market. Additionally, OPPO is embroiled in disputes with Nokia in countries such as the Netherlands and France.

In the perception of overseas users, OPPO is seen as a local brand rather than a foreign one. While this is OPPO's aspiration, the experience in Germany suggests that it lacks even a basic understanding of local laws, raising questions about how it can achieve localization and a true "deep dive."

Undoubtedly, while OPPO has invested in technological research and development, it still lags significantly behind competitors like Huawei and Apple in terms of technological innovation and patent portfolio. Although Liu Zuohu gained global recognition with the OnePlus brand, he has not been able to transfer that reputation to OPPO since joining the company.