The former king of Chinese stocks is back

![]() 10/31 2024

10/31 2024

![]() 713

713

Author: Lao Yu'er

Editor: Yang Xuran

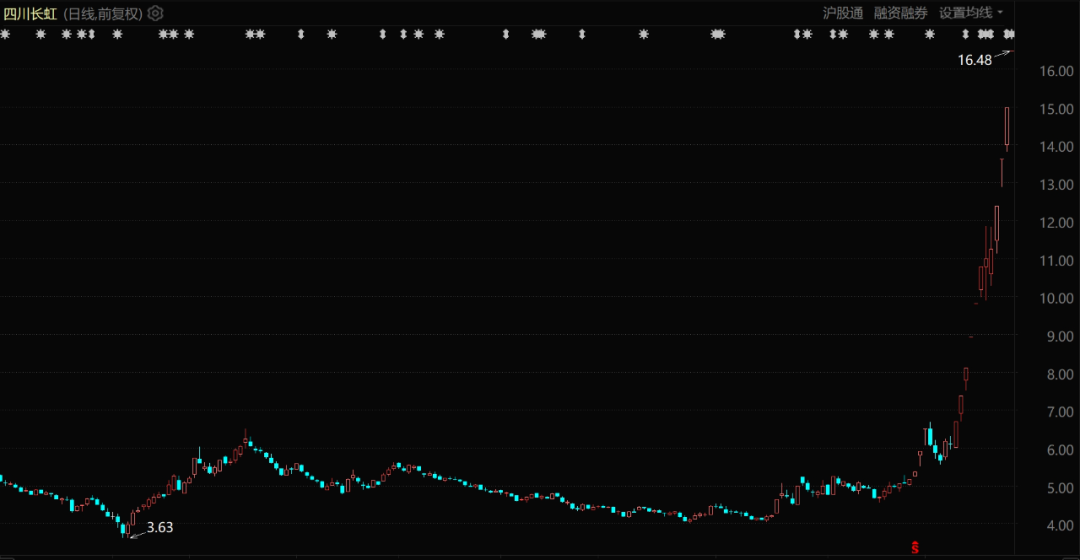

On October 31, Sichuan Changhong's share price surged again, marking its 10th consecutive trading day with a limit-up close in 12 trading sessions. As of the close on October 31, 2024, the company's shares had risen by a cumulative 170.61% over 12 consecutive trading days.

Since the beginning of the year, its market value has increased by over 210%, reaching 76.1 billion yuan, setting a new high since its listing in 1994.

It has been 26 years since Sichuan Changhong's market value first exceeded 60 billion yuan. Back in January 1998, Sichuan Changhong's market value reached 65 billion yuan, briefly making it the king of A-shares in its heyday. While a market value of 70 billion yuan is now somewhat mundane in A-shares, the fact that it has once again touched upon its former glory after 26 years is still remarkable.

Share Price Performance of Sichuan Changhong (since January 2024)

Although Sichuan Changhong has once again garnered market attention, neither its business performance nor its influence in the industry can be compared to 1998.

In the 1990s, Sichuan Changhong was undoubtedly the leader in the color TV market. Today, however, its market value growth is reliant on the capital enthusiasm sparked by various "concepts." These concepts, like kindling added to a roaring fire during market booms, have fueled Sichuan Changhong's market value to soar.

The disparity between the heated share price and the mediocre fundamentals creates a divergence in value. Sichuan Changhong, once the king of China's stock market, is now returning to the spotlight in a lamentable manner.

Numerous Concepts

Irrational speculation exists.

On the evening of October 30, Sichuan Changhong issued consecutive stock trading risk warning announcements for two days, noting that within the past 10 trading days, its shares had experienced three abnormal fluctuations, with a cumulative deviation of +100%.

It is certain that the support for its share price volatility does not come from its business performance. On the evening of October 25, Sichuan Changhong released its third-quarter report for 2024, revealing that its operating revenue for the first three quarters was 77.298 billion yuan, an increase of 10.33% year-on-year. The company's net profit attributable to shareholders of the parent company was 345 million yuan, a decrease of 28.03% year-on-year.

While revenue performance remained stable, net profit has long been at a low level, with a net profit after deducting non-recurring gains and losses of only 182 million yuan. Gross margin also declined from 11.38% last year to 9.93%.

Such business performance resulting in significant share price volatility has obviously exceeded the company's own expectations. In response, Sichuan Changhong issued an announcement stating that its shares had been "identified as experiencing severe abnormal fluctuations." "Given the significant short-term increase in the company's share price, there is an overheated market sentiment and irrational speculation."

At the same time, Sichuan Changhong believes that "there are no major issues affecting the severe abnormal fluctuations in the trading price of the company's shares; there is no other material information that should be disclosed but has not been disclosed concerning the company." "Neither the company nor its actual controllers have traded Sichuan Changhong shares."

Where does the enthusiasm for capital speculation originate? The myriad concepts associated with Sichuan Changhong play a significant role.

On October 29, 2024, Tonghuashun indicated that Sichuan Changhong had added the "drone" concept. The reason for inclusion is that the anti-drone system of its subsidiary, Lingyi Group, is developed based on Lingyi's independently developed radar and has won first prize in anti-drone competitions. The product has been put into practical use.

News from Mianyang News Network also shows that Changhong's anti-drone system has "formed serialized products" and has participated in various national safeguard projects, competitions, bids, and system constructions.

However, the drone concept is just one of the many assigned to Sichuan Changhong. Currently, Sichuan Changhong is tagged with a total of 43 popular concepts by Eastmoney, far exceeding other companies in the same industry. For example, as representatives of smart home enterprises, Hisense Visual Display is associated with 16 concepts; in the OLED sector, TCL Technology has 32 concepts; and in the smart TV sector, Skyworth Digital belongs to 33 sectors.

Sichuan Changhong's numerous concepts make it easier to attract capital attention during various trending events.

Including the recent popular "Western Development Concept," "Huawei Concept," and "Low-Altitude Economy Concept," all of which are related to Sichuan Changhong. However, it is likely that most of these are merely nominal.

Uncertain Returns

Numerous concepts, but uncertain returns.

On August 23, the "Several Policy Measures to Further Promote the Formation of a New Pattern for the Western Development" were reviewed, marking a new historical starting point for the Western Development and igniting the "Western Development Concept."

There is a view in the market that Sichuan Changhong, located in the strategic hinterland of the Western Development, possesses significant industrial status and capital influence.

Subsequently, the share price surged rapidly.

However, regarding such a national-level strategy as the Western Development, while it may seem appealing, its implementation from conception to execution will be a systematic and long-term process.

Changhong has substantial assets and industries in Sichuan

On October 29, Sichuan Changhong issued an announcement stating that regarding the "Western Development Concept," after self-examination, the company had not discovered any significant events directly related to its business or any matters that would significantly impact its production and operation.

This essentially Stripped off the halo of the Western Development concept.

A series of recently announced policies supporting large-scale equipment upgrades and trade-ins for old consumer goods have fueled market expectations for the prospects of the home appliance industry. As a seasoned representative of the home appliance industry, Sichuan Changhong's inclusion in the "trade-in" concept seems logical.

However, Sichuan Changhong has also clarified that the trade-in policy is "subject to the duration of the policy, the overall market competition environment, consumer purchasing power, and the company's specific implementation. The impact of this policy on the company's performance is uncertain."

According to data from AllView Cloud, with the strengthening of subsidy policies in September, retail sales in the home appliance industry increased by 28.6% year-on-year. However, as of September 2024, retail sales of China's home appliance market amounted to 614.4 billion yuan, still down 0.2% year-on-year.

Furthermore, as Sichuan Changhong directly and indirectly holds approximately 4% of Kunpeng Zhiyu, a company in Huawei's Kunpeng ecosystem, and collaborates with Huawei HiSilicon in the chip field, its subsidiary Changhong Jiahua has also maintained a good relationship with Huawei as an authorized general distributor for related businesses. Therefore, Sichuan Changhong is also considered a "Huawei Concept" stock.

Sichuan Changhong is one of Kunpeng Zhiyu's shareholders

In the recent wave of market trends, the "Huawei Concept" has also significantly driven fluctuations in Sichuan Changhong's share price.

However, upon closer examination, Kunpeng Zhiyu's net profit in 2023 was only over 10 million yuan, and the resulting investment income is negligible for Sichuan Changhong. The collaboration between Changhong Jiahua and Huawei has also lacked data support.

In other words, while there are numerous concepts, most remain uncertain in terms of their actual contribution to performance improvement. As a company, what Sichuan Changhong needs most is precisely this improvement in performance.

Fluctuating Performance

An inexplicable vicious circle.

In 1958, the state-owned Plant 780, the predecessor of Sichuan Changhong, broke ground as one of the 156 key projects during China's First Five-Year Plan. In 1972, Sichuan Changhong transformed into a TV manufacturer, gradually becoming synonymous with Chinese TVs and ranking first in national sales for 14 consecutive years.

At that time, color TVs were a high-growth sector, and Sichuan Changhong was a dominant leader with significant market appeal.

In the 1990s, Sichuan Changhong decided to reduce prices nationwide, offering a discount of 350 yuan per TV to consumers, marking the first price war in China's color TV history and signifying the full embrace of market economics by domestic color TVs. In 1994, Sichuan Changhong was listed on the Shanghai Stock Exchange, becoming the first blue-chip stock in Shanghai and entering the capital market.

Sichuan Changhong gradually grew into a larger company but fell into an inexplicable vicious circle.

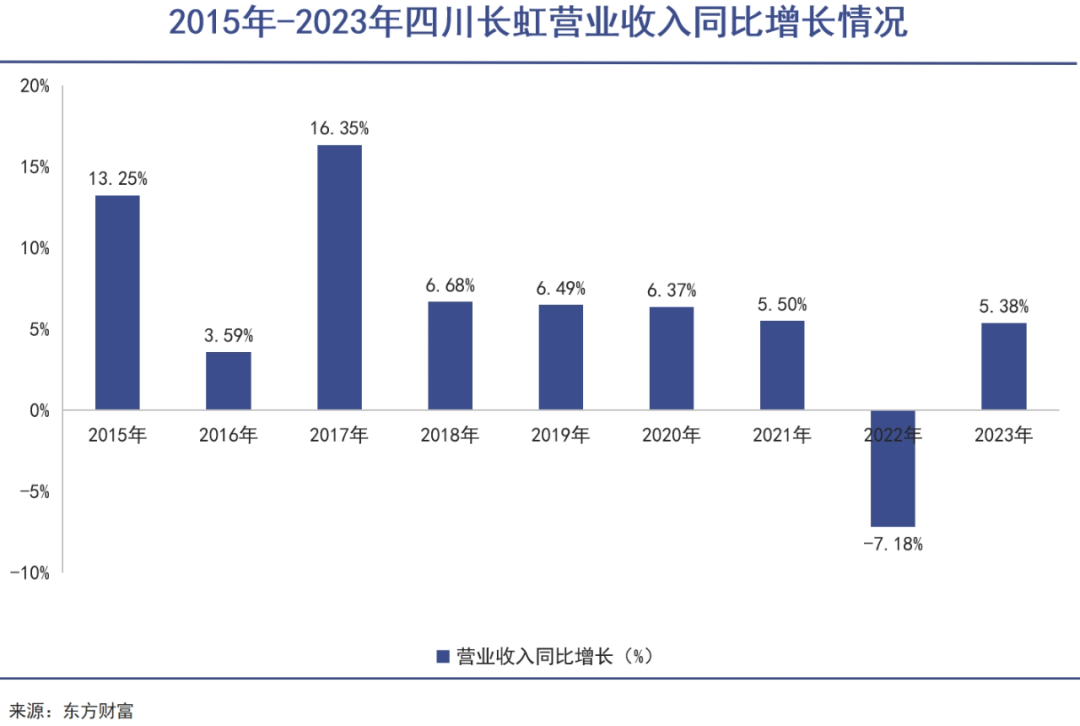

In the 30 years since its listing in 1994, Sichuan Changhong's revenue has grown from 4.274 billion yuan to nearly 100 billion yuan, but its net profit has consistently declined since 1998. In 2023, Sichuan Changhong's net profit of 688 million yuan was even lower than at its IPO in 1994.

For comparison, also in the black electronics sector, Hisense Visual Display reported revenue of 40.65 billion yuan in the first half of 2024, much lower than Sichuan Changhong's. However, its net profit of 1.31 billion yuan was nearly four times that of Sichuan Changhong.

Many factors contribute to this situation, including being duped by a US company in 2004, resulting in a massive loss of 3.681 billion yuan, and betting on the wrong technology (plasma) in 2015, leading to another substantial loss of 1.976 billion yuan. These are complex operational realities.

Ultimately, Sichuan Changhong has experienced unparalleled glory that many companies can only aspire to, but it has since been on a long quest for new growth paths, struggling to find a suitable next destination.

From a revenue structure perspective, according to Sichuan Changhong's semi-annual report, smart home appliance businesses represented by TVs, refrigerators, air conditioners, and washing machines account for 43.51% of total revenue. The second-largest business, "communication technology services," accounts for 34.47% of revenue and has increased by approximately 16.31% year-on-year. While this segment contributes significantly to revenue and demonstrates good growth, its gross margin is only 3.71%, limiting profitability.

In addition, Sichuan Changhong engages in a diverse range of complex businesses, including various network communication terminals, transportation and processing, military-civilian integration, real estate, and even logistics services, reflecting distinct characteristics of the times. None of these businesses can sustain the company's high-quality development.

The complexity of its businesses allows Sichuan Changhong to Rub a little bit on various capital concepts, creating a hotbed for capital speculation.

Given that there is not much room for significant growth in fundamental performance, the momentum behind the concepts will also be limited. When this momentum fades, people will still struggle to form a clear impression of today's Sichuan Changhong beyond its traditional home appliances.