Honor edges closer to IPO, a gamble amid market uncertainties

![]() 11/11 2024

11/11 2024

![]() 478

478

"In the context of peers actively expanding their product lines, Honor has failed to make an impact in diversification."

@ New technological knowledge original

Four years after going solo, Honor reaches a critical juncture!

Recently, Honor has initiated a new round of financing, attracting investors including China Telecom, funds under the China International Capital Corporation, Cornerstone Capital, and SDIC Fund, as well as a new round of investor platforms for agents (Jinshixingyao). Following the financing from China Mobile in August this year, Honor has now introduced a new batch of shareholders.

Honor has also announced plans to initiate the corresponding joint-stock reform in the fourth quarter of this year and subsequently start the IPO process in due course, disclosing relevant financial data during this process.

Although Honor has not disclosed the financing amount and valuation this time, there is a consensus in the industry that Honor has taken another step toward shareholding reform and accelerated its pace towards listing.

Frankly speaking, since Honor's independence, its determination to progress further can be seen in its product layout, channel reforms, and brand operations. After years of effort, Honor's shipments have rebounded after a tough period. However, as industry competition enters a white-hot stage again, Honor will also face new challenges.

01.

From Huawei's 'castaway' to regaining peak status

Tracing back Honor's history, it dates back nine years when it was still a sub-brand operated by Huawei, emulating Xiaomi's internet mobile phone strategy. Relying on Huawei, Honor's market share in China once approached 17%.

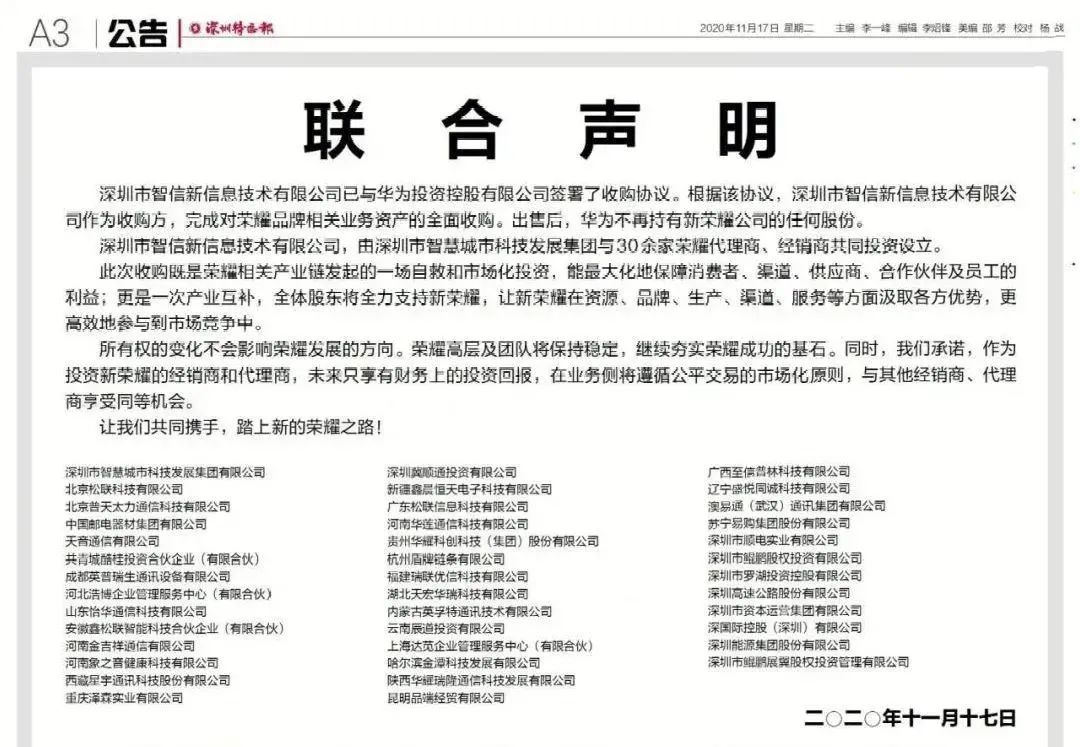

However, in November 2020, due to various factors, Huawei decided to spin off Honor and held a farewell ceremony. Ren Zhengfei also stated bluntly, "Once 'divorced,' there should be no lingering ties." After severing ties with Huawei, Honor instantly entered a difficult period.

From a market share perspective, Honor's market share plummeted to 3% in April of the second year after going solo, marking its "darkest moment." Zhao Ming, CEO of Honor, also mentioned that Honor's entire development platform and operating system had to be virtually rebuilt from scratch. Whether it's imaging capabilities, energy management, or operating systems, they all relied on the relatively stable platform that had previously been established. Therefore, when the platform changed, the entire system basically had to be reconstructed. "When the market and products are rebuilt, it's not just a fluctuation but a reset to zero."

Fortunately, Honor found new funding sources and employed a sea of machine tactics to occupy the void left by Huawei's departure as much as possible, even though the products launched were almost universally criticized as replicas of Huawei phones. For example, the Honor Digital series resembles Huawei's P series, while the flagship Magic series bears a similarity to Huawei's Mate series.

In response, Zhao Ming, CEO of Honor, did not deny this too much, merely stating that it would take some time to surpass the original.

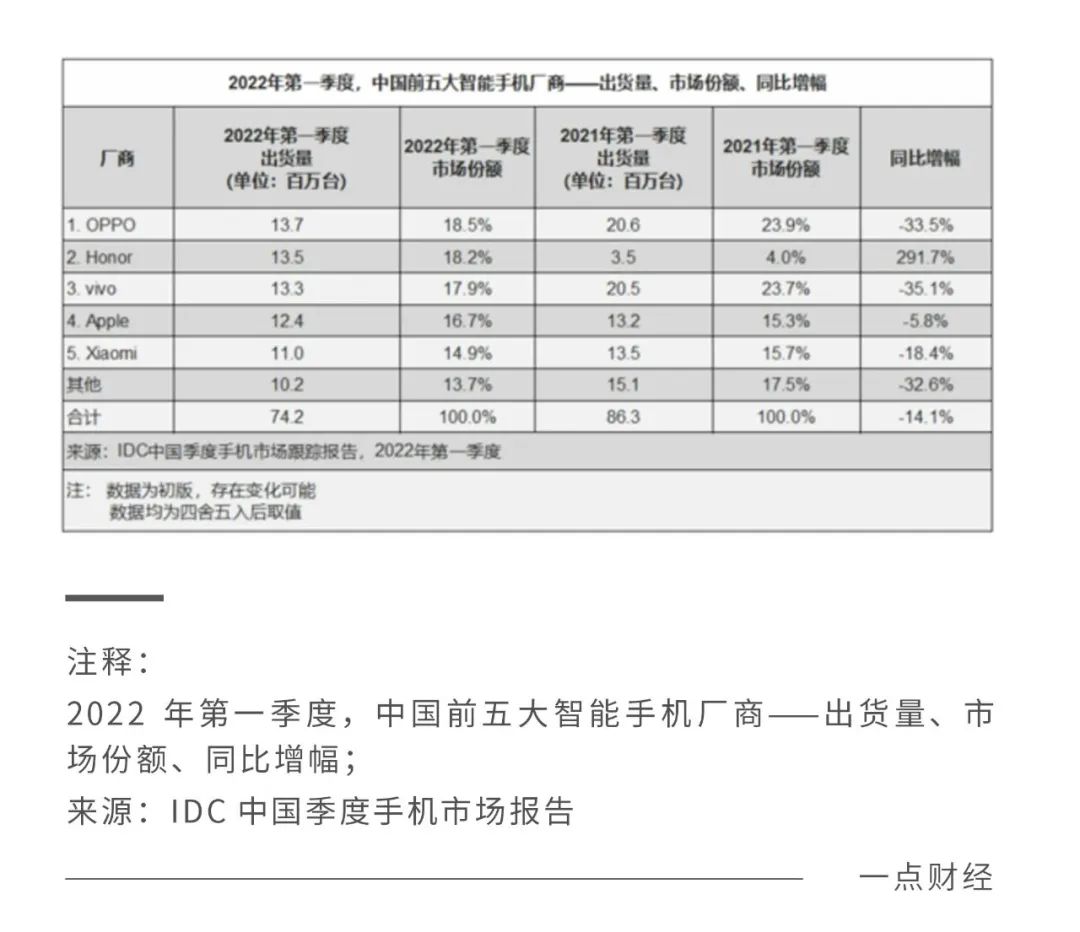

It was not until the third quarter of 2021 that Honor turned the corner and achieved significant growth. According to IDC data from market analysis firm in the first quarter of 2022, Honor's market share surpassed 18.2%. These two years were also ones of rapid pursuit for Honor, even claiming the top spot in the domestic Android market in 2023.

In 2021, Honor returned to the top five in the market with shipments of 13.8 million units and a market share of 11.7%; shipments increased by 34.4% in 2022. Entering 2023, Honor's sales continued to maintain high growth, ranking first in domestic Android market shipments in the fourth quarter of 2023 and throughout the year.

As the domestic smartphone market recovered in 2024 and Huawei made a complete comeback, Honor's growth began to falter, even declining, but it still maintained its top-five market position.

According to the latest data from market research firm Canalys, in the third quarter of 2024, Honor occupied the third position in the Chinese mobile phone market with shipments of 10.3 million units and a market share of up to 15%, while vivo and Huawei led the pack with market shares of 19% and 16%, respectively. Xiaomi and Apple, ranked fourth and fifth, respectively, were not far behind Honor, with market shares of 15% and 14%.

To Thoroughly solve the funding problem , Since independence ,Honor has been actively preparing for its listing.

It is reported that as early as August 2021, core Honor dealers revealed that Honor might go public soon, allowing dealers to purchase original shares with subscription amounts ranging from 5 million to 50 million yuan. However, according to China Business News, after the beginning of 2022, Honor withdrew the original share subscription notice. In 2023, Honor restarted channel share allocation, and insiders at the time revealed that the allocation was not only for channels but also for employees, with share allocation indicators distributed across various departments.

Among them, Honor's relatively dispersed shareholder base and the need to balance the interests of all parties may be one of the reasons for its "wavering" towards listing. Industry insiders stated that many of Honor's shareholders are its suppliers and have transactional relationships with Honor. Before going public, Honor still needs to further clarify these relationships and improve relevant structures and mechanisms.

To date, Honor's investors are diverse, encompassing third-party capital, upstream and downstream ecological enterprises in the industry, operators, and agent platforms. The good news is that investors have largely reached a consensus, and the listing is already "on the verge." However, the current capital market has passed the "frenzy" stage, and shareholders are more concerned about whether Honor has missed the listing window or will even face a situation where the stock price falls below the issue price upon listing.

Of course, regardless of whether it lists or not, from a business perspective, Honor has indeed gained a foothold and proven itself. However, from the perspective of the entire industry, it has also moved from an old battlefield to a new one, and the road ahead is far from smooth.

02.

From survival to development

If we divide Honor's post-independence period into two stages, the first few years were definitely about "survival," while after 2023, it became about "development."

Some Honor dealers indicated that there were many issues with Honor's product positioning in the early stages of its independence. In fact, in terms of research and development, in addition to Honor's existing team, some shared research and development with Huawei, such as the Beijing R&D team for the Nova product line, also transferred to Honor; on the user level, the "Huawei fans" (i.e., fans of Huawei and Honor) previously operated uniformly by Honor were partially separated for Huawei.

Honor even took away some raw material inventory, especially chip inventory. However, Zhao Ming later explained that the actual chip inventory taken by Honor was quite limited, and most of them were chips that could not be used in Huawei phones but were originally intended for Honor models, "After all, Huawei faced greater challenges in chip procurement and supply. When we came out, we had to strive for free market procurement."

Therefore, early Honor products were often referred to as "replicas" of Huawei, with sales mainly concentrated on low-end products. High-end products lacked competitiveness and struggled to compete directly with competitors.

It can be understood that Honor's rival in previous years was actually itself. "After separating from Huawei, Honor experienced a difficult period of 'making do with whatever materials are available.' It was not until 2022 that Honor regained its due product rhythm," Zhao Ming admitted at the time.

However, when products could be shipped on a large scale, it also meant that Honor needed to deliver results to its shareholders. Shortly after Honor's split, a new company composed of multiple Shenzhen state-owned enterprises and over 30 Honor dealers jointly acquired Honor. Most of these dealers were originally offline channel partners of Huawei.

It is also because of these dealers and the supply chain, which form a community of interests, that they became an important boost to Honor's early development. They not only actively distributed goods but were also questioned by the outside world about whether Honor's shipments were merely a transfer from the supply chain's "left hand" to the dealers' "right hand."

The Southern Daily once quoted industry insiders' analysis, stating that Honor's shipments might simply have shifted from the supply chain to the dealer system because many of Honor's dealers are also its shareholders. Shareholders creating momentum for their own enterprises meant that inventory did not truly reach consumers' hands.

Although Zhao Ming has repeatedly denied inventory pressure, whether Honor phones have truly reached consumers' pockets remains a mystery. However, from some side reports, it is evident that Honor's early shipments were somewhat "suspicious."

In January 2022, China Mobile purchased 1.5 million Honor 60 series models, and two months later, another 2 million Honor Magic4 series phones. In just three months, Honor completed two major deals with China Mobile, totaling over 10 billion yuan.

Judging from the financial reports of Honor's dealers, Tianyin Holding and Aiside, both companies experienced double increases in inventory and prepayments in 2022.

Regardless, from the outcome, Honor has survived and officially entered a stage of fierce competition with peers.

Unfortunately, since 2023, as Huawei's smartphone business has accelerated its return, Honor has come face-to-face with Huawei in the high-end market and encountered resistance from Xiaomi, OPPO, and Vivo in the low- to mid-end market. The situation is not optimistic. A fact is that as Huawei's production capacity gradually recovers, the challenges faced by Honor are indeed increasing.

Moreover, in the context of peers actively expanding their product lines, Honor has consistently failed to make an impact in diversification.

As a comparison, both Huawei and Xiaomi have long established diversified businesses. Taking Xiaomi as an example, its IoT and consumer products business and internet services business can even rival its smartphone business. Meanwhile, its auto manufacturing business, regarded as the "second growth curve," has also become a hit, with plans to deliver 100,000 new vehicles in 2024.

Luo Guozhao, editor-in-chief of CHIP, analyzed that from Honor's overall brand layout, its highly recognized/named product lines are relatively narrow, still concentrated in mobile communication products such as smartphones. Although Honor also has PC product lines, smart home product lines, and connected vehicle product lines, they are still in the climbing phase in terms of brand value and scale, contributing a small proportion of revenue to Honor.

Even compared with OPPO and vivo, whose ecological capabilities are not particularly strong, Honor has only been independent for three years, with a relatively short production history for its product lines. OPPO and vivo, on the other hand, are more enduring consumer electronics in the minds of consumers and are more readily accepted by dealers and audiences.

However, Zhao Ming believes that the mobile phone industry has not encountered a bottleneck, and "convolution" means continuous innovation. Manufacturers should focus on AI-enabled hardware and hardware innovation. "Objectively speaking, the mobile phone industry has been very competitive for many years. However, when the market capacity remains at 270 million units and each company's share is basically around 15%, the market feels even more convoluted than before."

Fortunately, the mobile phone market has started to recover this year, and many "new variables" have emerged. Honor's IPO being brought to the forefront at this time also shows its determination to fight a tough battle.

03.

Breaking into the high-end market requires a new story

Currently, Honor has four main strategic points: AI, foldable screens, the high-end market, and overseas markets.

First is AI. The industry generally believes that the integration of mobile device-side capabilities with AI large model capabilities will become everyone's personal intelligent assistant in the future, potentially leading to a tremendous change in smartphones. For Honor, AI phones are a high ground that cannot be abandoned.

In fact, using AI to reconstruct the OS has been a direction that Honor has been pursuing since its independence. It was not until four years later, with the launch of Magic OS 9.0, an AI operating system equipped with intelligent agents, that Honor's AI OS layout truly took a substantial step forward.

"Honor's true advantage lies in using AI to reconstruct the entire service," Zhao Ming said at the Honor Magic7 series launch event. Early product development was accustomed to solving problems using single-minded logical thinking, leveraging the capabilities of the hardware itself. AI+hardware endows hardware with a soul and proactive capabilities. To demonstrate this, he specifically showcased the YOYO intelligent agent's ability to "order 2,000 cups of coffee with one sentence."

However, developing AI and reconstructing the operating system is almost the path currently being taken by every mobile phone manufacturer. For example, Huawei recently released HarmonyOS NEXT 5.0, which also integrates native AI capabilities into the operating system.

It cannot be denied that AI phones have brought all smartphone manufacturers back to the same starting line. At this stage, Samsung, OPPO, Honor, vivo, Xiaomi, and others are all focusing on AI phones. Meizu even announced the cessation of traditional "smartphone" projects, while OPPO officially entered the AI phone era.

Frankly speaking, AI phones are indeed expected to usher in a new upward cycle for the mobile phone industry. However, there are still errors and limitations in data security, natural language processing, ecological application improvement, and other aspects, making users generally perceive AI phones not deeply. As AI large models are applied on mobile devices in the future, competition will become even more intense. This tests the brand's understanding of users. Only those who can capture users will have the opportunity to stand out.

In recent years, foldable screens have long become a new direction for mobile phone manufacturers to "convolute," and under constant competition, the entire foldable screen market has gradually grown. The market has initially formed a competitive landscape of "one pole and multiple powers," with Huawei accounting for 40% of the share and Honor ranking second with over 20%.

In fact, foldable screens can be considered one of Honor's "highlight battlefields." The Honor Magic V2 was released in July 2023, boasting the introduction of foldable screens into the "millimeter-level" era. In the secondary market overshadowed by the "fear of underpricing" that year, many users were even willing to pay a premium to purchase it.

In the foldable screen market, Honor does have the 'air of royalty', but the foldable screen phone market is still in a period of great uncertainty. It takes time to grow from a niche market to the mass market, which is both an opportunity and a challenge for Honor. In the future, it is bound to face more intense competition and needs to make greater breakthroughs in products, services, technology, and other aspects.

One of the more contradictory points about Honor lies in the high-end market. Although foldable screens sell well, the entire high-end market still lacks momentum.

Since last year, Honor has been looking for a breakthrough in the high-end market, but the results have often been unsatisfactory. At the end of last year, Honor announced a formal long-term strategic cooperation with Porsche Design, which was also seen as an important milestone in its layout of the high-end market. By leveraging the strength of different brands, Honor attempts to create high-end luxury products that showcase status and complete the crucial leap into the high-end market.

According to Honor, the first cooperative phone, the Honor Magic6 RSR Porsche Design Edition, sold extremely well during its initial sales period, with all pre-orders sold out within one day of its launch. However, it is worth mentioning that even now, the official has not announced the stock of this phone. Judging from the results, the current market price of this phone is discounted by 20%, yet its sales on e-commerce platforms are only in the double digits. Moreover, sales in official stores are only over 100 units, and the product is currently out of stock, which is obviously illogical.

Honor's genes predestine that its path to the high-end market will not be smooth.

Prior to this, whether in terms of brand positioning or marketing strategy, Honor had never attempted to enter the high-end market and had never accumulated a high-end user base. More crucially, Honor was forced to separate from Huawei's system and can no longer enjoy the brand premium brought by Huawei naturally.

Additionally, self-developed chips are currently recognized as an important cornerstone for establishing a firm presence in the high-end market. Previously, Honor was able to pull ahead of its peers due to the support of the Kirin chip. However, now that it uses industry-standard Qualcomm chips, Honor needs to first bridge the optimization gap with its peers and then find differentiated highlights before consumers will be willing to pay for its products.

While rapidly advancing domestically, Honor is also accelerating its exploration and expansion in overseas markets. Zhao Ming has stated on multiple occasions that 2022 was the first year of Honor's overseas market expansion, and 2023 is the "Year of Europe".

He also added that in the second year of its overseas expansion, Honor basically achieved profitable growth, with its overseas market share accounting for approximately 30% of its sales this year. Moreover, Honor aims to establish Europe as its second home market and become a high-end brand in the European market.

At the Berlin International Consumer Electronics Show held in September, Honor unveiled an open-ecosystem intelligent agent called 'AI Agent' and announced its commercial application on the next-generation flagship model, the Honor Magic7 series.

Unlike some domestic manufacturers' strategy of 'going overseas at low prices', Honor insists on opening up overseas markets with high-end products and technological innovation, but this also means continuous high-cost investment.

The head of a mobile phone brand in the European market previously stated that in developed markets with higher brand barriers, there is no secret to the rise of a high-end brand; it is simply about continuous accumulation and persistent investment. For consumers in the European market, short-term marketing has little significance. Consistent quarterly investments make users feel that the brand has always been there and is a trustworthy one, which may lead to in-store purchases.

There are far more uncertainties overseas than domestically, and it is unknown how much market share can ultimately be 'captured'. However, both Honor and other domestic brands are consistently increasing their efforts. This is a trend, a race to seize market share, and even more so, a survival rule.

This year marks the fourth year of Honor's independence. If in previous years Honor was proving itself, then in the future, it will strive to make a name for itself. Going public has become a hurdle that it must overcome at present. Reorganizing equity relationships and rewarding investors are minor matters; raising funds to prepare for future competition is the main priority. As for how high Honor can soar under the new era's business and product narratives, we will wait and see.