Lei Jun and Yu Chengdong step in, is the 'King of African Phones' in danger?

![]() 11/12 2024

11/12 2024

![]() 683

683

The long-stable African mobile phone market is finally seeing some movement.

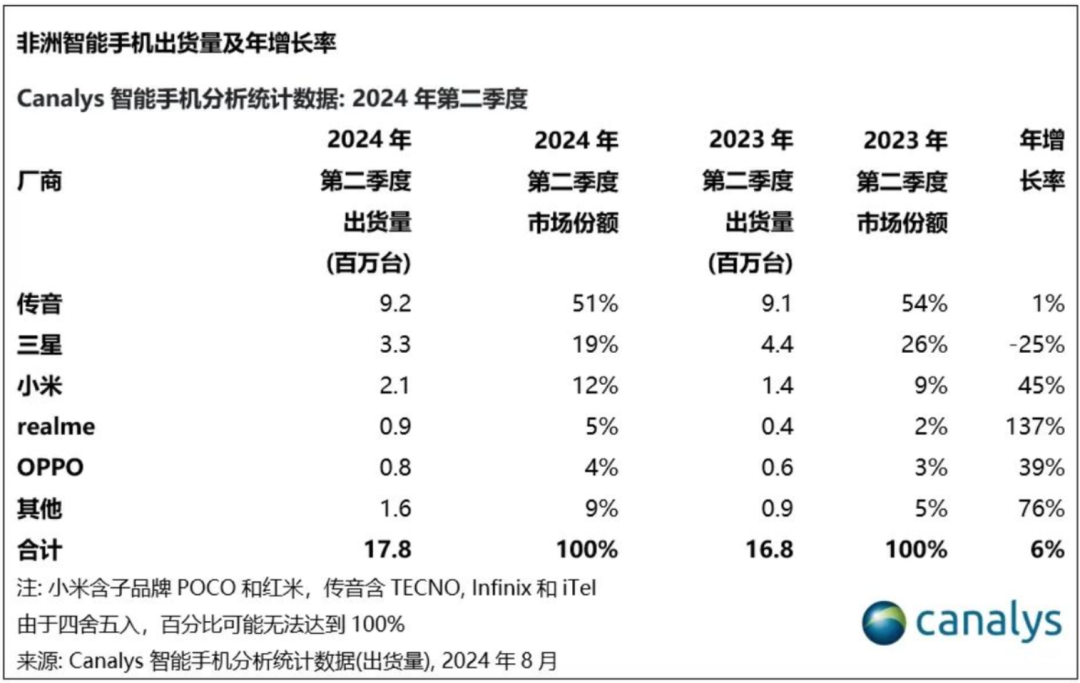

In the third quarter, Transsion, known as the 'King of African Phones,' saw a 41% plunge in net profit and a 7% year-on-year drop in revenue. Moreover, in the second quarter of this year, Transsion's market share in Africa began to decline.

Contrary to Transsion's plummeting net profit and declining market share, Xiaomi and OPPO experienced 100% and 259% growth in shipments in Africa, respectively.

This is an extremely significant signal.

It's worth noting that Transsion has been present in Africa for nearly 20 years. In 2006, when most people still didn't own mobile phones and Nokia dominated the global market, Zhu Zhaojiang, founder of Transsion, began conducting research in Africa. After Nokia's exit from the market and Samsung's demotion to second place in Africa, Transsion emerged as the fourth-largest mobile phone manufacturer globally, fueled by the African market.

Last year, Transsion's shipments and net profit increased by 30% and 123% year-on-year, respectively. Why has the situation taken a sharp turn for the worse? What changes have occurred in the African mobile phone market in the past year?

1. Leading the market in Africa with wall paintings and a month-long standby time

Zhu Zhaojiang, the founder of Transsion, is a low-profile individual who rarely grants interviews or appears in public, mirroring the low-key development of Transsion phones.

In 2006, Zhu Zhaojiang, then vice president of Bird, resigned to found Transsion and venture into the African market amidst unprecedented competition faced by domestic mobile phone manufacturers after China lifted restrictions on foreign mobile phone manufacturers obtaining licenses.

At the beginning of the 21st century, the emergence of PHS made mobile phones a mass consumer product, attracting major manufacturers to compete for users. At that time, Africa was dominated by Nokia. With an average GDP of just a few hundred dollars, most Africans couldn't afford mobile phones, and the penetration rate was only 20%, compared to over 90% in developed countries.

Transsion's first mobile phone, the Tecno T780, was a dual-SIM model, catering to locals who typically carried multiple SIM cards (due to poor cross-operator signal quality and high fees in Africa). This feature was highly popular, helping Transsion gain a foothold in Africa.

Subsequently, Transsion launched its first Android smartphone, the Tecno T1, and in 2013, introduced the high-end brand Infinix to compete directly with Apple and Samsung.

In 2016, Transsion surpassed Nokia and Samsung to become the mobile phone manufacturer with the highest market share in Africa, thanks to its dominance in feature phones. By 2018, Transsion's market share in Africa exceeded 50%, a figure it has maintained to this day.

Transsion's success in dominating the African mobile phone market, outperforming international giants, can be attributed to four main factors:

First, Transsion's low-price strategy.

Whether feature phones or smartphones, Transsion's prices are lower than those of Nokia and Samsung. Adopting a rural surrounding-the-city approach, Transsion focuses on third- and fourth-tier cities and rural areas, where Nokia and Samsung are mainly present in major cities. After establishing a firm footing in lower-tier markets, Transsion introduced high-end brands to enter first-tier cities.

Second, localized innovation.

Following the success of dual-SIM phones, Transsion introduced quad-SIM models and long-lasting batteries that can last up to a month without recharging. Addressing Africans' love for music and dance, Transsion phones feature loud volume playback.

Additionally, they developed camera functions suitable for darker skin tones, addressing issues like overly dark facial tones and poor night photography faced by other manufacturers. Customized innovations also include drop resistance, corrosion resistance, and high fingerprint unlocking success rates, tailored to the hot and sweaty conditions in Africa.

Third, 'Advertising + Channels' to foster cultural identity.

Transsion employs basic wall painting advertisements. Given Africans' love for football, Transsion has partnered with Premier League teams like Manchester City and Leicester City and local popular singers. Mimicking OPPO and VIVO's strategies, Transsion also boasts a well-developed offline distribution system.

Fourth, Transsion chose a relatively uncompetitive African market.

Although Transsion's phones are priced lower than Xiaomi's, its overall gross profit margin is higher. For instance, in 2023, Transsion's gross and net profit margins were 24.5% and 9%, respectively, compared to Xiaomi's 21.5% and 6.5% (even lower for its mobile phone business). While Xiaomi offers better configurations at similar prices, Transsion's localized innovations over the years have won over African consumers willing to pay for its unique features, resulting in a higher gross profit margin.

2. Xiaomi and Huawei flock to Africa, experiencing exponential growth

However, this year, Transsion's stable market share is being eroded by Chinese competitors.

According to IDC data, in the first quarter of this year, smartphone shipments in Africa reached 20.2 million units, a 17.9% year-on-year increase, while feature phone shipments fell to 18.8 million units, a 15.9% year-on-year decline. Smartphones outshipped feature phones for the first time.

The era of smartphones has quietly arrived in Africa.

In 2023, Transsion sold 34.5 million mobile phones in Africa, accounting for 54% of the market and ranking first. However, from the second quarter of 2024, Transsion's market share dropped to 51%, still leading but showing signs of erosion.

In the second quarter of this year, Xiaomi's smartphone market share increased from 11% last year to 12%. In 2022, Xiaomi's share was only 6%. Last year, Xiaomi's share in Nigeria, the largest mobile phone market in Africa, reached 19%, making it the second-largest mobile phone brand after Transsion. In the second quarter of this year, OPPO's market share in Africa also reached 5%, with its sub-brand Realme experiencing a 137% increase in shipments.

Although Huawei phones did not make the top five, Canalys data shows a significant 371% increase in Huawei sales in the fourth quarter of last year.

Mobile phone manufacturers like Xiaomi and OPPO are aggressively entering the African market with low-price strategies, targeting the mid-to-low-end market. A senior researcher at Canalys stated, 'In the first half of this year, the sub-US$100 market segment grew by 42%.'

Xiaomi emphasizes technological innovation and cost-effectiveness, exemplified by its popular Redmi 10A and Redmi 12C, priced at only US$75 and US$95, respectively, both below US$100 and featuring large-capacity batteries.

OPPO also emphasizes cost-effectiveness, particularly in photography performance.

Compared to Transsion, Xiaomi, and OPPO, Samsung places more emphasis on the mid-to-high-end market. Under pressure from Chinese manufacturers, Samsung's market share has declined. In the second quarter of this year, Canalys statistics showed that Samsung's market share in Africa fell to 19%, with smartphone shipments decreasing by 25% year-on-year.

Additionally, VIVO has announced its entry into the African market, and Honor plans to venture into the market soon. The entry of these giants will intensify competition in the African mobile phone market.

3. Transsion's ecosystem spans Africa, and while its stronghold remains, defense will become more challenging

It's undeniable that Transsion is facing fiercer competition from Chinese enterprises, but its market position in Africa is unlikely to be shaken in the short term.

In Africa, Transsion's presence extends beyond mobile phones.

Leveraging its substantial mobile phone user base in Africa, Transsion has established an internet software and hardware ecosystem, creating a moat. For instance, based on its 80 million active users across the HiOS, itelOS, and XOS systems (all based on Android), Transsion has developed app stores, game centers, advertising platforms, and mobile security software.

Drawing on its vast mobile user base, Transsion has launched seven apps with over 10 million monthly active users, including the Phoenix browser with 120 million monthly active users, the Boomplay music streaming service (the 'African version of NetEase Cloud Music') with 68 million, the Scooper news aggregator (the 'African version of Toutiao') with 27 million, and the Vskit short video platform (the 'African version of Douyin') with 30 million.

Transsion is also involved in the African versions of Alipay, online literature, and the gaming market.

In terms of hardware, Transsion boasts the 3C accessories brand Oraimo, the mid-to-high-end home appliance brand Syinix, and the entry-level home appliance brand itel. Oraimo's products include smart speakers, fitness trackers, power banks, and Bluetooth headsets. Syinix offers televisions, air conditioners, refrigerators, washing machines, audio equipment, microwaves, and juicers, covering a wide range of common and small appliances.

Bluetooth headsets are Oraimo's best-selling 3C accessory, with Oraimo headphones ranking first in overall sales in Africa in 2023, capturing over 30% of the market.

While Transsion's established moat may seem impregnable in the short term, the rising sales of domestic mobile phone manufacturers like Xiaomi and the expanding Xiaomi ecosystem in Africa pose a growing challenge to Transsion's defense of the African market.

As major manufacturers intensify their efforts, Transsion will face increasing difficulty in maintaining its position in the African market.