"King of Africa" TECNO Rakes in 5.549 Billion

![]() 04/28 2025

04/28 2025

![]() 685

685

TECNO, the "King of Africa," has quietly amassed a fortune.

According to its latest financial report, revenue in 2024 reached 68.715 billion yuan, a year-on-year increase of 10.31%, with a net profit attributable to shareholders of 5.549 billion yuan, up 0.22% year-on-year. Notably, the African market contributed 22.719 billion yuan in revenue, a 2.97% year-on-year increase, boasting a gross profit margin of 28.59% and a market share of 42%, firmly holding the top spot.

Even more impressive is its annual dividend of 3.421 billion yuan, accounting for over 60% of net profit, significantly surpassing the industry average.

"Our goal is not to replace Apple, but to empower everyone in emerging markets worldwide to own a smartphone," said TECNO Chairman Zhu Zhaojiang, encapsulating the company's market strategy: avoiding technological competition in mature markets and focusing on serving the "forgotten billion" consumer group in Africa through deep localization.

- 01 -

The Secret of the "King of Africa"

TECNO's founder, Zhu Zhaojiang, was born in Fenghua, Zhejiang, in 1973. After graduating from Nanchang Hangkong University, he joined Bird Mobile and rose from a grassroots sales position to head of international business.

In 2006, amidst a domestic mobile phone market mired in a price war, Zhu Zhaojiang chose an unconventional path—targeting the African market.

During his tenure at Bird Mobile, he visited over 90 countries and observed a significant gap in the African market. The local mobile phone penetration rate was less than 7%, and there was a dearth of products tailored to local needs.

In 2007, Zhu Zhaojiang founded TECNO Holding and launched Tecno T780, Africa's first dual-SIM dual-standby mobile phone, addressing the pain point of users needing multiple phones due to fragmented operators.

This innovation swiftly opened up the market, and TECNO subsequently developed differentiated features for African users, such as deep-skin color image algorithms and sweat-resistant structures.

By 2024, TECNO's market share in African smartphones exceeded 40%, and its feature phone market share reached 78%, earning it the moniker "King of Africa".

Why is TECNO so popular in Africa?

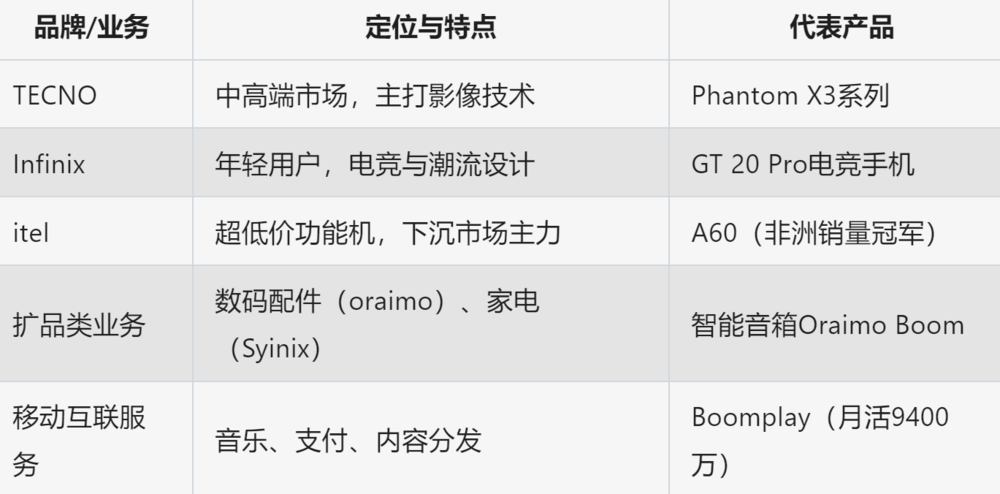

TECNO's Core Business Overview

First, precise innovation.

In TECNO's experience stores across Africa, an $89 TECNO phone is repeatedly showcased for its "unique skills".

The deep-skin color image algorithm captures a three-dimensional shine on chocolate-colored skin, the sweat-resistant structure ensures seamless phone usage during the rainy season, and the four-SIM four-standby design resolves the hassle of users frequently changing SIM cards to save on call fees.

"The average African user has 2.3 phone cards, but 90% of mobile phone manufacturers only provide dual card slots," revealed Li Wei, TECNO's Africa Market Director. This simple design change led to a 12-percentage-point surge in TECNO's market share in 2018.

Similar micro-innovations permeate the product line, including a 6000mAh ultra-long standby phone for areas with power shortages, a voice broadcast system for illiterate users, and specially optimized phone speakers to adapt to the intense rhythms of African pop music.

Second, channel expansion.

In the village of Walungu in northeastern Democratic Republic of the Congo, TECNO's "three-in-one" service outlet has become a local digital life hub, offering phone repairs, solar charging, and phone credit recharges for residents within a 200-kilometer radius. These 58,000 terminal outlets, reaching deep into deserts and rainforests, form TECNO's competitive moat.

"Competitors think low prices can open up the market but overlook the infrastructure gap," pointed out James Mwangi, an analyst at research firm AfriMobile. TECNO's full-cycle service system in Africa, from dealer rebate mechanisms to motorcycle delivery teams, makes its operating costs 17% lower than those of its peers.

Third, ecosystem development.

While Xiaomi was promoting smart TVs in India, TECNO delivered a "hardware combination punch" in Africa.

The digital accessory brand oraimo holds a 35% share of the Bluetooth headset market, the home appliance brand Syinix gained a foothold with "power-outage-resistant refrigerators," and it even collaborated with the local music streaming service Boomplay to launch a $0.10/month subscription service.

This "hardware paving the way, services making money" model contributed 2.1 billion yuan in revenue to TECNO's mobile internet business in 2024.

- 02 -

Stepping Out of Africa

Despite its African success, TECNO did not rest on its laurels but set its sights on Latin America.

In 2024, smartphone shipments in the Latin American market increased by 15% year-on-year to 137 million units, but models priced below $300 accounted for up to 72%.

This market, dominated by Samsung and Motorola for two decades, is now showing cracks due to the "consumption downgrade" spurred by economic downturns, presenting an ideal battleground for TECNO.

Data shows that TECNO's itel A60 phone is sweeping the market at $99 through the Positivo OEM factory. This product, equipped with a 6.5-inch screen and a 5000mAh battery, is 40% cheaper than Samsung models with similar configurations.

"We're not here to compete with Samsung on specifications but to solve basic needs," said Carlos Mendoza, head of TECNO Latin America.

TECNO's strategy in Latin America carries a distinct African DNA:

On the one hand, there's price segmentation. Infinix Hot 30 targets the $100-150 market, competing with Xiaomi's Redmi 12C; TECNO Spark 10 is priced at $79 through operator contracts, attracting users upgrading from feature phones.

The second is localization. It developed the Spanish/Portuguese smart assistant T-Bot, optimized the dual-SIM switching function for Latin America's multi-operator environment, and even added a "Day of the Dead" themed filter for Mexican users.

There's also a channel revolution. It collaborated with Colombia's Movistar operator to launch a "recharge and get a phone" campaign, built an offline network through 23,000 mom-and-pop stores in Peru, replicating Africa's "capillary" strategy.

It set up experience stations in farmers' markets in Quito, Ecuador, to train vendors to demonstrate the phone's dustproof features; and in communication blind spots in Chilean mining areas, it launched the Camon 20 series with enhanced antenna signals.

This "measuring the market with one's feet" approach allowed TECNO to surpass Motorola in shipments in Q4 2024 in Latin America.

- 03 -

Concerns and Breakthroughs

Despite a 40% increase in shipments in Latin America, the gross profit margin in this market is only 17.66%, 10.93 percentage points lower than in Africa. Soaring supply chain costs (a 22% increase in 4G chip prices) combined with currency depreciation (a 9% annual depreciation of the Brazilian real) have put TECNO in a vicious cycle of "the more it sells, the more it loses".

TECNO's moves in Latin America have also provoked counterattacks from competitors.

Samsung launched the Galaxy A05 in 2024, bringing the price of a 6.5-inch phone down to $109; Honor swept the Mexican market with the Enjoy 30 Plus priced at $79; even the local brand Unnecto launched a $75 model, igniting a price war.

When OPPO launched its $200 5G phone in Latin America, TECNO was still focused on 4G models, with its 5G research and development progress lagging behind mainstream manufacturers by 12-18 months. More severely, Latin America's 5G base station coverage rate is less than 10%, delaying the phone replacement wave and limiting premiumization attempts.

TECNO has adapted its strategy. In Mexico City, TECNO launched its first smart speaker, "Oraimo Boom," at $39, featuring the pre-installed Spanish-language music streaming service Tidal as a selling point. Together with the launch of the mobile payment platform PalmPay in Colombia, TECNO is attempting to replicate its African "hardware acquisition - service profit" model.

Meanwhile, it collaborated with the popular mobile game "Mobile Legends" to launch the gaming phone GT 20 Pro, attracting Gen Z with a 144Hz refresh rate and virtual button design; and the Tecno Phantom X3 features a four-skin-color image algorithm, aiming to establish a presence in the $400 price range.

A $260 million factory in Manaus, Brazil, will commence production in 2025, not only avoiding a 30% import tax but also shortening supply chain response times. "Future competition in the Latin American market will be a dual contest of African experience and localization depth," commented industry analyst Maria Fernandez.

"We are undergoing a transformation from a hardware company to an ecosystem platform," said Zhu Zhaojiang in the annual report, perhaps signaling TECNO's next phase, where it will narrate a new business story about digital equity on the vast expanse of emerging markets with a user base of billions.

This article does not constitute any investment advice. Images are from the official website.