Xiaomi and Honor Diverge in Their Paths to 'Premiumization'

![]() 05/22 2025

05/22 2025

![]() 662

662

Xiaomi and Honor have embarked on distinct paths in their journey toward premiumization.

Original Innovation Entropy, Frontier Technology Team

Recently, Xiaomi and its CEO Lei Jun, who had maintained a low profile for some time, have once again captured public attention. Following the heated debate sparked by the Xiaomi SU7 car accident in March, which brought intelligent driving safety into the spotlight, forcing all new energy vehicles promoting intelligent driving to "brake," Lei Jun and Xiaomi, usually the center of internet discussions, kept a low profile to avoid further public scrutiny. On May 15, Lei Jun announced on Weibo that Xiaomi's self-developed SOC chip, Xuanjie O1, would be released by the end of May. On the 19th, Lei Jun shared several updates on Weibo, announcing Xiaomi's strategic new product launch conference on May 22 and detailing Xiaomi's chip journey. In his post, Lei Jun admitted, "We realized that only by creating high-end flagship SoCs can we truly master advanced chip technology and better support our premiumization strategy."

Since officially proclaiming its premiumization slogan in 2020, Xiaomi has continuously deployed in the high-end mobile phone market. The launch of this self-developed chip marks a significant milestone. Amid the ongoing buzz around its automotive business, the excitement over "chip-making" has, to some extent, successfully "rescued" Xiaomi's mobile phone business, which forms the bedrock of its operations. Coincidentally, three hours before Lei Jun officially announced the news of the self-developed chip, Honor, which shares a similar timeline with Xiaomi in deploying high-end mobile phones, revealed that the Honor 400 would be the first globally to be equipped with the full-fledged Snapdragon 7 Gen4 chip, with the Pro version featuring the Snapdragon 8 Gen3 chip.

On May 16, Honor officially announced that the Honor 400 series would be released on May 28. However, compared to Xiaomi's self-developed chip and the new model Xiaomi 15S Pro, which frequently trended on Weibo for being the first to be equipped with Xuanjie O1, the topics generated by Honor's new model using Qualcomm chips seem relatively less popular. Since its inception, there have been market voices suggesting that Honor was a sub-brand launched by Huawei to compete with Xiaomi. In terms of the path to premiumization, the timelines of Honor and Xiaomi's layouts are also similar.

In the same year Xiaomi proclaimed its premiumization slogan, Honor separated from Huawei and embarked on an independent path. At that time, Zhao Ming, the helmsman of Honor, candidly stated, "In the future, only by achieving a high-end breakthrough and stabilizing our high-end brand can Honor's goal of serving the entire population become a reality." This laid the foundation for Honor's direction towards premiumization. Now, both companies have been on the path to premiumization for over four years, but their paths and current situations differ. While Xiaomi is striving to build technological barriers through self-developed chips, aiming at the market positions of Apple, Huawei, and Samsung, Honor has had to choose to focus on cost-effectiveness to save the company in a roundabout way due to its sales ranking falling into the 'others' category. Behind this divergence in paths lies not only the different genes of different enterprises but also different portrayals of China's mobile phone industry during its transformation period.

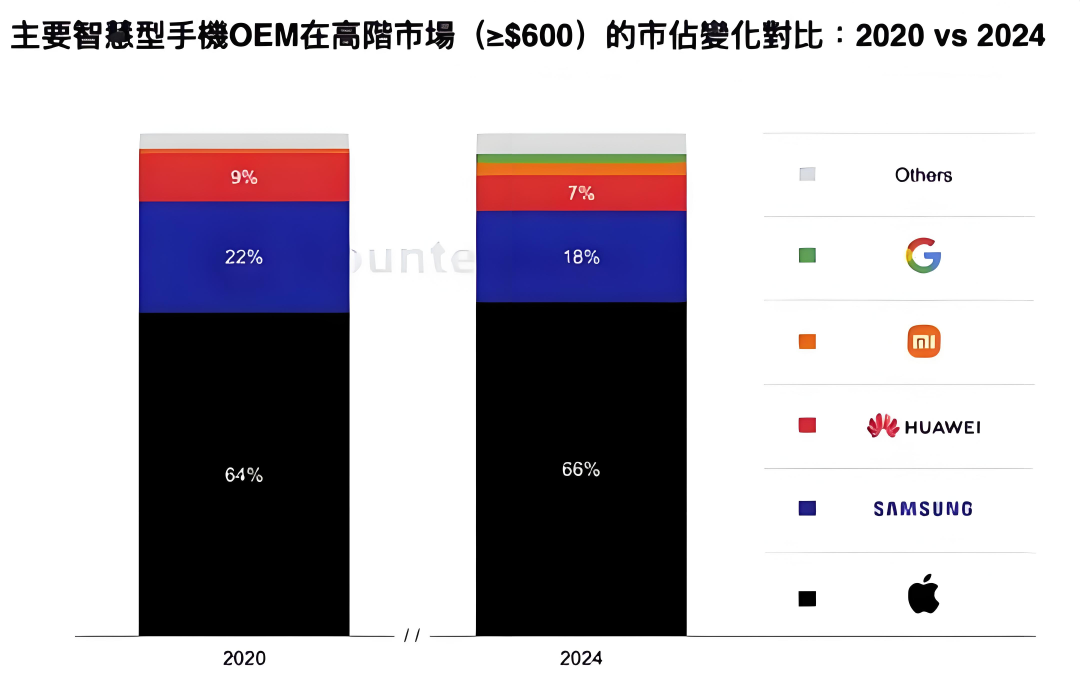

Self-developed SoC chips remain a "minority"

As a core component of mobile phones, the ability to independently develop and mass-produce chips is a crucial indicator of whether a mobile phone company has broken through core technologies and is also a significant boost to supporting market share in high-end mobile phones. Before Xiaomi, the only mobile phone manufacturers in the global market with the true capability to design SoC chips were Samsung, Apple, and Huawei. And it is precisely these three companies that have long dominated the high-end mobile phone market. According to data disclosed by Counterpoint Research, in the global high-end mobile phone market (priced at ≥$600) in 2024, Apple ranked first with a market share of 66%, Samsung ranked second with 18%, and Huawei ranked third with 7%.

Apart from the above three companies, Xiaomi has steadily grown in the high-end market in recent years, entering the top five globally in 2024. Although there is still a gap between Xiaomi and Apple, Samsung, and Huawei, as a mobile phone manufacturer without self-developed SoC chips at that time, Xiaomi's ability to compete with the above three is already remarkable compared to other competitors. Self-developed chips can be seen as an effort to elevate its position. However, the path to self-developed chips is not an easy one. The successful development of SoC chips, the core processors of smartphones, requires high tape-out costs, long-cycle technological iterations, supply chain control, software and hardware collaborative optimization, etc. Each aspect requires enterprises to make substantial investments in time, money, and manpower.

In 2017, Xiaomi released its first self-developed mobile phone SoC chip, the Penta S1, which was first equipped in the Xiaomi 5C, making Xiaomi the fourth smartphone brand globally to have self-developed mobile phone SoC chips at that time. However, due to various reasons, the Penta S1 received a lukewarm market response, and the subsequent Penta S2 even encountered tape-out failure, prompting Xiaomi to halt its mobile phone SoC project. In 2019, OPPO initiated a chip-making plan and assembled a luxurious R&D team of 3,000 people, but has yet to launch an SoC chip. In May 2023, OPPO announced the shutdown of its subsidiary Zeku, which was responsible for the self-developed chip business, and the 3,000-person team was disbanded immediately. At the meeting announcing the termination of the chip self-development business, Zeku CEO Liu Jun said, "Since ancient times, passionate dreams are the easiest to wake up," which also summarized the tragic ending of OPPO's chip-making efforts.

The twists and turns of Xiaomi and OPPO on the road to chip-making also prove the difficulty of chip-making, which requires facing the possibility of huge expenditures going down the drain. Based on this, the current achievements in self-developed chips are even more precious, especially since SoC (System-on-Chip) is still an achievement reached by the "minority." More mobile phone manufacturers currently still choose to cooperate with chip suppliers such as Qualcomm and MediaTek, taking a more prudent path. This is the path taken by Honor and vivo.

As a mainstream domestic mobile phone manufacturer, vivo has also made some layouts in self-developed chips, but it mainly focuses on self-developed imaging chips and other smaller chips. In terms of highly integrated SoC chips that serve as the core role of mobile phones, vivo has close ties with Qualcomm and MediaTek. In 2023, Zhao Ming candidly stated that there are currently no plans to develop SoC chips. At that time, he said, "Today, Honor's cooperation with MediaTek and Qualcomm allows us to obtain the best chip solutions. At the same time, Qualcomm and MediaTek will also open many capabilities to Honor or communicate future plans." With the launch of Xiaomi's Xuanjie O1 and the announcement of large-scale mass production, the number of domestic mobile phone manufacturers with self-developed SoC chips has increased to two. This technological barrier belonging to the "minority" undoubtedly adds momentum to Xiaomi's assault on the high-end mobile phone market. TF Securities believes that in the mobile phone market competition, the experience advantages and scale effects brought by self-developed chips provide Xiaomi with the basic elements for premiumization. It is expected that self-developed chips may help enhance the overall experience of Xiaomi's high-end mobile phones.

Path divergence due to shipment differentiation

While self-developed SoC chips add momentum to Xiaomi's premiumization efforts, there is a reason for their existence. Honor's choice to take the route of supply chain integration without blindly developing SoC chips is a comprehensive weighing of technological risks, business efficiency, and the political environment. Considering the historical background of Huawei's spin-off of Honor, it is not difficult to understand that Honor's independence was fundamentally a bold move by Huawei to deal with the supply chain crisis brought about by sanctions. As an independent Huawei sub-brand, Honor can procure chips independently to survive without being affected by the policy ban on Huawei. After independence, Honor's primary goal was to "survive," i.e., to seize market share. Choosing mature Snapdragon and Dimensity chips undoubtedly ensures faster product iteration and avoids missing the window period due to delays in self-developed SoC chips. During Huawei's silence, Honor, as a replacement for Huawei, achieved a significant rebound in market share through rapid adjustments to its supply chain, product strategy, and brand positioning. In the second quarter of 2022, Honor ranked first in China's smartphone shipments for the first time.

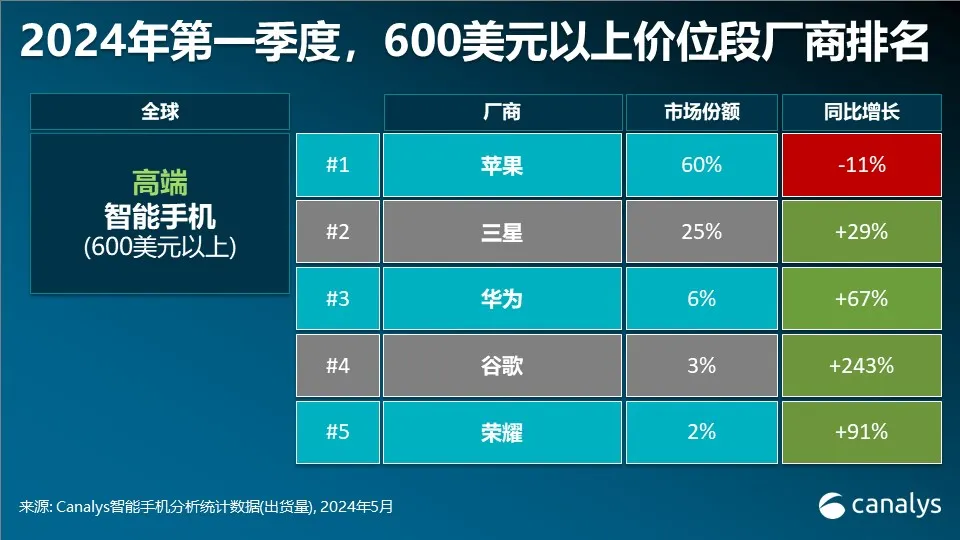

However, in the second half of 2023, as Huawei gradually returned to the market, Honor's growth rate slowed down significantly and began to decline. Canalys data shows that after the third quarter of 2023, Honor's share in the Chinese market has been declining, with six consecutive quarterly declines so far and two consecutive quarters falling out of the top five. Amid this dilemma, during Zhao Ming's tenure, Honor's focus was on assaulting the high-end market. Based on the clear understanding that self-developed SoC chips could not solve immediate needs, Honor deployed the high-end market through the straight-plate flagship Magic digital series and the foldable flagship Magic V series. With multiple layouts, Honor's premiumization once achieved good results. Canalys data shows that in the first quarter of 2024, Honor ranked fifth in the global high-end market (above $600) for the first time, with a 91% increase and a 2% market share.

However, as Huawei's advantage in the high-end mobile phone market continues to emerge, and with senior management changes at Honor earlier this year, Zhao Ming stepped down, and the new helmsman Li Jian, facing the overall sales decline of Honor, began to launch multiple cost-effective new products in an attempt to boost market share. This has also led to a temporary slowdown in Honor's long-standing premiumization route. In contrast, on Xiaomi's side, Canalys data shows that Xiaomi's smartphone shipments have grown to become the third largest globally in 2024.

In the first quarter of this year, IDC data showed that Xiaomi became the mobile phone manufacturer with the largest growth rate in China's smartphone market, with shipments increasing by nearly 40% year-on-year and ranking first. The overall increase in shipment rankings undoubtedly provides more confidence for Xiaomi's premiumization. In February 2025, at the Xiaomi 15 Ultra and Xiaomi SU7 Ultra new product launch conference, Lu Weibing, president of Xiaomi Group, stated that after five years of premiumization, Xiaomi has stabilized its position in the 4-6K range and is assaulting the 6K+ deep-water zone; from the Chinese market to the global market; in the next five years, it aims to achieve a comprehensive breakthrough in the 6K+ ultra-high-end segment. The divergence in overall sales between Xiaomi and Honor is also the underlying reason for their divergence in premiumization development goals: Xiaomi, which aims to assault the ultra-high-end market, has launched self-developed chips, while Honor, which is eager to boost market share, has begun to focus on cost-effectiveness.

Financing considerations behind the listing

For Honor, the declining sales trend is forcing it to seek new growth stories. Against the background of a temporary slowdown in the path to premiumization, Honor is betting on AI for its development focus in the coming period. It is foreseeable that excellent AI capabilities can also increase bargaining chips for deploying the high-end mobile phone market. In March this year, at the 2025 Mobile World Congress, Li Jian, the new CEO of Honor, made his public debut and unveiled the Alpha strategy, announcing that Honor will transform from a smartphone manufacturer to a globally leading AI terminal ecosystem company.

To ensure the seamless progression of the Alpha strategy, Li Jian has announced an investment of over $10 billion over the next five years. However, the competition in AI among mobile phone manufacturers is nothing new, and leveraging AI to innovate necessitates navigating a fiercely competitive landscape. In light of this, Honor is unveiling an ambitious narrative centered around an open ecosystem. The scope and timeline of this narrative's investment are comparable to the intensity of investing in self-developed chips. It is evident that this is an ambitious goal, not easily attainable. To achieve this, the IPO, which is already on the agenda, may emerge as one of the key pathways. While some market observers believe that Honor's proactive listing, despite its financial stability, is primarily driven by the desire of shareholders, dealers, and employees to realize their value, Honor maintains, "To drive the company's strategic development in the next phase, Honor will pursue an IPO to enter the capital market."

The "strategic development of the next phase" may also encompass funding considerations for the Alpha strategy. Zhao Ming, CEO of Honor, stated in a media interview, "Diversifying shareholders and capital is inherent in enterprise growth, and additional resources can propel the enterprise forward."

Among domestic mainstream mobile phone manufacturers, only Xiaomi Group and Transsion Holdings have chosen to list on the secondary market. Given that Transsion's primary market is Africa, Honor is often compared to Xiaomi during its IPO process. Indeed, the current capital market differs significantly from when Xiaomi Group listed on the Hong Kong stock exchange in 2018, and Honor's IPO will not be a mere replication of Xiaomi's path. Nonetheless, Xiaomi's capital market journey offers valuable insights. When Xiaomi listed on the Hong Kong stock exchange in July 2018, it allocated 30% of the funds raised for R&D in core products like smartphones, TVs, laptops, and AI speakers. Subsequently, Xiaomi conducted refinancing through placements, cost issuances, and other methods in 2020 and 2021. Notably, in December 2020, Xiaomi raised approximately HK$24 billion through its first share placement, primarily investing in the automotive business. This year in March, Xiaomi Group announced another share placement, with the funds aimed at accelerating business expansion, R&D investments, and other corporate purposes.

It is evident that Xiaomi's achievements in chip R&D and the automotive business are closely tied to the capital injection, brand upgrading, and global resource integration during its listing process, as well as the subsequent refinancing efforts. For the journey towards high-end products, listing can be a strategic tool, serving as a model for Honor's aspirational high-end path. In terms of the latest AI layout, Xiaomi is also making substantial investments. During the Xiaomi 15 Ultra launch event on February 27, Lei Jun revealed that Xiaomi's R&D budget for 2025 will exceed RMB 30 billion, with approximately a quarter dedicated to AI and related businesses.

Clearly, as demand escalates, the market share of high-end mobile phones continues to expand. In the future, competition in the high-end market will remain intense, with the focus shifting from singular hardware capabilities to a multi-dimensional evaluation of overall user experience. Foldable screens, chips, AI, and other factors may all become crucial for success. For Xiaomi and Honor, which have chosen divergent paths, there may be competition or differences in their future AI strategies. However, one thing is certain: the journey to high-end products for mobile phone manufacturers is far from over.

Source: Zinc Scale, "Reinventing Itself with High-End Products: A Necessary Test for Honor"; National Business Daily, "Honor CEO Li Jian Announces New Open Strategy: Transforming into a Global AI Terminal Ecosystem Company with a Five-Year Investment of $10 Billion"; Photon Planet, "Honor, Pushed to Go Public"; China Finance, "Changes in the Structure of China's Mobile Phone Market in the First Quarter: Xiaomi Tops the List After a Decade, Apple's Market Share Declines"; Fast Technology, "Global High-End Mobile Phone Market: Huawei Third, Xiaomi Fourth, Apple Dominates"