Milestone Achievement: Domestic Storage Chips Achieve Full Localization, Breaking Free from External Constraints!

![]() 07/24 2025

07/24 2025

![]() 482

482

Recent domestic media reports reveal that one of the nation's leading storage chip enterprises has established a production line entirely reliant on domestic chip equipment. Trial production is anticipated to commence in the latter half of this year, with full-scale mass production set for next year. This marks a definitive resolution to the persistent challenges faced by domestic storage chips.

Both domestic logic chips and storage chips have historically been subject to restrictions. Logic chips demand advanced chip technology, with TSMC already mass-producing 2-nanometer technology. In contrast, storage chips, prioritizing durability, have remained above the 10-nanometer process, necessitating relatively less sophisticated technology.

It is noted that domestic logic chip technology has reached a level comparable to 7-nanometer technology, but the leap to more advanced 5-nanometer technology faces formidable hurdles. While existing DUV lithography machines can theoretically achieve 5-nanometer technology through multiple exposures, this approach grapples with issues like exceedingly low yield and high costs, with the progress of this method uncertain.

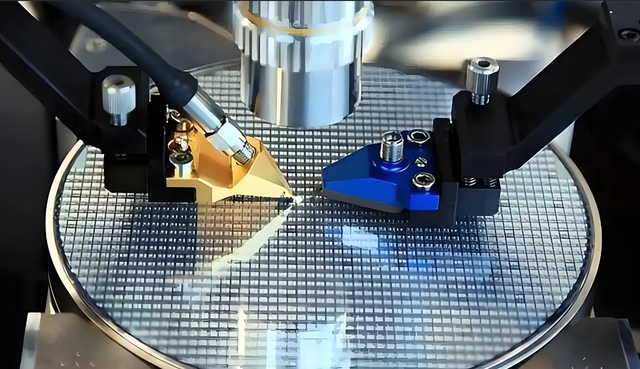

Storage chips, however, have less stringent technological requirements and do not necessitate highly advanced equipment like lithography machines. This presents favorable conditions for the localization of storage chips. In recent years, domestic storage chip manufacturers have diligently worked to replace imports with domestic chip equipment and photoresist, aiming to circumvent external control.

From the information disclosed, it is evident that the localization of domestic storage chips is progressing smoothly. In just three years since the restrictions imposed in 2022, domestic chip equipment has achieved localization substitution. This underscores the rapid advancement of domestic chip equipment, highlighting the robust foundation of domestic technology and manufacturing. With the right impetus, rapid breakthroughs are attainable.

The localization of domestic storage chips was also compelled by external factors. In 2022, domestic storage chips mass-produced the world's most advanced 232-layer NAND flash storage chips, astonishing the globe. From the establishment of storage chip enterprises in 2016 to catching up in 2022, it took a mere six years.

This posed a significant threat to US, Japanese, and South Korean storage chip enterprises, prompting the US to collaborate with Japan and the Netherlands to restrict their chip equipment enterprises from supplying advanced chip equipment to Chinese storage chip enterprises. Even existing lithography machines on the production line faced halted maintenance and servicing, a blatant violation of trade principles.

Consequently, the innovation speed of domestic storage chips slowed down. In 2023, US, Japanese, and South Korean storage chip enterprises took the lead in mass-producing 3D NAND flash storage chips with over 300 layers, securing a technological edge and market share advantage—occupying over 90% of the market. They swiftly pushed up storage chip prices, increasing China's capital costs for procurement.

Undeterred, China's chip industry responded robustly. Since then, it has actively replaced imports with domestic chip equipment. In just three years, it has successfully substituted imports with domestic chips. This will expedite the replacement of imported chips with domestic storage chips. With China procuring nearly 30% of global storage chips, a large-scale substitution will save substantial foreign exchange and drive down prices of US, Japanese, and South Korean storage chips, achieving multiple benefits.

The successful localization of storage chips sends a clear message to the West: they cannot stifle the development of China's chips. Rather, the pressure they exert has fueled the progress of China's chips, accelerating innovation. This outcome undoubtedly surpasses their expectations. The consequences of suppression have instead caused chip equipment enterprises in the US, Japan, and the Netherlands to incur significant revenue losses and permanently lose the Chinese market.