Yan Guanyun: How Meituan is Evolving into a Digital Behemoth Resembling Alibaba

![]() 07/24 2025

07/24 2025

![]() 538

538

When mentioning Meituan, the public might still envision the yellow figures darting through city streets and alleys, a vast food delivery empire. However, this perception is outdated. Today, Meituan has quietly transcended the label of a 'food delivery platform' and is meticulously weaving a vast commercial network encompassing all aspects of life, including food, accommodation, transportation, travel, shopping, and entertainment. It is no longer merely content with 'helping everyone eat better' but is committed to the grand narrative of 'living better', becoming a significant, influential, and unignorable core player in the latter half of China's Internet landscape.

How does Meituan's seemingly all-encompassing business sectors operate internally through synergistic effects to achieve astonishing growth? When food delivery, flash shopping, on-site dining, hotel travel, ride-hailing, bike-sharing, and even unmanned delivery are integrated into a super app, what profound impact does this have on industry competition, consumer choice, and even the operational efficiency of society as a whole? Furthermore, as Meituan's business reach continues to expand, clashing with other internet giants, is its development path mirroring that of Alibaba?

From High Frequency to All Domains, Laying the Foundation for Synergy

The rise of any commercial empire cannot be separated from its solid business foundation. For Meituan, the construction of its extensive ecosystem is not a castle in the air but is built on the solid foundation of two core engines: food delivery and on-site hospitality. These two engines are like the 'Ren and Du meridians' of the human body, with one providing a continuous flow of 'qi and blood' (traffic and infrastructure) and the other accumulating deep 'internal energy' (profit and cash flow), together laying an unshakable foundation for Meituan's ambitious blueprint to expand from high-frequency dining services to all local life scenarios.

Food delivery is the starting point of Meituan's story and the logical origin of its entire business ecosystem. As a business that satisfies the most basic and frequent human needs, food delivery services naturally possess strong user stickiness and traffic aggregation effects. It is through this business that Meituan successfully connects hundreds of millions of users and millions of merchants on its platform, constructing a large and active bilateral market.

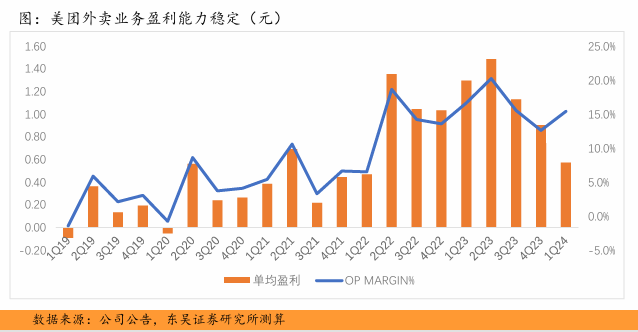

According to financial report data, Meituan's instant delivery business continues to expand in scale. In 2022, the total number of instant delivery orders reached 17.7 billion. By 2023, this figure increased by 24% to a staggering 21.9 billion. In the first quarter of 2024, the number of instant delivery orders on the platform increased by 28% year-on-year to 5.46 billion, and in the second quarter, the number of instant delivery orders reached 6.2 billion.

It can be said that the food delivery business drew the first and most intense stroke in Meituan's empire. It is not only an independent business segment but also the traffic entrance, data source, and performance cornerstone of the entire ecosystem, with strategic value far exceeding the revenue contribution of the business itself.

On-site Dining and Hospitality, the Ballast of Profit

If food delivery is the 'pioneer force' for Meituan to acquire users and build infrastructure, then on-site dining and hospitality businesses are the 'logistics department' that provides continuous 'ammunition'. Compared to food delivery, services such as on-site dining, hotel travel, and leisure entertainment have significantly higher gross profit margins. These businesses constitute another pillar of Meituan's 'Core Local Commerce' segment and are the group's main source of profit.

Financial report data clearly reveals this point. In 2022, Meituan's Core Local Commerce segment achieved an operating profit of 29.5 billion yuan, with the operating profit margin increasing from 13.8% in 2021 to 18.4%. Entering 2023, this segment continued to maintain strong profitability, with revenue increasing by 28.7% to 206.9 billion yuan and operating profit increasing by 31.2% year-on-year to 38.7 billion yuan, with the operating profit margin stabilizing at 18.7%. By 2024, profitability further increased, with operating profit climbing to 52.4 billion and a profit margin of 20.9%.

These tens of billions of annual operating profits constitute the 'profit ballast' of Meituan. They bring stable cash flow to Meituan, giving it sufficient 'ammunition' to invest in the exploration of new businesses (such as Meituan Youxuan and Xiaoxiang Supermarket) and cutting-edge technology research and development (such as unmanned delivery and artificial intelligence). This 'fighting to support fighting' model allows Meituan to maintain strategic focus and make long-term investments and layouts in the face of fierce market competition.

More importantly, there is a natural synergistic effect between on-site businesses and food delivery. For users, one app can simultaneously satisfy the two core local consumption needs of 'home delivery' and 'on-site dining', greatly enhancing convenience. For merchants, Meituan can provide an integrated digital solution covering the entire chain from online traffic diversion, food delivery performance, on-site verification, to membership management. This complementarity allows Meituan to more deeply bind users and merchants, constructing a higher competitive barrier than single-business platforms.

The Growth Secret of Unblocking the 'Ren and Du Meridians'

If food delivery and on-site hospitality are Meituan's solid foundations, then its true terrifying aspect lies in its ability to connect the potential energy of different business segments to form a self-reinforcing and accelerating 'synergistic flywheel'. This is the root cause of the 'chilling' feeling users experience. Through ingenious strategic design and organizational support, Meituan has successfully unblocked the 'Ren and Du meridians' between businesses, allowing traffic, users, data, and performance capabilities to flow efficiently within the ecosystem, creating an exponential growth effect of '1+1>2'. This growth secret is mainly reflected in three levels: the explosion of instant retail, the integration of membership systems, and the synergy of organizational structure.

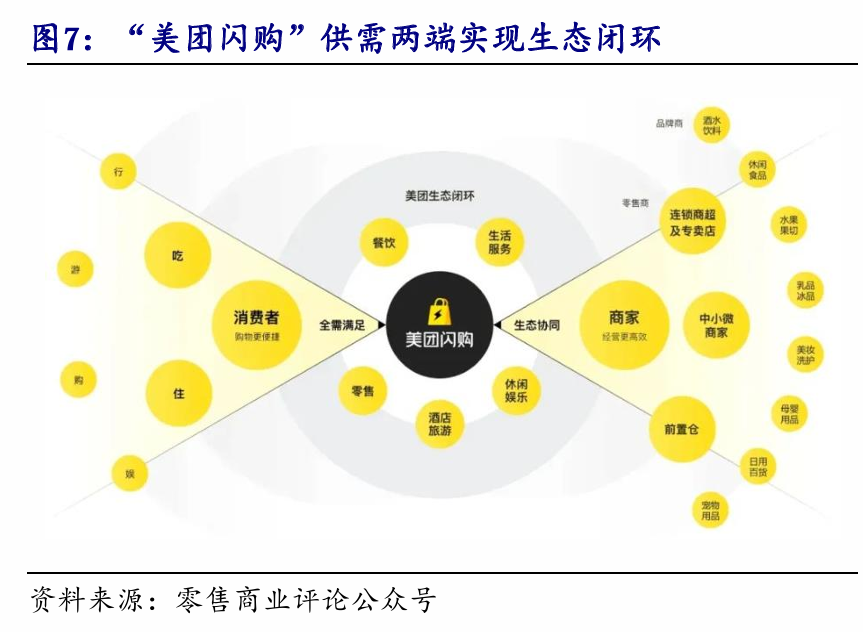

The rise of Meituan Flash is the perfect embodiment of its synergistic flywheel effect. It clearly demonstrates how Meituan leverages the advantages of its core business to deliver a 'dimensionality reduction strike' on a brand-new trillion-yuan market. The logical chain behind this is clear and powerful:

'The essence of instant retail is the 'dimensionality reduction strike' of 'local supply + instant delivery' on traditional e-commerce.' - Kaiyuan Securities Industry Weekly Report

The success of Meituan Flash is built on these two core capabilities. First, it seamlessly reuses the user mindset cultivated by the food delivery business. For users accustomed to ordering meals on Meituan and enjoying the '30-minute delivery' service, the psychological cost of switching from purchasing a spicy hot pot to buying a mobile phone, a bouquet of flowers, or a box of cold medicine is extremely low. Secondly, and most crucially, the flash shopping business directly reuses the instant delivery network established by Meituan at great cost. The existence of this network allows Meituan to extend its services from 'food delivery' to 'delivery of everything' at an extremely low marginal cost without having to build a warehousing and logistics system from scratch like traditional e-commerce.

Data eloquently proves the success of this strategy. In 2023, the order volume of Meituan Flash's business increased by more than 40% year-on-year, far exceeding the 24% growth rate of the food delivery business. Entering the first quarter of 2024, the growth rate of flash shopping orders was as high as 65%, with an average daily order volume of 8.4 million. In terms of categories, it has long surpassed the scope of traditional supermarkets, covering high-value goods such as 3C electronics, home appliances, beauty and personal care, truly fulfilling the promise of '30-minute delivery of everything to your home'. As of the first quarter of 2025, the cumulative number of Meituan Flash's transacting users has surpassed the 500 million mark, becoming a strong 'second curve' driving Meituan's growth.

To support the rapid development of the flash shopping business, Meituan has also launched the innovative 'Lightning Warehouse' model. This is a front-end warehouse model focused on online orders without offline stores. By the end of 2024, the number of Lightning Warehouses had exceeded 30,000 and is planned to increase to 100,000 by 2027. This asset-light, high-turnover model greatly enriches local commodity supply and becomes a core competitive advantage for the flash shopping business.

At the same time, Meituan has adopted a clear dual-wheel drive strategy in the field of instant retail. In addition to the platform model of 'Meituan Flash', there is also the self-operated model of 'Xiaoxiang Supermarket' (formerly Meituan Maicai). Positioned as an 'online supermarket', Xiaoxiang Supermarket focuses on fresh produce and a full range of daily necessities, providing higher-quality services and products through self-built front-end warehouses and private brands. This layout forms a sharp contrast with the strategic contraction and exit from some loss-making regions of the community group-buying business 'Meituan Youxuan' in recent years. This clearly indicates that Meituan is shifting its resources and strategic focus towards the instant retail sector, which has stronger synergy with its core businesses, a deeper moat, and clearer profit prospects.

1. The Integrative Value of the 'Supreme Membership' System

If flash shopping is synergy at the business level, then the upgrade of the 'Supreme Membership' system is deep integration at the user level. Meituan keenly realized that as its business territory expands, it must have a unified membership system to break down business barriers and enhance user stickiness and value across the entire ecosystem. At the beginning of 2024, Meituan internally initiated a membership system reconstruction project regarded as an 'S-level' strategic project, led by Zhou Mo, a core member of the former food delivery business department, after being transferred to the platform.

The core change in the upgraded 'Meituan Membership' system lies in upgrading the 'Divine Coupons' originally mainly used for food delivery to benefits applicable across the entire platform. This means that the coupons users obtain after purchasing membership are no longer limited to food delivery but can be used across multiple core life scenarios such as on-site dining, hotel travel, leisure entertainment, and flash shopping.

According to the performance disclosure, the order share of the 'Supreme Membership' plan has continued to rise, exceeding 40% of the total orders of Core Local Commerce, and over 70% of on-site hotel and travel merchants have participated in the plan. This indicates that the 'Supreme Membership' system is effectively binding Meituan's various business segments together to form a powerful value community.

2. Changes Born for Synergy

The implementation of strategy cannot be separated from the support of organizational structure. To maximize synergistic effects, Meituan conducted a significant organizational structure adjustment at the beginning of 2024. The company integrated its previously independent Home Business Group, On-site Business Group, Meituan Platform, and Basic Research and Development Platform into a unified 'Core Local Commerce' segment, with Senior Vice President Wang Puzhong taking overall responsibility. This adjustment is not a simple merger of departments but fundamentally breaks down internal business walls and data walls.

This series of changes 'born for synergy' ensures that Meituan's growth flywheel can rotate smoothly. From the business extension of instant retail to the user integration of membership systems and the underlying support of organizational structure, Meituan has successfully transformed its advantages in a single field into the linkage potential energy of the entire ecosystem through systematic strategic design, constructing a synergistic barrier that is difficult for competitors to surpass.

3. Building the Infrastructure of the Future

In Meituan's strategic blueprint, 'retail' defines the breadth of its business territory, while 'technology' determines the depth of its moat. CEO Wang Xing proposed the concept of the 'second half of the Internet' early on, believing that growth will be driven by underlying technologies such as AI, big data, and cloud computing. Therefore, Meituan's ultimate vision is not merely to become a 'super platform' connecting online and offline but to build 'a new generation of infrastructure' for the operation of future cities through continuous investment in cutting-edge technology. The 'unmanned delivery' and AI layout mentioned by users are key moves in this grand vision, aiming to reshape cost structures, define service boundaries, and ultimately establish long-term technological barriers that are difficult to imitate and surpass.

Meituan has been exploring autonomous delivery services since 2016 and has made significant progress after years of research and iteration. By the end of 2024, its autonomous delivery vehicles had completed nearly 5 million commercial orders, with autonomous driving mileage accounting for up to 99% in some pilot regions (such as Shunyi, Beijing). Its new generation of unmanned delivery vehicles, 'Mobox 20', has a load capacity of 150kg and all-weather operation capabilities.

In the realm of low-altitude logistics, Meituan's drone technology is swiftly progressing towards commercialization. By committing significant investment to unmanned delivery, Meituan aims to establish a formidable technological barrier around its retail empire. This shift is not merely about enhancing delivery efficiency but fundamentally reshaping its future business model.

As Meituan matures, it increasingly resembles Alibaba.

Meituan's ascendancy, akin to a powerful geological force, has profoundly transformed the landscape of China's internet sector. Its relentless expansion inevitably clashes with other giants, redefining the competitive terrain. Gradually, we observe that Meituan is evolving to mirror Alibaba. Considering Meituan's developmental trajectory, it is evident that the company is diverging. Meituan's growth story represents both a conquest of the local lifestyle sector and a parallel journey with giants like Douyin and Alibaba, albeit on different battlegrounds, converging towards similar objectives.

1. Misaligned Offensive and Defensive Maneuvers with Douyin

In recent years, Douyin has posed the most direct challenge to Meituan, entering the local lifestyle market with an immense flow of traffic. This clash between "traffic" and "an iron army" has significantly impacted the market structure of local life services.

In 2023, competition between the two intensified. Leveraging low-price group purchases and traffic advantages, Douyin achieved a year-on-year GMV growth rate of 256%, putting considerable pressure on Meituan. To counter this, Meituan adopted an aggressive counterattack strategy, including the introduction of live streaming, increased user subsidies, and merchant rebates. While this subsidy war stabilized market share (estimated GTV ratio post-verification between Meituan and Douyin stabilized at around 7:3), it also significantly impacted Meituan's profit margins. The operating profit margin (OPM) of its on-site hotel and travel business declined from 48% in Q1 2023 to 29% in Q4.

However, as we enter 2024, the smoke of this war is gradually clearing. Both sides recognize that the unsustainable burn of subsidies must cease, and the focus of competition is shifting from market share pursuit to quality growth and profitability (ROI-driven). Douyin is prioritizing advertising monetization and write-off rates, while Meituan's profit margins are beginning to recover.

2. The Mirrored Paths of Meituan and Alibaba

The relationship between Meituan and Alibaba is more intricate and profound. They resemble two climbers ascending from different directions who may eventually meet at the summit. Their paths exhibit an intriguing "mirrored" relationship:

1. Alibaba: From Far-Field to Near-Field. Alibaba's core lies in far-field e-commerce (Taobao, Tmall). Its expansion into local lifestyle services is an extension from "goods" to "services" and from "national" to "regional". To achieve this, Alibaba vigorously promoted the "New Retail" strategy, integrating businesses like Ele.me, Gaode Maps, and Flying Pigs, aiming to build a commercial empire encompassing all scenarios.

2. Meituan: From Near-Field to Far-Field. Meituan's starting point is near-field retail and services (takeout, dine-in). Its expansion path extends from "services" to "everything" and from "regional" to "full-category". Through services like Meituan Flash, Meituan is applying its real-time fulfillment capabilities to a broader range of physical goods retail.

However, at the juncture of 2024-2025, the strategic postures of the two companies have diverged markedly. Following the "1+6+N" organizational transformation, Alibaba is entering a phase of strategic contraction and focus. To "revitalize e-commerce," Alibaba is divesting non-core assets, such as selling Sun Art Retail and Intime Retail, bidding farewell to the once high-hoped "New Retail" strategy and instead concentrating resources on core e-commerce and cloud businesses. While its local lifestyle businesses (Ele.me, Gaode Maps) continue striving to reduce losses, their strategic position within the group seems adjusted, with greater emphasis on synergy with core e-commerce operations.

In stark contrast, Meituan is in a period of robust integration and expansion. Whether it's organizational structure adjustment, membership system integration, or firm investment in instant retail and cutting-edge technology, all indicate its strong intention to build an ecological closed loop and strengthen business synergy. From this perspective, today's Meituan, with its business landscape and strategic ambition, increasingly resembles Alibaba during its peak expansion period several years ago.

This phenomenon of "reaching the same goal by different paths" may reveal an ultimate law of internet platform economy development: When a platform establishes sufficient user and infrastructure advantages in a high-frequency field, it inevitably expands into related fields, aiming to build a "super app" and closed-loop ecosystem that meets users' multi-dimensional, full-scenario needs. Meituan's growth path serves as another vivid illustration of this law.

Shadow of Monopoly and Regulatory Game

Behind Meituan's rapid expansion and grandiose narrative of building a global commercial empire, the invisible "sword of Damocles" of antitrust regulation looms. This is a source of deep concern for users. When a platform's power grows so vast that it begins to control the "water, electricity, and coal" of local lifestyle, its potential threat to fair market competition, merchants, and consumer interests inevitably attracts close regulatory scrutiny. The game between Meituan and regulation is a crucial and persistent undertone throughout its developmental journey.

History offers profound lessons. In 2021, China's internet industry entered an era of stringent regulation. In April of that year, the State Administration for Market Regulation (SAMR) initiated an investigation into suspected monopolistic behaviors by Meituan, such as "choose one from two," based on reports. After several months of investigation, SAMR imposed an administrative penalty in October 2021, concluding that Meituan had a dominant position in China's online catering takeout platform service market since 2018 and abused this market dominance by implementing differentiated rates, delaying merchants' onboarding, charging exclusive cooperation deposits, and other methods to urge platform merchants to sign exclusive cooperation agreements, thereby eliminating and restricting market competition.

In accordance with China's Anti-Monopoly Law, Meituan was fined 3% of its 2020 sales in China, amounting to RMB 34.42 billion. Simultaneously, regulators ordered it to cease illegal activities, fully refund exclusive cooperation deposits, and comprehensively rectify issues such as improving the platform commission fee mechanism and strengthening the protection of the legitimate rights and interests of delivery riders. It was also required to submit self-inspection compliance reports to SAMR for three consecutive years.

This penalty marks another landmark antitrust case in the platform economy following Alibaba, clearly signaling to the market that China's antitrust enforcement has entered a normalized and refined stage, with no platform exempt from the law. For Meituan, this is not only a significant financial blow but also a profound compliance warning, forcing it to re-examine its business conduct and competitive strategies.

According to the penalty decision, Meituan's three-year rectification period should have concluded by the end of 2024. However, the latest information indicates that the regulatory sword remains unsheathed. According to the Annual Report on China's Antitrust Enforcement (2024) released by SAMR, regulators are still "deeply assessing the progress of Meituan's rectification and requiring timely completion." Foreign media reports also claim that regulators have extended Meituan's "rectification period" without specifying an end date.

This pending sword has become the most effective "shackle" restraining Meituan's disorderly expansion. It forces Meituan to balance its social responsibilities and legal obligations while pursuing commercial interests, thereby alleviating market concerns to a certain extent about its potential formation of absolute monopoly.

A Giant Running Between Opportunities and Shackles

Looking ahead, Meituan's resolute "retail + technology" strategy has established a profound long-term barrier. On the "retail" front, starting from high-frequency takeout services, it leverages real-time delivery as a core infrastructure to forge ahead in full-category retail, demonstrating immense potential to reshape the retail landscape. On the "technology" front, it deploys unmanned delivery and artificial intelligence with forward-looking vision, not only enhancing current operational efficiency but fundamentally reshaping future cost structures and business intelligence, building an insurmountable technological barrier for its vast empire.

However, amidst opportunities, the shadow of challenges looms large. Meituan's boundless expansion inevitably puts it in conflict with almost all internet giants on different fronts, from Douyin in local lifestyle to Alibaba in e-commerce, with competition intensifying daily. More importantly, its growing market power and vast ecosystem keep it under the regulatory spotlight. The "antitrust" sword of Damocles has not vanished with the end of the three-year rectification period but has transformed into normalized supervision and deterrence, becoming an invisible "shackle."

Therefore, Meituan's future development will be a continuous dynamic game between pursuing huge growth opportunities and responding to fierce competition and the "shackles" of strict regulation. It cannot cease expanding, as stagnation means being overtaken in the brutal internet competition; but it cannot run rampant like before, as compliance and social responsibility have become prerequisites for advancement.

It is foreseeable that Meituan will continue to deepen its ecological synergy and technological investment but will do so with more prudence and refinement. It will prioritize quality growth over market share at any cost and emphasize win-win cooperation with ecological partners rather than maximizing platform interests alone. The competitive landscape of China's internet is far from settled, and the ultimate form of this "behemoth" Meituan will no longer be solely determined by its own strategy and execution but will continuously evolve and be defined under the joint shaping of market, technology, and regulation.

References:

- Meituan's First Quarter: Flash Purchase and Overseas Expansion Highlighted, High-Frequency Rider Income Increased by 12% - Securities Times

- Meituan Releases 2024 Q3 Financial Report: Revenue of RMB 93.6 Billion, Multiple Measures to Promote Ecological Win-Win

- Core Local Business Strives for Progress While Ensuring Stability, Meituan Faces the Future with Patience

- Full Text | Meituan Q1 Earnings Call Recap: Irrational Competition in Takeout is Unsustainable, Will Spare No Effort to Win Competition

- Meituan Releases 2024 First Quarter Financial Report: Revenue of RMB 73.3 Billion, Up 25% Year-on-Year

- Instant Logistics Accelerates Everything to Your Door, Meituan Delivery Awarded "2023 China's Outstanding Logistics Enterprise"

- Meituan's 2022 Revenue Reached RMB 219.95 Billion, with 17.7 Billion Instant Delivery Orders Throughout the Year - E-commerce News

- Meituan's 2023 Financial Report: Core Local Business is Healthy and Stable, R&D Investment Reached a Record High of RMB 21.2 Billion

- Meituan's Turnaround - Huxiu

- Meituan's 2023 Revenue Increased by 26% to RMB 276.7 Billion, with 21.9 Billion Instant Delivery Orders

- Core Local Business Strives for Progress While Ensuring Stability, Meituan Faces the Future with Patience - 36Kr

- Alibaba's Latest Financial Report Released, Local Life Has Reached the Next Level - Sina Finance

- Meituan's 2025 Retail Strategy: Dual-wheel Drive of Lightning Warehouses and Small Elephant Supermarkets - Sina Finance

- Meituan Net Earned RMB 13.9 Billion in 2023: The Highlight is Not Takeout - Sina Finance

- Meituan's Zhou Mo Explains Membership System: Not Just Privileges, but a New Engine for Long-term Growth - Sohu

- Meituan Launches a New Membership System Covering All Scenarios of Life, Including Food, Accommodation, Travel, Entertainment, Shopping, and Healthcare - Xinhuanet

- Analysis Report on the Competitive Landscape Between Meituan and Douyin in 2024 - Fenghuo Research Report

- Actively Embrace New Technologies Such as Drones and Artificial Intelligence, Continue to Strengthen Independent Innovation - Meituan

- Series Report on the Evolution of the Internet Landscape (I) Review of Local Life Competition

- SAMR Releases Annual Report on China's Antitrust Enforcement, Alibaba, and Meituan - Observer

- Antitrust Guidelines for the Platform Economy Sector of the State Council Antitrust Commission - Chinese Government Website