Setting Sail! Drone Delivery! How Will Meituan Become a Global Tech Giant?

![]() 06/13 2024

06/13 2024

![]() 706

706

Produced by: Bullet Finance

Editor: Qianqian

Auditor: Song Wen

On June 6, Meituan released its financial report for the first quarter of 2024. Benefiting from the recovery of offline consumption and the continuous warming of tourism performances, Meituan's various businesses continued to achieve steady growth - total revenue reached 73.3 billion yuan, a year-on-year increase of 25%; net profit was 5.4 billion yuan, an increase of 2 billion yuan compared to the same period last year.

The market's evaluation of Meituan's performance report is generally "exceeding expectations." Especially when the market's patience is only reserved for companies that can make money, Meituan has proven itself.

In fact, over the past year, Meituan could be described as "moving forward with a heavy load": the competition in the local lifestyle market has become increasingly fierce. Fortunately, Meituan timely adjusted its strategy, not only defending its position but also quickly restoring market confidence in it. In February this year, Meituan's share price once fell below its issue price of 69 Hong Kong dollars, reaching a low of 61 Hong Kong dollars, but it quickly rebounded, with the share price climbing to a high of 116.700 Hong Kong dollars on June 12.

1. Focusing on growth, Meituan still doesn't care about profitability

Since its inception, Meituan has been inherently connected to competition. Due to its early adherence to a retail strategy, new businesses were constantly launched, coupled with the large number of players in the local lifestyle sector, increasing subsidies to compete for market share was a commonly used tactic in the industry. From the initial group-buying website to a wider range of local lifestyle services such as takeaways, hotel bookings, and travel ticketing, Meituan offered significant discounts to attract users and merchants. This strategy was undoubtedly correct, and Meituan became the "leader" in the market.

However, after it got on track, Meituan had long shed this label and demonstrated with its performance that it could make money.

(Image / East Money Choice)

This also shows that the current Meituan already possesses the ability to continuously generate revenue, and this ability is a key indicator of competition among current enterprises.

In the early stages of the internet's development, relying on capital infusion could indeed allow some companies to rise rapidly, but with the advent of the industrial internet and consumer internet era, those companies that continue to follow the old path may disappear at any time. Daily Fresh is a case in point, lacking the ability to generate revenue on its own, and collapsing after leaving financing. In contrast, companies standing in the first tier of the internet industry, such as Tencent, Alibaba, and Pinduoduo, undoubtedly possess strong self-sustainability.

Meituan has experienced almost the entire cycle of domestic internet development, and naturally has a deep understanding of this. And it achieved a style switch three years ago.

After the organizational structure adjustment earlier this year, Wang Puzhong is responsible for Meituan's core local business, including takeaways, in-store dining, hotels and travel, and flash shopping, which is the foundation of Meituan and supports a significant portion of its performance.

As the first-quarter financial report shows, the revenue of the core local business was 54.6 billion yuan, a year-on-year increase of 27%, accounting for nearly 75% of total revenue. Net profit was 9.7 billion yuan, accounting for 180% of total profit. It is not difficult to see that the core local business plays a decisive role in the company's stable growth.

The biggest highlight is the growth rate of instant delivery orders. In this quarter, Meituan's instant delivery transactions reached 5.465 billion orders, an increase of 28.1% compared to 4.26 billion orders in the same period last year, significantly exceeding expectations.

In addition, in the first quarter, Meituan Flash's average daily order volume reached 8.4 million. Meituan CFO Chen Shaohui said during the earnings call that it is expected that in the second quarter of this year, the year-on-year growth rate of Meituan Flash orders will be higher than that of catering takeaways, even more than twice as high.

Such outstanding results are mainly attributed to the accelerated growth in the number of platform users and merchants in the first quarter, reaching record highs, boosting the growth of delivery services, commissions, and online marketing services across the board.

Specifically, online marketing service revenue grew by 33.1% year-on-year, becoming the category with the highest growth rate in the core local business. The reason is that Meituan started to focus on live streaming in the second half of 2023 and explored some new marketing positions, effectively increasing user participation and enhancing advertisers' willingness to pay. Delivery revenue and commission revenue also performed well, with year-on-year growth rates of 26.7% and 24.6%, respectively.

It is worth noting that the growth in revenue scale is mainly driven by rising expenses. The financial report shows that the year-on-year increase in sales costs, operating expenses, and unallocated items for the core local business in Q1 reached 34.3%, outpacing the overall income growth rate of this segment.

The core local business is the foundation of Meituan. Facing the fierce attacks of market newcomers, Meituan regards defending its position as the primary task rather than being overly concerned with profitability.

From the results, Meituan's strategy is worthwhile. The number of annual active users of Meituan's takeaway business has increased to nearly 500 million, and the transaction frequency of medium and high-frequency users has further increased year-on-year, driving the number of instant delivery orders to grow by 28.1% year-on-year to 5.46 billion orders, far exceeding the company's previous guidance and the 22% to 24% growth rate shown by market research.

As a leading player in the local lifestyle sector, Meituan's GTV (Gross Transaction Value) has always been relatively prominent. A report from BOCOM International pointed out that in 2023, Meituan's in-store GTV exceeded 700 billion yuan, a year-on-year increase of over 100%, and it is expected that the growth rate in 2024 will exceed 40%.

The first quarter encompassed the winter vacation and the Spring Festival, which are traditionally peak seasons for the local lifestyle industry. Consumer enthusiasm drove the steady growth of Meituan's in-store dining and travel business, with its GTV growing by over 60% year-on-year, achieving a good start for the year.

Although Meituan has many businesses, they are not operated independently. Resources such as ground promotion, merchants, and delivery channels can be coordinated or diverted. Therefore, when the core local business continues to develop steadily, it has, to a certain extent, promoted the improvement of the fundamentals of new businesses.

The new business segment includes preferred, grocery shopping, Kuaili, ride-hailing, shared bicycles, restaurant management systems, etc. Meituan faces more competitors in these areas and still needs to continuously invest resources to consolidate its market position.

However, these businesses also represent Meituan's future development potential and direction, being regarded as new growth engines. In the first quarter, new businesses showed strong momentum, with revenue growing by 18.5% year-on-year to 18.7 billion yuan, and operating losses narrowing from 5 billion yuan in the same period last year to 2.8 billion yuan.

And in terms of expenses, the sales costs, operating expenses, and unallocated items of this segment only increased by 3.1% year-on-year. In other words, Meituan leveraged a relatively low cost to drive significant incremental growth, which is inseparable from Meituan's "retail + technology" strategy, leveraging technological innovation to enhance the efficiency of the retail industry.

Revenue-generating ability is an important factor affecting market capitalization. Since its listing in 2018, although Meituan's revenue scale has grown, its share price performance has been lackluster due to its lack of profitability for a long time. However, after achieving its first profit in 2019, its share price began a "soaring" mode, reaching a peak of over 400 Hong Kong dollars after achieving a record-high net profit margin of 4.1% in 2020.

As Meituan demonstrates its agile adaptability, its share price is already recovering, and it is expected to continue to support the repair of its valuation in the future.

2. Can going overseas support a second growth curve?

In the business world, scale effect is often seen as a panacea, believing that as long as the scale increases, revenue will naturally rise along with it, and profitability will not be a problem. However, blind expansion only increases costs without bringing in revenue, and it is better to cut off dragging businesses and focus on areas of expertise. After all, walking on multiple legs can actually slow one down.

Over the past year, focusing on business has become the main theme and consensus in the internet industry, with large companies carrying out "slimming down" to reduce costs and increase efficiency. For example, ByteDance reduced its game team, Didi sold its car manufacturing business, and Xiaohongshu closed its welfare society and Xiaolvzhou.

In contrast, Meituan has strengthened its determination to focus on local business and made organizational structure adjustments, classifying "exploratory businesses" as new businesses.

Early last year, Meituan took the lead in "cutting" its ride-hailing business, abandoning its self-operated taxi business and fully shifting to an aggregation model. The aggregation model allows Meituan to operate with a lighter load, greatly reducing cost burdens.

During the financial report results meeting released in March this year, Meituan's management also made it clear that it will make strategic adjustments in 2024, aiming to significantly reduce operating losses in the new business segment.

Will unprofitable businesses be cut off? The answer is yes. Wang Xing said, "If a new business cannot become a valuable asset, we will make timely adjustments to our strategy."

However, Meituan is not blindly making reductions in new businesses, but rather continuing to explore boundaries based on market trends and making additions when necessary.

With a solid foundation in the core business and reduced losses in new businesses, Meituan has more confidence to make additions. From Wang Xing's supervisory business, we can glimpse that Meituan's future business direction will mainly focus on two areas.

According to public reports, on February 2nd this year, Wang Xing sent an internal email to all employees announcing a new organizational structure adjustment, stating that "drones and overseas business will report to me." This shows the strategic position of going overseas and drones in Meituan.

As everyone knows, the domestic market is severely competitive, and customer acquisition costs continue to rise, making it inevitable for Chinese companies to go overseas.

In recent years, Meituan has pinned its hopes for growth on community group buying and instant retail businesses, but while Duoduo Maicai clung to Meituan, content platforms such as Douyin, Kuaishou, and Xiaohongshu also joined the fray. With too many players and not enough market share, Meituan was in a position of "burning money to maintain share".

Considering the healthy development of the company, Meituan cannot put all its eggs in one basket. As early as 2018, it invested in two local lifestyle service platforms, Swiggy in India and Gojek in Indonesia. In May 2023, it even took the plunge itself, launching the food delivery platform KeeTa for Hong Kong, China.

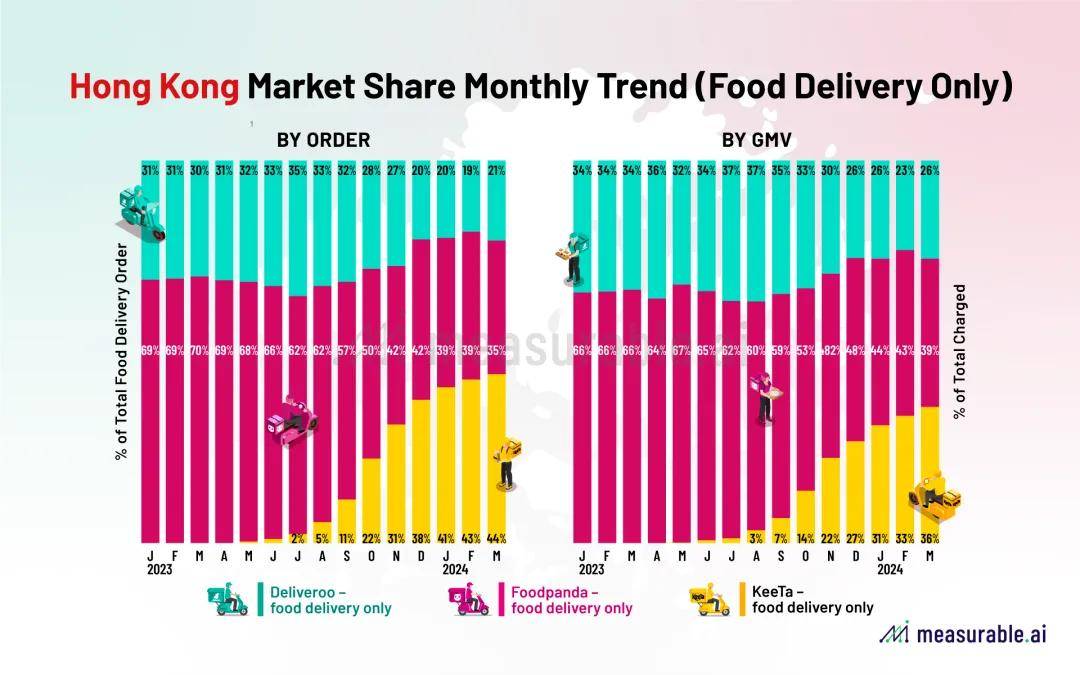

According to the latest data released by market research firm Measurable AI, calculated based on order volume in March 2024, Meituan's Hong Kong food delivery business KeeTa accounted for a market share of 44% in terms of order volume, while the market shares of the other two food delivery platforms Foodpanda and Deliveroo were 35% and 21%, respectively.

(Image / Measurable AI)

As a newcomer, KeeTa's achievements demonstrate its strength. Nowadays, Meituan is recruiting and expanding its team, aiming to replicate Hong Kong's successful experience in the Middle East market.

Currently, Hong Kong and Saudi Arabia are two markets that Meituan favors, both of which have significant untapped markets that could become new growth points for Meituan. However, compared to the domestic market, overseas markets present more uncertainties, testing wisdom and patience. At the same time, the size of the food delivery market in Hong Kong and Saudi Arabia is limited, with a far lower takeaway penetration rate than the mainland, making it difficult to support a second growth curve in the short term.

Wang Xing also has similar expectations and has given the market a heads up in advance, saying, "I think it may take us another 10 years to establish a foothold in overseas markets," and emphasizing that they will explore overseas expansion with a very prudent attitude, maintaining financial discipline and not blindly throwing money at it.

This further indicates that for a long time in the future, overseas business will contribute limitedly to Meituan's overall performance. So, will drones become Meituan's second growth point?

In the modern lifestyle with an ever-accelerating pace, consumers have increasingly higher requirements for the timeliness of goods, which has given rise to the development of instant retail business, and "instant buying and delivery" has become a new consumption habit.

However, the speed limitations of ground transportation and regular congestion cannot keep up with the growth rate of instant retail. To meet consumer demand, Meituan has taken the lead in utilizing drones to "build roads" in the low altitude, establishing a three-dimensional urban delivery network to revolutionize fulfillment efficiency. This means that drones and automated delivery will be the "infrastructure" of future businesses.

In recent years, Meituan's drones released their fourth-generation model last year, which has seen significant improvements in delivery distance, payload, speed, and resistance to adverse weather conditions.

Favorable policy signals continue to be released, promoting the explosion of the potential of the low-altitude economy and expanding the development space for Meituan's drone delivery. Meituan has been approved by the Civil Aviation Administration of China and obtained relevant licenses, enabling its drones to commence commercial operations.

3. Conclusion

The first-quarter financial report not only verifies the resilience and effectiveness of Meituan's business model and diversified layout but also highlights the company's ability to respond and strategic vision in the face of a complex market environment.

At present, the two main characteristics exhibited by Meituan are a "solid foundation" and "steady construction of new businesses." The former remains the guarantee of the company's profitability, while the latter is a promising new growth point.

Such a layout not only allows Meituan to maintain its market leadership but also serves as a powerful testament to its long-term growth potential. Based on this, market and user confidence are steadily improving. Coupled with its continuous efforts in technological innovation and strategic execution, we have reason to believe that Meituan is expected to achieve differentiated strategies and maintain higher-quality development in future competition.

*The cover image in the article is from the Interface News image library.