Cross-border E-commerce in Southeast Asia is Heating Up

![]() 06/14 2024

06/14 2024

![]() 556

556

Currently, domestic e-commerce platforms are embracing the most crucial period of the mid-year promotion, with an atmosphere of sprinting everywhere. Overseas, cross-border e-commerce is also changing from its sluggish first half of the year and is about to enter the peak season of the whole year. In Europe, the "Euro Cup" and Paris Olympics are becoming rare promotional opportunities for local cross-border e-commerce platforms; in Southeast Asia, the upcoming 9.9, 10.10, Double 11, Double 12, and other important promotional nodes throughout the year will successively arrive. Taking the 9.9 promotion in 2023 as an example, the number of merchants participating in TikTok Shop's event increased by 780% compared to the previous year's 9.9, the number of paid orders increased by 923%, and the paid GMV increased by 553%. Many new brands have successfully deepened their brand image and built brand awareness through this promotional node. As a result, numerous cross-border sellers are looking forward to making a stunning comeback during the promotional nodes in the second half of this year, achieving the goal of leapfrog growth. Meanwhile, as a shortcut to go abroad, cross-border e-commerce is also attracting more and more domestic e-commerce sellers and traditional foreign trade enterprises to seek new overseas business opportunities. In fact, cross-border e-commerce is becoming a powerful force in China's foreign trade development.

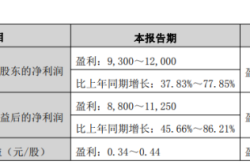

According to relevant data from the Ministry of Commerce, China's cross-border e-commerce trade scale has grown by more than 10 times in the past five years, and the number of cross-border e-commerce enterprises has exceeded 120,000. In the first quarter of 2024, cross-border e-commerce imports and exports reached 577.6 billion yuan, an increase of 9.6%, of which exports were 448 billion yuan, an increase of 14%. Among them, Southeast Asia, due to its close trade ties with China, similar geographical location, and the emerging e-commerce dividend, is becoming an important destination for cross-border merchants seeking overseas growth. However, the Southeast Asian market is inherently different from the domestic market, with geographical dispersion, diverse consumption habits, and increasingly strict market compliance, posing challenges for merchants intending to layout in Southeast Asia. To welcome the e-commerce dividend in Southeast Asia, many novice merchants urgently need a "refresher course".

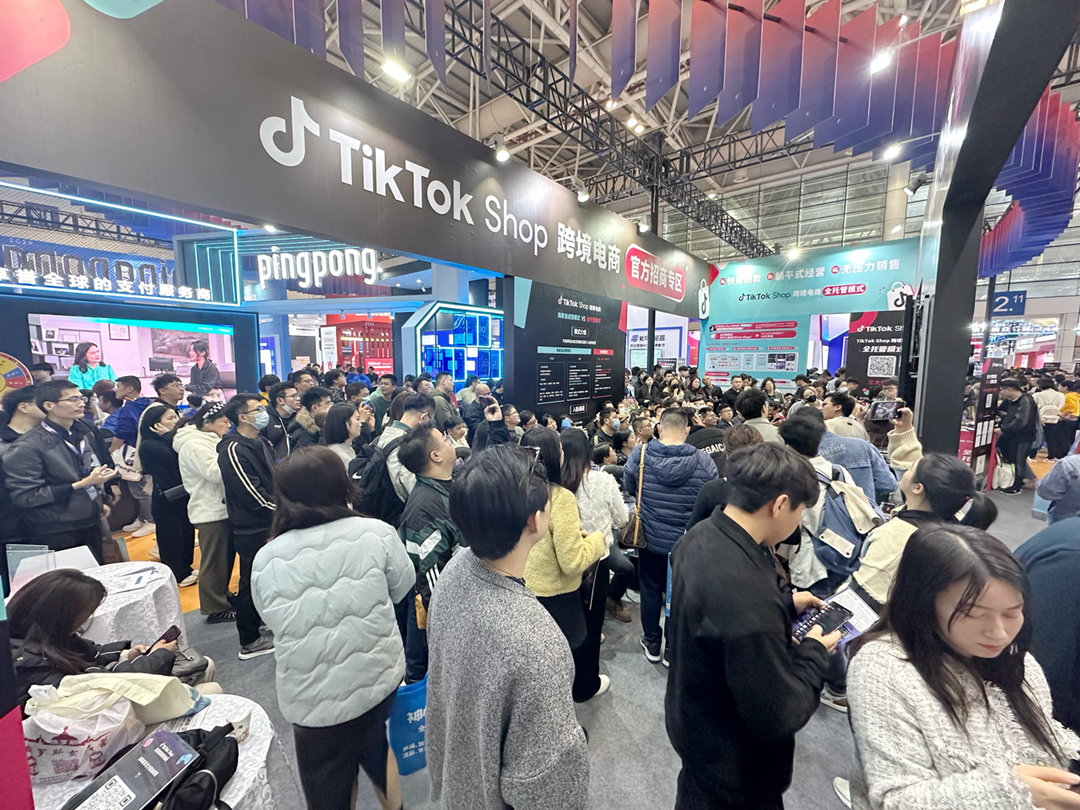

Since the beginning of 2024, the popularity of cross-border e-commerce has been evident: at the beginning of the year, many merchants always pay the most attention to the latest situation of TikTok Shop when participating in industry exhibitions, keeping up with the latest progress of cross-border e-commerce; at the end of January, at a forum focused on TikTok Shop, the enthusiasm for catching the wave was also evident on the spot, "Many merchants even crowded into the corridors and aisles to listen." Described by a Shenzhen seller to Xiaguangshe.

At a TikTok Shop cross-border e-commerce event early this year, merchants crowding for consultation

Behind this is the increasing demand for going abroad among cross-border merchants. Going abroad has been the hottest word in the corporate circle in the past two years. From industry giants and large enterprises with trillion-scale revenues to individual merchants with revenues of less than 10,000 yuan; from cutting-edge digital technology innovation enterprises to traditional factories and small commodity operators behind the production line, they are all leaping out of the domestic market in different ways, moving overseas, and integrating into new globalization. Cross-border e-commerce has built a convenient platform for enterprises to go abroad. The biggest characteristic of cross-border e-commerce is that it breaks geographical restrictions, which is very suitable for products to enter overseas markets in the early stage, directly targeting overseas C-end users, and increasing product premiums. In fact, since last year, global cross-border e-commerce has flourished. According to estimates from research firm ecommerceBD, global retail e-commerce sales reached 6.3 trillion US dollars in 2023, 800 billion US dollars higher than the 5.5 trillion US dollars in 2022; by 2025, this figure will exceed 7 trillion US dollars; by 2026, it is expected to reach 8.1 trillion US dollars. Domestically, cross-border e-commerce has become a major highlight in China's foreign trade field. Customs data shows that in 2023, China's cross-border e-commerce imports and exports reached 2.38 trillion yuan, an increase of 15.6%. Among them, exports were 1.83 trillion yuan, an increase of 19.6%.

More and more Chinese companies are choosing to explore overseas markets through cross-border e-commerce. It is expected that by 2025, China's cross-border e-commerce transaction volume will reach 2.5 trillion yuan, bringing new opportunities for Chinese enterprises and brands. In overseas markets, Southeast Asia, an emerging market, is attracting the attention of Chinese enterprises and merchants with its unique charm and potential. China and Southeast Asian countries have had close trade ties for a long time, and the trade volume is increasing. Currently, ASEAN and China have become each other's largest trading partners. The total trade volume between China and ASEAN has grown from 443.6 billion yuan in 2013 to over 6.4 trillion yuan in 2023, accounting for 15.4% of China's total foreign trade value.

In January this year, the fifth round of negotiations for the 3.0 version of the China-ASEAN Free Trade Area opened. The 3.0 version of the China-ASEAN Free Trade Area will further enhance the level of trade and investment liberalization, expand pragmatic cooperation in emerging areas such as intermediate goods trade, digital trade, cross-border e-commerce, standards, green and low-carbon, based on the existing China-ASEAN Free Trade Agreement and the Regional Comprehensive Economic Partnership Agreement (RCEP). Among them, the most notable change is the addition of cooperation in cross-border e-commerce. In fact, the development of cross-border e-commerce in Southeast Asia is indeed noteworthy. Market research firm eMarketer has released the "Global Retail E-commerce Forecast Report", which estimates that Southeast Asia's e-commerce market revenue will be 113.9 billion US dollars in 2023, with e-commerce sales growing by 18.6%, far exceeding the global average growth rate of 8.9%. The development of cross-border e-commerce in Southeast Asia benefits from the rapid recovery of Southeast Asian countries' economies after the pandemic. In 2023, the total GDP of ASEAN's ten countries exceeded 3.8 trillion US dollars, making it the world's fifth-largest economy. The growth of ASEAN's economy is mainly driven by local consumption, tourism, demographic dividends (680 million), etc. On the other hand, Southeast Asia's digital economy is developing rapidly. According to the Great Wall Securities research report, the scale of Southeast Asia's digital economy has maintained double-digit growth in recent years, and is expected to exceed 295 billion US dollars in 2025, with a compound annual growth rate of 16% from 2023 to 2025.

While Southeast Asian e-commerce is developing rapidly, the supply in the upstream industry is in short supply. For Chinese merchants, this is undoubtedly a dividend that is being released.

Amid this e-commerce dividend, the content e-commerce trend represented by TikTok Shop is becoming the most significant variable. In February this year, Xiaguangshe visited Southeast Asian countries and spoke with several merchants. They all said that more and more friends around them are paying attention to content e-commerce, "Both consumers and merchants are trying this emerging e-commerce model." And more perceptive are China's live streaming hosts. Sansheyang Network, which owns the top host "Crazy Xiaoyangge," has also accelerated its pace of overseas live streaming this year. Since the beginning of this year, it has successively tested the waters of live streaming in Singapore, Malaysia, Thailand, and other markets, once topping the TikTok Shop Singapore regional GMV ranking.

When domestic merchants and hosts accelerate their exploration of the Southeast Asian cross-border e-commerce market, they should also note that Southeast Asia is not a unified large market but a region composed of more than ten countries. Due to the numerous ethnic groups here, people's customs and needs vary, so to deeply cultivate the Southeast Asian e-commerce market, it is necessary to grasp the consumption trends of different countries more meticulously and find small but beautiful opportunities. On January 9, 2024, TikTok Shop Southeast Asia e-commerce released its 2024 Southeast Asia e-commerce product selection trends on its official WeChat platform.

In the consumer electronics industry, practical and portable electronic gadgets are gradually becoming the favorite of consumers in this market. For example, consumers pay more attention to portability and comfort when it comes to earphones, often preferring compact and rounded styles; for phone stands, charging cables, phone cases, and other accessories, consumers prefer brightly colored and co-branded styles; handheld mini fans, portable emergency lights, and other practical and portable small appliances are also very popular.

For the fashion industry, women prefer basic and versatile styles, plain and cool-toned tops, as well as minimalist-style tote bags, macaron-colored small wallets, and large-capacity canvas bags suitable for commuting; in addition, sports pants continue to sell well in Southeast Asia.

In the FMCG industry, the hot and humid climate leads consumers to prefer strong oil-control and waterproof beauty products. Women also love contouring and false eyelash products; when choosing skincare products, consumers here prefer those with whitening, moisturizing, and sun protection functions; in addition, facial cleansing products such as facial cleansers and blackhead removal patches have become trendsetting products.

Finally, in the daily necessities industry, tissues and cleaning agents occupy a significant proportion of household care products consumption; when choosing office stationery, they prefer refillable black pens and colored markers; for beddings, consumers prefer brightly colored and cute patterned beddings; surprisingly, people in Southeast Asia are increasingly paying attention to pets, and mid-to-high-end priced dog and cat food are hot-selling items, consistently occupying the top of the best-selling list.

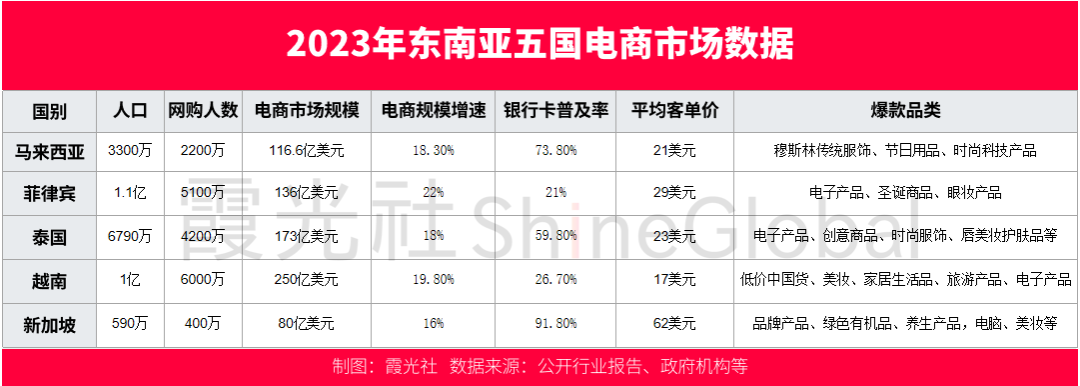

Taking several countries in Southeast Asia with relatively large cross-border e-commerce market sizes and potentials as examples, we analyze the popular industry categories and business opportunities on cross-border e-commerce platforms in each country. First, let's look at Malaysia. Malaysia is the third-largest economy in Southeast Asia, with a young consumer group and a preference for cross-border shopping. Similarly, Malaysia's Chinese market has great potential, liking Chinese goods and valuing cost-effectiveness. Since 2024, the Malaysian government has imposed a 10% low-value goods tax on low-priced imported goods with a value of not more than 500 ringgit sold online. Therefore, high-value cross-border goods are more suitable here. Islam is the state religion of Malaysia, and people like traditional clothing and apparel, so consumers have a high demand for Muslim traditional clothing, robes, and headscarves; in addition, shoes are the first choice for Ramadan shopping; Malaysian festivals are numerous, and festival-related items are quite popular; cost-effective electronic products and accessories are also selling well, and fashion tech products such as dresses, mobile phone accessories, smartwatches, robot vacuum cleaners, and vacuum cleaners also have a market.

A live streaming host

Next, let's look at the Philippines. With a population of over 100 million, young consumer groups and the middle class are the main driving forces of the Philippine e-commerce market. The Philippines also has one of the longest Christmas seasons in the world (almost 5 months), which is the peak season for Philippine cross-border e-commerce, so Christmas goods and children's toys are quite popular.

In addition, Filipinos love "scrolling through their phones," and there is a high demand for electronic products and mobile phone accessories in the market; locals love basketball, and sports equipment is also popular locally. For women, Filipinos' skin tone is mainly brown, preferring European and American makeup styles, and eyeliner, eyebrow pencils, contouring, and other eye makeup products are deeply welcomed in the market.

Third, Thailand. Amid the wave of cross-border e-commerce sweeping Southeast Asia, Thailand is considered one of the most promising markets in Southeast Asia. Thailand has a young consumer group and a growing middle class, with 17-36-year-old youth users being the main force in the e-commerce market. They value product quality and authenticity, emphasize brand image, but are sensitive to prices and are more likely to accept affordable goods. Consumers here rely heavily on social media and are willing to try products recommended by influencers. Consumers here have a high demand for electronic products and household appliances such as mobile phones and peripherals; in addition, the younger generation pays attention to fashion trends and personal image, and there is a large market for beauty and skincare products and fashion clothing; in terms of household goods, Thai consumers prefer cute and creative items such as lighting and home care products.

Fourth, let's look at Vietnam. In the first quarter of 2024, Vietnam's e-commerce market sales reached 2.777 billion US dollars, an increase of 78.69% year-on-year, showing robust vitality. Vietnam has a young population structure, bringing strong purchasing power to the consumer market. Due to Vietnam's relatively low per capita income, consumers prefer mid-to-low-priced goods when shopping online and have a high acceptance of Chinese products. In terms of categories, Vietnamese consumers continue to lead in spending on beauty, home living goods, and women's clothing. Sports and tourism products have also grown rapidly in the past year. In addition, the consumption of home appliances, mobile phones, and tablets is shifting from offline to online.

Finally, let's look at Singapore. Singapore is an international financial