''' People are using their dusty power banks again, indicating the decline of the sharing economy

![]() 06/14 2024

06/14 2024

![]() 679

679

Nowadays, shared power banks are both expensive and difficult to return.

"There's no way to return shared power banks."

A few years ago, shared power banks were popular, but recently they have trended on social media in this manner.

The incident originated on May 27th, when a woman in Guangdong posted a video complaining that after borrowing a power bank on the street, she found "no way to return it." After running over 50 kilometers consecutively, she found that every borrowing and returning point was full of power banks with no available machines, leading her to "angrily smash the power bank."

In fact, in recent years, there have been increasing controversies surrounding shared power banks. From initially being a convenient new lifestyle to being labeled "power bank assassins," from being highly praised and widely anticipated to being feared and ignored, shared power banks have clearly undergone a significant reversal in reputation.

In fact, it's not just shared power banks. From early shared bicycles and umbrellas to the newly emerging shared mahjongs and charging piles, this "sharing economy" formed under the Internet+ model has become a paradigm.

However, as the era of Internet growth nears its end, this model built on traffic foundations seems to be facing its moment of falsification.

01

Hundreds of millions of people can't support power bank companies

"Shared power banks are really disappointing."

When Ms. Wang in Beijing mentions shared power banks, she is full of complaints. "8 yuan for 2 hours, and less than 40% of the battery is charged. Why not just rob money?"

In her memory, it used to take less than 2 hours to fully charge, and although the unit price was similar, it was faster to charge. Now, not only does it charge slowly, but it's also difficult to find a return point. "After finally finding a return point, the equipment is broken, and I have to contact customer service every time to end the service."

Prices are getting more expensive, but user experience is getting worse. This seems to be the consensus among consumers in recent years regarding shared power banks. Many people even question whether companies intentionally reduce the output of power banks and slow down charging speeds to increase usage time and thus charge more fees.

On the Heimao Complaint Platform, consumers' complaints about shared power banks are numerous, with various reasons for complaints ranging from difficulty in returning, inability to charge, to malicious deductions, continuous deductions after returning, and hidden fees. Not only users but also merchants who install power banks in their own stores face issues such as "unable to withdraw power bank payments" and "unable to contact customer service, leading to consumer disputes."

Image source: Heimao Complaint Platform

In a nutshell, for the shared power bank market, the current value brought by its practicality may not be worth the negative effects of its inconvenience and low cost-effectiveness.

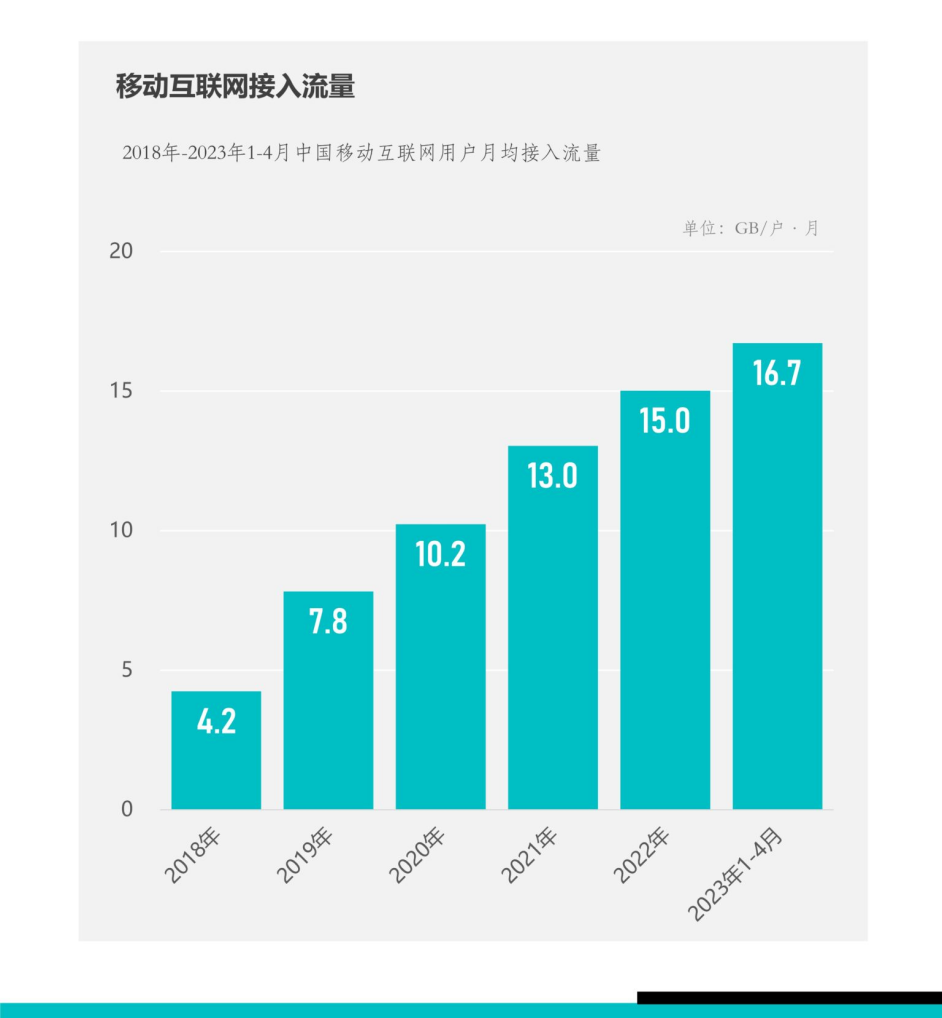

In fact, the development of smartphones and mobile internet to this stage has brought a very large market to the shared power bank market.

On the one hand, high energy consumption of mobile phones is a major trend.

According to the "Domestic Mobile Phone Market Operation Analysis Report for December 2023" released by the China Academy of Information and Communications Technology, from January to December 2023, domestic 5G mobile phone shipments reached 240 million units, an increase of 11.9% year-on-year, accounting for 82.8% of mobile phone shipments during the same period. Recently, data from the Ministry of Industry and Information Technology showed that in the first quarter, China's 5G mobile phone shipments reached 56.43 million units, accounting for 83.7% during the same period. Data from Daily Interaction also showed that as of the first quarter of this year, 5G mobile phones accounted for 61% of the market, an increase of 26.6% year-on-year and 15.4% from the end of 2023.

Data source: Daily Interaction

Due to the addition of 5G radio frequency and antenna modules in hardware, these complex components require more power to drive, resulting in significantly higher power consumption for 5G mobile phones.

In addition to hardware, with the increasing popularity of applications such as games, short videos, and social software, there are more high-energy consumption scenarios for mobile phones.

Image source: Fastdata

Currently, the average capacity of mainstream mobile phone batteries has reached 4962mAh. Combined with the results of a simulation test conducted by Xiaobai Evaluation on mainstream models, the average remaining battery life after 3 hours of light use is 61.1%, and only 13.1% remains after 5 hours of heavy use. Assuming a 10-hour usage, it can be estimated that the daily power requirement is 7532mAh, resulting in a power gap of approximately 2571mAh compared to the mainstream capacity.

High energy consumption is continuously catalyzing the demand for charging.

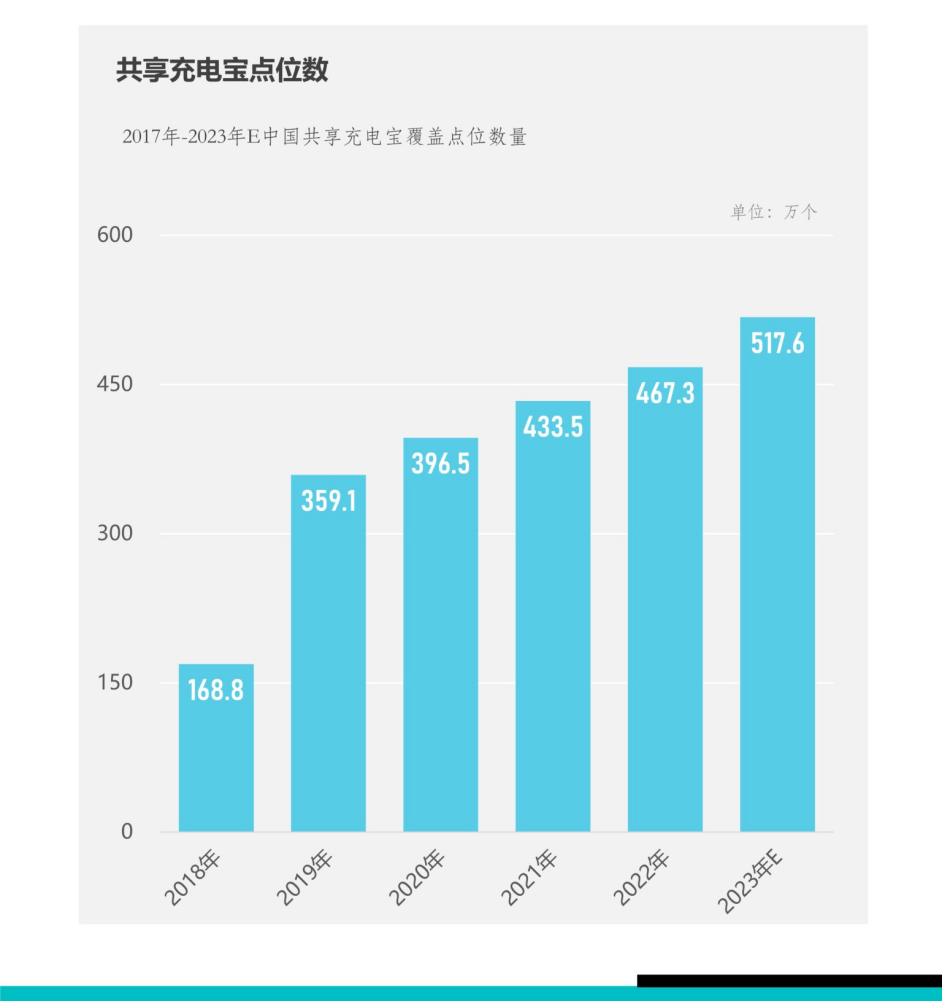

On the other hand, the number of locations covered by shared power banks and the number of users are both continuing to grow. According to Fastdata, the number of locations covered by shared power banks is continuously increasing, with over 5 million locations nationwide by the end of 2023; the number of users has also reached 300 million, an increase of over 30% compared to 2022.

Image source: Fastdata

However, even with a market of hundreds of millions of people, it still seems small for shared power bank companies.

If early incidents such as the collapse of LeDian, which was once heavily invested in by 1.2 billion capital in 40 days, and the closure of "Cool Power" reported by many people were limited to small companies, then the spread of losses to industry leaders should raise alarms.

Taking Monster Charging as an example, financial reports show that its net profits attributable to shareholders in 2021 and 2022 were -125 million yuan and -711 million yuan, respectively. After a brief recovery last year, total revenue fell by half to 397 million yuan in the first quarter of this year, and net profits turned from profit to loss.

Meituan also assigned its power bank business line BD to Meituan Select in July 2021. In 2022, Meituan's revenue was approximately 220 billion yuan, but the operating loss of its "new business" segment, which includes shared bicycles and power banks, reached 28.4 billion yuan. In 2023, this segment's loss was still 20.2 billion yuan, requiring continuous blood transfusions from the takeout business to maintain.

With a market of hundreds of millions of people and demand still growing, how come several power bank companies can't survive?

02

The end of "pseudo-sharing, real leasing" is price hikes

In fact, it's not just shared power banks that are struggling.

In March 2024, Tianyancha showed that ofo-related companies Dongxia Datong (Beijing) Management Consulting Co., Ltd. and Beijing Bykelock Technology Co., Ltd. had a new enforcement information, with an execution target of over 16.86 million yuan. However, this has not caused much public outcry for ofo, which has long been defunct in name only.

Before ofo's bankruptcy, starting in 2017, companies like Wukong Bikes, Kuqi Bikes, Xiaolan Bikes, and Xiaoming Bikes successively fell into deposit scandals and subsequently went bankrupt, merged, or were sold, leaving a mess behind. In 2022, Mobike was fully integrated into the Meituan APP, and the Mobike APP and WeChat Mini Program stopped services and operations.

In addition to shared bicycles, businesses such as shared umbrellas and clothes that were once popular are also fading from people's视野.

The reason behind this is that the development of the domestic sharing economy is reaching its limits.

The essence of the sharing economy lies in efficiently connecting the supply and demand of idle resources through the aggregation effect of internet platforms, achieving the maximum utilization of resources.

It relies on the accumulation of user traffic, integrates dispersed individual or corporate resources through big data analysis and intelligent matching on the platform, and provides convenient and low-cost services externally, thereby attracting investments, advertisements, and other business collaborations to achieve the purpose of traffic monetization.

For internet platforms conducting business around the To C end, they essentially engage in a "borrowing chickens to lay eggs" business. For them, lending out power banks or bicycles is a way to attract traffic. Subsequently, whether it's Monster Charging's advertising business, selling alcohol, or selling masks, or HelloBike's numerous businesses such as games, social media, dating, and pets, they are essentially maximizing the use of platform traffic for monetization.

The commonality is that these "shared" projects are light assets with low individual costs. Direct purchase and deployment can quickly achieve scale. For investors, they are concerned about whether the business model is viable, profitable, and scalable. They don't care about whether they can build a shared platform to reorganize value processes, increase new supply, or shape new consumer behaviors.

In fact, this should also be the normal profit model after the sharing model matures abroad. But the problem is that the domestic sharing economy model has just emerged and coincided with the peak of traffic growth, entering the stage of intense competition early on. In practice, "sharing economy" has only been a shell from the start, and the true core beneath this shell is actually "leasing economy."

Among the two traditional models, leasing economy focuses on heavy assets, while sharing economy favors light assets. For light asset sharing economy, the bilateral network effect of C2C is very obvious, which can promote the growth of the platform. However, for the B2C leasing economy, the network effect is not obvious.

This has a lot to do with national conditions. In China, with a large population and regional and class inequalities in resource allocation, this leads to significant differences in demand and supply for resource sharing in different regions, resulting in a large amount of idle resources in some areas and resource shortages in others. In this context, the need to optimize resource allocation through platforms is more urgent, but it also provides vast market space for leasing economy.

When leasing economy develops to a certain stage, price hikes are the only solution to development issues.

First, with the rapid development of leasing economy, some popular resources may experience a supply shortage. The limited nature of resources and increasing demand will lead to price increases.

Taking shared power banks as an example, although the industry has undergone several rounds of reshuffling and the competitive landscape has stabilized, the homogeneity of business models determines that this competitive landscape can easily be broken.

Based on this, shared power bank companies have to invest a lot of money to compete for high-traffic locations such as cinemas, commercial streets, and large supermarkets. Xiaodian Technology's entry fee ratio surged from 1% in 2018 to 16.3% in 2020, and Monster Charging's entry fee expenditure also increased from 106 million yuan in 2019 to 380 million yuan in 2020, a year-on-year increase of 260%.

Second, leasing economy companies need to bear costs such as maintenance, renewal, management, and services. When the business expands to a certain scale, these costs will significantly increase, forcing companies to increase rental prices to maintain profit margins.

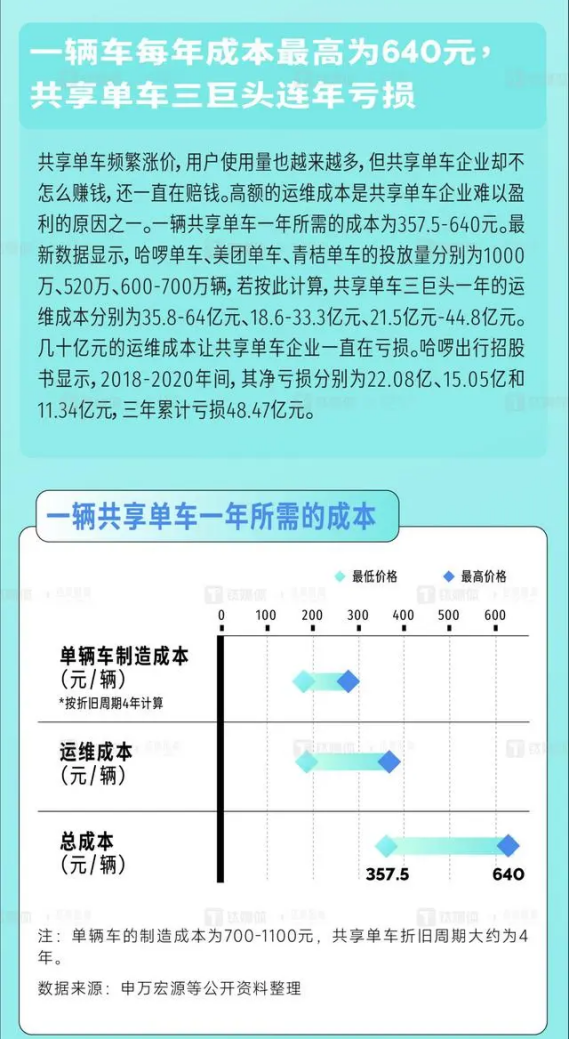

Taking shared bicycles as an example, around the Qingming Festival this year, HelloBike was found to have "quietly raised prices," from an initial single ride of 0.5 yuan/30 minutes to the current 2.8 yuan/30 minutes, an increase of 560%. This is due to the continuous increase in operation and maintenance costs.

Public data shows that the production cost of a shared bicycle ranges from 700 to 1,100 yuan. If calculated based on a four-year usage cycle, the annual average cost of a bicycle is 175 to 275 yuan. In addition, the daily operation and maintenance cost of a single bicycle ranges from 0.5 to 1 yuan, resulting in annual operation and maintenance costs of 182.5 to 365 yuan.

Image source: Taimedia

Overall, the annual cost required for a shared bicycle is 357.5 to 640 yuan. Calculated based on a maximum deployment of 10 million bicycles per year, HelloBike's operation and maintenance costs can reach 6.4 billion yuan. It should be noted that according to the prospectus, HelloBike's revenue was only 6 billion yuan in 2020, and the company has suffered losses for several years, with a cumulative loss of 4.847 billion yuan from 2018 to 2020.

Apart from resource and cost constraints, an imperfect regulatory system is also a major factor to be addressed.

After experiencing rapid growth, the leasing market will also face issues of market saturation. When demand growth slows down, companies often choose to raise prices to maintain or increase revenue. If competition in the leasing market is not intense enough, leading companies may increase prices through pricing power to increase profits. This behavior is particularly common in markets lacking effective competition regulation.

In addition, as China's mobile payment capabilities continue to strengthen, some user groups are less sensitive to prices, and price hikes can be seen as compensation for improved quality or services. This should also be a breakthrough point for these companies.

Otherwise, for ordinary consumers, if quality doesn't improve, services don't enhance, and the experience declines, they naturally won't continue to "send money" to the company. Facing increasingly fierce competition and the pressure of declining users, companies can only survive day by day, forced to believe in the story of "survival of the fittest"...

'''