Before 618, "Refund Only" has been online for 168 days

![]() 06/14 2024

06/14 2024

![]() 749

749

Author | Bailu

Declaration | The cover image is sourced from the internet.

Original article by Jingzhe Research Institute. If you wish to republish, please leave a message to apply for permission.

In 1999, Alibaba's "Eighteen Arhats" gathered in Hangzhou, and the statement "making it easy to do business everywhere" ushered in a glorious chapter in China's e-commerce industry. Today, 25 years later, while prefixes like search, shelves, live streaming, and short videos have been added before "e-commerce," and the competitive landscape has stabilized and unified, the difficulty of doing business has not decreased.

On December 26, 2023, Taobao announced the launch of a "Refund Only" service, and the next day, JD.com quickly followed suit, announcing a new policy of "supporting user refunds only." By then, Pinduoduo, Taobao, and JD.com had all rolled out "Refund Only."

Coupled with Douyin, which introduced the "Refund Only" service in September 2023, and Kuaishou, which joined the "Refund Only" team in January 2024, Pinduoduo's rule, which has been in effect since 2021, has almost become an industry standard.

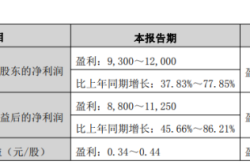

If we calculate from the official effective date of JD.com's "JD Open Platform After-sales Service Management Rules" for the "Refund Only" policy, starting on December 29, 2023, today's "Refund Only" has been online for 168 days before 618.

Not long ago, Pinduoduo released its first-quarter financial report for 2024, with its market capitalization surpassing Alibaba once again, making "questioning Pinduoduo, understanding Pinduoduo, becoming Pinduoduo" an increasingly new trend in the e-commerce industry. However, when the e-commerce industry collectively turns to "Refund Only," it does not mean that everyone has a "bright future."

The e-commerce industry ecosystem comprising platforms, users, and merchants is experiencing a "great adventure" at the expense of merchants.

The Eve of "Refund Only"

2019 was a special year for China's e-commerce. On a macro level, China's economy, which had just emerged from a period of rapid growth, had experienced a "deceleration period" for five consecutive years, with GDP growth rates dropping from 7.3% in 2014 to 6.1% in 2019.

On a micro level, the new economic cycle led to slower income growth. Chinese consumers, whose appetites had been opened by consumption upgrades, shifted their attention back to cost-effectiveness. Pinduoduo, seizing the opportunity, emerged from "outside the Fifth Ring Road" and entered the "city" dominated by Alibaba and JD.com.

Riding on the carriage of the new economic cycle, Pinduoduo boldly ventured into Goose City and became the magistrate: The 128G version of the iPhone 11, priced at 5999 yuan on Apple's official website, could be purchased for as low as 5299 yuan with Pinduoduo's hundred-billion subsidy. The huge subsidy discount was like silver thrown by bandits into users' homes at night, buying users' loyalty while粗暴地搅乱了Alibaba and JD.com's long-standing promotional methods.

Although "cutting a price" may seem embarrassing, human nature cannot withstand temptation. Even if a user buys inferior goods on Pinduoduo, most users will rationalize it with the thought, "At this price, what more could you ask for?" After using its hundred-billion subsidy to open a new market entrance, Pinduoduo has also quietly accumulated its own competitive chips—the supply chain.

Just entering the city from outside the Fifth Ring Road, Pinduoduo knew that it could not compete head-on with Tmall and JD.com, which had rich supply chain resources. Instead, it focused on white-label merchants who had products, production capacity, but no brand. It was precisely through the C2M (Customer to Manufacturer) model that Pinduoduo achieved a弯道超车using "low prices."

Financial report data shows that Pinduoduo had 585.2 million active buyers in 2019, a net increase of 167 million from the same period last year, representing a year-on-year growth of nearly 40%. In the fourth quarter of 2019, the net increase in users for Pinduoduo, Alibaba, and JD.com was 48.9 million, 18 million, and 27.6 million, respectively.

Alibaba and JD.com also took timely measures in response to Pinduoduo's rapid growth driven by its hundred-billion subsidy. On the eve of the "Double 12" in 2019, Juhuasuan, under Alibaba, urgently launched a "hundred-billion subsidy" with a benchmarking nature. JD.com, which is particularly sensitive to the supply chain, also launched Jingxi in this year, similarly deploying the C2M model. However, these actions did not truly produce results.

It is rumored that there were not a few complaints about Juhuasuan's hundred-billion subsidy on Alibaba's internal network. Especially compared to Pinduoduo's "simple and粗暴" hundred-billion subsidy, Juhuasuan was burdened with negative evaluations of being insufficiently user-friendly and having too many tricks. To a certain extent, this attitude towards the hundred-billion subsidy was also influenced by management's will.

Daniel Zhang, the former Chairman and CEO of Alibaba Group, once said in a financial report conference call, "No one in history has been able to change the situation through continuous price subsidies." Since it has been understood that "you cannot beat your opponent using their own methods," then Alibaba's other imitation behaviors have lost their specific meaning.

JD.com also encountered similar issues. In 2020, Jingxi, which had been established for a year, was upgraded from a business unit to a business group, led by Liu Qiangdong personally. Combining the strategic goal of seizing the下沉market and the market opportunities brought by the "black swan" of the pandemic, Jingxi Pinpin joined the fierce competition in the field of community group buying.

Unfortunately, Jingxi Pinpin failed to survive the "thousand-group war." With Liu Qiangdong acknowledging the failure of "Jingxi" at a strategic meeting in July 2022, JD.com's 2.5-year-long下沉market strategy also came to an end.

During JD.com's Q4 financial report conference call in 2021, CEO Xu Lei summarized, "Commercial competition is constantly changing and can sometimes be cruel." What makes Alibaba and JD.com's failures even more tragic is that Pinduoduo has already achieved results on the C2M path.

On April 30, 2021, Pinduoduo released its 2020 annual report, which was also the first annual report after founder Huang Zheng stepped down. The data showed that as of the end of 2020, Pinduoduo's annual active buyers reached 788.4 million, surpassing Alibaba's annual buyer count of 779 million for the same period. In addition, Pinduoduo's annual active merchants increased from 5.1 million in the previous year to 8.6 million, representing a year-on-year growth of 69%.

From imitating Pinduoduo to enter the下沉market to collectively rolling out the "Refund Only" policy, the giants watched as Pinduoduo completed its "diao丝逆袭" while trying to keep up with the market rhythm. And the current "Refund Only" is like a Pandora's box, having a series of complex impacts on the e-commerce industry.

Who Does "Refund Only" Benefit?

Opening the Black Cat Complaint Platform and searching for "Refund Only" will yield over 150,000 complaint messages. However, unlike common consumer complaints against merchants, most of the content here is merchants' complaints against e-commerce platforms like Pinduoduo for their unreasonable "Refund Only" behavior.

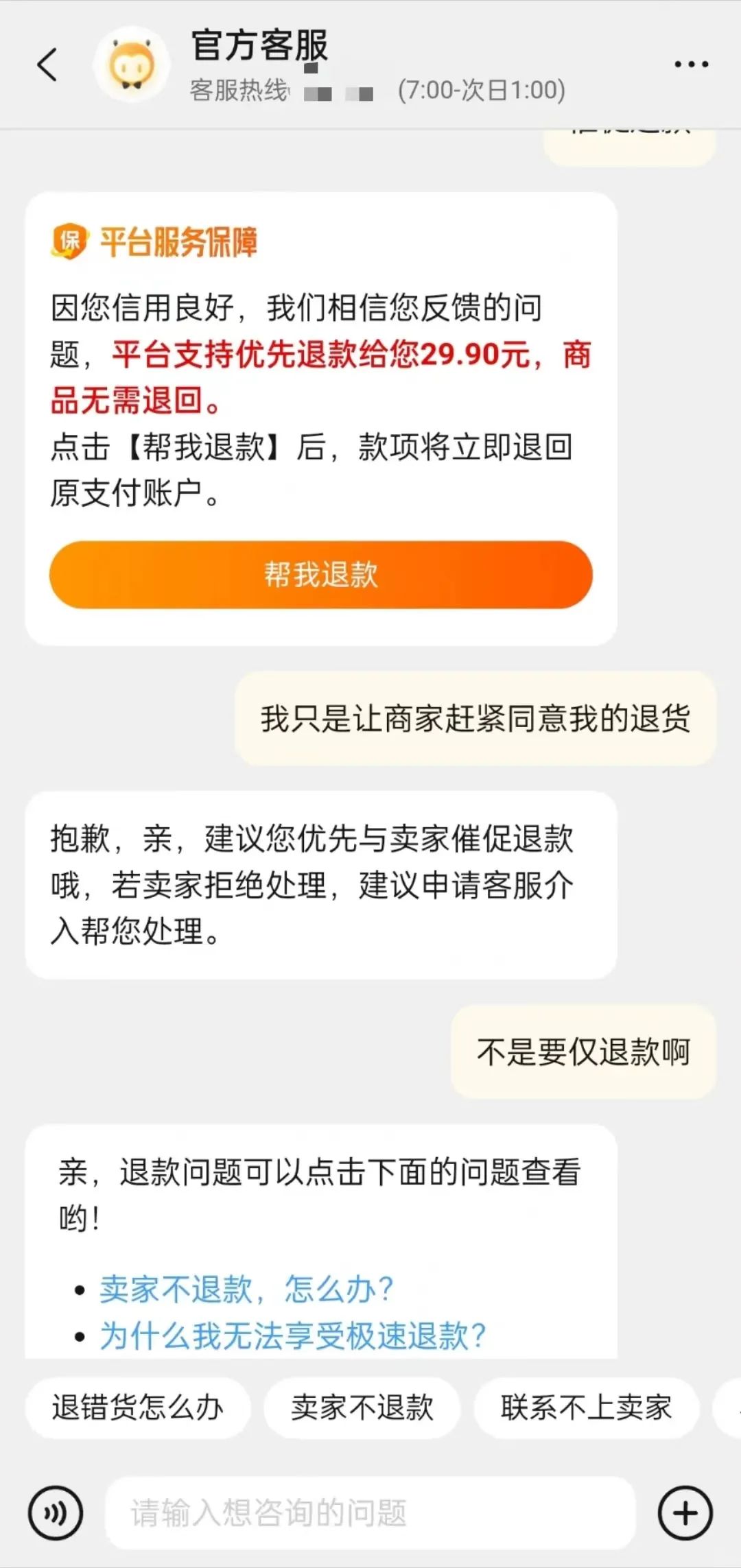

For example, after a buyer reports an after-sales issue on the platform, the merchant has not yet had a chance to understand the relevant situation, and the platform has already proactively intervened to provide a "Refund Only" compensation to the buyer. Or a buyer may request a refund only after receiving or even using the product for a while, citing various reasons.

According to Jingzhe Research Institute's observations, the amount of goods involved in "Refund Only" complaints ranges from tens of yuan to hundreds of yuan, with the majority of the involved categories being clothing, shoes, digital accessories, and fresh food. Judging from the number and specific content of complaints, Pinduoduo merchants' opinions on "Refund Only" are particularly concentrated.

Industry insiders have previously pointed out that the introduction of a refund-only policy by e-commerce platforms helps reduce consumers' rights protection costs and simplify after-sales processes. In addition, e-commerce platforms themselves can lower shopping thresholds, reduce decision-making costs, and achieve the purpose of attracting consumers. However, it seems that in the "ecological triangle" composed of e-commerce platforms, consumers, and merchants, only merchants do not receive any benefits.

Li Jun, who operates household products on multiple e-commerce platforms such as Pinduoduo and JD.com, told Jingzhe Research Institute that "Refund Only" is a very unfair platform rule for merchants and is more detrimental than beneficial to the overall development of the e-commerce industry. "Directly refunding customers for any issues improves the consumer experience, and customers will of course feel great about it. The platform also reduces after-sales costs, but the contradiction still exists."

Li Jun pointed out that on platforms like Pinduoduo, which mainly target the下沉market, there are not many merchants with mature e-commerce operation experience. "Many merchants are just running a factory in some village and do not have the skills, awareness, or ability to operate a store. They simply open a store on Pinduoduo because their prices are low enough and they want to sell their goods online. Pinduoduo specifically targets these white-label merchants."

According to Li Jun's description, the contradictions caused by "Refund Only" actually reflect the mismatch between the products and services provided by merchants and consumers' actual expectations. On the one hand, small and medium-sized merchants lack necessary production processes, such as common burrs in plastic products, which are not resolved during production and quality inspection. On the other hand, white-label merchants generally lack attention to service details, such as insufficiently secure packaging, leading to appearance damage when the goods reach consumers.

"Sometimes, the platform automatically detects certain keywords and proactively intervenes in the after-sales process, directly sending a refund-only pop-up window to consumers. In such cases, merchants lose autonomy. This also shows that the platform chooses to stand on the side of consumers, while merchants have to bear the losses caused by refund-only on their own."

Li Jun特别强调that the introduction of a refund-only policy on e-commerce platforms was originally intended to eliminate inferior merchants and improve user experience, but the platform's one-sided favoritism towards consumers has not only failed to solve the problem of inferior merchants but has instead given rise to "professional wool party" members.

According to Jingzhe Research Institute's understanding, most e-commerce platforms have not clearly defined the reasonable scope of application for "Refund Only." For example, on the Pinduoduo platform, consumers can choose to receive a refund only without returning the goods when they discover quality issues with the goods. However, there is a lack of relevant basis for determining quality issues.

Correspondingly, in the self-organized rights protection communities of small and medium-sized merchants, they continuously share various unbelievable reasons for "Refund Only," such as applying for a refund only due to damaged outer packaging or poor-tasting food. It is the platform's support for such subjective feedback that gives wool party members an opportunity.

"Refund Only has amplified the evil side of human nature. Particularly puzzling is that there are still many student groups specifically looking for freebie guides and exploiting loopholes in the refund-only policy to get freebies. It is difficult for merchants to pass complaints afterwards, and many merchants choose to endure silently to avoid affecting their daily operations." Li Jun said that he has now closed his Pinduoduo and JD.com stores and is turning more of his attention to live streaming and private domain channels.

Who Does "Refund Only" Solve the Troubles of?

In fact, judging from Pinduoduo's development path, the introduction of the refund-only service was originally intended to address various issues arising during the delivery process while continuously regulating white-label merchants through platform rules to improve product quality and service experience. However, this "one-size-fits-all" platform rule is too crude, making some small and medium-sized merchants who are not very familiar with the e-commerce industry targets for wool party members.

At the same time, other e-commerce platforms that have joined the "Refund Only" team appear to be enhancing user experience and competing for user attention on the surface, but their real purpose behind the scenes is actually to seek new growth by leveraging the power of small and medium-sized merchants or even sacrificing their interests. Put more bluntly, e-commerce platforms want both "low prices" and high quality, but they are unwilling to invest more themselves. Therefore, merchants have become the "scapegoat" bearing the risk of being exploited by "Refund Only."

It should be noted that the impact of "Refund Only" on brand merchants is negligible. The main reason is that the express delivery fulfillment process of branded merchants on the platform is sufficiently standardized, with a low probability of errors, and their after-sales service experience is relatively more complete. In addition, out of fear of well-known brands, "wool party" members will not dare to take risks and get freebies. As a result, small and medium-sized merchants, who have less say in their relationships with e-commerce platforms, are "placed with high hopes."

Taking Taobao as an example, according to Alibaba's annual report released on July 21, 2023, Taobao added 5.12 million merchants in the 2023 fiscal year ending March 31, the vast majority of whom are small and medium-sized merchants. These small and medium-sized merchants, as fresh blood for the platform, naturally have to bear more responsibility for platform growth, and "Refund Only" is an efficient means to quickly activate them.

On the surface, "Refund Only" is like a safety net, allowing consumers to boldly try products provided by small and medium-sized merchants. However, e-commerce platforms are also using "Refund Only" to evade their own responsibilities. As an e-commerce platform providing a trading scenario, it also needs to be responsible for the goods sold on its platform. It has the primary responsibility of timely detecting and addressing illegal merchant behaviors such as counterfeiting, false advertising, etc.

However, after the introduction of "Refund Only," the merchant governance link that e-commerce platforms need to complete upfront has been weakened. Any dissatisfaction of consumers with products or services can be resolved through "Refund Only," and the actual losses are borne by small and medium-sized merchants.

In this way, consumers get the low prices they want, and the operating costs are shared by small and medium-sized merchants, while the value of e-commerce platforms is more focused on traffic, and they can devote themselves to doing what they do best—traffic business. This approach of only reaping benefits without taking risks has naturally been questioned by merchants.