Luxshare Precision: How Can the "King of Apple's Supply Chain" Get Rid of Dependency?

![]() 06/19 2024

06/19 2024

![]() 712

712

AI mobile phone innovation has empowered Apple's share price to reach an all-time high, and consumer electronics are expected to usher in a recovery?

Here, let's talk about Luxshare Precision, the leading OEM company in Apple's supply chain.

As an early entrant into the OEM industry, Luxshare Precision once reaped ample benefits from Apple's supply chain. Now, however, it faces challenges in growth, gross profit, and security.

From a performance perspective, the 2023 annual report and the first-quarter report of this year are basically similar, with revenue growth slowing down. The revenue growth rate in 2023 dropped to a single digit, reaching a record low, and it was even less than 5% in Q1 this year. However, the net profit attributable to shareholders of the listed company in 2023 exceeded 10 billion yuan for the first time, with a growth rate of around 20%.

The direct reason for this contrasting data is the poor sales of Apple's hardware products, its core customer. Apple's revenue and net profit for the full year of 2023 and the first two quarters of this year both declined. If the big brother doesn't eat enough, the little brothers will also suffer from hunger. In the past three years, the revenue contributed by Apple accounted for more than 70% of Luxshare Precision's total revenue. With the majority of income relying on one customer, and mainly concentrated in the consumer electronics sector, its performance is largely dependent on the customer's performance.

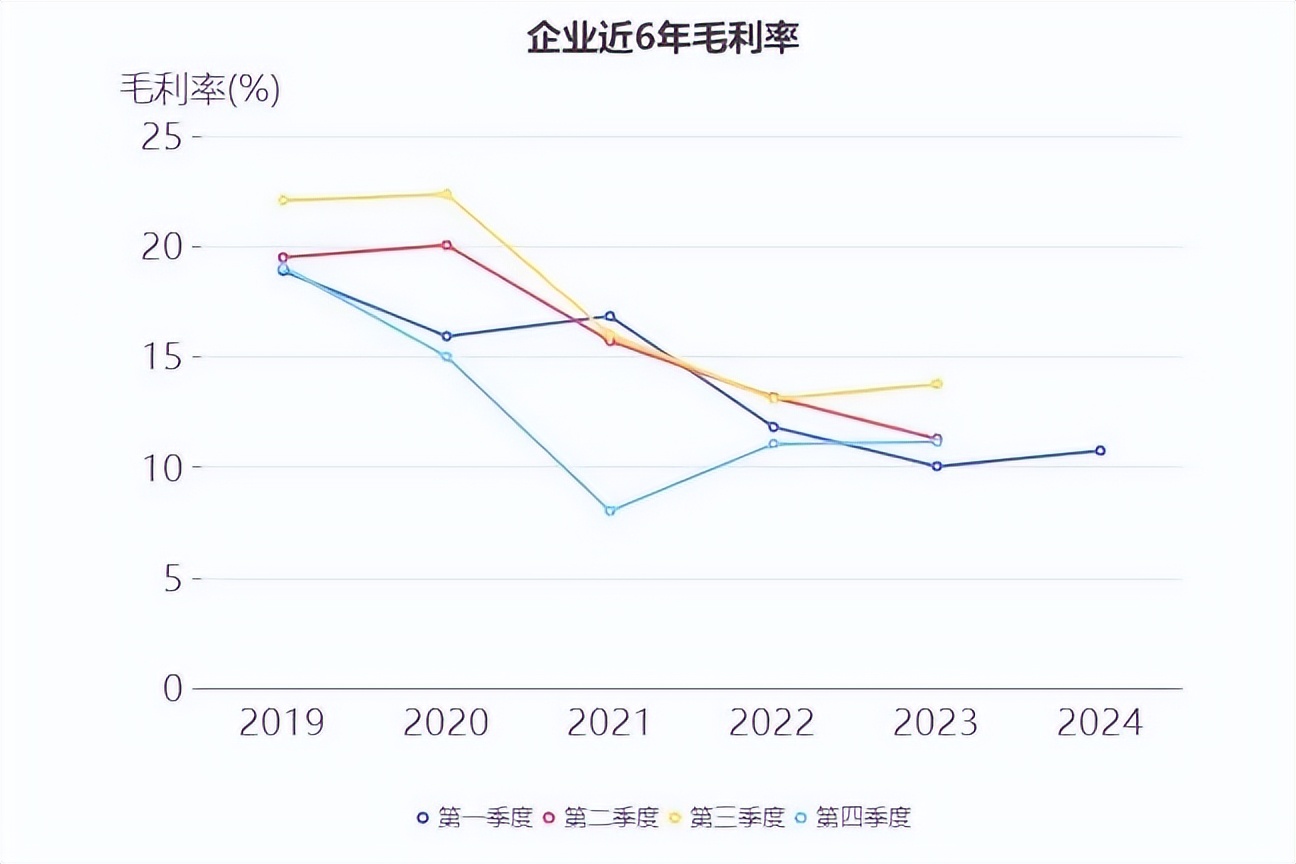

The 20% profit growth rate is impressive, but unfortunately, the growth in profits mainly comes from the decrease in expense ratio and investment income due to cost reduction and efficiency improvement, rather than an increase in gross profit margin. Since 2018, due to the significant increase in the proportion of low-margin assembly business, Luxshare Precision's gross profit margin has declined continuously for six years to around 12%.

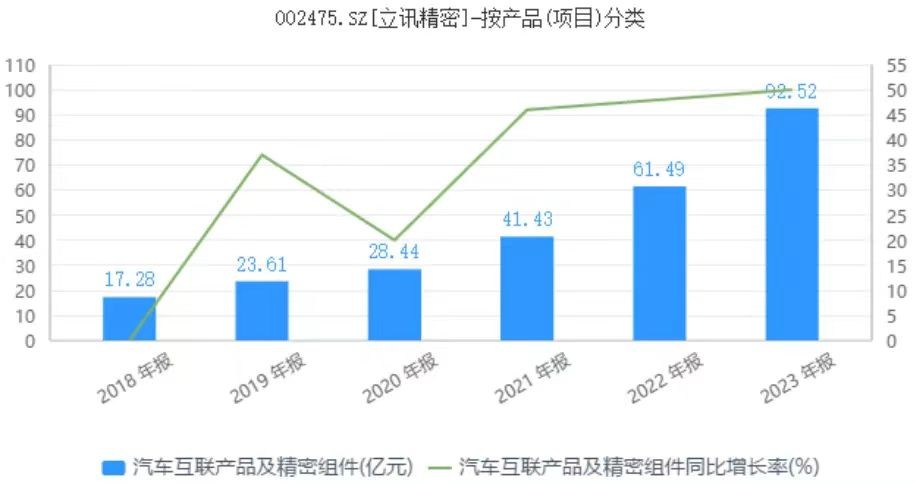

To get rid of "Apple dependency," Luxshare Precision has made considerable efforts. One of the most significant efforts is to lay out the smart automobile sector. It has successively collaborated with Chery and GAC, and the revenue growth rate of its automotive business has exceeded 40% in the past three years.

However, the absolute value is still less than 10 billion yuan, which has a relatively limited impact on its total revenue exceeding 230 billion yuan. It seems that the "small horse" of the automotive business cannot pull the "big cart" of consumer electronics in the short term.

Luxshare Precision currently has two stories to tell about its future. One is its original business, OEM consumer electronics for Apple. With the recovery of consumer electronics this year, AI is expected to empower hardware products and boost Apple's hardware sales. The other is its "second growth curve." Recently, Intel invested in a subsidiary of Luxshare Precision.