"The darling of capital" Huisuanzhang: How come the more they calculate, the more they lose?

![]() 06/21 2024

06/21 2024

![]() 646

646

Produced by: Entrepreneurship Frontline

Editor: Li Yuxuan

Audited by: Song Wen

After a year, Huisuanzhang has once again launched an attack on the Hong Kong Stock Exchange.

On June 14, Huisuanzhang Holding Limited (hereinafter referred to as "Huisuanzhang") submitted an application to the Hong Kong Stock Exchange, with CITIC Securities as the sole sponsor and CICC and CCB International as the overall coordinators.

In terms of total revenue, Huisuanzhang has been China's largest provider of tax and financial solutions for small, medium, and micro enterprises from 2021 to 2023. However, this market is highly fragmented, and the company's market share in 2023 was only 0.5%.

The reason why Huisuanzhang has attracted so much attention is undoubtedly related to the powerful investment groups behind it, including Xiaomi, Tencent, Sunshine Life Insurance, 51CC, and others.

However, while these investors bring glory to Huisuanzhang, they also impose a "tightening spell" on the company. According to regulations, if the company fails to complete a qualified listing within 5 years from the D-round issuance date or earlier, investors can request the company to redeem the shares.

In April 2021, Huisuanzhang issued D-round preferred shares, which means that April 2026 will be a crucial milestone for the company. In the next two years, impacting the capital market will become the top priority for Huisuanzhang's development.

1. Second application, accumulating losses of 2.9 billion yuan

This is not the first time Huisuanzhang has targeted the capital market.

As early as June 30, 2023, Huisuanzhang had submitted an application to the Hong Kong Stock Exchange, but ultimately, the prospectus expired. And choosing to submit a prospectus to the Hong Kong Stock Exchange again at this time may be a last resort.

According to the prospectus submitted by Huisuanzhang for the first time, if the listing application is not renewed within six months after expiration, the redemption right will be restored. On June 14, the second submission was made 5.5 months after the first prospectus expired, leaving only half a month before the redemption right is restored.

In fact, after a year of development, Huisuanzhang's performance has not made any significant breakthroughs, but rather shows signs of fatigue.

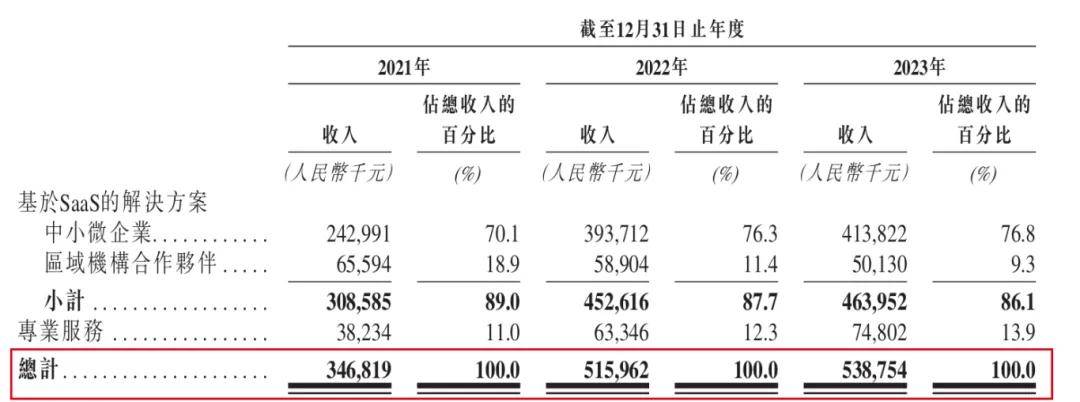

The prospectus shows that from 2021 to 2023 (hereinafter referred to as the "reporting period"), Huisuanzhang achieved revenues of 347 million yuan, 516 million yuan, and 539 million yuan.

Among them, the year-on-year growth in revenue for 2021 and 2022 was 26% and 49%, respectively, but in 2023, the growth rate was only 4.4%.

(Image / Huisuanzhang Prospectus)

Regarding the slowdown in revenue in 2023, Huisuanzhang attributed it to changes in the external environment. It explained that the company's revenue in the first four months of 2023 increased by about 15% year-on-year, but the revenue growth during the rest of 2023 was hampered by the slowdown in economic recovery, resulting in a narrowing of the revenue growth rate in 2023.

Behind the slowdown in revenue, Huisuanzhang faces significantly increased pressure to expand and retain customers.

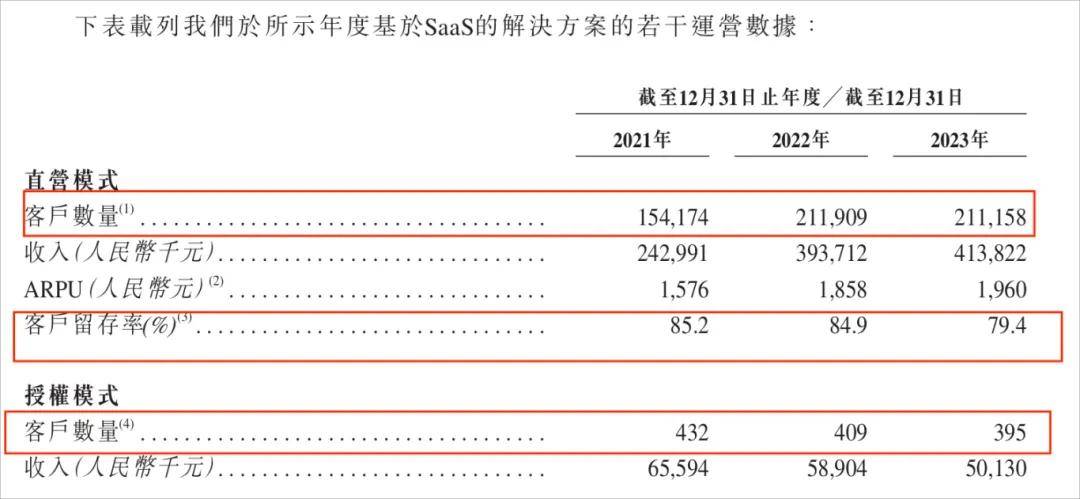

Taking the company's pillar business based on SaaS solutions as an example, the number of customers has shown a downward trend. From 2021 to 2023, the number of direct-sale mode customers was 154,200, 211,900, and 211,200, respectively. In 2023, the number of customers decreased by 751.

(Image / Huisuanzhang Prospectus)

Compared to the number of customers, the performance of customer retention rates is even more pessimistic. During the same period mentioned above, the customer retention rates for the direct-sale mode were 85.2%, 84.9%, and 79.4%, respectively, showing a continuous decline.

Not only that, but the number of customers under the franchising model is also declining. From 2021 to 2023, the number of customers under this model was 432, 409, and 395, respectively.

Huisuanzhang admitted that the growth trend of subscription demand and renewal intentions among small, medium, and micro enterprises has slowed down. In addition, more and more small, medium, and micro enterprises are becoming more price-sensitive and tend to subscribe to cheaper solutions.

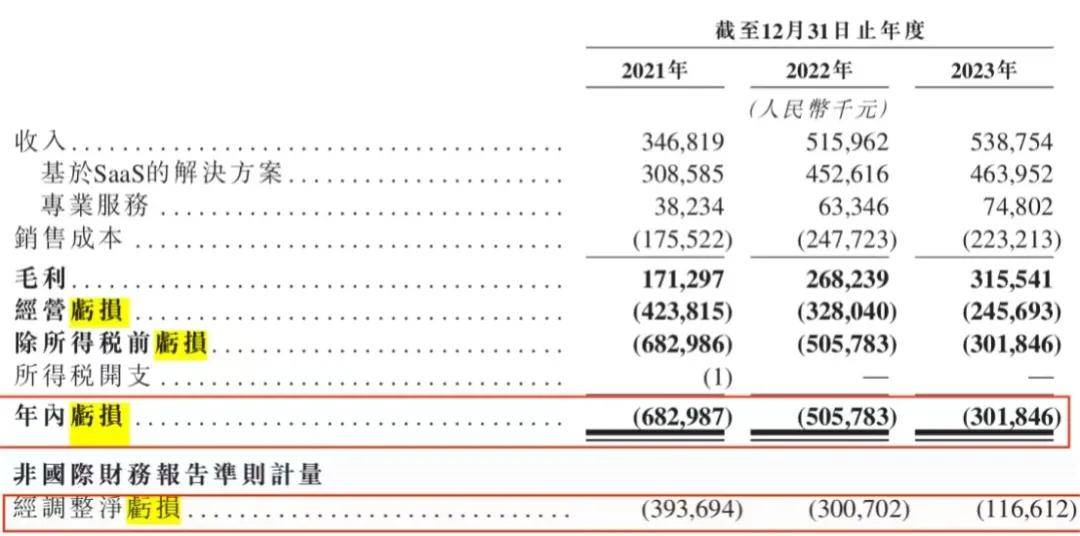

This is undoubtedly adding insult to injury for Huisuanzhang's performance, as the company is still on a path of losses. From 2021 to 2023, its net profit losses were 683 million yuan, 506 million yuan, and 302 million yuan; adjusted net losses were 394 million yuan, 301 million yuan, and 117 million yuan.

(Image / Huisuanzhang Prospectus)

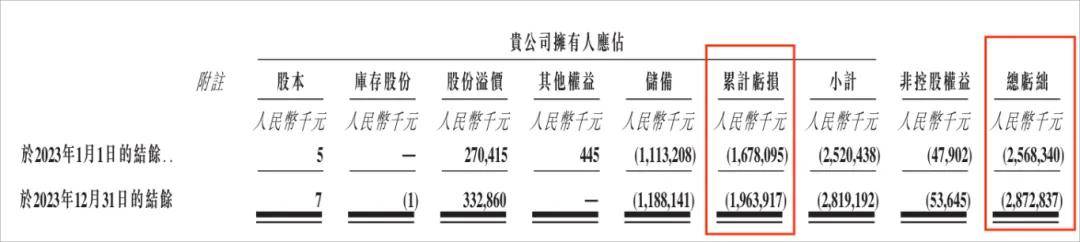

Years of cumulative losses have pushed Huisuanzhang's total losses to a high level. The prospectus shows that as of December 31, 2023, the company's total deficit reached 2.873 billion yuan. Among them, the cumulative losses attributable to the company's owners amounted to 1.964 billion yuan.

(Image / Huisuanzhang Prospectus)

And this is not the end of the losses. Huisuanzhang expects to continue to record adjusted net losses in 2024 and may not be able to achieve profitability in the short term.

2. Executive compensation of tens of millions, and the founder's "fancy" profits

In fact, Huisuanzhang has not been around for a long time.

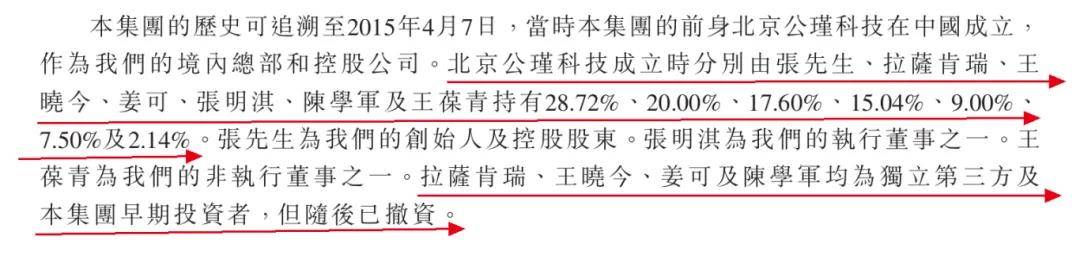

In April 2015, the predecessor of the group, Beijing Gongjin Technology, was established, with Zhang Shugang, Lasa Kenrui, Wang Xiaojin, Jiang Ke, Zhang Mingqi, Chen Xuejun, and Wang Baoqing holding 28.72%, 20.00%, 17.60%, 15.04%, 9.00%, 7.50%, and 2.14% equity, respectively.

(Image / Huisuanzhang Prospectus)

Among them, Lasa Kenrui, Wang Xiaojin, Jiang Ke, and Chen Xuejun have withdrawn their investments, leaving only Zhang Shugang and Zhang Mingqi as executive directors, and Wang Baoqing as a non-executive director. Among them, Zhang Shugang also serves as the Chairman of the Board and CEO, while Zhang Mingqi is the Senior Vice President and Direct Sales Leader.

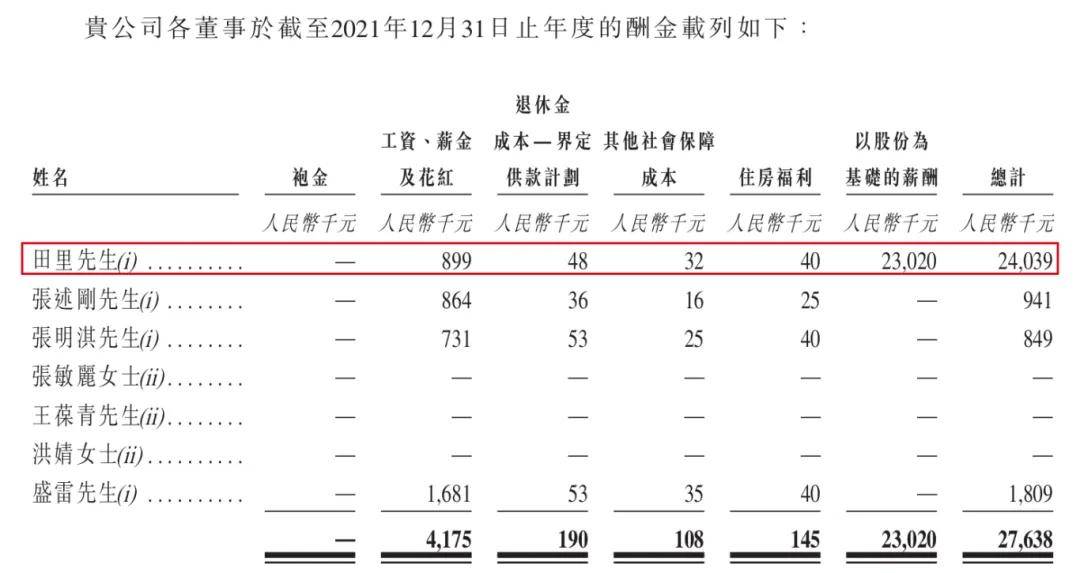

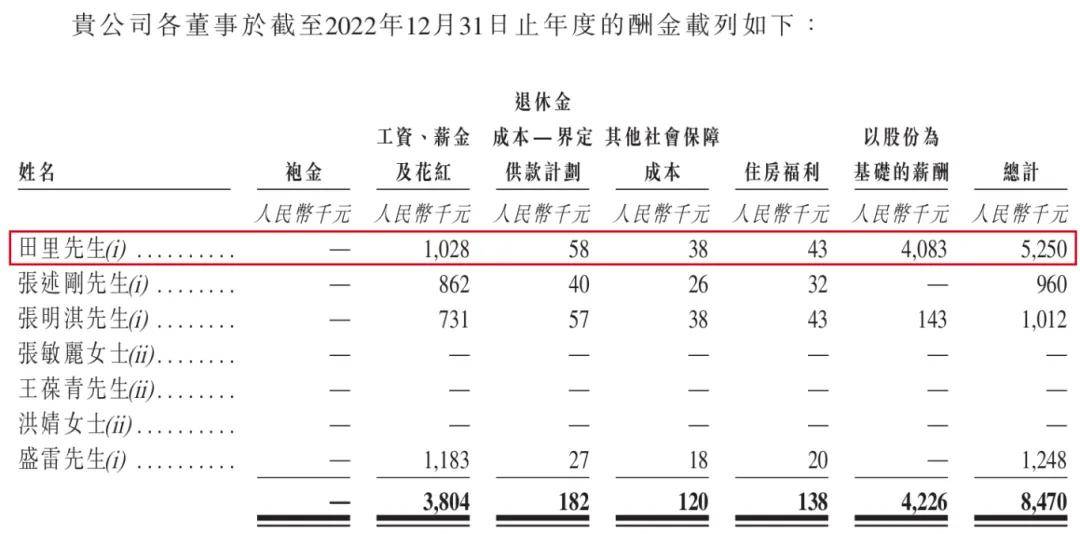

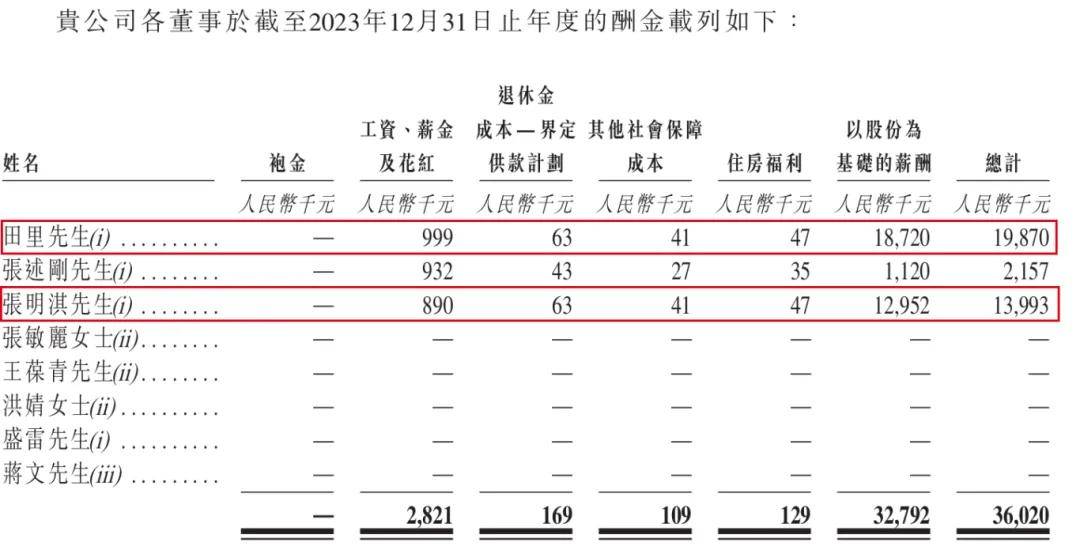

However, what surprised the outside world was that the highest-paid individual at Huisuanzhang was not one of these founders, but Tian Li, who joined in 2018.

Public information shows that Tian Li previously worked at Tencent, engaged in research and development of search engine optimization. After leaving, he successively entered IDG Capital and FreesFund, gaining rich experience in investment. At Huisuanzhang, he holds multiple positions, including Senior Vice President, Executive Director, and Franchising Business Leader.

From 2021 to 2023, Tian Li received total compensation of 24.039 million yuan, 5.25 million yuan, and 19.87 million yuan. Among them, compensation based on shares reached 23.02 million yuan, 4.083 million yuan, and 18.72 million yuan, respectively.

(Image / Huisuanzhang Prospectus)

It was not until 2023 that Zhang Mingqi, serving as Senior Vice President and Direct Sales Leader, reached the ten-million level of compensation, with a total of 13.993 million yuan. In 2021 and 2022, his compensation was below 1.1 million yuan. During the reporting period, the compensation of the company's top leader Zhang Shugang has never exceeded 2.2 million yuan.

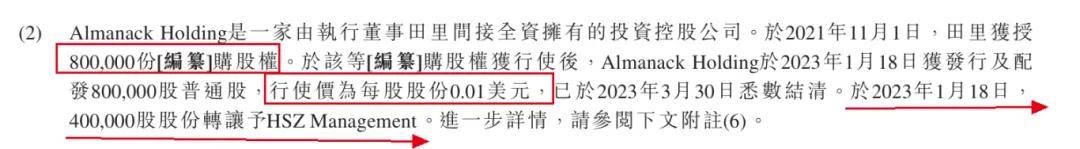

Entrepreneurship Frontline noticed that Tian Li does not hold a large number of shares in Huisuanzhang, but he acquired them at an extremely low price.

The prospectus shows that on November 1, 2021, Tian Li was granted 800,000 share options. After the options were exercised, Almanack Holding, which Tian Li controls, was issued 800,000 ordinary shares by the company on January 18, 2023, with an exercise price of US$0.01 per share, costing only US$8,000.

(Image / Huisuanzhang Prospectus)

It is worth noting that the last D-round financing round of Huisuanzhang was in April 2021, when the issue price per share had already reached US$8.96.

(Image / Huisuanzhang Prospectus)

On the same day that the shares were issued, Tian Li transferred 400,000 shares to HSZ Management, a shareholding platform used by the company for management incentives. After the transfer, Tian Li still had 400,000 ordinary shares in his hands, representing a shareholding ratio of 0.69%.

(Image / Huisuanzhang Prospectus)

So, why did Tian Li immediately transfer 400,000 shares after being issued 800,000 ordinary shares? What was the transfer price? In addition, why did Tian Li, who holds only a small number of shares in the company, repeatedly receive high compensation based on shares? Why did Zhang Mingqi's compensation suddenly surge to over ten million yuan in 2023? Entrepreneurship Frontline attempted to obtain information from Huisuanzhang regarding these matters, but as of press time, no response has been received.

Although not as high as Tian Li's compensation, Zhang Mingqi and Zhang Shugang also have other ways to profit.

For example, in August 2021, From Dust Limited, wholly owned by Zhang Mingqi, transferred 223,100 ordinary shares of Huisuanzhang Holding to CE Fintech, cashing out US$2 million.

(Image / Huisuanzhang Prospectus)

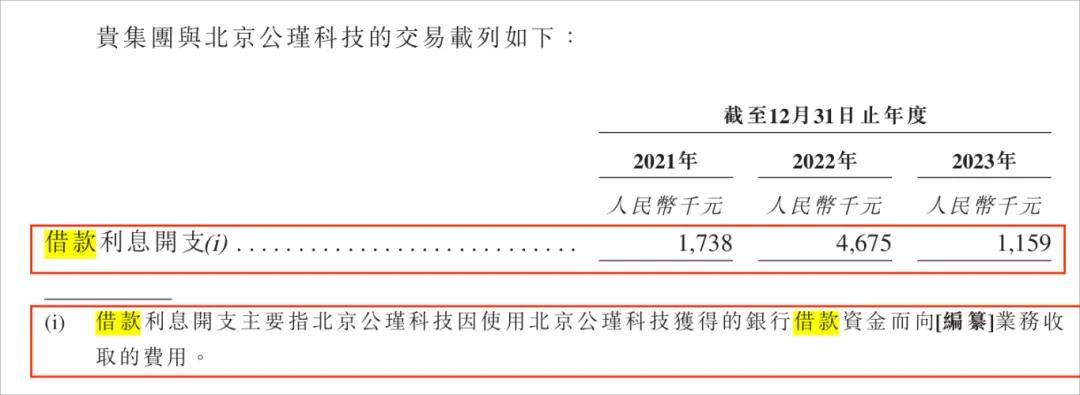

In addition, Entrepreneurship Frontline also found that Beijing Gongjin Technology, a contact of Zhang Shugang, lent money to Huisuanzhang to obtain interest.

From 2021 to 2023, Huisuanzhang paid interest to Beijing Gongjin Technology of 1.738 million yuan, 4.675 million yuan, and 1.159 million yuan, respectively.

(Image / Huisuanzhang Prospectus)

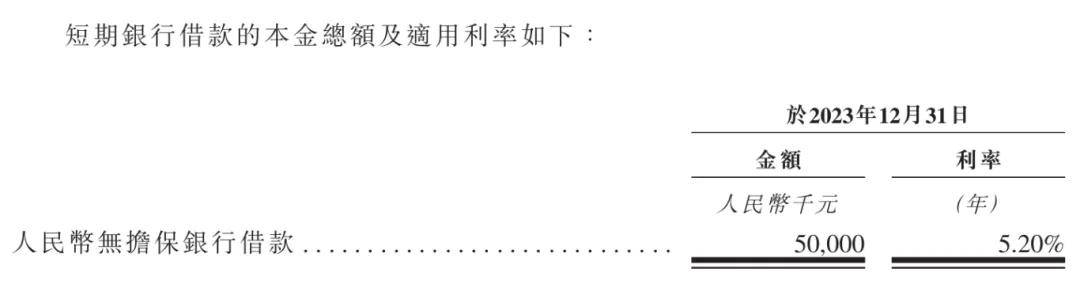

Entrepreneurship Frontline found that Huisuanzhang, which has been using Beijing Gongjin Technology's funds, did not borrow from banks in 2021 or 2022. It was only in 2023 that the company borrowed 50 million yuan from a bank at an interest rate of 5.2%. It was also in this year that the interest paid by Huisuanzhang to Beijing Gongjin Technology decreased by 75%.

(Image / Huisuanzhang Prospectus)

So, what is the interest rate of Huisuanzhang's loan from Beijing Gongjin Technology? Why didn't the company directly borrow from a bank before, but instead used Beijing Gongjin Technology's loan? Entrepreneurship Frontline attempted to obtain information from Huisuanzhang regarding these matters, but as of press time, no response has been received.

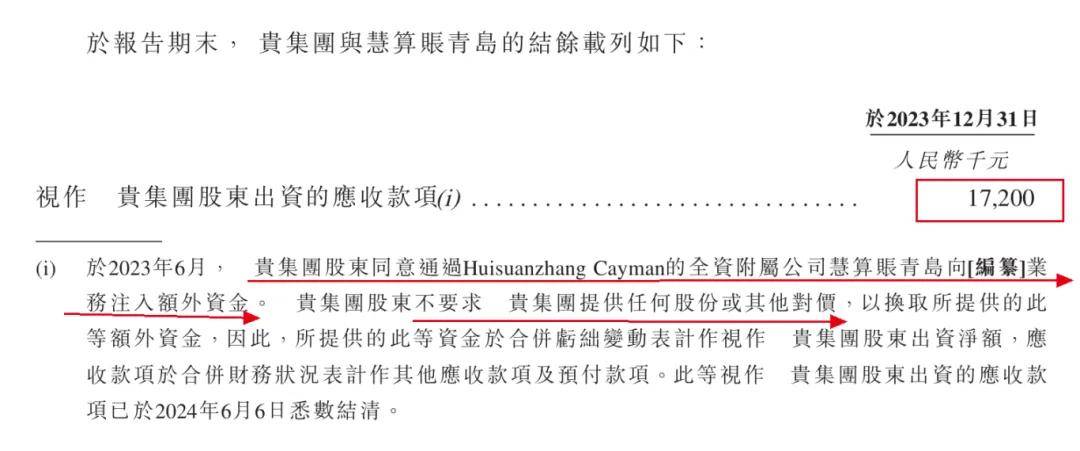

Even more puzzling is that on the eve of submitting the application, Huisuanzhang Cayman, a close contact of Zhang Shugang (indirectly holding 100% equity in Beijing Gongjin Technology), suddenly injected funds into Huisuanzhang unconditionally.

In June 2023, the shareholders of the group agreed to inject additional funds of 17.2 million yuan into the company through Huisuanzhang Qingdao, a wholly-owned subsidiary of Huisuanzhang Cayman, without requiring the group to provide any shares or other consideration in exchange for the additional funds provided.

And this fund was only fully settled on June 6, 2024, on the eve of submitting the application.

(Image / Huisuanzhang Prospectus)

Entrepreneurship Frontline attempted to obtain information from Huisuanzhang regarding why Huisuanzhang Qingdao delayed payment for a year until the eve of submitting the application and how the company would balance bank loans and related party loans in the future, but as of press time, no response has been received.

3. Withdrawal of A-round investors, 2016 becomes a crucial node

Before the IPO, Huisuanzhang was undoubtedly the darling of capital.

Huisuanzhang claims that since its inception, the company has received a total of 9 rounds of financing. However, in reality, Huisuanzhang has undergone a total of 10 rounds of financing, except that A-round investors Zhou