The total market value has evaporated by over $750 billion. Can the "Big Seven" of the U.S. stock market still hold onto their dominant position?

![]() 07/26 2024

07/26 2024

![]() 607

607

The "warning bell" for the U.S. stock market has sounded.

July 24th can be described as a "Black Wednesday" for the U.S. stock market. By the close, the three major U.S. stock indexes fell collectively, with the Dow Jones Industrial Average down 1.25% to 39,853.87 points; the Nasdaq Composite Index down 3.64% to 17,342.41 points; and the S&P 500 Index down 2.31% to 5,427.13 points.

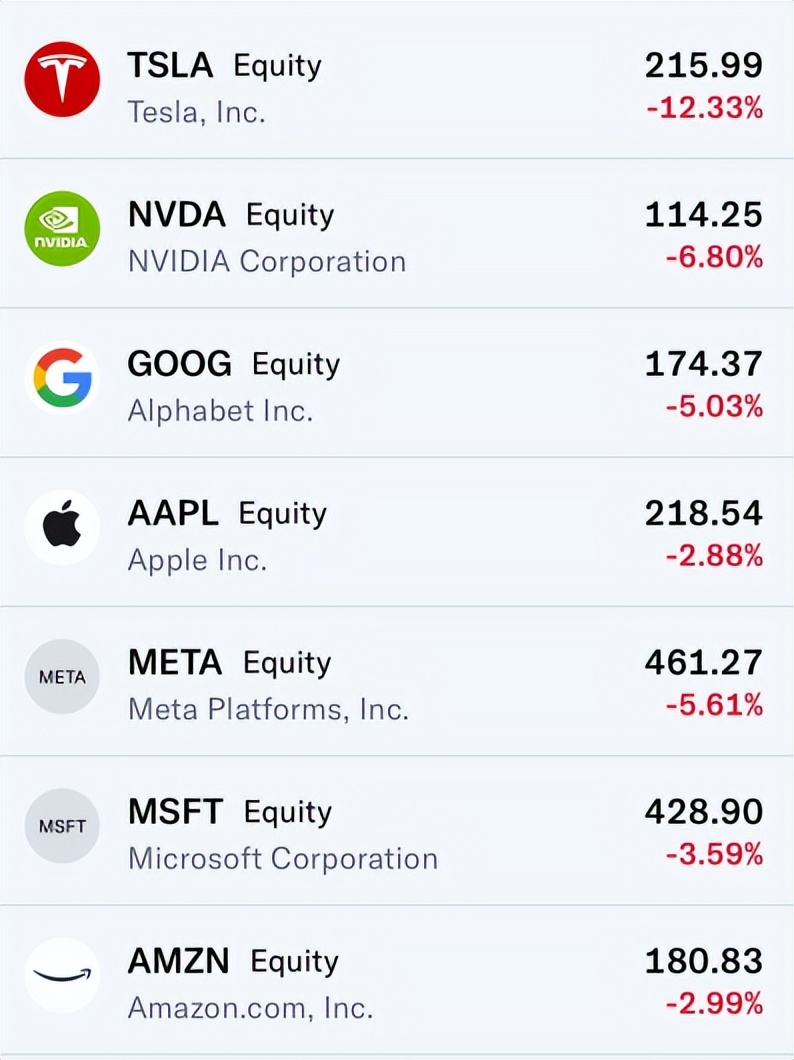

Simultaneously, the share prices of the "Big Seven" of the U.S. stock market fell collectively, with Apple down 2.88%, Microsoft down 3.59%, Amazon down 2.99%, NVIDIA down 6.8%, Tesla down 12.33%, Meta down 5.61%, and Google down 5.03%. According to iFind data from Tonghuashun, the combined market value of the "Big Seven" evaporated by over $750 billion in a single day.

Specifically, as the core assets of the U.S. stock market, these "Big Seven" companies are all in high-growth industries and occupy leading positions. Especially amidst the AI boom, they have been further entrusted with high hopes by investors. However, their collective collapse now begs the question: Does it mean that the market is truly starting to "deflate the bubble"?

Let's rewind a few days ago, and we can see that after Tesla and Google released their financial reports, they had already sent out certain negative signals.

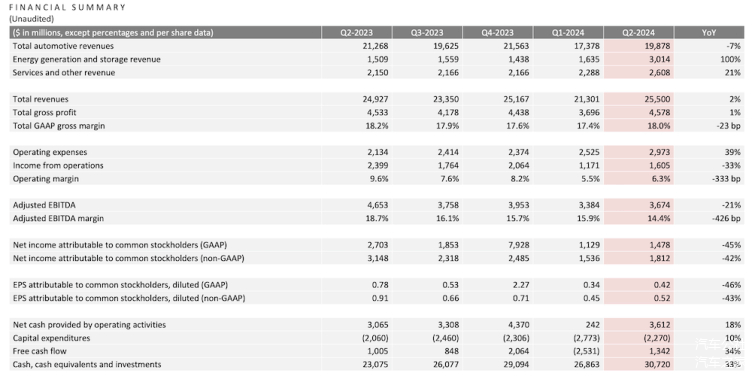

It is reported that on July 23rd (EDT), Tesla released its latest financial report, showing that the company achieved revenue of $25.5 billion in the second quarter of 2024, an increase of 2.3% year-on-year; operating profit was $1.605 billion, a decrease of 33% year-on-year; and net profit attributable to ordinary shareholders was $1.478 billion, a decrease of 45% year-on-year, nearly halving.

Overall, this is a disappointing "report card," reflecting that Tesla's profitability pressure continues to increase.

Although Musk also brought some "new expectations" to investors, such as "striving to bring the FSD V12.5 system to China and Europe by the end of the year, and the internally highly anticipated Robotaxi product will also be officially launched on October 10th," considering the current fierce market competition, especially the continuous improvement in the intelligent driving capabilities of related automakers in the Chinese market, investors remain concerned about Tesla's future development.

In contrast, Google's performance was relatively impressive. The financial report showed that in the second quarter of 2024, Google's revenue was $84.742 billion, an increase of 14% year-on-year; net profit was $23.619 billion, an increase of 29%. Both revenue and net profit exceeded market expectations. However, why did the market still respond flatly to such a growth trend?

Upon closer inspection, there may be the following factors at play. On the one hand, Google's core advertising business growth slowed down, with a year-on-year growth rate of 11.2% in the second quarter, falling short of the previous quarter's 13% growth rate. On the other hand, according to the remarks made by senior executives during the earnings call, Google may face future earnings pressure risks, mainly considering the increase in the number of employees due to the arrival of new graduates in the third quarter, and the potential surge in capital expenditures under the trend