Xiaoyangge's "business empire" is doomed to collapse

![]() 09/19 2024

09/19 2024

![]() 618

618

Capital looks at money, fans look at products, and Xiaoyangge ends up with nothing.

On September 17, the Hefei High-tech Zone Market Supervision and Administration Bureau issued a situation report stating that it had initiated an investigation into suspected misleading consumer behavior during livestream broadcasts by Sanyang Network Technology Co., Ltd.

From the crab dispute between Xinba and Xiaoyangge, Xinba issued two statements, and then paid out an industry compensation of 100 million yuan. Xiaoyangge shifted from the fringes of public opinion to the center of the vortex, losing 2.314 million followers in a single month, a harbinger of a major shakeup in the livestream industry.

On the occasion of the Mid-Autumn Festival, Mei Xin mooncakes became Mei Cheng mooncakes, and the "weasel and mongoose" switch once again pushed Xiaoyangge to the forefront of public opinion.

Xiaoyangge managed to escape unscathed from the "315 Preserved Vegetable Pork Belly" incident, where "Xian Duo Yu" synthetic beef was transformed into prime beef in livestreams, and children's shoes with excessively high levels of plasticizers were sold, even suspected fake Moutai liquor. In these shocking incidents, Crazy Xiaoyangge has been labeled as having lax product selection standards.

When something gets too big, it attracts attention, and Xiaoyangge's situation has taken a sharp turn for the worse. At this point, the phrase "to keep silent" aptly describes Xiaoyangge.

Coincidentally, Dong Yuhui's interview with Li Juan backfired, Xinba's promotion of hairy crabs faced price scrutiny, and Luo Yonghao's friend's livestream room sold suspected counterfeit mooncake gifts... Top livestreamers have fallen into a collective dilemma, with internet buzz passing from one livestream giant to another, often ending in anticlimactic conclusions and ridicule.

Behind the collective shift in capital, the power dynamics protecting livestreamers have been dismantled, the logic of monetizing traffic has been made public, and livestream commerce has quietly entered a relatively calmer second half.

01

The Final Frenzy

The Come and Go of Livestream Selling

True or False Monkey King. Selling inferior products as premium ones has always been a common tactic in Crazy Xiaoyangge's livestreams.

Mei Xin mooncakes became Mei Cheng mooncakes, transforming into a high-end alternative brand with excellent quality and price in Sanyang's livestream room. With flashy packaging and energetic sales pitches, Sanyang's livestream matrix achieved a luxurious performance of 50 million yuan.

Behind the frenzy of daily profits lies the brutal and violent operation of livestream commerce.

Public records show that the producer of the Mei Cheng mooncakes sold by Xiaoyangge is Guangzhou Meicheng Technology Co., Ltd. and Foshan Meicheng Food Co., Ltd., with its origin in Foshan, Guangdong Province.

However, the sales company, Hong Kong Meicheng Group Co., Ltd., was established on April 15, 2019. Here, Xiaoyangge completed the first step of the "weasel and mongoose" switch, replacing Guangzhou Meicheng with the concept of Hong Kong Meicheng.

Subsequently, Hong Kong Meicheng registered all related trademarks under its own name, securing full usage rights for similar products.

Hong Kong Meicheng transformed mainland-made mooncakes into high-priced overseas products without even leaving the country, selling them in livestreams.

The Yang brothers knew that in addition to trademark disguise, celebrity endorsements could add an extra layer of deception to products.

Thus, Eric Tsang appeared.

Eric Tsang's involvement validated the authenticity of Hong Kong Meicheng. Viewers who felt their desire for truth had been satisfied resolutely placed orders in the livestream.

Ultimately, the "weasel and mongoose" switch created a closed loop.

"Cut the Leek ," the crazy livestream room was filled with self-proclaimed smart consumers. From production to distribution to consumption, a makeshift three-tier system emerged abruptly and stood tall.

Just like Xiaoyangge at the beginning, raw and unruly.

In 2014, amidst the internet wave, "there were carrots everywhere," and Xiaoyangge, known for "exploding ink bottles," amassed his first batch of followers by imitating others' pranks and gimmicks.

In 2019, Xiaoyangge began creating family sitcoms themed around "Desperate Weekends," with absurd and self-destructive humor becoming his unique trademark.

Looking at the short video content released by Xiaoyangge, his creative formula can be summarized as follows:

First, introduce exaggerated actions and plots to capture "spontaneous" traffic from short video platforms like Douyin within seconds using contrasting elements. Second, sprinkle in occasional jokes and punchlines throughout the video to establish Xiaoyangge's character through pranks and family harmony, entertaining viewers and attracting loyal followers to the platform.

With traffic and a solid persona, how to retain it?

The trend of short videos naturally attracted a host of gray industries, with risqué content rapidly accumulating substantial traffic in a short period. However, individual IPs rarely survive the spotlight, and the gap between ideal and reality often leads to a sharp decline in audience trust.

Xiaoyangge's shrewdness lies in maintaining consistency between online and offline. With the value recognition of traffic bolstering the core of his "quirky family" persona, the fan base of "Crazy Xiaoyangge" surged. Traffic began to translate into tangible capital, and the logic of monetizing traffic moved from behind the scenes to center stage.

Channels for monetizing internet traffic include advertising placements, platform subsidies, livestream tips, and livestream commerce. According to Douyin Star Chart, the highest quoted price for a single video by Crazy Xiaoyangge exceeded 500,000 yuan. Assuming six monthly advertising collaborations at the maximum quoted price, advertising and platform revenue would amount to 3 million yuan. Furthermore, Xiaoyangge revealed in a livestream that a single livestream session for the "Crazy Xiaoyangge" account alone could easily exceed 3 million yuan after tax.

On one hand, there are multiple video advertising placements with low profits, and on the other, there is a new path of livestream commerce with fewer sessions but higher profits. The scales have tipped.

Unlike top livestreamers like Li Jiaqi, Xiaoyangge, who rose to fame through pranks and down-to-earth jokes, has a surprisingly low "style" of product endorsement. White-label and low-priced products are regulars in his livestreams and Douyin storefronts.

Known for his quirky persona, Xiaoyangge's livestreams remain chaotic, resembling a bustling market with at least 100,000 viewers per session. On September 7th evening, the Yang brothers reappeared in their livestream, racking up 150 million yuan in sales and 633,200 transactions, adding a meaningful conclusion to the "Lion vs. Sheep" rivalry.

The "reverse livestream selling" style of "strong interaction, unexpected twists, and pranks" has become the hallmark of their livestreams. Naturally, in personal branding, nothing is more valuable than trust.

However, different livestream audiences have vastly different potential for product endorsements.

With a large audience, high daily usage frequency, low prices, and the immediacy of purchase, hard-demand products like disposable garbage bags have become the mainstay of endorsements. The purchase volume of disposable garbage bags in Crazy Xiaoyangge's Douyin storefront has even surpassed 10 million orders. Compared to rumored commissions of up to 80% for Li Jiaqi's endorsement of Huaxizi beauty products, the commissions and shelf fees generated by white-label and low-priced products are hardly comparable.

Image source: Douyin

Taking Douyin as an example, archaeological and official data show that the Yang brothers, with 118 million followers, have an average unit price of 100-200 yuan per item, which is still lower than that of the Guangdong couple, who have only 60 million followers.

Image source: Archaeological Plus

The Guangdong couple's livestreams focus on promotional offers for international luxury brands, with the top ten best-selling products priced over 1,000 yuan each. The top three best-selling products are all beauty products. Relying solely on white-label and low-priced commodities for volume rather than value seems to have hit a ceiling, with a stark contrast in endorsement potential.

Image source: Archaeological Plus

According to Green Eyes Intelligence data, international makeup brands saw their GMV decline by 6.1% and 22.1% year-on-year on Taobao, JD.com, and other platforms in 2023. Traditional marketing channels on online shopping platforms are entering a bottleneck, and engaging with livestreamers on platforms like Douyin has become an important way for makeup brands to gain new growth points. This is precisely where Xiaoyangge sees an opportunity for a comeback.

During the 2023 Singles' Day, Xiaoyangge took the lead in launching a "Singles' Day Beauty Festival" in his livestream, gradually introducing big brands like Givenchy, Dior, L'Oréal, and YSL. Xiaoyangge even revealed in a livestream that negotiations alone with L'Oréal took from April to November.

However, the forced upgrade in livestream "style" led to a loss of persona and audience.

The potential for beauty product endorsements directly depends on the livestream audience's demographics. With around 40% female viewers and a dominant age group of 31-40 years old, the potential for beauty product endorsements was effectively quashed. According to Chanmama data, during the 2023 Singles' Day, Crazy Xiaoyangge conducted six livestreams with total sales ranging from 350 to 450 million yuan. While beauty and skincare products were the most prevalent category, daily necessities were the top-selling items.

Xiaoyangge's team, with one foot already in trouble, was ill-suited to the new environment.

02

The Mad Dragon

The Dragon Slayer Turns

The feast of traffic continues unabated, and the path to monetization is within reach.

In the intertwined circle of capital, top livestreamers, and content platforms, Xiaoyangge was the first to attempt to break free and ascend.

According to the "2023 China Live E-commerce Market Data Report," the transaction volume of live e-commerce reached 4,916.8 billion yuan in 2023, an increase of 40.48% year-on-year. Another intriguing detail is that the number of enterprises in the live e-commerce industry surged from 3,545 in 2018 to 24,000, making the e-commerce race increasingly crowded and mixed, seemingly becoming another norm.

In the era of traffic, any preferential treatment from the platform can propel mid-tier livestreamers into the top tier. In live e-commerce, platforms like Kuaishou, Taobao, and Xiaohongshu compete directly with Douyin, which faces the possibility of top and mid-tier livestreamers leaving. For super top livestreamers like Xiaoyangge, Douyin is bound to favor them, even at the expense of compressing the survival space for mid-tier and lower-tier livestreamers.

Simultaneously, the sustained efforts of mid-tier livestreamers have given Douyin the possibility of containing top livestreamers. For the platform, putting all eggs in one basket is too risky. When top livestreamers wield the most influence, both platforms and merchants are hostage to their demands, leading to profits tilting towards livestreamers and necessitating urgent restrictions on them.

Caught between a rock and a hard place, live e-commerce has entered a phase of Calm down and orderliness.

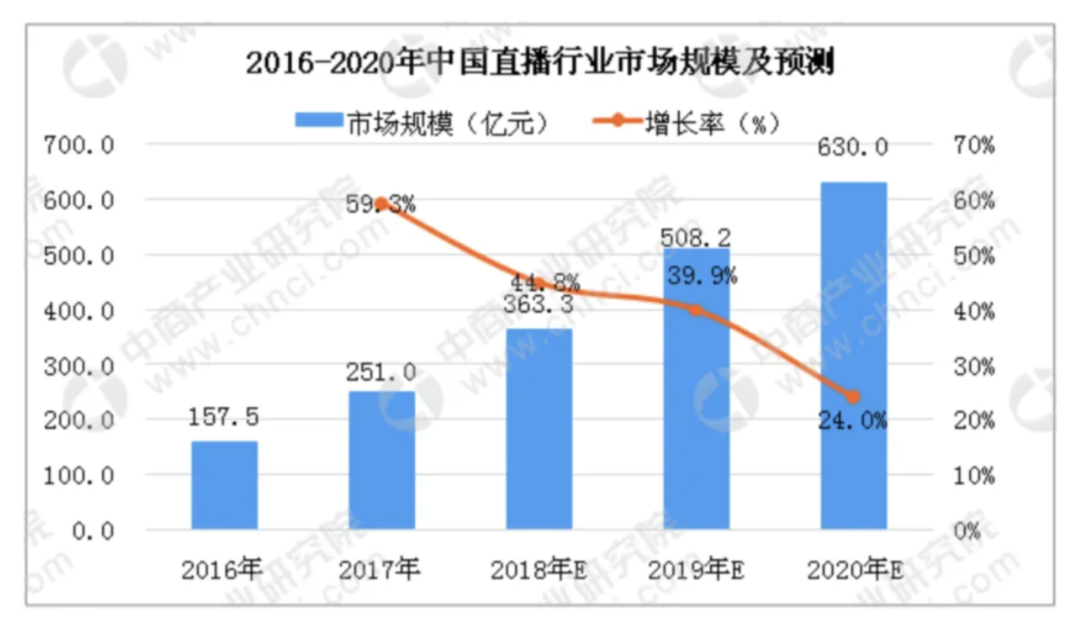

According to data from the China Industry Business Research Institute's "2018-2023 China Online Live Broadcasting Industry Market Prospects and Investment Research Report," decreasing growth rates year after year indicate that it is increasingly difficult to expand the live e-commerce market. Overinvestment in live e-commerce has led to significant reductions in other links in the commodity economy chain, resulting in declining profits and brand influence, and live e-commerce is gradually cooling down.

Image source: China Industry Business Research Institute

Amidst the false prosperity, the real crisis is beginning to emerge. Xiaoyangge anticipated this "trend."

If the economy is becoming virtual, then build a supply chain; if live e-commerce is not sustainable, then accelerate the cash-out of traffic. Xiaoyangge embarked on a two-pronged approach to construct the labyrinth of his vertical business empire, "Sanyang.""On one hand, having firmly secured the throne as Douyin's top livestreamer, Xiaoyangge realized that one person alone could not generate enough revenue. Therefore, he set out to incubate and create more "Xiaoyangges," leveraging his own IP to develop a matrix of influential livestreamers within the "Yang family," forming a "family-style endorsement" alliance.

Sanyang's official WeChat account states that the company's mid- to long-term plan is to continuously introduce top influencers with over 1 million followers. Data shows that Xiaoyangge has incubated at least ten influencer matrix livestreams on Douyin, including Sanyang Network, Sanyang Network Beautiful Life, Sanyang Network Fruits and Vegetables, Red Green Light Huang, Zui Ge, Seven Boss, Qiao Mei, and Chen Yili. According to Xiaoyangge, the company pays out over 50 million yuan in salaries per month alone.

Expanding the endorsement team in a family-style manner is not blind expansion.

Seemingly unintentional yet purposeful. When signing Seven Boss, Xiaoyangge rallied his followers in the livestream to buy beauty products from Seven Boss, who subsequently gained one million followers. Signing Zui Ge was due to his reputation as a fitness influencer, with the intention of turning him into a fitness endorsement expert.

For Xiaoyangge, the "style" of endorsements is always the biggest growth point at hand. Since he cannot change the demographics of his followers, he uses the influencer matrix to automatically filter them, gradually transforming the endorsement products from low-profit daily necessities and generic platforms for affordable goods into specialized platforms for high-value branded goods, Gradually improve a "general-specific" business layout.

On the other hand, under the direct threat of platform de-centralization, Xiaoyangge's countermeasures against platform dominance are even more proactive.

In the past 30 days, the number of followers for Sanyang Network's own brand, "Xiaoyang Select," has approached 5 million. For products priced between 10-50 yuan, pure livestream sales have reached 5-7.5 million yuan, continuing Xiaoyangge's low-price, high-volume endorsement style."Regarding this, Xiaoyangge clarified that "Xiaoyang Select" is not merely a "white-label OEM" product but rather a part of his own industrial chain, forming a perfect closed loop of "production-sales," bypassing platform commissions, and ultimately avoiding platform risks, transitioning from online marketing to retail that combines online and offline elements.

Image: Xiaoyang Select Data Performance

In April of this year, "Sanyang Theater" emerged, and the Yang brothers officially announced their entry into the booming short-form drama market. Shifting from livestreaming to the film and television sector, Xiaoyangge, who had begun to feel burnout, gradually withdrew from the endless cycle of livestream endorsements and started exploring ways to extend the vitality of his content, transforming his IP into a brand that sustains his content's life force."Obviously, brand marketing is more challenging than product marketing in livestreams. However, converting livestream traffic into stable traffic and addressing the risks of top livestreamers and market uncertainties is undoubtedly a solid path to fortifying defenses."Having emerged from short videos, Xiaoyangge undoubtedly understands the mechanics behind internet traffic. However, dancing with wolves is always treacherous, and capital will not allow others to encroach on its profit margins. Sanyang may become a "thorn in the side," and its fate is evident.

03

The Calm After the Live E-commerce Storm

Traffic Is Not Inventory, and Entertainment Is Not Commerce

The era of dominating live e-commerce with just a smartphone and a product is over. The industry is evolving towards a multi-polar differentiation with strict hierarchical division of labor and cooperation.

After bidding farewell to the barbaric growth and disorderly development period, the live streaming market still has great potential. Compared to the previous short-chain mechanism of "factory-streamer-fan", agents, MCN distribution companies, internet companies, and clip companies have entered the short video traffic ranks in the role of "contractors", breaking the balance of the relatively vertical and streamlined model of product promotion, making the path from traffic to money less smooth.

In the traditional long supply chain system that winds through contractors, distributors, and ultimately users, such changes are directly reflected in the prices of products promoted through live streaming.

Image: Product categories and price distribution promoted by Little Yang

Statistics show that Crazy Little Yang has gradually ventured into industries with higher unit prices, such as beauty and cosmetics, from selling cheap items like garbage bags. The live stream, which once boasted of saving money for its "brothers," has quietly transformed into a professional sales venue for harvesting fans, capturing an even greater profit margin. The prices of his promoted products are comparable to, or even more expensive than, those on e-commerce platforms and other channels.

Image: Products recommended by Little Yang

In the ebb and flow of the market, peak traffic is but a beautiful facade, and ultimately, it is the money behind the facade that retains the traffic.

Traffic is deliberately concentrated under the coercion of capital. In other words, top streamers are the relatively decent niche created by capital. Essentially, the emergence of top streamers is a distorted product of mutual restraint and achievement among individuals, platforms, and capital. Streamers like Xinba and Little Yang have become legitimate entertainment tools for the masses, pushed forward by capital.

Once a subordinate "usurps the throne," the superior is bound to be replaced. Thus, mid-tier streamers have become the most direct counterforce against top streamers.

In the first half of live streaming product promotion, traffic was blind and explosive in a disorderly platform mechanism, providing a breather for individual streamers to gradually gain more power and influence. However, in the second half, traffic streamers with a lucky streak were completely shut out of the rules.

On one hand, top and mid-tier streamers hold sway over the consumer end, exerting strong guidance on consumers. On the other hand, e-commerce platforms control production resources and have a stronger influence on pricing. At this stage, streamers' excessive demands for pricing power and e-commerce platforms' over-reliance on traffic and big data have led to a confrontational outcome where streamers go their own way and e-commerce platforms decentralize.

Unable to compete openly, one can only wait helplessly. Underneath the glamorous facade of live streaming product promotion lies the ultimate competition for capital and the relentless pursuit of profit.

The quiet departure of top streamers signals an age-old truth to the entire industry: Division of labor implies progress and thresholds, as well as the impending departure of some from their era.

Entertainment is entertainment, and product promotion is product promotion.

Parallel to industry standardization, there is a painful period of rapid compression and developmental shift in the personal growth space of entertainment streamers.

Similarly, e-commerce platforms are also entering the second half of the competition.

Citing data from the National Bureau of Statistics, China's online retail sales reached 709.91 billion yuan in the first half of 2024, up 9.8% year-on-year; nationwide online retail sales amounted to 15.4264 trillion yuan in 2023, up 11.0% year-on-year; and four years ago, the growth rate once exceeded 20%.

With decelerating growth, the fast-paced e-commerce industry has entered a stage of stock competition, where low prices have become the primary factor hindering sustainable development.

The delicate relationship between e-commerce and streamers is bound to undergo significant integration and fragmentation.

Consumption is inherently a long and arduous journey, requiring profound insight and strength. The root of the problem lies in the need for better integration between the production and sales ends. There are still diverse possibilities in the supply chain, ultimately leading to niches suitable for each player.

Conclusion

As enterprises embark on overseas expansion in 2024, shelf e-commerce struggles to maintain momentum, top streamers find themselves in a predicament, and new retail tracks emerge. All forces will inevitably come to the negotiating table, driving deeper institutional reforms within the industry: Disorder is giving way to order, barbarism is becoming calm, and division of labor is becoming the norm.

Monopoly eventually leads to disintegration.

The steamed bun cannot be eaten by one person alone, nor can the pie fall on one person's head.