Like to use the “brute force” of Alipay, always believing that “great efforts create miracles”

![]() 09/23 2024

09/23 2024

![]() 591

591

In the tech circle, “rumors” often come with far-reaching prophecies.

This time, Ant Group's full acquisition of Haodf.com is no exception.

According to Tianyancha APP, Haodf.com's entity company, Hudongfeng Technology (Beijing) Co., Ltd., recently underwent a business change, with its major shareholder changing from its original founder Wang Hang to Shanghai Yunyang Enterprise Management Consulting Co., Ltd., a wholly-owned subsidiary of Ant Group. The latter now holds a 100% stake in Hudongfeng Technology (Beijing) Co., Ltd.

During the pandemic years, the online medical care sector boomed. However, once the pandemic subsided, the sector quickly plummeted. Fundamentally, while it claims to offer consultations, its essence is an e-commerce platform for selling medication, driven by product logic rather than service logic.

So, the question arises: in 2024, why would Alipay choose such an unsexy sector?

01

The real intention lies beyond the surface: low-frequency business combinations are the true objective

To understand why Ant Group fully acquired Haodf.com, we must first look at what Alipay has been up to recently.

In June, Alipay hosted its first content open day for creators and announced an investment of 1 billion yuan in cash, 10 billion in traffic, and 100 million in advertising resources to support content creators.

As a tech media professional with over a decade of experience, I recall that content creators were last this popular in 2016.

However, like the acquisition of Haodf.com, the content creation sector is no longer as alluring, yet Alipay persists…

In addition, at the recent Bund Summit, Alipay unveiled its new AI lifestyle assistant app, “Zhibaby”, accelerating its push into smart assistant technology.

If there were an app competition for perseverance, Alipay would undoubtedly rank top. Regardless of popularity, capital interest, or new narratives, Alipay wants it all. It believes in the power of “brute force” and trusts that “great efforts create miracles”.

Over the years, Alipay has undertaken numerous endeavors, ultimately aiming to transcend its tool-like status and forge a new monetization model through services and content stickiness.

However, the online medical care sector has struggled in recent years, with many players failing or barely surviving through questionable practices. JD Health and Ali Health follow an e-commerce model, while Ping An Good Doctor, despite managing to turn a profit this year through cost-cutting, relies heavily on its parent company Ping An Group for clientele, shifting its strategic focus from C-end to B-end users.

Online medical consultation services targeting C-end users are not a promising sector due to their low frequency and low spending, making the business model somewhat unattractive.

In the eyes of the internet industry, Alipay may see value in this very unattractive attribute. While online medical consultation services have lost strategic focus for most giants, they remain urgent and indispensable. They may not stir up significant waves but can differentiate Alipay's platform.

This differentiation is precisely what Alipay lacks. It is now pursuing a “three jackasses make a wise man” approach, combining various low-frequency services into a high-frequency consumption package, encompassing online consultations, electricity bill payments, social security, package tracking, job hunting, and rental services, among others.

At this rate, even the omnipotent Taobao pales in comparison to Alipay.

This transition finally allows Alipay to shed its tool-like image and embrace its desired service-oriented identity, firmly branding itself as such.

Therefore, regardless of whether it's acquiring the “outdated” Haodf.com or focusing on content, Alipay's ultimate goal is to:

Become the second all-around “WeChat” without social attributes.

The advantage of this approach is that compared to other tool platforms, Alipay can offer more differentiated content. However, the downside is that Alipay risks becoming the “Zhou Yu” in the saying “if Zhou Yu lived, why bother with Zhuge Liang?”

Of course, these are more macro-level observations. Specifically regarding the acquisition of Haodf.com, since Alipay's core is financial, while online medical consultations lack imagination in the capital market, healthcare is closely tied to insurance, similar to the logic behind insurance companies like Ease. Furthermore, insurance is inherently financial, which undoubtedly aids Alipay in refining its financial ecosystem!

02

Is “Tap and Pay” or AI the catalyst for Alipay's transformation?

Apart from bolstering content creation, Alipay has undertaken numerous other initiatives.

For instance, it has vigorously promoted “Tap and Pay” and targeted AI with the launch of Zhibaby.

Honestly, both moves have merit but remain rough around the edges in terms of overall strategy and execution.

Let's start with “Tap and Pay”. Its intention is to facilitate faster payments, increase Alipay's usage frequency, and boost small and large transactions and platform liquidity.

However, in practice, it seems somewhat “redundant”.

Firstly, the usage threshold is relatively high. “Tap and Pay” requires a phone with NFC functionality, which not all devices possess. Moreover, compared to the ubiquitous QR code payments, some seniors are unfamiliar with NFC and thus do not use “Tap and Pay”.

From my personal experience, the security of “Tap and Pay” is also concerning. The entire process leaves more room for potential fraudulent activities…

Therefore, compared to QR code payments, “Tap and Pay” complicates a simple process.

Strategically, it also contradicts Alipay's content-focused approach.

In terms of usage and scenarios, “Tap and Pay” resembles an access card.

So, what's the purpose of an access card? To open doors quickly, i.e., increase Alipay's usage frequency, but reduce dwell time. If users don't need to open the Alipay app to pay, why would they stay longer? This reinforces Alipay's tool-like identity!

Isn't this at odds with Alipay's content-focused strategy?

Thus, comparing Alipay and “Tap and Pay” to WeChat's quick payments misses the mark. What Alipay truly desires is not just high usage frequency but also extended dwell time.

From this perspective, even though Han Xinyi, President and CFO of Ant Group, believes that “Tap and Pay” offers new experiences, commerce, and technology…

And Li Jiajia, Vice President of Alipay, sees it as a “natural experience for the younger generation and the best entry point for merchants to tap into future business opportunities”.

From a macro-strategic perspective, the overall management's understanding of “Tap and Pay” seems unclear, prioritizing short-term growth over long-term strategic considerations.

This is undoubtedly insufficient for a competent leader.

Turning to AI, this direction is correct.

As mentioned earlier, Alipay currently resembles a general store that gathers low-frequency demands. While seemingly convenient at first glance, users must search for specific functions individually. This store lacks a “key” to respond swiftly to all needs.

AI, or Zhibaby, is precisely that key.

In the future, Zhibaby's ideal scenario resembles that of a smart home, where a single command fulfills all life's needs.

However, like smart homes, which have been talked about for years but few have materialized, Zhibaby still faces many challenges to truly become an AI lifestyle assistant.

Firstly, Alipay's AI capabilities are functional but not efficient. For instance, it takes seven to eight seconds for Alipay's AI to activate a bus pass.

Secondly, the AI interaction mode is problematic. Whether voice activation or manual input, both seem awkward in practical scenarios.

Imagine standing on a bus or subway, shouting at your phone to activate your bus pass and then waiting for several seconds. Even the most extroverted person might feel embarrassed in such a situation!

Lastly, strategically, while Alipay shows a clear trend towards becoming an “omnipotent” platform, allowing Zhibaby to operate as a separate app seems contradictory, as if intentionally decentralizing power.

It's evident that even though Alipay has chosen the right AI direction, management is still using “brute force” to blindly explore, yielding limited positive feedback.

03

Starting with compliance, Alipay needs to achieve maximum results with minimal effort

Before unleashing the potential of AI and Zhibaby, how can Alipay leverage its strengths effectively?

There are three main areas of focus:

1. Address Alipay's shortcomings. For instance, improve financial compliance and content moderation.

Last July, Alipay was fined 3.06 billion yuan by the People's Bank of China for violating seven regulations, including payment account management and telecom fraud prevention.

Furthermore, a previous article in Bandao City News titled “No Pets, Yet Automatically Charged for Pet Insurance on Alipay? No Way to Cancel!” revealed that some users were unwittingly enrolled in insurance plans after browsing insurance pages on Alipay.

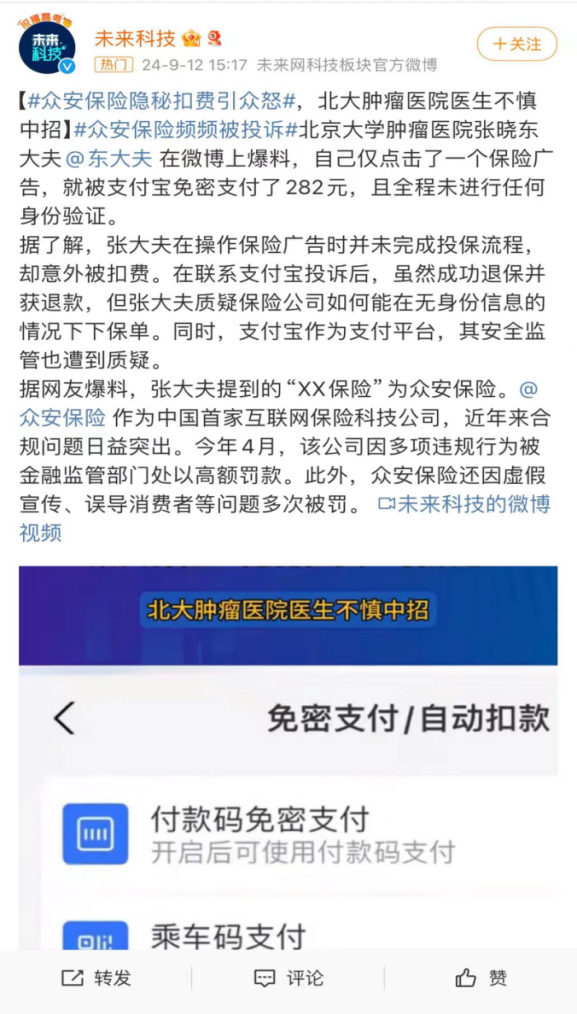

This doesn't seem isolated. Recently, Dr. Zhang Xiaodong, a verified gastroenterological oncologist at Peking University Cancer Hospital, tweeted that he was charged 282 yuan without authorization after clicking on an embedded insurance ad. “The entire process lacked identity verification, signatures, or facial recognition. I was insured without my consent or personal information.”

This sparked concerns about Alipay's security and reliability among netizens.

If Alipay fails to address these security flaws, how can “Tap and Pay”, with its added convenience, ensure secure market adoption?

In terms of content, some media outlets have also discovered potential copyright infringements on Alipay's short video platform.

Several accounts have uploaded clips from Tencent Video's exclusive dramas, such as “Out of the Jade Gate”, without proper authorization.

Generally, “exclusive” indicates copyright ownership, prompting moderators to remove such content. However, Alipay's “content moderation mechanism” appears inadequate.

Moreover, Alipay's short video platform hosts numerous “wool-gatherers” seeking rewards for posting irrelevant comments.

While these users may not be of high quality, their sheer numbers, backed by Alipay's vast user base, could potentially contribute to building a content ecosystem in the short term.

However, judging from these users' comments, Alipay seems to lack the final retention strategy…

2. Create nationwide marketing campaigns.

To thrive, tool-based products must constantly remind users of their existence. Alipay, despite its “omnipotent” potential with services like taxi hailing, food delivery, and shopping, rarely garners attention for these features.

This is due to tool-based products' inherent short user dwell time and low exploration desire.

Thus, marketing is not just icing on the cake for Alipay; it's a lifeline. Unfortunately, after the success of the “Collect Five Blessings” campaign, Alipay hasn't replicated another nationwide hit, an area it needs to strengthen.

3. Do what it does well, right.

This refers to Alipay's content strategy. Regardless of the outcome, it's essential to make users aware.

Alipay has already found some footing, such as offering free short dramas, following Tencent Music's lead and attracting user attention.

However, compared to Meituan's branded short dramas, Alipay's offerings are still behind, requiring innovation to create premium content aligned with its strategy.

In summary, Alipay's overarching strategy is sound. However, execution lacks a holistic perspective, possibly due to KPI pressures, leading to inconsistencies.

While these contradictions are overshadowed by Alipay's “brute force” approach, with increased competition from Taobao and WeChat's interoperability, Alipay must act swiftly to stay ahead.