Deliver food delivery to the Middle East, another battle for Meituan's Wang Xing

![]() 09/25 2024

09/25 2024

![]() 600

600

Meituan has officially launched its first international expansion beyond the Chinese market.

Recently, Meituan's overseas food delivery platform Keeta was launched in Saudi Arabia. To attract new users, Keeta offers free delivery for orders over 25 Saudi Riyals (USD 6.66) and discounts of up to 70% on selected meal sets. Additionally, Keeta promises delivery within 30 minutes, and users can also opt for pick-up from restaurants.

After Meituan's organizational restructuring in February this year, the importance of its international business was further enhanced. Qiu Guangyu, who previously served as Wang Xing's assistant, was appointed as the head of international business, reporting directly to Wang Xing.

Previously, Keeta expanded rapidly in Hong Kong and successfully broke the previous duopoly in the market within a year, becoming the third largest player in Hong Kong's food delivery market with a 43% share of orders. Can Meituan replicate its success in Hong Kong in the Middle East?

I. Why the Middle East?

Meituan's move into the Middle East has been long-planned.

Last May, Wang Xing and other senior executives from Meituan's overseas strategic investment department visited Saudi Arabia to meet with government ministers and members of the Saudi royal family, assessing the feasibility of launching a food delivery pilot program in the country. In April this year, it was reported that Meituan was seeking to recruit staff based in Riyadh.

Similar to its strategy in Hong Kong, Keeta is likely to be launched in phases, initially targeting specific regions. However, instead of Riyadh, Meituan chose Al Kharj, a city in central Saudi Arabia, as its first launch location.

Why choose the Middle East, particularly Saudi Arabia, as the first overseas market?

Firstly, Saudi Arabia is the largest economy in the Middle East after Turkey. In recent years, the online food delivery market in Saudi Arabia has grown rapidly.

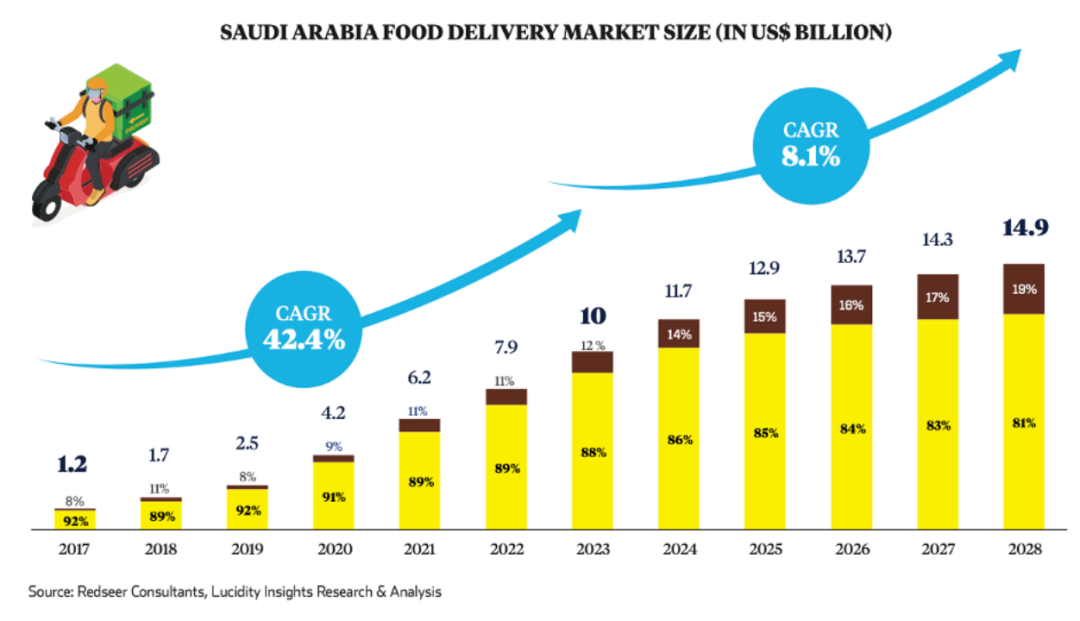

According to Lucidity Insights, a prominent African research firm, the food delivery market in Saudi Arabia was worth USD 10 billion in 2023 and is projected to grow at a rate of 8.1%, reaching USD 14.9 billion by 2028.

Secondly, enhancing user value is crucial for business profitability.

36Kr reported that Meituan had considered acquiring Foodpanda, a Southeast Asian food delivery brand, but ultimately chose not to proceed due to Foodpanda's unprofitable operations in the region, low average order value, and slow order growth.

Currently, while Saudi Arabia has a relatively small number of orders, its high per capita GDP results in significantly higher average order values compared to China, offering potential for profitability.

In 2023, Meituan delivered over 60 million orders daily, peaking at 78 million. Meanwhile, Jahez, a publicly traded food delivery company in Saudi Arabia, delivered an average of 211,000 orders daily in the first half of 2023, which for Meituan would be equivalent to the order volume in a single district in Beijing.

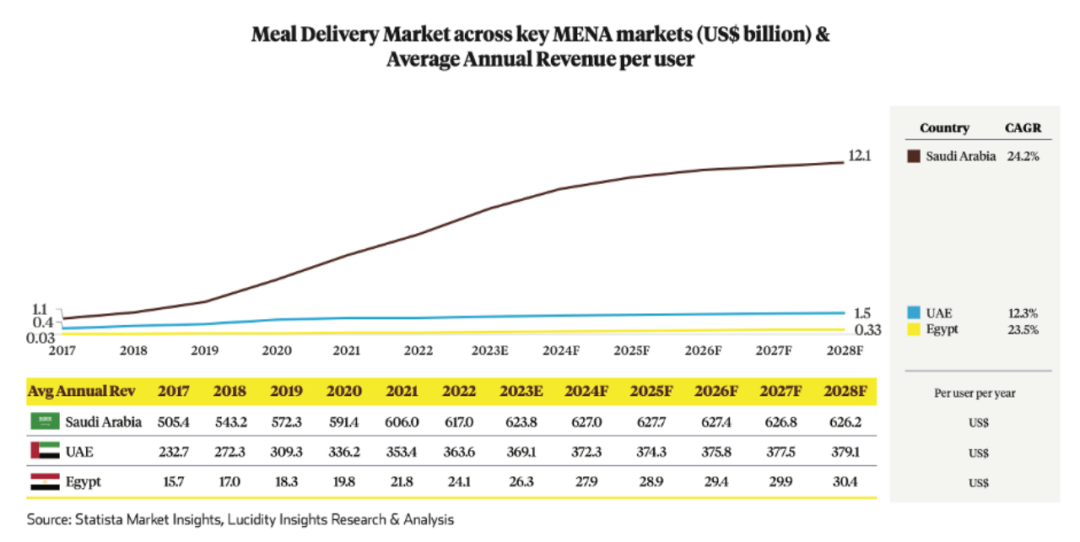

However, Saudi Arabia boasts a higher Average Revenue Per User (ARPU). The aforementioned report notes that Saudi Arabia's ARPU exceeded USD 600 in 2022, over 25.6 times the average in Egypt and 1.7 times that of the United Arab Emirates. Clearly, Saudi Arabian consumers are willing to spend more on food delivery services.

Take Jahez as an example; its Average Order Value (AOV) is 60 Saudi Riyals (USD 16), significantly higher than Meituan's domestic AOV of approximately USD 7.

This implies that even with significant subsidies in the Saudi Arabian market, Meituan's AOV is likely to increase, potentially leading to rapid profitability.

Lastly, once a delivery system is established in Saudi Arabia, there is ample room for future growth and imagination.

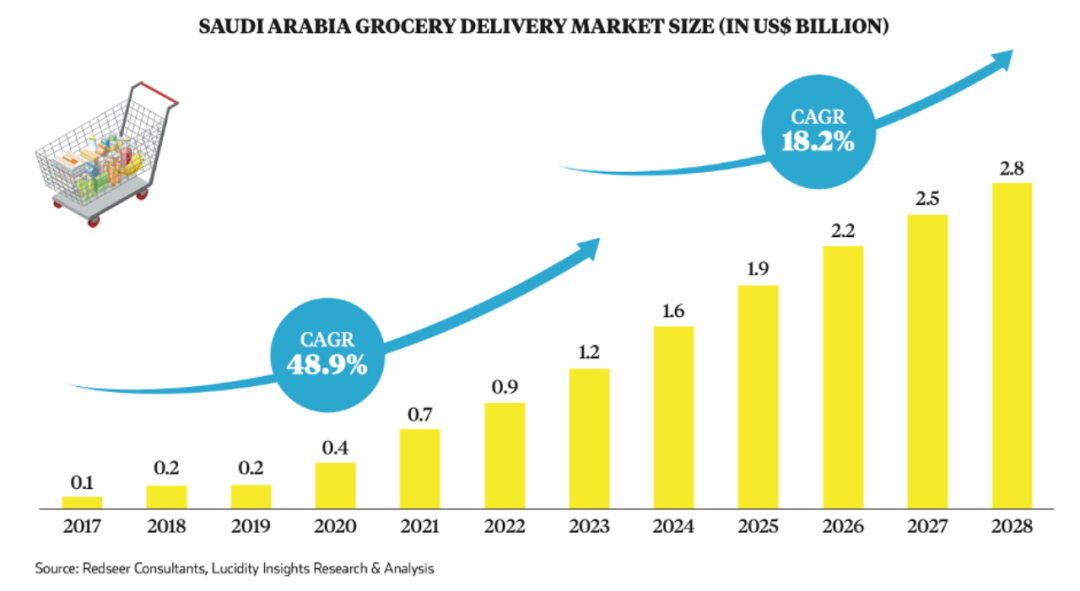

Food delivery services are evolving into grocery delivery services. The aforementioned report states that food delivery currently accounts for 88% of the market share in Saudi Arabia. However, by 2028, the grocery delivery market in Saudi Arabia is projected to reach USD 2.8 billion, with a CAGR of 18.2%, surpassing the 6% CAGR of the food delivery market.

For Meituan, establishing an instant delivery system in Saudi Arabia, similar to its domestic operations, will gradually expand beyond food delivery to encompass a wider range of goods, opening up new possibilities for delivery services.

II. Can Meituan replicate its Hong Kong growth?

To expand into the Middle East, Meituan has been testing the waters in Hong Kong for over a year.

Wang Xing once explained that Hong Kong was chosen as the starting point for overseas operations due to its cultural and dining habits being similar to those in mainland China, facilitating future expansion into international markets.

Food delivery is Meituan's core business, and its development in Hong Kong is crucial for its overseas expansion. Meituan aims to optimize its products and operations in Hong Kong to replicate its success in international markets.

And Meituan has succeeded.

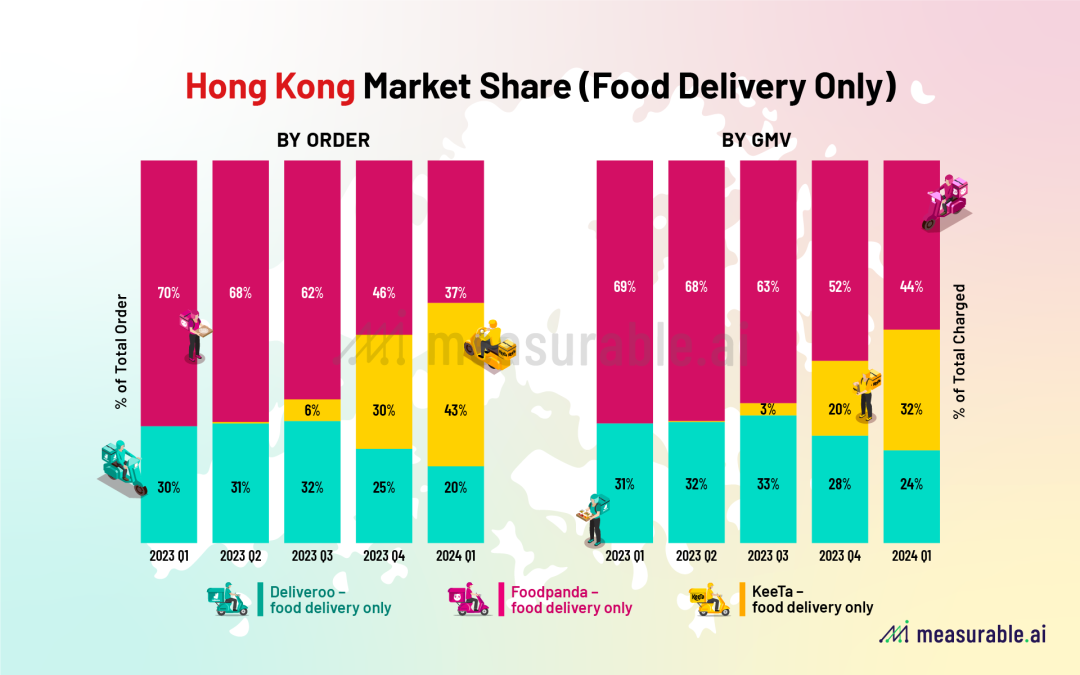

From 2018 to 2021, Hong Kong's food delivery market was dominated by Foodpanda, UberEats, and Deliveroo. After UberEats exited, the market became a duopoly between Foodpanda and Deliveroo. In May 2023, Keeta entered the market, reshaping the landscape into a three-way competition.

According to data from Measurable AI, as of the first quarter of 2024, Keeta held a 32% market share in terms of GMV and a 43% share in terms of order volume for food delivery services (excluding groceries and pick-up services).

But can Meituan replicate its success in Hong Kong in the Middle East?

A Middle Eastern user who introduced themselves as an investor in the US and Saudi Arabian markets commented, "Chinese companies rely on low margins and high volumes. If they find opportunities in our (Saudi Arabian) market, they might continue operating. Based on consumer behavior, I've noticed that they have no loyalty to delivery companies. What matters most is fast service and reasonable prices, making it easy for any new entrant to enter the market."

Moreover, a considerable number of Saudi users have expressed their welcome to Keeta on social media, stating that "the market needs such competition" and "users can have better and cheaper options."

However, the future of Keeta in the Saudi market is not optimistic.

On one hand, the food delivery market in the Middle East is relatively mature, leading to intense competition.

The main competitors in the Saudi market are HungerStation, a subsidiary of German food delivery giant DeliveryHero, and publicly traded Jahez. According to Redseer data, HungerStation and Jahez combined held a 70% market share in 2023.

According to a GF Securities report, HungerStation and Jahez lead in different regions of Saudi Arabia. For instance, in central areas with a high concentration of salaried workers and expatriates, where consumers prioritize delivery speed and fulfillment experience, Jahez is more popular among high-end customers, leading in market share. In contrast, HungerStation offers more affordable dining options, giving it an advantage in western regions with higher price sensitivity.

As Keeta enters the Saudi market, it must find its unique selling points to compete.

On the other hand, the complex environment in the Middle East poses challenges for Meituan's localized operations.

For example, the region lacks comprehensive data on accurate delivery addresses. Zhao Yating, Marketing Director of cross-border logistics company iMile in the Middle East, told the media, "The Gulf countries have not been modernized for a particularly long time. Their infrastructure development has not kept pace with their wealth growth. Many areas governed by sheikhs and tribes do not have clear house numbers, and the government has not prioritized this in the past, resulting in many ambiguous addresses."

Taking Saudi Arabia as an example, 95% of its population is concentrated in major cities like Riyadh and Jeddah. However, due to immature urban planning, the accuracy of addresses provided by buyers is often unreliable. Expressions like "the Xth house to the left of the mosque on a certain street" are not uncommon.

Furthermore, the region has a high proportion of Cash On Delivery (COD) transactions. Statistics show that an average of 60% of online purchases in the Middle East are paid for upon delivery, which can affect the fulfillment and execution of food delivery orders.

Unlike Hong Kong, Saudi Arabia represents a fundamentally different food delivery market. As Li Jianggan, founder of Moteng Venture Capital, pointed out in his blog, "You can send managers from mainland China to Hong Kong and expect them to operate normally, but you can't do the same in Saudi Arabia. Can locally hired managers in Saudi Arabia effectively collaborate with a strong Chinese core team?"

Therefore, whether Meituan can compete with established players like HungerStation and Jahez and replicate its Hong Kong growth remains to be seen.

III. Unique challenges faced by Meituan's overseas expansion

Compared to other internet companies, Meituan's overseas expansion can be described as starting early but arriving late to the party.

As early as the 2016 World Internet Conference in Wuzhen, Wang Xing mentioned that overseas markets represented one of three growth avenues for the internet's second half, stating, "There are still many untapped markets or places where user penetration has not reached the level seen in China, where it is already over half-saturated."

It was also at the end of that year that Meituan established its overseas accommodation project. From 2018 onwards, Meituan focused on overseas investments centered around its "Food+Platform" strategy.

However, compared to the rapid overseas expansion of Temu and TikTok, Keeta's pace has been significantly slower. The reason lies in the fact that expanding overseas poses more challenges for Meituan than for Pinduoduo or Douyin (TikTok's Chinese version).

Li Jianggan discussed in a podcast, "Pinduoduo controls the domestic supply chain and is proficient in advertising on platforms like Facebook. Facebook's share price once exceeded expectations by 20%, with a significant portion of this attributed to contributions from Chinese advertisers, which I believe Pinduoduo had a significant impact on."

Therefore, Temu enjoys significant advantages in its global expansion by leveraging resources through partnerships with third-party service providers. TikTok, on the other hand, possesses a robust content platform and only needs to further promote the development of its content and e-commerce ecosystem.

However, when local lifestyle service platforms attempt to enter new markets, they face significant challenges. Each new market entry requires rebuilding a complete ecosystem locally, a highly complex process.

This is precisely the unique challenge facing Meituan's overseas expansion.

During last year's Q4 earnings call, Wang Xing stated, "It took Meituan 10 years to build its business in the Chinese market, and it may take another 10 years to achieve notable success in overseas markets. However, the company has sufficient patience to achieve this."

Clearly, Meituan, with its heavy offline investment, will need to devote more time and effort to overseas markets. But once achieved, it will establish formidable barriers to entry.