Live streaming reshapes e-commerce in Southeast Asia

![]() 09/27 2024

09/27 2024

![]() 476

476

Author | Liu Yu

Editor's Note:

Since the beginning of this year, e-commerce in Southeast Asia has exhibited certain periodic changes. In the first half of the year, e-commerce in Southeast Asia was generally in a state of building momentum; however, in the second half, good news kept coming for e-commerce in Southeast Asia. Not only did major e-commerce platforms begin or were about to enter the profit stage in individual markets, but intensive promotional activities also contributed to the thriving state of e-commerce in Southeast Asia. In particular, live streaming e-commerce has emerged as the most notable growth area for e-commerce in Southeast Asia.

In light of this, Xiaguangshe has launched the "Southeast Asia Cross-border Trendsetter" column to observe, record, and analyze new developments in cross-border and e-commerce in Southeast Asia, exploring new opportunities for overseas expansion.

"E-commerce in Southeast Asia is entering a new era," said an e-commerce practitioner who has begun to feel this way.

On the one hand, as several major e-commerce platforms have successively achieved profitability, the market is moving towards a healthier state, with platforms, logistics, and payment companies focusing on enhancing the e-commerce service experience and infrastructure in Southeast Asia. On the other hand, an increasing number of young people in Southeast Asia are embracing live streaming as a new medium, becoming influencers, and even in some Southeast Asian e-commerce companies, many college students are taking on part-time jobs as influencers and anchors, "much like the early days of self-media in China, except they're doing it on TikTok."

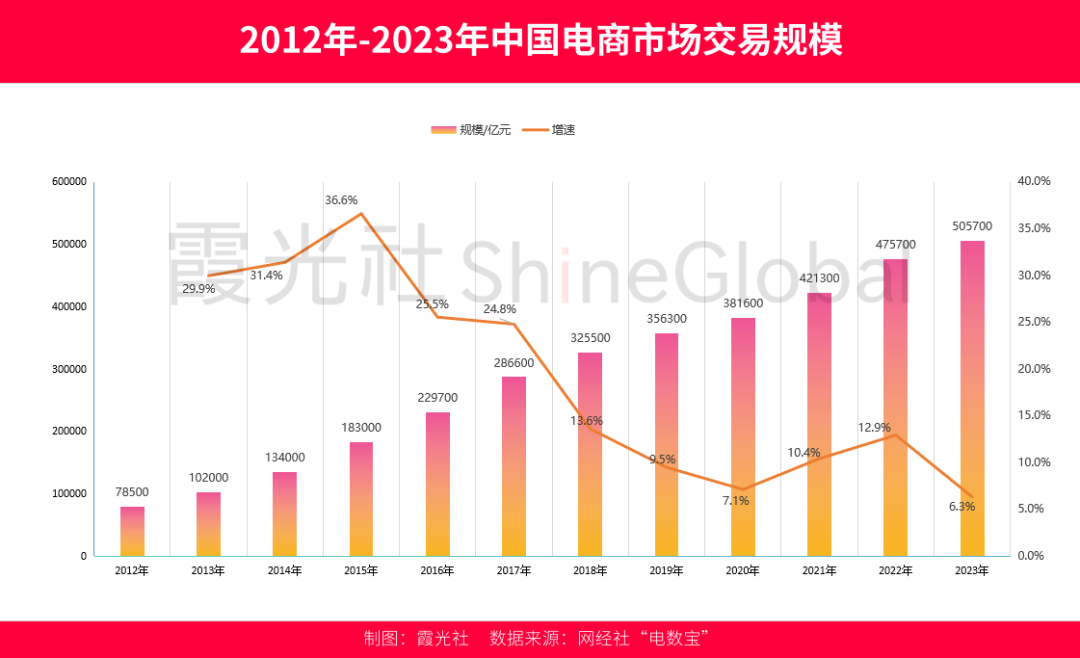

Over the past two decades, China's e-commerce development has garnered worldwide attention. From 2003 to 2023, China's e-commerce market size grew from RMB 1.16 billion to RMB 50.57 trillion, an increase of over 400,000 times. Several pivotal developments that fueled China's e-commerce growth include: in 2009, private express delivery services received national policy support and encouragement; in 2013, online payments entered a period of rapid growth; and in 2016, live streaming e-commerce emerged, ushering in a second growth curve for e-commerce.

In contrast, key factors such as logistics, online payments, and live streaming e-commerce in Southeast Asia have improved significantly in recent years. Coupled with the current explosion of "self-media influencers" in this youthful market, live streaming e-commerce, represented by TikTok Shop, is propelling Southeast Asian e-commerce into a new development cycle, presenting new opportunities and potential for cross-border e-commerce in the region.

In mid-September this year, while China was still celebrating the traditional Mid-Autumn Festival, delegations from Jiangxi and Jiangsu boarded flights bound for Southeast Asia.

One of the key items on their agenda was to explore cooperation opportunities in the Southeast Asian market with local enterprises, with a particular focus on the development prospects of cross-border e-commerce in the region.

In 2024, as overseas expansion continues to gain momentum, the Southeast Asian market has become even more attractive to Chinese companies venturing abroad.

A Chinese entrepreneur in Southeast Asia remarked that last year, one of his most important tasks was hosting visits from Chinese business inspectors; this year, he has hosted even more of them than before.

In Southeast Asia, Malaysia is one of the markets favored by Chinese businessmen. An entrepreneur in Shenzhen who does cross-border business (pseudonym Yu Hui) said that there is a rumor circulating in the overseas business community that over one million Chinese have traveled to Malaysia this year, "and flights from China to Kuala Lumpur are often fully booked."

This claim was corroborated by Malaysia's Minister of Tourism, Arts, and Culture, Datuk Seri Tiong King Sing, who stated earlier this year that as of May 2023, the number of Chinese visitors to Malaysia reached 1.18 million, an increase of 194% year-on-year. Furthermore, AirAsia Malaysia (AK) will begin operating four weekly flights from Penang to Shenzhen from October 28th, 2023 onwards.

What is it about Southeast Asia that attracts the attention of Chinese tourists, businessmen, and entrepreneurs?

For one, Southeast Asia is geographically close to China, with robust industrial demand and a rapidly growing economy, attracting many Chinese companies to invest there.

On the other hand, Southeast Asia's digital economy is also growing rapidly. According to the "e-Conomy SEA 2023" report published by Google, Temasek, and Bain & Company, the total gross merchandise value (GMV) of the digital economy in Southeast Asia is projected to reach USD 218 billion in 2023, a year-on-year increase of 11%. ASEAN Secretary-General Lim Jock Hoi has stated that the digital economy in the ASEAN region is expected to grow to USD 2 trillion by 2030.

A rapidly growing economy naturally attracts and requires more business participants.

Within the digital economy of Southeast Asia, e-commerce has emerged as the fastest-growing digital service. The "e-Conomy SEA 2023" report notes that the GMV of e-commerce in Southeast Asia reached USD 139 billion in 2023 and is projected to reach USD 186 billion by 2025, representing a 16% growth rate. This level of growth is considered high on a global scale, reminiscent of China's e-commerce market before 2018, when GMV growth rates of over 16% were common.

In fact, since China's e-commerce market entered its fast lane of development in 2003, it has experienced more than a decade of high growth. From 2004 to 2017, China's e-commerce market maintained a growth rate of over 20%, with some years even exceeding 40% in the early stages.

This sales channel gave rise to numerous well-known merchants and brands, making e-commerce a "wealth creation machine" at the time. Many brands leveraged the momentum of e-commerce to achieve leapfrog development and become leaders in their respective fields.

The rise of live streaming e-commerce in 2016 opened up another niche segment within the broader e-commerce industry. Since then, live streaming e-commerce has become increasingly popular among young consumers. According to the "DianShuBao" e-commerce big data platform of the China E-Commerce Research Institute, China's total online retail sales reached RMB 15.4 trillion in 2023, while the transaction volume of live streaming e-commerce amounted to RMB 4.9 trillion, representing a year-on-year growth of 40.48%.

Looking back at live streaming e-commerce in Southeast Asia today, it is reminiscent of the early stages of live streaming e-commerce in China around 2018, when it was on the verge of exploding in popularity.

TikTok Shop first launched in Indonesia in early 2021. In the first half of 2022, it expanded into Thailand, Vietnam, the Philippines, Malaysia, and Singapore. Subsequently, live streaming e-commerce began to take off in Southeast Asia.

A Southeast Asian girl live streaming in front of the camera

Public reports indicate that in 2023, TikTok Shop's total e-commerce transaction value in Southeast Asia reached approximately USD 16.3 billion, nearly four times the USD 4.4 billion recorded in 2022. However, the overall e-commerce penetration rate in Southeast Asia is still below 6%, leaving significant room for growth compared to China's 45.9% e-commerce penetration rate.

At the same time, many companies initially encounter differences when entering the Southeast Asian market compared to China.

In reality, Southeast Asia's population is ethnically diverse, with significant variations in customs, preferences, and income and consumption levels. This means that relying solely on domestically proven product selection and sales strategies may not fully resonate with local consumers. Therefore, businesses looking to advance in the region need to consider revising products and selecting items based on local consumer preferences, developing a unique Southeast Asian strategy tailored to the local market.

Taking the booming pet consumption trend this year as an example, Thai consumers prioritize high-quality, refined pet food, while Malaysian consumers are also interested in pet travel and toys. Businesses must prepare appropriate products to cater to these different market demands.

Building on this foundation, businesses can further enhance the consumer shopping experience by improving e-commerce service quality and perfecting logistics and payment infrastructure.

In August of this year, as some Southeast Asian e-commerce platforms entered profitability in individual markets, the profitability model of e-commerce in Southeast Asia was further validated, ushering in a new stage of development. Alongside optimizing platform services, greater emphasis is being placed on building e-commerce infrastructure such as logistics and payment systems.

An entrepreneur who has long provided e-commerce services in Southeast Asia told Xiaguangshe that while e-commerce in Southeast Asia has been growing rapidly in the past, consumers' experiences were often marred by inadequate local logistics and payment infrastructure, leading to issues like long delivery times and cumbersome online payment processes. However, significant improvements in logistics and payment experiences have been noticeable in the past two years.

"This year, overseas warehouses have become particularly popular. For instance, TikTok Shop has fully opened up access to overseas warehouses for cross-border merchants in Southeast Asia. The biggest advantage of overseas warehouses is that they significantly shorten logistics timelines by moving products originally shipped from China to local markets. Deliveries that once took a week can now be completed in 2-3 days," said the entrepreneur.

Online payments are also becoming more convenient. In Thailand, QR codes are increasingly displayed in shops across cities and towns. This is part of PromptPay, a digital payment system developed and promoted by the Thai government. According to the government's targets, 42% of payment transactions in Thailand will be digitized by the end of 2024. In Cambodia, the National Bank of Cambodia is also frequently collaborating with online payment providers to promote QR code payments.

Looking back at China's e-commerce development, growth rates peaked in 2013 and beyond, with an annual growth rate of up to 36.56%. A crucial factor behind this growth was the rapid development of online payments and the widespread adoption of electronic waybills, which significantly improved logistics efficiency. The improvement in e-commerce infrastructure contributed to a new level of growth in e-commerce transaction volume.

Similarly, Southeast Asia is now experiencing a surge in e-commerce infrastructure development, indicating significant growth potential for the industry. Unlike China, Southeast Asia's e-commerce sector is also witnessing the emergence of live streaming e-commerce, represented by TikTok Shop, which is creating new opportunities for entrepreneurs.

In fact, most Southeast Asian countries have felt the enthusiasm of Chinese businessmen this year. In addition to Malaysia, as mentioned earlier, an entrepreneur in Vietnam (pseudonym Li Tong) also observed a surge in Chinese businessmen visiting the country to explore e-commerce opportunities, with TikTok Shop emerging as the preferred platform for Chinese cross-border merchants looking to expand overseas.

"The popularity of live streaming e-commerce in Southeast Asia is closely related to some unique characteristics of the region," said Li Tong.

According to the latest statistics, Southeast Asia has a population of 678 million, with over 50% under the age of 30 and 74% under the age of 45. Young internet users in this region are avid social media users and receptive to new things. The combination of e-commerce and social interaction in live streaming is highly appealing to internet users in the region.

Mr. Lin, the head of a Southeast Asian live streaming e-commerce service agency, told Xiaguangshe that based on his experience with ad placements, the primary target audience is the 25-34 age group, followed by the 35-44 age group, with relatively few over the age of 45.

These young people, influenced by social media, have a higher acceptance of live streaming e-commerce. "Many college students work part-time as influencers in our company. When a brand enters the market, influencers will proactively reach out to the brand to help with content promotion," said Mr. Lin.

From logistics to online payments to the influencer community, the gradually improving ecosystem is fertile ground for the development of live streaming e-commerce in Southeast Asia.

An increasing number of people are realizing that live streaming e-commerce is emerging as a new species amidst the transformation of new retail scenarios.

This brings us back to the fundamental differences between traditional shelf e-commerce and live streaming e-commerce. Traditional shelf e-commerce relies on consumers actively searching for products and making purchasing decisions based on product descriptions and images. In contrast, live streaming e-commerce encourages purchasing decisions by showcasing engaging content and influencers experiencing products live.

As a result, the paradigm shifts from "people finding products" to "products finding people." This change reflects how live streaming e-commerce fully exploits the functional and emotional value of products, matching consumer needs from multiple dimensions and shortening the decision-making process for faster transactions.

Furthermore, there are differences in the sales process between shelf e-commerce and live streaming e-commerce. For a new fashion item, it typically takes about a week to arrive, be photographed, have its description written, and then be listed for sale. In contrast, with live streaming, products can be sold as soon as they arrive.

For popular items and those with strong seasonality or time sensitivity, time is of the essence, making it a crucial factor for merchants.

Through long-term observation of live streaming e-commerce in Southeast Asia, Mr. Lin has identified some patterns: "Generally speaking, new products tend to be sold on TikTok Shop. For instance, when a beauty brand launches a new product, its sales peak will undoubtedly occur on TikTok Shop due to the platform's larger traffic and broader user reach, which also helps to increase brand awareness."

Given these advantages, live streaming e-commerce has become the focus of attention in Southeast Asia's e-commerce market.

It is foreseeable that as the e-commerce ecosystem improves and live streaming becomes more professional, live streaming e-commerce will accelerate the reshaping of e-commerce and even new retail models in Southeast Asia.