""Billions of reductions" become standard, can e-commerce "traffic tax" be eliminated?

![]() 10/08 2024

10/08 2024

![]() 479

479

Store opening fees, tool fees, and technical service fees are fixed costs for merchants and account for a relatively low proportion. What really makes it difficult for merchants to survive is the traffic fee—this is a problem that both small and medium-sized merchants and Zhang Dayi have been forced to close their stores.

Author | Liu Shanshan

Editor | Yang Ming

"For us merchants, the most important thing is whether we can achieve equal traffic rights."

A merchant named "Xiaomi'er" who sells cat food on an e-commerce platform and once ranked top 10 in the entire platform complained. The cost is that they have to spend more than 3 million yuan in traffic fees each year, resulting in insufficient income to cover expenses.

All the money was earned by the platform. The unbearable operating costs forced her to permanently close the store. "I can't afford it anymore, I'm out."

Reducing the burden on merchants has become a common choice for major e-commerce platforms. "Since the second half of this year, we have continuously received preferential policies from various platforms, including reduction and rebate policies," several merchants reported.

Among them, the "billions of reductions" declared to reduce the burden on merchants has become the most talked-about topic in the e-commerce industry before Singles' Day. At the end of August, Pinduoduo announced its "billions of reductions" plan, which includes a package of reduction measures such as service fee refunds, margin reductions, exemption from logistics transit fees, upgraded merchant after-sales service, and automatic refund of technical service fees.

On September 12, Tmall and Taobao also introduced "billions of reductions" policies for this year's Singles' Day, including services like Return Guarantee, Quick Refund, and Commission-Free Promotions.

Similarly, JD.com introduced a "no registration required" mechanism for this year's Singles' Day, launching the "Hundred Billion Subsidies for Factory Goods" project for white-label products. Platforms such as Douyin E-commerce, Kuaishou, and Xiaohongshu also introduced preferential policies for merchants.

It is not difficult to see that the e-commerce industry is quietly undergoing a historic transformation. The question is, when "billions of reductions" become the industry standard, do merchants really benefit from the burden reduction? Will the e-commerce industry enter a new cycle as a result?

01

Why have "billions of reductions" become the standard?

"According to previous rules, many merchants struggled to survive for more than three years," a well-known e-commerce observer judged. In recent years, the negative effects of the intensifying "price war" in the industry have gradually emerged. Small and medium-sized merchants like "Xiaomi'er" who invested heavily and suffered greatly, or even went bankrupt, have become the norm.

During this year's 618 shopping festival, a news story went viral: a merchant earned only 550,000 yuan from an annual turnover of 18 million yuan on an e-commerce platform. This was earned through partnerships with gaming companies and inserting promotional cards into packages. "Am I working for the e-commerce platform?" This was his helpless lament.

A common formula in the e-commerce industry is that actual GMV minus actual costs equals the actual revenue for merchants. GMV is related to traffic, conversion rate, average order value, and repurchase rate, while the latter requires undertaking costs for store opening, operating tools, platform services, traffic promotion, logistics, and after-sales.

The increasingly sophisticated infrastructure has made logistics costs more efficient; production costs have been effectively reduced through manufacturing upgrades and the emergence of C2M large-scale customization.

The real significant expenditure is marketing costs, including traffic promotion, promotional activities, and advertising placement, which seems reasonable and even necessary—for example, using marketing tools and strategies to increase traffic, conversion rates, average order values, and purchase frequencies.

The real problem is that in situations of traffic depletion and excess supply on e-commerce platforms, the platforms intentionally or unintentionally increase the operating cost pressure on merchants.

A typical example is that influenced by top live streamers like Li Jiaqi and Wei Ya, platforms have skewed traffic heavily towards high-end brands and large companies for a long time. Coupled with the highest industry costs for live streaming "slots" and store marketing expenses, many merchants have seen a significant decline in the ROI of their marketing investments, with marketing costs rising too fast and survival space shrinking.

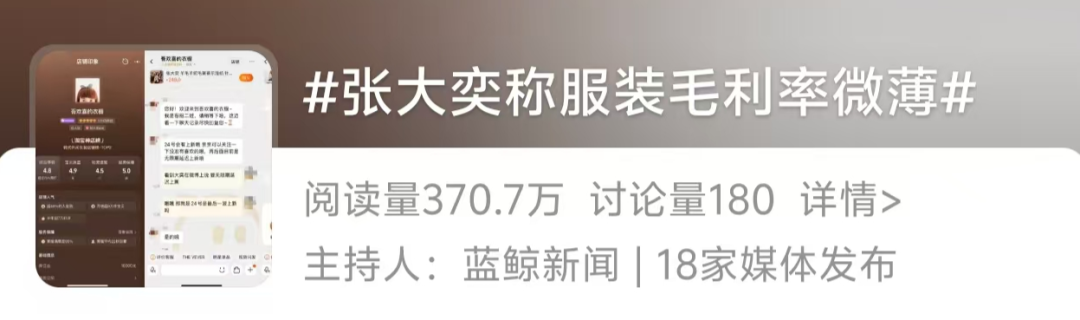

Not only small and medium-sized merchants but even top players struggle to bear the burden. Recently, well-known internet celebrity Zhang Dayi announced the closure of her 10-year-old online store "My Favorite Wardrobe" due to low gross margins and intensified traffic competition, ringing an alarm bell for the industry. According to relevant data, "My Favorite Wardrobe" has 12.41 million followers and sells over 90,000 products per month, making it a top-tier store on Taobao.

All these indicate that merchants, regardless of their size, now face difficulties in acquiring traffic, high operating costs, and uncertain GMV growth. As a result, either merchants suffer losses and exit the market or cut corners and pass on costs, leading to a vicious cycle where neither platforms, merchants, nor consumers benefit.

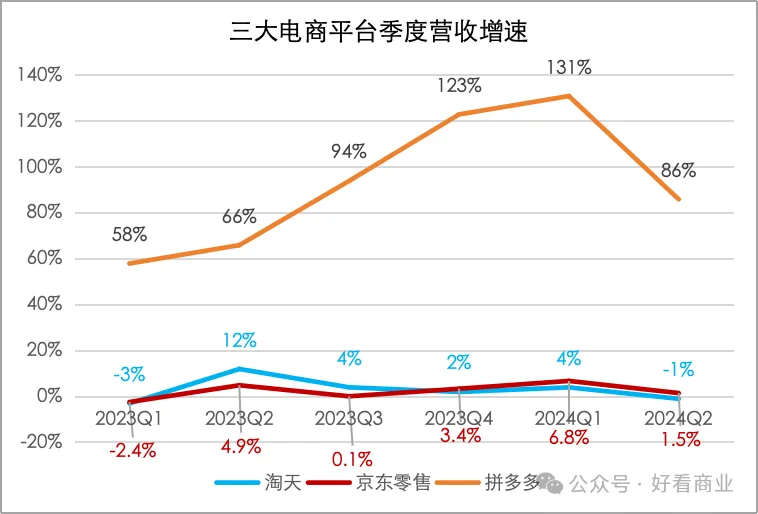

The difficulties faced by merchants, combined with the current complex economic situation, have made growth slowdown a keyword for major platforms. According to Alibaba's first quarterly report for fiscal year 2025, Taobao and Tmall Group's revenue was 113.373 billion yuan, a 1% decrease from the same period last year, making it the only business segment among Alibaba's six major segments to experience negative growth. JD.com also saw its revenue growth rate slow to just 1.2% in the second quarter, the lowest quarterly growth rate since its listing.

Wei Wenwen, President of Douyin E-commerce, also recently acknowledged that Douyin E-commerce's GMV growth rate slowed to 46% year-on-year, down from 320% and 80% in 2023 and 2022, respectively. Chen Lei, Chairman and Co-CEO of Pinduoduo, even expressed pessimism in a financial report conference call, stating that current revenue growth would slow down and that there would be no repurchases or dividends in the coming years.

The era of rapid growth is over. Nevertheless, a healthy business ecosystem requires balancing the interests of consumers and merchants. "Creating a favorable platform ecosystem remains crucial for stable growth in the future," executives from Pinduoduo and Alibaba concurred in recent half-year earnings conference calls.

As a result, reducing operating costs and helping merchants lighten their burden on the supply side has become the main theme of change in the e-commerce industry in recent months. Observers even consider this a battle for "new quality supply" in the industry.

Since 618, several platforms have held closed-door meetings with merchants to accelerate changes and adjustments to relevant terms. For example, Taobao began to loosen restrictions on full refunds, introduced a "semi-managed" model, made "experience score" the core basis for store traffic allocation, and eliminated annual fees. JD.com launched a "reverse price protection service," while Kuaishou E-commerce announced the "New Merchant Launch Plan." However, these changes are still being piloted on a small scale overall.

What truly made "billions of reductions" become an industry benchmark was Pinduoduo's introduction of a new "billions of reductions" policy at the end of August—it had a wider impact on merchants, and Pinduoduo made it clear that this was a long-term strategy.

Since then, platforms like Taobao and Tmall have explicitly mentioned "billions of reductions" in their new regulations. This is what the industry has remarked upon—from "billions of subsidies" to "full refunds" to "billions of reductions," the industry seems to be following Pinduoduo's footsteps.

02

What are the similarities and differences between similar policies?

So far, the burden reduction policies for top e-commerce merchants have been launched for more than two months and have gradually been implemented intensively. Overall, JD.com, which has economies of scale in self-operated categories, has a significantly different business model from Taobao and Pinduoduo, making direct comparisons difficult.

Direct comparisons can be made between Taobao and Pinduoduo—the two platforms have overlapping merchant groups and mainly adopt similar policies of "operational support + fee adjustments," but they differ in the speed, intensity, scope, and focus of burden reduction.

It must be acknowledged that the regulations of the two platforms are not empty promises but have, to varying degrees, alleviated the financial pressure on merchants during promotional periods and helped them acquire more business opportunities.

"Now the technical service fee for pay-after-use has been uniformly reduced to 0.6%, and with the automatic refund of previous resource position technical fees and promotion software service fees, we can save about 50-60,000 yuan per month on average, allowing us to invest more funds into the agricultural supply chain," said a fruit merchant from Sichuan on Pinduoduo.

Similarly, some Tmall merchants reported receiving refunded annual fees for those who achieved their annual sales targets from January to August this year. Additionally, merchants who joined after September 1st will no longer have to pay this fee annually.

It is worth noting that the refunded annual fees on Taobao and Tmall apply only to merchants with annual transaction amounts of ≤120,000 yuan. From September 1st to December 31st, 2024, merchants with transaction amounts between 120,000 and 1 million yuan will receive Alimama coupons equivalent to 50% of their basic service fees. Furthermore, for merchants with high average order values and those engaged in wholesale, the maximum fee will be capped at 60 yuan per transaction until 2025.

Annual fees—more professionally known as basic software service fees—can be understood as the cost of using the platform's servers, bandwidth, and software development. Previously, Tmall merchants in different categories had to pay annual fees ranging from 30,000 to 60,000 yuan. In contrast, Pinduoduo merchants did not have to pay this fee before. This means that Tmall has officially aligned itself with Pinduoduo in this regard.

Both platforms charge basic technical service fees—fees for providing merchants with transaction, logistics, data analysis, and other related technical services. Before the "billions of reductions," both platforms had different payment ratios based on the merchant's business category. After the "billions of reductions," both platforms charge a fee of "transaction amount x 0.6%" for pay-after-use services.

The 0.6% basic technical service fee is an industry-standard charging model adopted by Pinduoduo, Douyin, and JD.com—Taobao and Xianyu personal stores did not charge this fee before, but with the elimination of annual fees and the addition of a commission, it can be seen as a targeted complement.

In terms of entry barriers, Pinduoduo announced that the basic deposit for merchant stores will be reduced from 1,000 yuan to 500 yuan. Currently, Taobao individual and corporate merchants still need to pay a security deposit of 1,000 yuan, slightly higher than Pinduoduo's. Tmall deposits vary from tens of thousands to hundreds of thousands of yuan depending on the category.

The difference may not be significant for one or two stores, but it adds up for merchants who operate multiple stores. Some merchants revealed that many merchants in Quanzhou and Putian, Fujian, "operate multiple stores" with hundreds of stores as the norm.

In the after-sales link , which troubles merchants the most, major e-commerce platforms have made varying degrees of optimization and improvement. Taobao and Tmall's "Return Guarantee" policy is similar to shipping insurance. Consumers who successfully apply for and complete a return or exchange within 90 days of the merchant's order shipment will receive a refund for the first-weight shipping cost (excluding packaging fees, damage fees, and other expenses, with a maximum of 26 yuan).

Pinduoduo has made two main optimizations. First, it has opened a green channel for abnormal orders, malicious complaint orders, and negative experience orders from consumers, establishing a special after-sales service team. If the merchant successfully appeals, the platform will compensate for the relevant orders. Second, there is no longer a limit on the number of appeals.

It is worth noting that the two platforms differ in their appeal regulations. According to the "Taobao Platform Seller Dispute Appeal Management Regulations" formally implemented on August 19th, sellers have only one opportunity to file an appeal for the same adjudication matter, unless otherwise specified in other rules or rights. Industry insiders said that fewer appeal opportunities actually mean a higher probability of appeal failure.

The biggest difference may lie in logistics transit fees in remote areas. Although Taobao, which also has a large number of transit warehouses, has not yet followed Pinduoduo's lead. The difference in logistics operating costs in remote areas is one of the main pain points for merchants. In the past, when purchasing goods in remote areas such as Xinjiang, Tibet, and Inner Mongolia, the goods usually needed to be first shipped to a transit warehouse before being forwarded to the consumer, incurring transit fees in the process.

"The transit fee for a single order is over ten yuan," said one merchant. Currently, under Pinduoduo's new policy, the cost of shipping to transit warehouses will be borne by the platform.

03

Merchants will truly benefit only by escaping the traffic dilemma

Another significant difference is that although Taobao and Tmall were the first to loosen restrictions on full refunds and introduced the Return Guarantee service, they surprisingly did not loosen restrictions on the 0.6% "basic technical service fee for refund orders" for all products, as Pinduoduo did.

Previously, after a Pinduoduo order was refunded, the marketing fee for each order was not refunded until the new policy was introduced on September 25th, stating that for fully refunded orders, the platform would automatically refund the promotion fee in the form of red envelopes, covering all in-station activities such as Hundred Billion Subsidies, Flash Sales, Platform Promotions, and 9.9 Special Sales.

This is not a small amount. In recent years, the return rate in the e-commerce industry has continued to rise. According to data from the E-commerce Report, the daily online shopping return rate is 10%, and the return rate during Singles' Day can reach 30%.

According to the prospectus of Fengchao, a set of hidden data is even more striking. From 2019 to 2023, the compound annual growth rate of e-commerce reverse logistics in China's express delivery industry was 22.7%. Simply put, more than 20 million items are returned or exchanged every day.

Observers believe that the reason Alibaba does not cancel the basic technical service fee for refund orders is because, under the renewed focus on GMV as the core growth indicator, it needs to make up for the shortfall in CMR (customer management revenue).

Some also believe that Taobao and Tmall are newly following the 0.6% technical service fee. Considering the attractiveness of this measure to promote small and medium-sized merchants on the platform, Taobao and Tmall may soon follow suit to boost their long-tail effects. Last year, JD.com relied on its "Spring Dawn Plan" to drive a 4.3-fold increase in the number of merchants.

Overall, the actual operating costs such as store opening fees, tool fees, and category commissions are fixed costs that account for a relatively low proportion and are generally acceptable to most merchants. What really makes it difficult for merchants to survive is the traffic promotion fee—this is a problem that most merchants face. Without investing in traffic, GMV growth is impossible, but investing in traffic means working for the platform, which can be seen as a historical burden.

This is the root cause of the forced store closures experienced by small merchants to top players like Zhang Dayi. In her announcement of the store closure, Zhang Dayi revealed the common dilemmas faced by merchants over the years: high return rates, thin margins, high marketing costs, and increasing burdens.

According to incomplete statistics from LinkShop, since 2024, no fewer than 40 online women's clothing stores have announced closures or cessation of new product launches, including many established stores with millions of followers or decades of operation. Examples include "Sinking Deep Blue LOSVLUE", "Retro Big Bang", "The Bubble", "Girly Kaila", etc., all indicating that traffic promotion is a burden that merchants cannot bear.

In terms of the cost of traffic promotion, based on previous calculations by "Brocade", Taobao's category is well-established with various paid marketing tools, and merchants' overall marketing investment is between 10% and 30%. "LatePost" even reported that among Taobao's operating costs, traffic promotion expenses account for more than 50% for many merchants, with some even reaching 70%.

"Taobao Train is a paid search tool on Taobao's mobile app; Gravitational Magic Cube is a combination of the previous Super Recommendation and Diamond Display, mainly displayed on the homepage of Taobao's mobile app; Turbo Push is an explosive tool for new products or seasonal products, and products with good conversion rates can be quickly scaled up." One merchant believes that the most powerful tool is Wanxiangtai, which can appear in any position such as search, recommendation, and post-purchase. Simply put, the more traffic is allocated, the better Wanxiangtai can perform.

It is generally believed in the industry that traffic promotion costs are relatively lower on JD.com and Pinduoduo. JD.com POP merchants' marketing expenses account for about 10% of their revenue, with a comprehensive cost including fulfillment and third-party logistics of around 25%. On Pinduoduo, natural traffic (price, keywords) does not require payment. "JD.com's advantage lies in its self-operated business and logistics, while Pinduoduo's advantage is lower overall operating costs. For example, merchants not participating in the Hundred Billion Subsidy Program do not pay commissions, and those who do participate pay relatively low commissions, generally 1%-3%, not exceeding 5%."

On August 15, promotion tools such as Taobao Train, Gravitational Magic Cube, and Wanxiangtai officially ceased service – at the same time, Wanxiangtai Unbounded, which integrates the aforementioned tools, officially entered the stage of operational promotion. It integrates almost all commercial traffic on Taobao, bridging search, exposure, short videos, live broadcasts, leads, and dynamic images.

However, the "Hundred Billion Subsidy" did not mention Wanxiangtai Unbounded. Judging from the Double 11 actions, Wanxiangtai Unbounded did not take any additional measures to reduce the burden on merchants beyond enhancing AI capabilities.

Therefore, some merchants believe that the new policies of annual fee exemptions, relaxing the "refund only" rule, and charging basic software service fees will actually make it difficult to reduce operating costs for small and medium-sized merchants with limited GMV – the 0.6% basic software service fee is a very tangible cost input for small and medium-sized merchants.

"The cost of acquiring customers continues to rise, and if the traffic allocation method remains unchanged and fails to achieve traffic equality, small and medium-sized merchants will still face difficulties in survival, and the cost of acquiring traffic will only continue to increase." One merchant operating women's clothing believes that, undoubtedly, all resources will tend to be allocated to larger-scale merchants with greater financial resources to invest in traffic promotion.

In recent quarters, Taobao has gradually allocated more traffic to small and medium-sized merchants with more competitive pricing, but in terms of GMV, it is still primarily contributed by top merchants. According to a report released by Orient Securities, the number of active merchants on Tmall exceeds 100,000, with the top 1% of merchants contributing 30%-40% of GMV. On Taobao, which has over 1.2 million active merchants, the top 6% contribute 40% of GMV.

This poses a dilemma for Taobao: if it favors top merchants, small and medium-sized merchants will struggle more and lose more business; if it favors small and medium-sized merchants, their ability to pay for traffic will be significantly inferior to that of top merchants, affecting Alibaba's revenue and profits.

Therefore, when the "Hundred Billion Subsidy" becomes an industry standard, whether it can boost the confidence of merchants on various platforms, balance the interests of merchants, platforms, consumers, and the industrial chain, and truly reduce the burden on merchants on various platforms, remains to be observed over a long period of time.

From the platform's perspective, however, this may also be a watershed moment – under different traffic operation rules, Taobao's GMV may grow, while Pinduoduo's revenue growth will continue to slow down. During the recently concluded second-quarter earnings call, Pinduoduo's management indicated that they are prepared to sacrifice short-term profits for long-term investments.

"We expect CMR growth to gradually synchronize with GMV growth over the next few quarters," said Alibaba's management during the earnings call. The 0.6% technical service fee will contribute revenue over the last seven months of the fiscal year. According to previous media calculations, an increase of 0.6% in CMR will bring more than 28 billion yuan in positive revenue to Alibaba, with direct profit exemptions contributing around 10 billion yuan.

END

Produced by: Huang Qiangqiang