How high can Netflix fly after its thrilling performance?

![]() 10/18 2024

10/18 2024

![]() 634

634

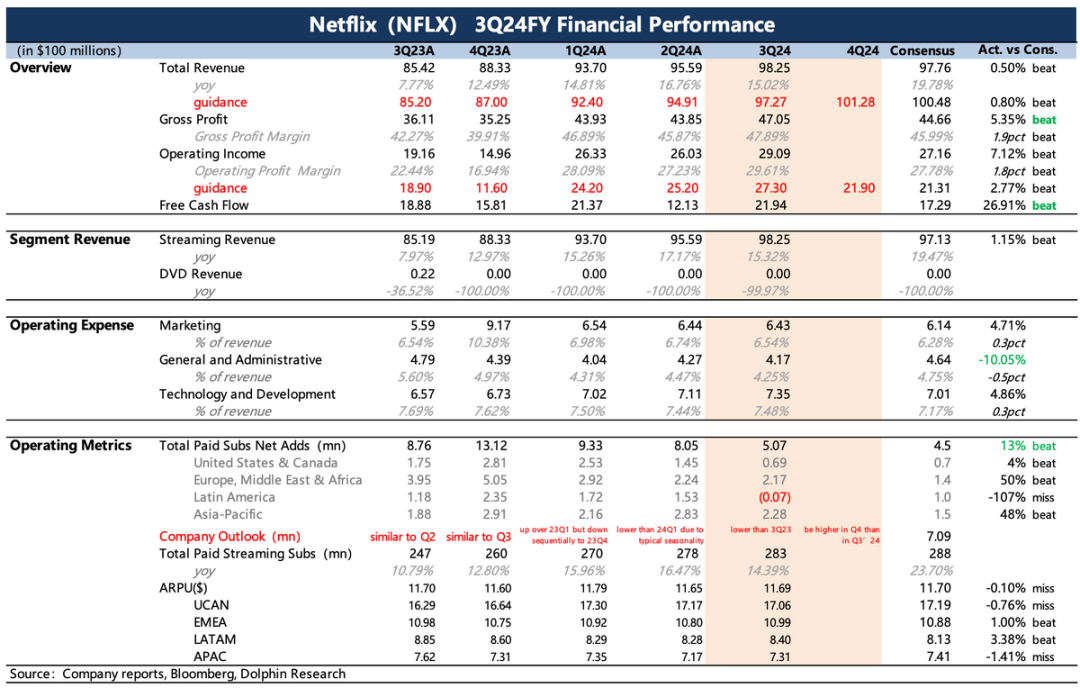

Netflix (NFLX.O) released its Q3 2024 financial results after market close on October 18, Eastern Time. The results were solid, with all key metrics meeting or slightly exceeding market expectations. As Dolphin mentioned in the previous quarter, the market had overreacted to Netflix's revenue guidance miss for Q3, but given the relatively stable competitive environment in the short term and Netflix's typical peak season in the second half of the year, the outlook remains relatively positive.

In addition to slightly exceeding expectations for Q4 guidance, Netflix also provided guidance for 2025. From both revenue and profit perspectives, the guidance falls within market expectations, but the implied margin improvement is slightly slower than anticipated, potentially due to the widespread promotion of lower-priced advertising-supported plans next year, which may negatively impact short-term profitability. Key highlights from the earnings report:

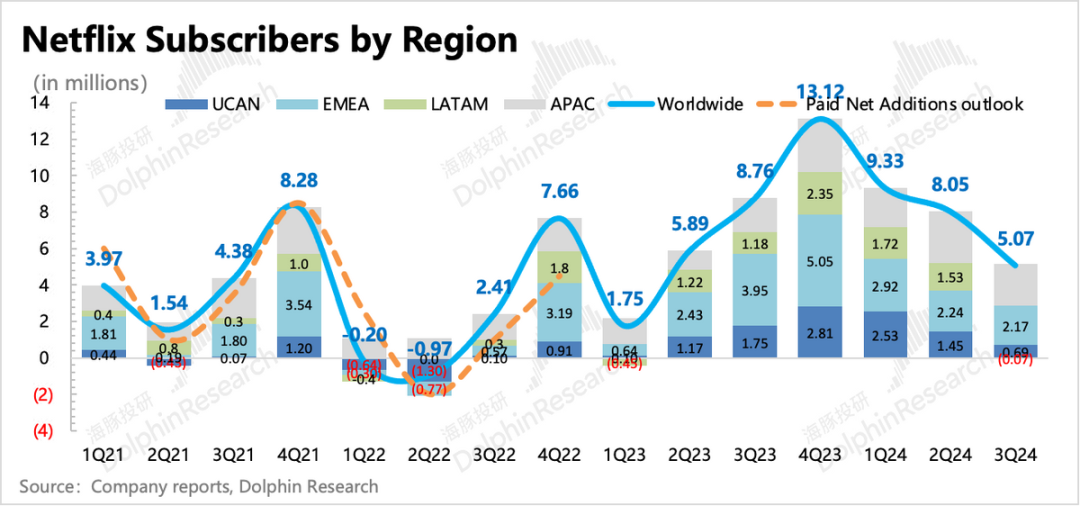

1. Subscriber Growth: Q3 on Track, Q4 Seasonal Uptick Expected Due to Peak Season and Popular Content

Netflix added 5.07 million net subscribers in Q3, slightly beating Bloomberg consensus estimates and in line with top analyst forecasts.

For Q4, Netflix expects subscriber growth to be higher than Q3 due to seasonal trends, bolstered by the release of "Squid Game" Season 2 and popular sports events like "The Jake Paul/Mike Tyson fight."

2. Europe and Asia Drive Subscriber Growth

North America, which benefited from efforts to combat account sharing, continued to slow down in Q3 after the impact of price increases at the end of last year. Europe and Asia returned as the primary sources of subscriber growth, while Latin America saw a sequential decline.

According to third-party data:

The UK, France, Germany, Japan, and India saw the highest growth rates this quarter. Beyond general acquisition strategies, Netflix relies heavily on increased investment in local content production to drive subscriber penetration.

In Latin America, including Brazil, downloads declined year-over-year and quarter-over-quarter, attributed by the company to price increases and limited local content offerings. Dolphin believes this may also be due to diminishing benefits from early account sharing crackdowns in the region.

3. Growing Share of Advertising-Supported Subscribers

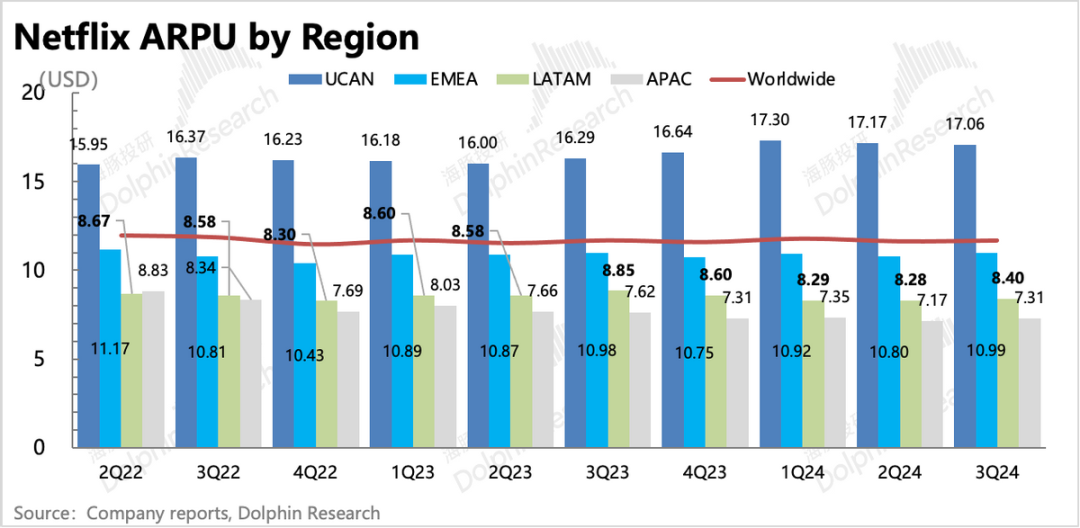

Apart from the US and Canada, where ARPU continued to decline quarter-over-quarter, all other regions saw a resumption of growth in Q3. While there were price increases in the US and Canada over the past six months, there was no apparent "surface-level" price increase in terms of per-user spending, reflecting the growing share of advertising-supported subscribers. With advertising inventory not yet fully utilized, these lower-priced plans naturally drag down overall ARPU.

The company disclosed that advertising-supported subscribers grew 35% quarter-over-quarter, up from 34% in the previous quarter. With over 40 million advertising plan subscribers disclosed in May, there are now likely over 70 million, accounting for over 25% of total subscribers.

4. 2025 Revenue and Profit Guidance in Line with Expectations

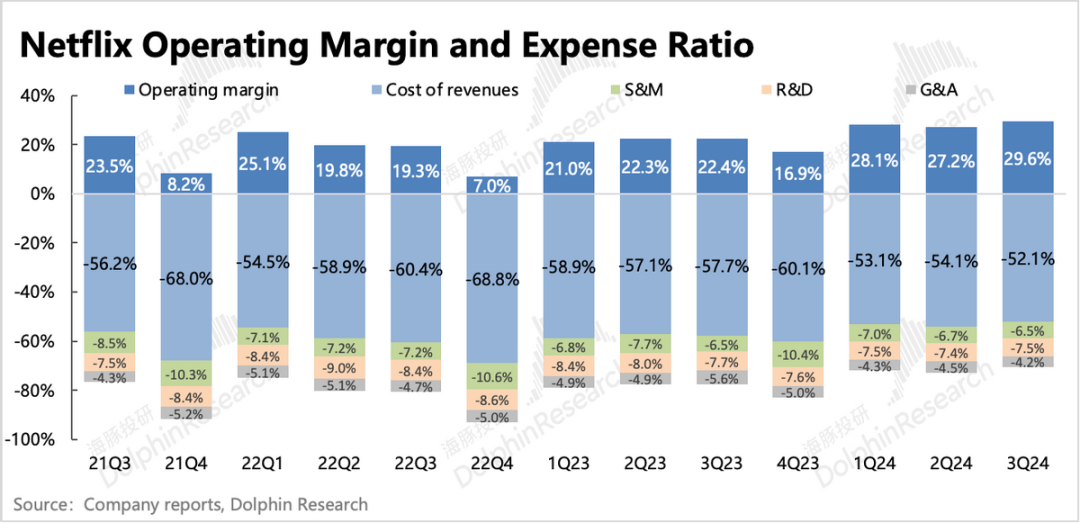

Netflix generated an operating profit of $2.9 billion in Q3, up 52% year-over-year and accelerating sequentially from the previous quarter despite a high base. This was driven by steady double-digit revenue growth of 15% coupled with continued cost control.

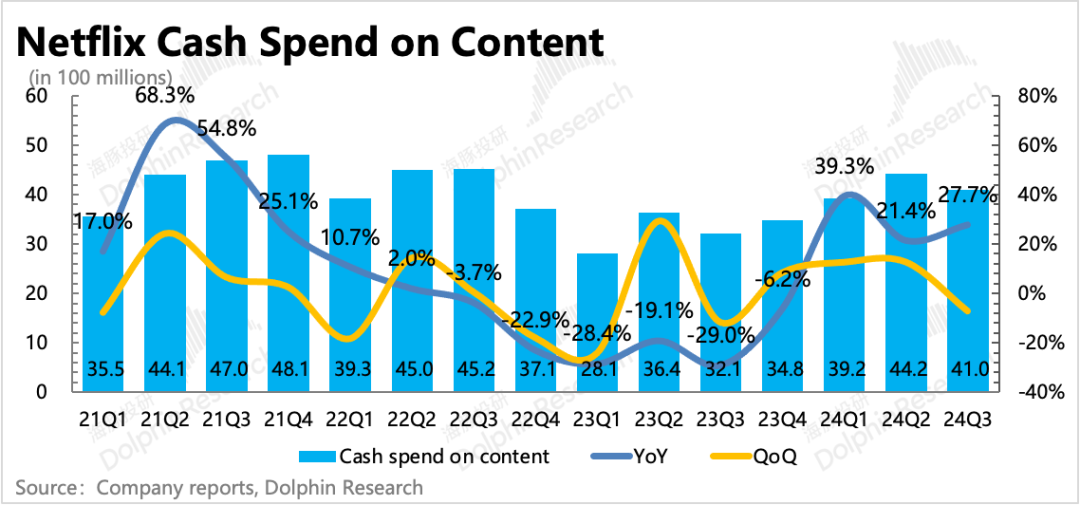

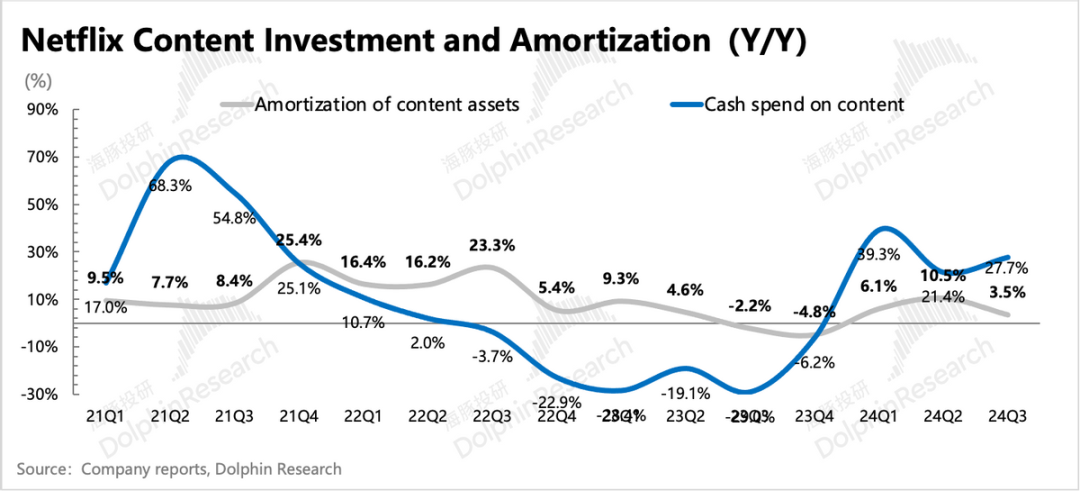

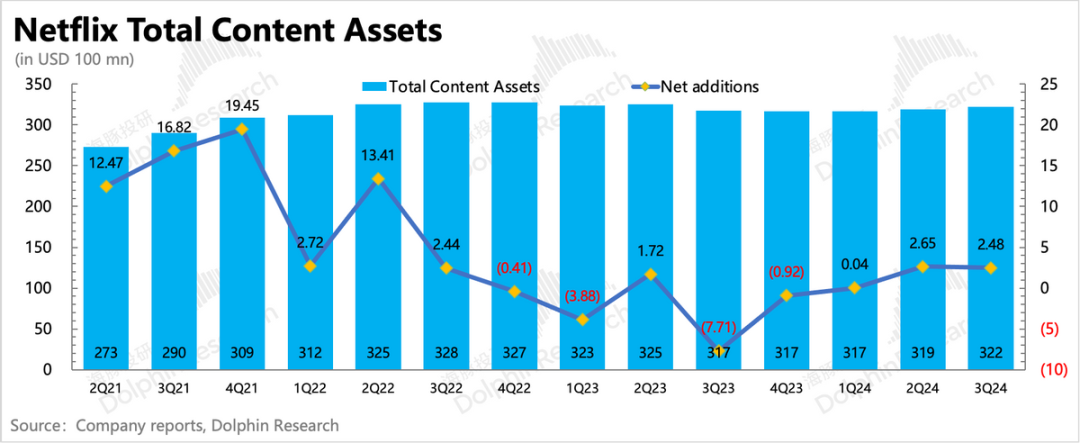

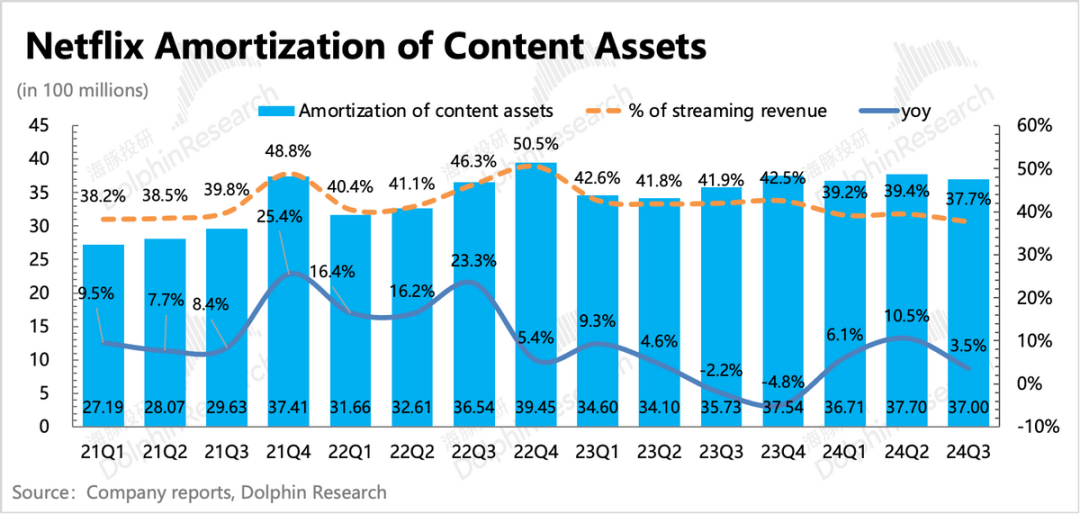

However, the quarterly gross margin improvement may have been influenced by temporary factors, as content cost amortization declined slightly quarter-over-quarter. This could be attributed to a relatively weaker slate of content compared to the previous quarter and the same period last year. As major shows premiere in Q4, content costs are expected to rebound. Over the medium term, Netflix's content investment is steadily recovering post-strike.

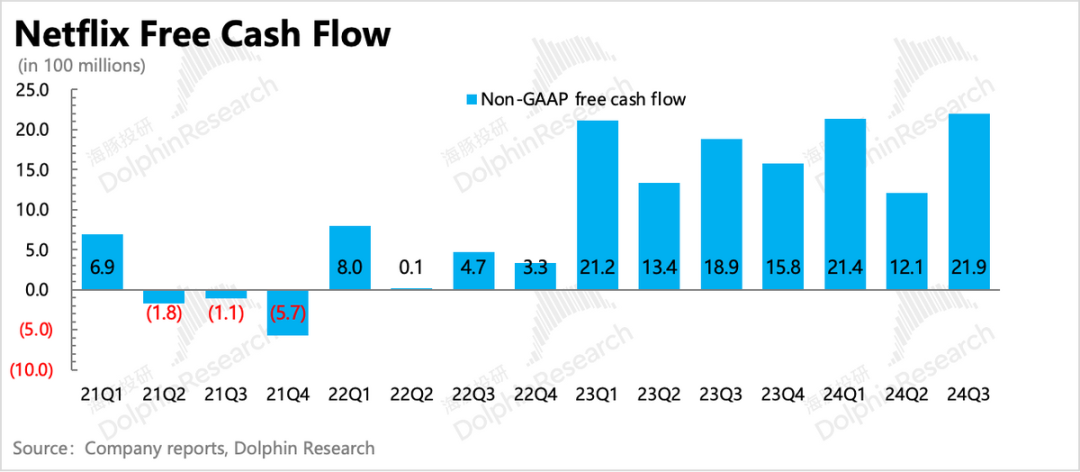

Increased investment also impacted free cash flow, with Netflix spending less than $12.5 billion of its $17 billion content budget in the first three quarters. This suggests a spend of $4.5 billion in Q4, accelerating the pace. Despite this, due to higher revenue and profit margins, the company raised its free cash flow guidance from $5-$6 billion to $6-$6.5 billion.

Based on positive expectations for combating account sharing, advertising revenue, and pricing power, Netflix raised its 2024 operating margin guidance to 27% and expects a further increase to 28% in 2025. The smaller year-over-year increase reflects the potential drag on margins from the growing share of advertising-supported subscribers, who generate lower ARPU than standard plan subscribers.

5. Borrowing to Fund Buybacks

Netflix has a history of debt financing to fund its substantial content investments, particularly during early stages when profits were thin. With a new investment cycle underway, Netflix has limited excess cash on hand.

As mentioned in our previous earnings review, there was a $600 million gap between investment and liquidity. In Q3, Netflix closed this gap by issuing top-rated blue-chip bonds, raising $1.8 billion primarily to repay short-term debt maturing within 12 months.

Despite the need for financing to address short-term cash flow gaps, Netflix did not slow down its share repurchases. It spent $1.7 billion to repurchase 2.6 million shares in Q3, with $3.1 billion remaining under its authorized repurchase program.

6. Key Financial Metrics Overview

Dolphin Investment Research Perspective

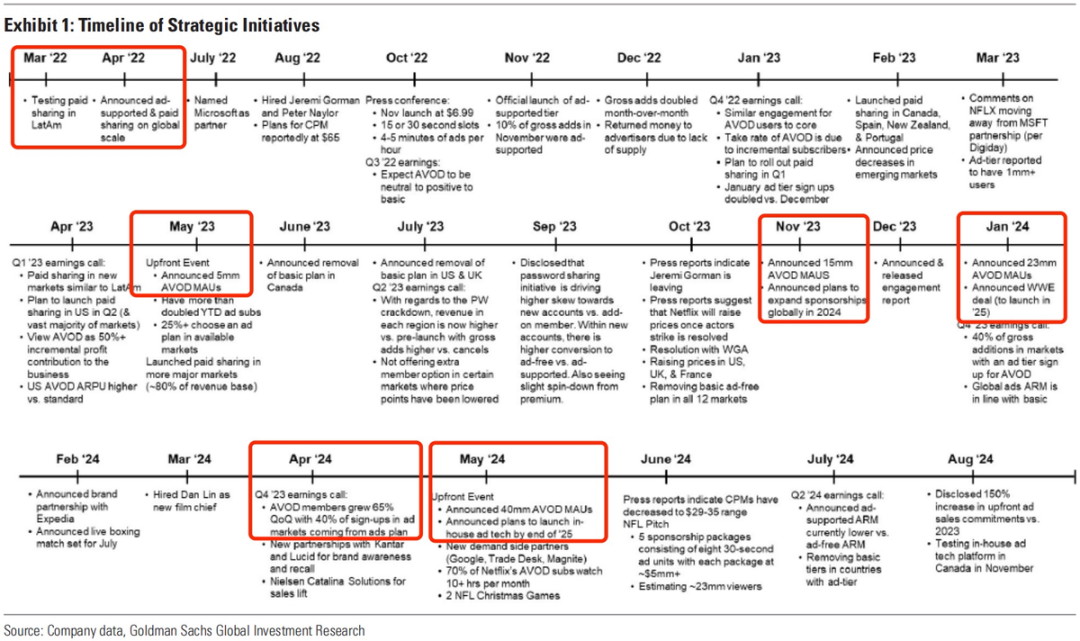

Since peers began prioritizing profit over growth in 2023, it signals a shift in the streaming landscape, with Netflix facing less intense competition. The Hollywood writers' strike further accelerated this trend, benefiting Netflix with its content library advantage. Its measures to combat account sharing, introduce advertising plans, and raise prices have been Smooth implementation , while competitors have seen limited benefits.

Ultimately, users are willing to pay for quality content, and price is not the primary consideration. This is why Dolphin has been less concerned about Netflix's fundamentals in the short term, as we highlighted late last year.

However, as we enter 2025, with the benefits of combating account sharing waning and competition heating up again (with signs of competition emerging in Q3 due to weaker content offerings from Netflix), maintaining growth will be challenging for Netflix, especially given high market expectations (current market valuation implies a 2025 forward PE of 30x, with revenue growth expected at 12% and operating profit growth at 16%). More efforts will be needed to meet these expectations.

Sports and gaming are significant investment areas for Netflix. While gaming is a natural extension of Netflix's mature IP portfolio and primarily enhances subscriber benefits without standalone monetization, sports content represents a more strategic shift in its business model, potentially tied to advertising plans.

However, the success of these efforts remains to be seen. Short-term pressures on the advertising revenue model may persist until advertising tracking, targeting technology, and partner ecosystems mature. Netflix currently partners with advertising platforms but plans to manage its own campaigns in the future. Whether the market's high expectations can be sustained remains uncertain.

,

The market also views pricing power as a growth driver for Netflix, but this is based on the assumption of a slowing overall subscriber base. Dolphin is cautious about Netflix's pricing potential in its ad-free plans, given its already high prices and the competitive landscape.

For Detailed Analysis

I. Subscriber Growth: Q3 on Track, Q4 Expected to Rise Seasonally

Netflix added 5.07 million net subscribers in Q3, exceeding Bloomberg consensus of 4.5 million and in line with top analyst forecasts. Subscriber growth continued to be driven by efforts to combat account sharing and the introduction of advertising plans.

Regionally, North America continued to slow, potentially due to diminishing benefits from advertising plan promotions and price increases. In contrast, Asia and Europe remained the primary growth drivers, with significant gains in Japan, India, the UK, and France.

Netflix plans to expand advertising plans to more regions. As of Q3, advertising-supported subscribers grew 35% quarter-over-quarter (following growth rates of 70%, 70%, and 67% in the previous three quarters), implying a subscriber base of over 70 million or over 25% of total subscribers.

For Q4 2024, Netflix expects seasonally higher net subscriber additions than Q3. Market consensus stands at 7.09 million. With the release of "Squid Game" Season 2 and popular sports events, Dolphin believes Netflix can exceed expectations.

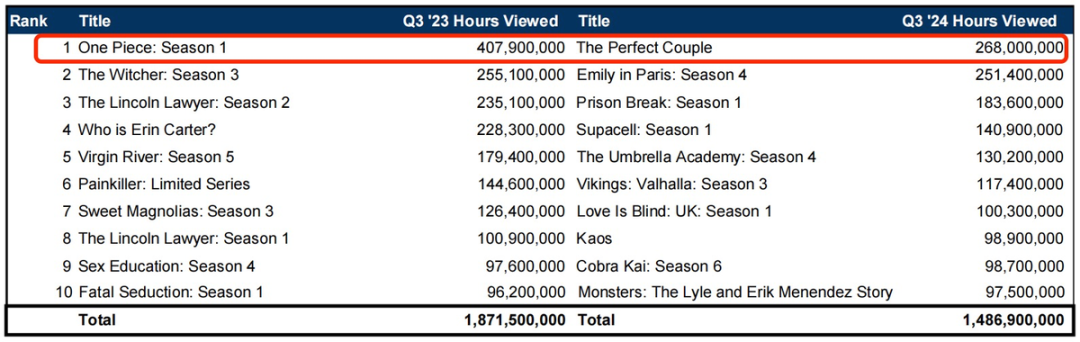

While Q3 is typically a peak season, the sequential improvement was muted due to diminishing benefits from combating account sharing and a relatively weaker content slate. Compared to the same period last year, top 10 show ratings in Q3 were lower.

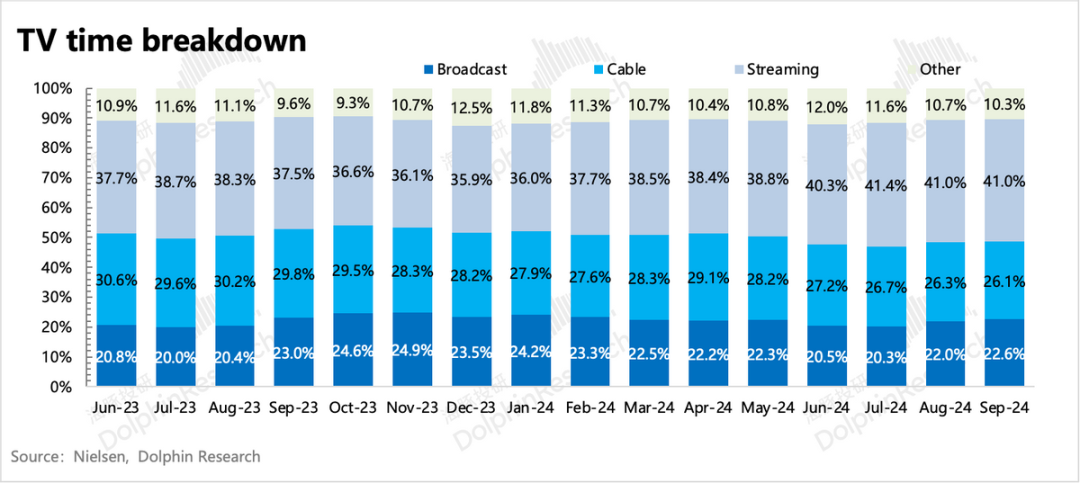

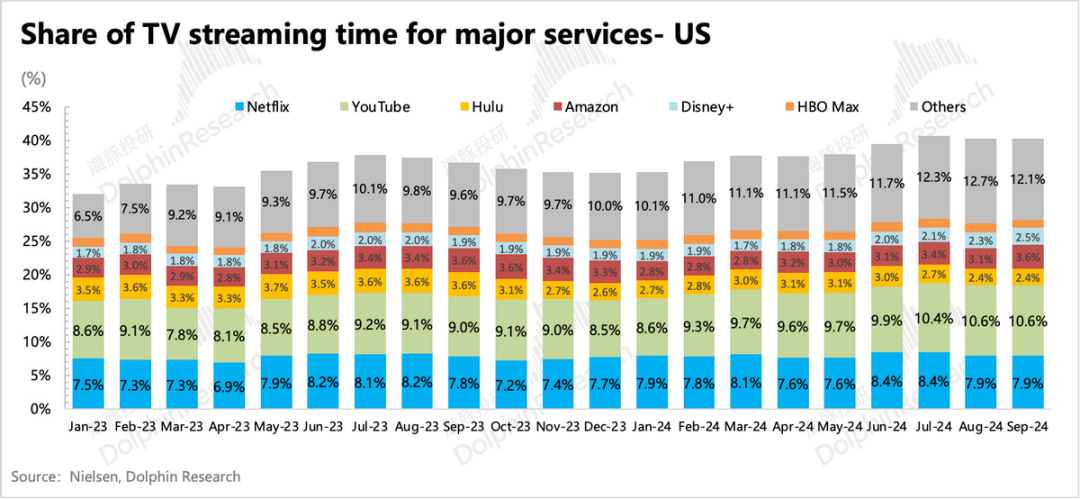

In the long run, the key narrative is the substitution of cable TV by streaming services, with Netflix maintaining its competitive edge and industry leadership. According to Nielsen, despite the Olympics and US presidential debates (typically viewed on cable TV), streaming viewership share still increased by 1 percentage point to 41%, setting a new high.

II. North America Slows, Europe and Asia Drive Growth

Netflix generated $9.83 billion in revenue in Q3, up 15% year-over-year but slightly weaker sequentially. DVD revenue declined to zero following the company's announcement to shut down the service by the end of Q3 2023.

Streaming revenue growth was primarily driven by subscriber expansion. Despite price increases in some regions, there was no apparent "surface-level" price increase in terms of per-user spending. Except for Latin America, where ARPU marginally grew due to significant price hikes, all other regions saw declines in ARPU, reflecting the growing share of advertising-supported subscribers.

Netflix disclosed that advertising-supported subscribers grew 35% quarter-over-quarter, up from 34% in the previous quarter. With over 40 million advertising plan subscribers disclosed in May, the current subscriber base is likely over 70 million, accounting for over 25% of total subscribers.

While advertising revenue is not expected to significantly contribute to Netflix's financials in 2025, its contribution is projected to increase, with advertising revenue currently accounting for around 5% of total revenue. However, advertising monetization is highly correlated with traffic, underscoring the importance of expanding the subscriber base. This includes replicating strategies from the UK, France, and North America by accelerating the phasing out of basic plans and promoting advertising plans in more regions.

,"While this may temporarily drag down per-user ARPU, especially given Amazon Prime's experience of declining user engagement post-advertising introduction, the long-term benefits are significant. If Netflix can improve its advertising technology and navigate the adaptation period, advertising-supported subscribers may generate higher ARPU than basic plan subscribers, enhancing monetization efficiency and profit margins.

,

However, for Netflix, which has limited advertising experience, this remains a work in progress. To prove its advertising conversion rates, Netflix will need to invest more in foundational technologies or partner with external advertising agencies, especially as it faces competition not just from YouTube but also Google and Amazon.

,"III. Competitive Landscape: Keeping an Eye on YouTube and Amazon

As previously discussed, Dolphin believes Netflix will operate in a relatively comfortable zone throughout 2023. However, due to a weaker content slate in Q3, competitors like YouTube gained ground in viewership share.

,"According to Nielsen, Netflix's viewership share fell to 7.9% in Q3, while YouTube and Amazon Prime Video continued to gain. Disney+ benefited from bundling Hulu, offsetting Hulu's decline and maintaining overall stability.

,"While YouTube's share gains were expected, Dolphin advises monitoring competitors' momentum in Q4. If Netflix's viewership share recovers with stronger content offerings, it would indicate a relatively stable competitive environment in the short term.

IV. Bridging Cash Flow Gaps with Financing and Continuing Buybacks

Netflix set a content investment target of $17 billion for 2023. As of Q3, it had spent $12.4 billion, with Q3 investment declining sequentially but accelerating year-over-year. With 27% of the annual budget remaining, investment is expected to accelerate in Q4.

The free cash flow rebounded to RMB 2.19 billion in the third quarter. Due to the improvement in operating margin, the annual cash flow target for 2024 was raised from RMB 5-6 billion to RMB 6-6.5 billion. However, as mentioned in the previous quarter's review, the issue of Netflix's funding gap was addressed by issuing bonds in the third quarter. The RMB 1.8 billion raised through bond issuance will be used to repay bonds maturing within 12 months.

Despite the short-term funding gap that necessitated financing, Netflix has not slowed down its share repurchases. In the third quarter, the company repurchased 2.6 million shares at a cost of USD 1.7 billion, with an authorized repurchase quota of USD 3.1 billion remaining.

V. Potential Slowdown in Profit Margin Growth Next Year

Netflix achieved an operating profit of RMB 2.9 billion in the third quarter, a significant year-on-year increase of 52%. The profit margin rose to 29.6% quarter-on-quarter, and the full-year operating margin guidance was raised from 26% to 27%, representing a 7 percentage point increase year-on-year.

Breaking it down, the increase in profit margin in the third quarter may have been partly due to an accidental improvement in gross margin caused by lower amortization costs as a result of weaker content offerings during the period. In terms of operating expenses, administrative expenses declined significantly year-on-year, but marketing and R&D expenses accelerated.

The company's guidance for the 2025 operating margin is 28%, representing a 1 percentage point increase over 2024, indicating a noticeable slowdown in the pace of improvement. Although 28% is in line with market expectations, the market had anticipated a 2 percentage point increase to 28%.

Dolphin Insights believes that a significant factor behind this is the expected increase in advertising revenue next year, which may drag down profitability due to the short-term lower ARPU. Additionally, investments in new content, such as sports, games, and movies, will require more marketing and promotion efforts. Moreover, optimizing R&D expenses will be challenging as the company aims to build its own advertising system and enhance ad tracking and targeting technologies. Therefore, if competitive pressure intensifies next year, it could potentially have a greater impact on Netflix's short-term profitability.

While it remains to be seen whether Netflix's absolute monopoly position in the industry will face pressure, the aforementioned factors undoubtedly limit the further upside potential of Netflix's valuation given the current growth expectations implied in its valuation.