The impact of cross-border e-commerce sales promotions is surging in Southeast Asia

![]() 11/06 2024

11/06 2024

![]() 646

646

Edited by | Liu Jingfeng

While many merchants are preparing for domestic sales promotions, a new battleground for sales promotions has emerged.

Walking down the bustling streets of Ho Chi Minh City, Vietnam, one cannot help but notice the pop-up promotions and discounts on large screens. Inside malls, eye-catching promotional banners advertise discounts on various products, continuously stimulating consumers' enthusiasm for shopping.

Online, sales promotions have become the most critical driver of consumer spending. Take Vietnam's sales promotion in the first half of this year as an example. Võ Hà Linh, a TikTok influencer with over 4.88 million followers, has long been a leader in Vietnam's live streaming e-commerce sector. During the 6.6 sales promotion, she set a record for single-session live streaming sales, ranking first among Southeast Asian live streams on that day.

In Thailand, online shopping has become a habit, and online sales are even surpassing those of offline convenience stores. According to Statista, Thai online shopping reached an all-time high in the past year, with a value of 700 billion baht, equivalent to the combined sales of over 14,000 convenience stores. Among these sales, influencer marketing and online promotions have emerged as new growth engines.

In fact, not only Vietnam and Thailand but also the rapidly developing e-commerce markets in Southeast Asia, including Malaysia and the Philippines, are continuously evolving with new promotional strategies. Here, in addition to traditional shopping festivals like Eid al-Fitr and Songkran, consumers are also familiar with shopping festivals like 6.6, 9.9, 11.11, and 12.12.

The impact of sales promotions is surging in Southeast Asia, propelling cross-border e-commerce in the region into an era of branded consumption.

Many people do not realize how strong the shopping desire of Southeast Asian consumers is.

"Southeast Asian consumers seem to have an innate desire to shop. They are always enthusiastic about purchasing novel products. Domestic consumers might use a product for many years, but many young people here particularly enjoy replacing old products with new ones," said Lisa, who has lived in Southeast Asia for many years.

Taking luggage as an example, Vietnamese consumers generally favor two types of luggage: high-end brand alternatives and products with unique brand designs. Young people, in particular, adore the latter, with almost all popular and trending items falling into this category.

Especially with the rise of cross-border e-commerce in recent years, sales promotion festivals have become the most anticipated shopping events for local consumers.

"I'm really looking forward to the 11.11 sales promotion. The online shopping model allows me to shop at ease even when I'm busy with work, without worrying about missing discounts because I don't have time to go to the mall," shared Dizaye, a Malaysian girl.

This is her second 11.11 sales promotion. In her view, the variety of products available online is gradually increasing, especially those with excellent cost-performance ratios.

Yang Zhenxin, the overseas manager of the Coveral Klors luggage brand, has been paying attention to the Southeast Asian e-commerce market, especially in Vietnam, Thailand, and the Philippines, since 2017. Over the past seven years, he has observed significant changes in the Southeast Asian e-commerce market:

For example, consumers now have more options for online shopping, evolving from traditional e-commerce shelves to new live streaming e-commerce and from traditional holiday shopping festivals to emerging shopping festivals like 6.6, 9.9, 11.11, and 12.12.

In terms of gameplay, consumers' understanding of sales promotions has greatly improved. "Two or three years ago, we had to teach users how to get and use coupons more economically during sales promotions. Now, everyone has a certain understanding of roulette wheels and prepayments," Yang said.

From a consumer trend perspective, consumers' attitudes towards price reductions have begun to diversify. "In the past, people would buy whatever was cheaper. But in the past two years, we've seen that people place more emphasis on the cost-performance ratio of products. For example, within a certain price range, they will compare brands, design, quality, and not just focus on low prices," Yang added.

Live streaming is a particularly suitable marketing method for conveying cost-performance ratios. Through live explanations by hosts, consumers can intuitively understand the value of products. Limited-time discounts and on-site promotions during live streams also help consumers perceive the cost-performance ratio of the products being sold.

A prominent example is the Vietnamese market. In the first half of this year, Võ Hà Linh, a top Vietnamese influencer, set a new record for GMV (Gross Merchandise Volume) in a single live stream session in Southeast Asia on TikTok Shop. It's worth noting that among all Southeast Asian countries, Vietnam is neither the most economically developed nor the most populous, yet it maintains sales records for top influencer live streams. "It's a bit like the domestic market now, with the rapid rise of top live streamers," Yang said.

The success of top influencers to some extent reflects the maturity of influencer live streaming in the region.

"A few years ago, there weren't many influencers in Vietnam. Later, the number of influencers gradually increased, but initially, their cooperation was very rudimentary and simple. Basically, the influencer would just finish speaking and post a link, and some wouldn't even say 'three, two, one, link up!'" Yang observed. This meant that influencers did not fully explore the true value of the products they were promoting, nor did they stimulate a strong desire in consumers to purchase them.

However, changes have become increasingly apparent since last year. Especially in July this year, after Yang launched the Coveral Klors luggage brand in Vietnam and began live streaming, he personally experienced this significant change. "I found that the influencers we have deep cooperation with are not only very proficient in the process but also increasingly professional in their explanations," Yang said. For example, they provide additional value, create promotional atmospheres, and form price comparisons.

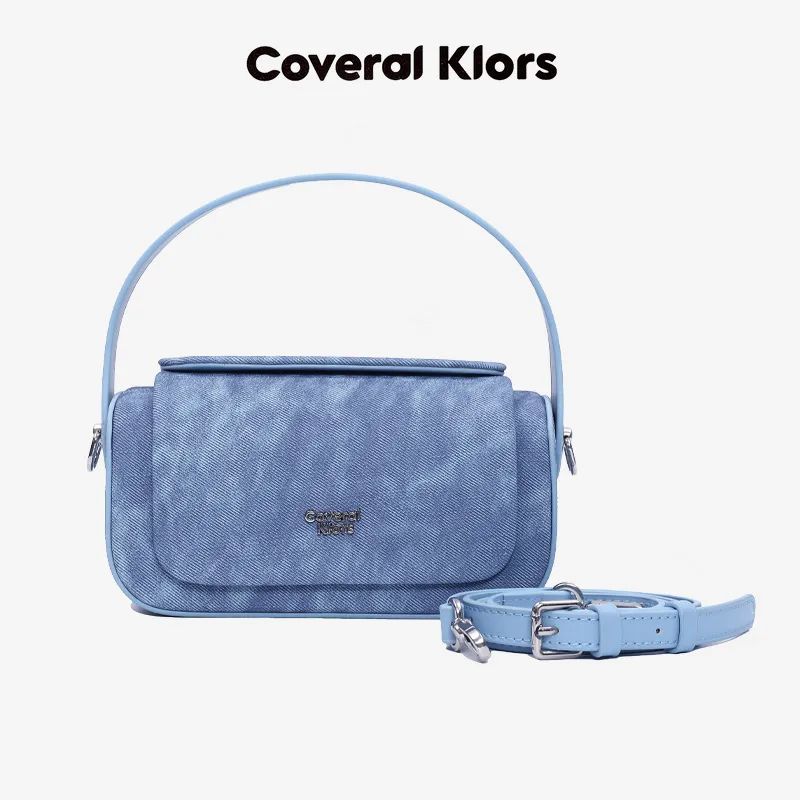

Shortly after entering the Vietnamese market, Coveral Klors luggage, with its trendy designs and high-end texture, gained the favor of zhuzhu, a Vietnamese influencer with over 1.38 million TikTok followers. As a top Vietnamese influencer, zhuzhu has always had strict requirements for the quality of the products she promotes. Her initial intention in collaborating with Coveral Klors was to bring this high-quality luggage to more Vietnamese buyers. In the future, she hopes to introduce more high-quality cross-border e-commerce products to Vietnamese consumers through content e-commerce.

Vietnamese top influencer zhuzhu showcasing Coveral Klors bags (photo provided by the interviewee)

With professional influencer sales, the results achieved surprised Yang – over 800 orders were placed on the first day the product was launched. It's worth noting that Coveral Klors luggage has a medium-to-high price range of 150-200 yuan in Vietnam, but its sales exceeded 300,000 yuan in the first month. "This was achieved during a cold start," Yang added.

Afterwards, Yang reviewed the situation and believed that "Southeast Asian e-commerce is increasingly reliant on influencer marketing and live streaming." This means that for shopping events like sales promotions, if brands can make adequate preparations in advance, they will achieve excellent results.

What Yang regrets is that he was not fully prepared for a sales promotion in October this year.

Since its launch in Vietnam in July this year, Coveral Klors achieved sales of over 300,000 yuan in the first month, rising to 500,000 yuan in the second month, and exceeding 1 million yuan in the third month, essentially doubling monthly sales. Therefore, based on this growth rate, Yang prepared for the Vietnamese Mother's Day sales promotion in October.

However, after the sales promotion began, the order volume for Coveral Klors luggage surged, and Yang struggled to meet the demand due to insufficient inventory. He later reflected, "If we had sufficient inventory, sales could have doubled."

The surge in orders for Coveral Klors was not surprising. On the one hand, although Southeast Asian consumers have a high demand for trendy and innovative consumer goods, local supply cannot meet this demand. Yang previously communicated with many local managers in Vietnam and found that there are few locally produced luggage products. Even if there are individual luggage manufacturers, they cannot meet local consumer demand, so these products mainly rely on cross-border trade. On the other hand, the rise of cross-border e-commerce, especially content e-commerce, has made it more convenient for local consumers to learn about and purchase these products.

Coveral Klors is fully prepared for the upcoming sales promotions.

Therefore, for the upcoming 11.11 and 12.12 sales promotions, Yang predicts that Coveral Klors will achieve monthly sales of 2 million yuan. For a new brand that has been around for less than five months, this achievement is quite representative.

In fact, it's not just Coveral Klors. More and more merchants are discovering the rapidly unleashed potential of branded sales in Southeast Asia.

Southeast Asian consumers are more willing to follow the advice of local circles. How to ignite trends through these circles has become the key for merchants to market new products. Especially in the past two years, the explosion of top influencers in Southeast Asia has guided consumers' strengthened brand awareness.

"The core reason we've been able to grow rapidly is that we've capitalized on the explosion of top influencers in content e-commerce. When these top influencers help us promote products, they greatly influence our overall decision-making," Yang said.

Therefore, the rise of live streaming e-commerce has presented a rare opportunity for branded merchants. Some merchants who previously engaged in wholesale business are increasingly realizing the benefits of branding.

On the one hand, Southeast Asian consumers are more receptive to new and trendy products. When making purchases, they actively seek out "newness" and try new brands and products, providing significant opportunities for merchants in scenarios such as new product launches, new market entries, and repositioning of old products as new.

On the other hand, for deeply entrenched product categories, also known as branded products, they rely more on influencer marketing and recommendations. This approach is also easier to create high premiums.

The Coveral Klors luggage brand operated by Yang is a clear example. "In the past few years of branding, we've deeply felt that joining TikTok Shop has accelerated our branding process and made the core focus of branding clearer," Yang said.

Initially, when promoting his brand from 0 to 1 in Southeast Asia, Yang needed to rely on various overseas media platforms. However, after some time, he found that "the overall experience was scattered, and it was difficult for us to focus our efforts on this task." Some platform influencers might not fulfill their commitments because they were unfamiliar with e-commerce practices. "During that time, our overseas branding progress was slow, and it might take a year to complete the 0-to-1 phase for a brand," Yang said.

However, in Vietnam, Coveral Klors not only achieved monthly sales of over 1 million yuan in just three months but also gained a certain market reputation.

This is also the case in Thailand. According to a report by the Thai media platform Lanxiang, TikTok Shop created a new phenomenon during the 11.11 shopping festival in 2023, with platform brands and merchant sales growing by over 300%. This was less than two years after TikTok Shop entered the Thai market.

Thais have a unique habit of preferring to watch videos rather than read to obtain news and information. Therefore, TikTok has become the most popular platform in Thailand. This has made TikTok Shop accepted by consumers from the outset. Chawaphon Fah-Amnuayphon, a senior e-commerce and digital marketing professional in Thailand, said that both corporate brands and online merchants should learn to analyze customer behavior, understand current trends, and proficiently use various sales techniques to generate significant revenue.

For merchants, although various e-commerce platforms in Southeast Asia have begun to notice the rise of content e-commerce, there are not many options for truly accelerating business through this approach.

Yang observed that "if you want high-quality content, cheap traffic, and traffic conversion, TikTok Shop is the best choice."

Of course, the influencer strategy will be adjusted accordingly as the brand grows. At the initial stage of brand growth, more emphasis can be placed on live streaming by top influencers. However, when the brand has achieved a certain sales volume and popularity, the ratio of mid-tier influencers and short videos for marketing purposes needs to be considered.

It is difficult for brands to accomplish these tasks alone and requires some assistance from the platform.

The explosion of content e-commerce in Southeast Asia is bringing new growth opportunities for cross-border merchants.

However, Yang found many differences when transitioning from traditional e-commerce to content e-commerce, such as influencer connections and control over critical nodes. For novice merchants lacking experience, these are indeed thresholds.

But he felt that his experience with TikTok Shop has been relatively smooth. "The platform has provided us with significant support and assistance. For example, in the first month we arrived in Vietnam, the platform helped us connect with many top live streamers, which was one of the reasons for our rapid growth. Additionally, the TikTok Shop cross-border industry manager team provides us with directions and implementation suggestions at various stages, such as control over critical time nodes. Furthermore, they offer advice on localized product design and content promotion," Yang said.

This 'nanny-style' support has paved the way for merchants to engage in content-based e-commerce and has led to the rapid growth of the platform. Since entering the Southeast Asian market in 2021, TikTok Shop has maintained rapid growth. According to the '2024 Southeast Asia E-commerce Report' released by Momentum Works, TikTok Shop's Gross Merchandise Volume (GMV) in Southeast Asia almost quadrupled in 2023, reaching $16.3 billion.

This year, targeting the upcoming sales events, TikTok Shop Southeast Asia has scheduled the 11.11 Shopping Festival from November 2 to November 12. Specifically, Singapore's event will run from November 2 to November 11, spanning 10 days; the Philippines' from November 5 to November 11, lasting 7 days; Malaysia's from November 7 to November 11, lasting 5 days; Thailand's also from November 7 to November 11, spanning 5 days; and Vietnam's from November 8 to November 12, lasting 5 days.

In terms of preparation strategies, TikTok Shop officials have provided three 'moves' in inventory management, online live streaming participation, and promotional campaign strategies.

Regarding inventory, TikTok Shop recommends that merchants maintain efficient inventory management to ensure ample stock, enabling sustained sales momentum during promotional campaigns and reaching peak sales. To this end, the platform has also introduced corresponding preferential policies, such as setting up video ranking competitions and emerging star contests for the Southeast Asia 11.11 promotion, incentivizing merchants to post short video content with purchase links through cash, vouchers, and exposure support; and providing subsidies, additional allowances, and other support for flash sales activities.

For live streaming, TikTok Shop has launched live streaming competitions, flash sales, emerging star contests, Syok vouchers, and other activities, using bonuses, vouchers, exposure incentives, and other methods to guide merchants to leverage live streaming for the 11.11 promotion.

In terms of product selection, based on the popular product trends during TikTok Shop's 10.10 promotion, low-penetration, high-potential products include beauty and personal care items such as nail products and eye and lip care, outdoor gear and household cleaning products under home and daily use, jewelry and lingerie under apparel, shoes, bags, and accessories, and audio-visual equipment and air humidifiers under 3C digital appliances.

Driven by multiple incentives, more and more cross-border merchants are embarking on this gold rush in Southeast Asia.