Caocao Mobility's Key Challenge: How to Convince the Market to Buy into an Old Story

![]() 11/07 2024

11/07 2024

![]() 442

442

Image Source: Company Official Website.

The Internet era was heavily influenced by ride-hailing apps.

Around 2014, to compete for the domestic ride-sharing market, Didi Chuxing engaged in fierce battles with Kuaidi Dache and Uber, supported by mobile payment providers and other financial backers. This multi-billion-dollar ride-hailing war eventually became a footnote of an era.

During this process, more and more people gradually developed the habit of using ride-hailing apps.

Eventually, the grand capital game ended with the merged Didi acquiring Uber's China business. However, the ride-hailing story was far from over, as the huge market attracted a flood of capital, with Caocao Mobility being one of them.

As of 2024, the ride-hailing industry has undoubtedly entered a mature stage. For latecomers, this represents their last chance to succeed.

Among them, Dida and Ruqi successfully entered the capital market in June and July, respectively. Backed by Geely Group and ranking third in the industry, Caocao Mobility has also stepped up its IPO efforts, submitting its prospectus to the Hong Kong Stock Exchange for the first time at the end of April and updating it again on October 30.

In recent years, Caocao Mobility has relied on its aggregation platform to achieve revenue growth and narrowed its losses through its "customized vehicle" strategy. On the surface, everything seems to be improving. However, upon closer inspection, we find that the financial statements reveal numerous challenging obstacles.

01

A Steep Gap: The Awkward Third Place

Founded in 2015, Caocao Mobility relies on Geely Automobile and is part of Geely Group's strategic layout for "new energy shared mobility".

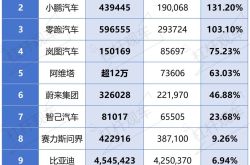

After a decade of operation, Caocao Mobility currently operates in 83 cities across China and consistently ranks third among domestic ride-hailing platforms, with a 4.8% market share in 2023.

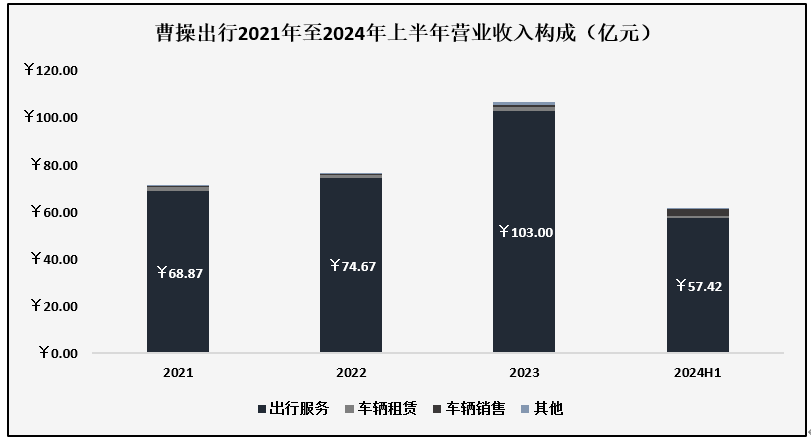

Caocao Mobility currently operates in four main business areas: mobility services, vehicle leasing, vehicle sales, and other automotive-related services.

Mobility services are the core revenue source, accounting for approximately 95% of total revenue.

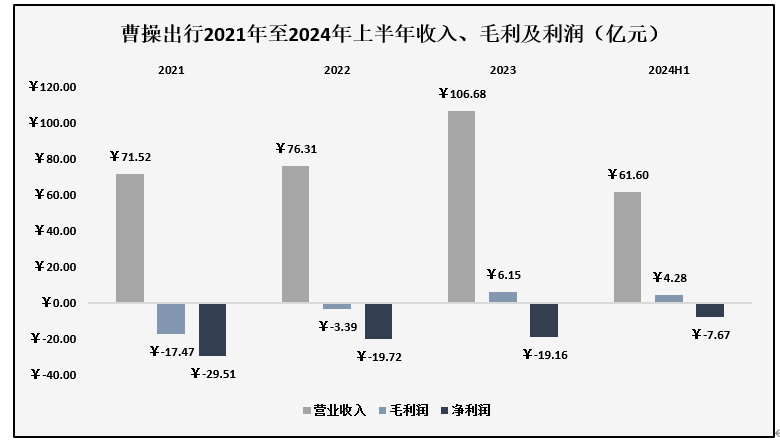

Driven by mobility services, Caocao Mobility's total revenue has increased from 7.152 billion yuan in 2021 to 10.668 billion yuan in 2023, with a 24.72% year-on-year growth to 6.16 billion yuan in the first half of 2024.

Compared to industry leader Didi, Caocao Mobility's shortcoming lies in its reliance on aggregation platforms for growth: from 2021 to the first half of 2024, GTV from aggregation platforms accounted for 43.8%, 49.9%, 73.2%, and 82.6% of its total, respectively; orders obtained through aggregation platforms accounted for 43.6%, 51.4%, 74.1%, and 83.1% of its total orders during the same period.

While the heavy reliance on aggregation platforms brings a large number of orders to Caocao Mobility, it also limits the company to being just a ride-hailing service provider rather than a true ride-hailing platform. Without the unique "network synergy" of internet platforms, its intrinsic value is significantly diminished.

In fact, the status of aggregation platforms in the shared mobility industry has been increasing in recent years. The proportion of ride-hailing orders fulfilled through aggregation platforms has increased from 3.5% in 2018 to 30% in 2023 and is expected to reach 49% by 2028.

This trend is due to Didi's established transportation capacity and user base, leveraging network synergy (increasing user growth attracts more transportation capacity, which enhances ride-hailing efficiency, attracting more users) to solidify its dominant position, holding a 75% domestic market share in 2023.

The steep gap makes it nearly impossible for second-tier platforms like Dida and Caocao to challenge Didi's position without launching another large-scale price war. Since a single platform cannot compete alone, the aggregation model emerged, essentially a "grouping" effort by second-tier platforms under the dominance of traffic platforms.

For example, Gaode Maps, with a large user base (i.e., traffic), would have to compete with Didi for transportation capacity if it directly entered the ride-hailing market, requiring significant investment. However, by aggregating various transportation capacity providers (Dida, Caocao, T3, Shouqi, etc.) onto its platform, it can efficiently respond to users' mobility needs.

Conversely, for second-tier ride-hailing platforms, rather than endlessly competing for traffic through subsidies, it may be more beneficial to seek growth by paying "commissions" to traffic platforms. Homogeneous services can only attract and retain users if they consistently offer cheaper and more efficient options.

As the saying goes, every medicine has its side effects. While second-tier platforms benefit from the growth brought by "grouping," the entire value chain is also reshaped by aggregation platforms.

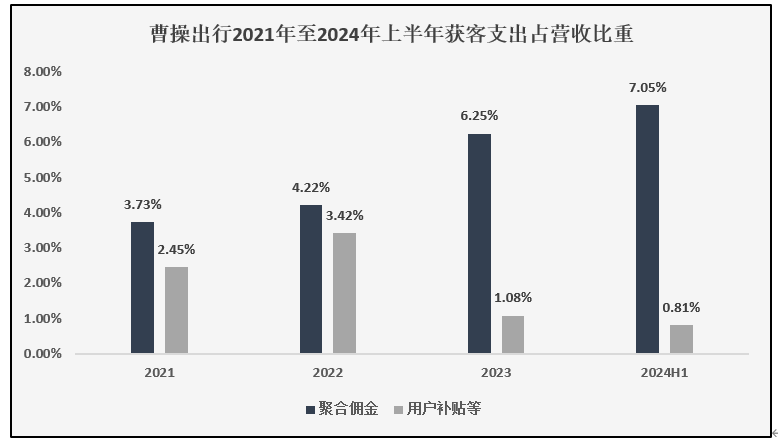

Taking Caocao Mobility as an example, since 2022, as the contribution of aggregation platforms has increased, the "user subsidies" paid have continued to decrease, but the fees paid to traffic platforms have increased.

More importantly, under the aggregation model, users cannot be retained on the platform itself, depriving Caocao Mobility of its "platform" attribute and its ability to leverage network synergy for self-enhancement. In the long run, it will become even more dependent on aggregation platforms, further reducing its bargaining power.

02

Innovative Business Model, but Old Story Hard to Sustain

While the shared mobility market is huge, industry participants still face widespread losses; even Didi, which holds a monopoly position, achieved its first profit in 2023.

According to the prospectus, Caocao Mobility's gross profits for 2021 to the first half of 2024 were -1.747 billion yuan, -339 million yuan, 615 million yuan, and 428 million yuan, respectively; net profits attributable to shareholders for the same period were -2.951 billion yuan, -1.972 billion yuan, -1.916 billion yuan, and -767 million yuan.

Overall, driven by gross profits, Caocao Mobility's losses have narrowed, primarily due to significant reductions in driver subsidies, which represent the largest expenditure for ride-hailing platforms. From 2021 to the first half of 2024, "income and subsidies" paid to drivers accounted for 100.67%, 82.36%, 76.36%, and 73.02% of Caocao Mobility's revenue, respectively.

Caocao Mobility's successful cost reduction strategy is mainly attributed to its "customized vehicle" strategy.

Starting in 2022, Caocao Mobility began introducing "customized vehicles," selling and leasing special vehicles (Maple Leaf, Caocao 60) developed in collaboration with Geely Group to transportation capacity partners and drivers. This not only enhances the user experience through in-depth scenario design but also significantly reduces vehicle operating costs through its automotive services deployment – the TCO of its customized vehicles is over 30% lower than that of typical electric vehicles.

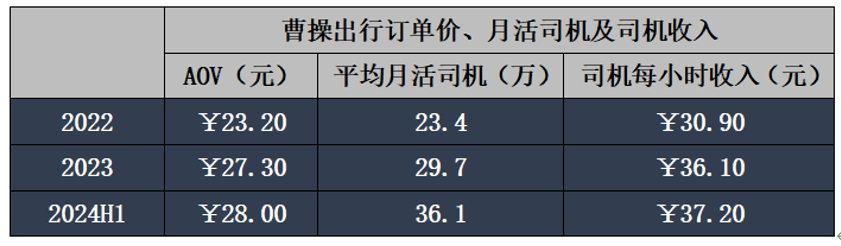

From 2022 to the first half of 2024, the GTV contribution from customized vehicles continuously increased, accounting for 4.5%, 19.6%, and 25.3%, respectively. During the same period, the increase in order prices, monthly active drivers, and average hourly driver income indicate that the "customized vehicle" strategy has been successful so far.

By reducing drivers' operating costs and increasing their income through customized vehicles, Caocao Mobility has achieved its cost reduction goals by lowering driver subsidies and expenditures, representing an innovative response to industry competition.

In summary, Caocao Mobility's ability to narrow losses is cored on providing specialized vehicles that meet the deep needs of drivers and passengers, which differs from the reutilization of surplus value in the sharing economy. The growing demand for customized vehicles actually reflects a shift of more labor towards ride-hailing as a primary occupation, mirroring the overall economic slowdown in recent years.

Currently, Caocao Mobility is expanding its customized vehicle layout through "outsourcing" – selling and leasing customized vehicles to transportation capacity partners. While this may still reap short- to medium-term benefits, the company's heavy reliance on aggregation platforms for users and the likely weakened bargaining power of transportation capacity after expansion leave Caocao Mobility with little more than a "shell" on both ends.

Moreover, in the long run, as the Robtaxi business model gradually opens up and penetrates, the advantage of selling shovels will diminish.

03

Conclusion: Gaining Investor Recognition is a Challenge

Caocao Mobility's strategic innovation with customized vehicles has achieved cost reduction and efficiency enhancement, which is commendable.

However, as it drifts further away from the sharing economy's primary nature and internet platforms, carrying a massive 8.5 billion yuan in interest-bearing liabilities (5.6 billion yuan in short-term interest-bearing liabilities with only 1.5 billion yuan in cash on hand), and facing potential disruptive challenges in the industry, a pressing question arises:

Even if it successfully goes public, how can Caocao Mobility capture the recognition of secondary market investors with its value narrative and long-term expectations?