Soul-searching, has Unity hit rock bottom?

![]() 11/11 2024

11/11 2024

![]() 617

617

Hello everyone, I'm Dolphin!

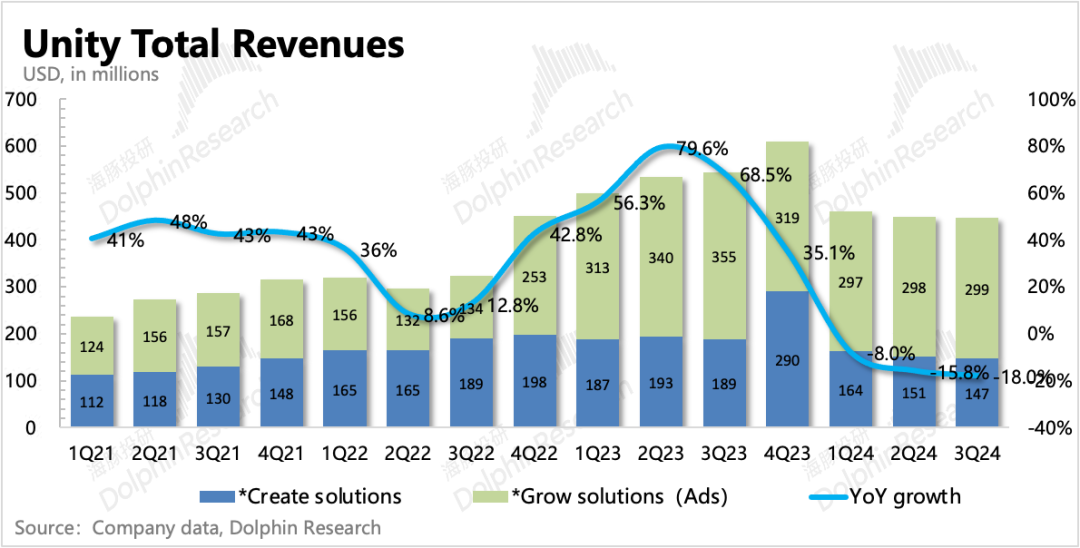

After the U.S. market closed on November 7, EST, Unity, the leading game engine company, released its Q3 2024 earnings. Although the announcement in September to eliminate Runtime fees has caused the stock price to surge by nearly 30% since then, Dolphin has always believed that the core to supporting a solid return in valuation lies in when the Grow business will rise from its current state, due to more logistically damaging competitive issues.

Regarding this question, does the Q3 report reflect signs of business recovery? Let's first take a look at the financial report.

Unity is still approaching a critical turning point, but during this period, most financial indicators lag behind the company's strategic and operational changes, and operational information is mainly discussed during earnings calls. Therefore, Dolphin will again discuss how to view this financial report after carefully reading the shareholder letter and earnings call content.

Let's first go through the financial report performance through several key operational questions:

1. Despite turmoil, the engine still has a solid user base: During the year of repeated turmoil for Unity due to changes in its pricing model, there have been voices in the industry advocating abandoning Unity in favor of Unreal/Cocos. Although eliminating Runtime fees indicates a certain degree of concession on Unity's part, the stable growth in core subscriptions also shows that Unity remains irreplaceable in the eyes of its "die-hard fans."

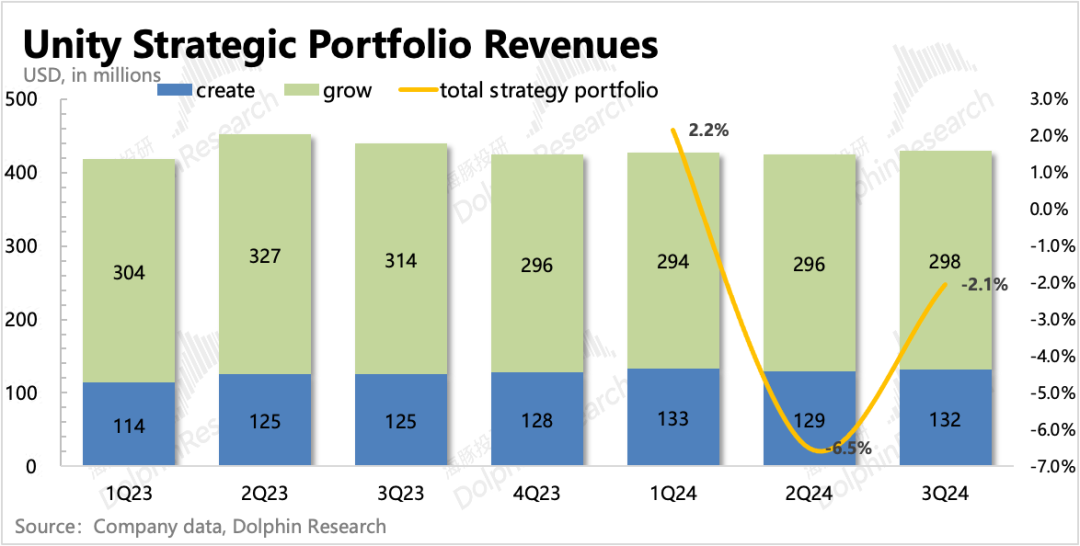

In Q3, according to the disclosure standards of the Strategic portfolio, Create grew by 5.6% quarter-over-quarter, showing some recovery, while engine subscription revenue, which accounts for the majority, continued to maintain a healthy year-over-year growth rate of 12% (the growth rate for the previous two quarters was also 13%).

The company explained that this growth is mainly driven by an increase in average revenue per user (ARPU). On the one hand, this is driven by price increases every 1-2 years, and on the other hand, it is promoted by users switching from lower-priced packages to premium packages. For example, after eliminating Runtime fees, Unity plans to increase prices for Pro and Enterprise by 8% and 25%, respectively, starting from January 1, 2025.

However, compared to this, Dolphin pays more attention to whether the "scale of subscribers" is continuously increasing. This indicator reflects how many customers lost due to Runtime fees have changed their minds and returned, and it is also a basic prerequisite for Unity to continue acquiring new customers if it wants to maintain its growth potential.

Unity 6 was released in early October, and during the earnings call, management expressed satisfaction with current customer adoption (with over 500,000 downloads to date). Management is confident in the subsequent adoption of Unity 6. Since Unity 6 changes the original iterative update method by providing a powerful testing environment to allow customers to experience new features in real-time, it achieves the effect of timely improvement/launch of product features. Therefore, for Unity 6, the company believes that this generation of the engine will become the main driver supporting subsequent growth.

2. Advertising share is still being eroded: Although the engine's core user base is relatively stable and recovering, Dolphin has repeatedly mentioned that the valuation pressure caused by performance is more related to the lingering issues with the Grow business.

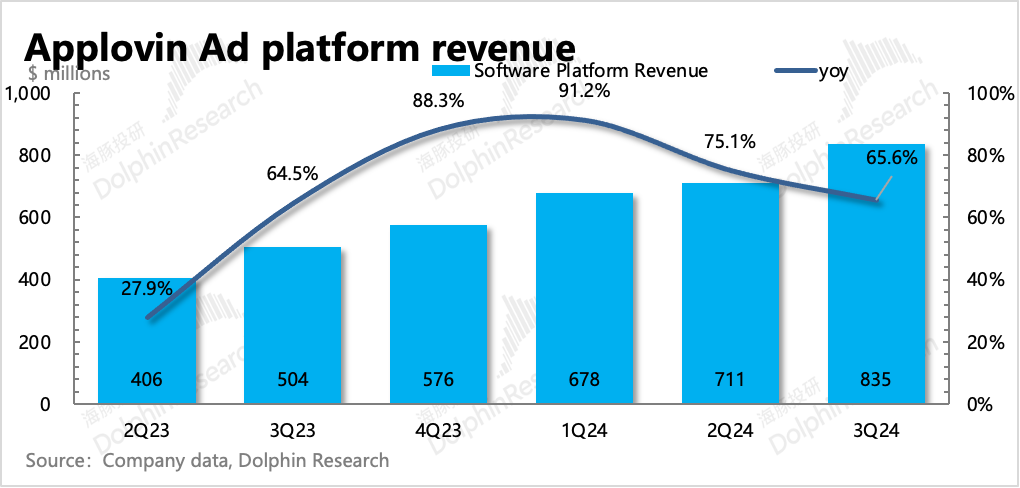

In Q3, the Grow business in the Strategic portfolio declined by 5% year-over-year, while the overall industry performance was good during the same period, as evidenced by the impressive performance of advertising stocks in Q3. However, compared to its peers, Unity's performance was still weak, and the exceptional results of direct competitor Applovin made Unity's underperformance even more apparent.

In the previous quarter's financial report, management mentioned the adjustments they were working on:

1) Introducing two experts to adjust the advertising business, including Jim Payne, one of the co-founders of MoPub, a mobile advertising and marketing platform, who later founded Max advertising systems. Max is the platform that integrated with Applovin to launch Applovin Max, one of Applovin's core advertising technologies. Unity has effectively brought a "core player" back home.

2) Increasing investment in machine learning and data stacks to repair advertising technology damaged by IDFA.

Dolphin believes that the above two actions will not immediately repair the advertising business, especially given that competitors have mature and advanced technologies. Therefore, it is likely due to the uncertainty in the adjustment pace of the advertising business that management did not significantly increase the full-year revenue guidance, merely increasing the portion that exceeded expectations in Q3.

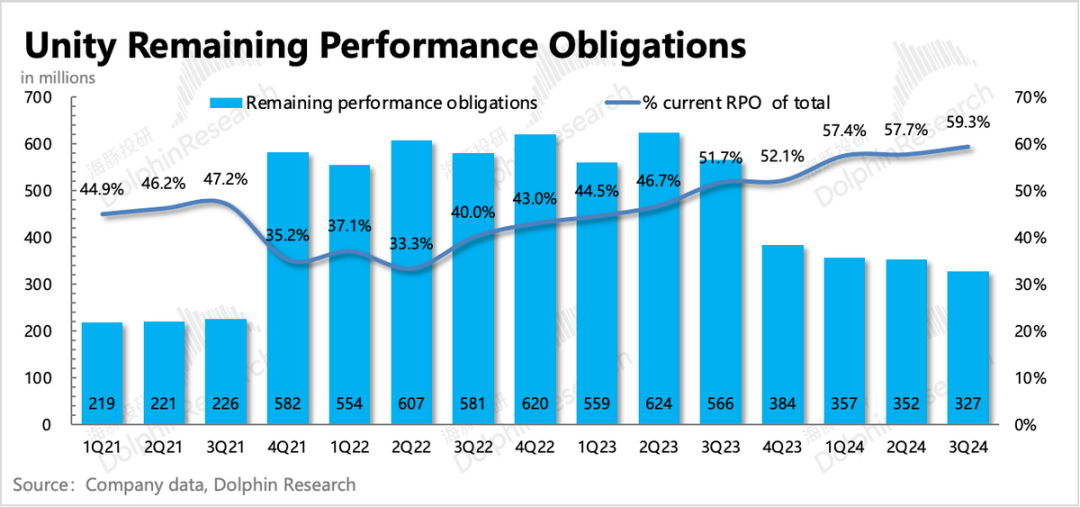

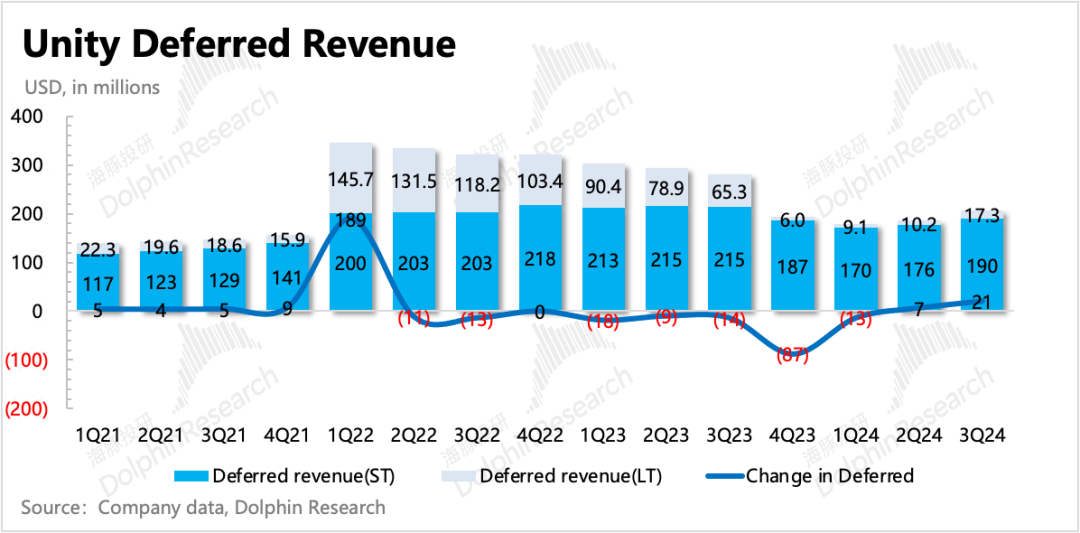

3. Forward-looking indicators are "conflicted": Several forward-looking indicators that showed signs of hope for two consecutive quarters showed signs of stagnation in the momentum of improvement in Q3, with only (1) deferred revenue increasing quarter-over-quarter. For other indicators:

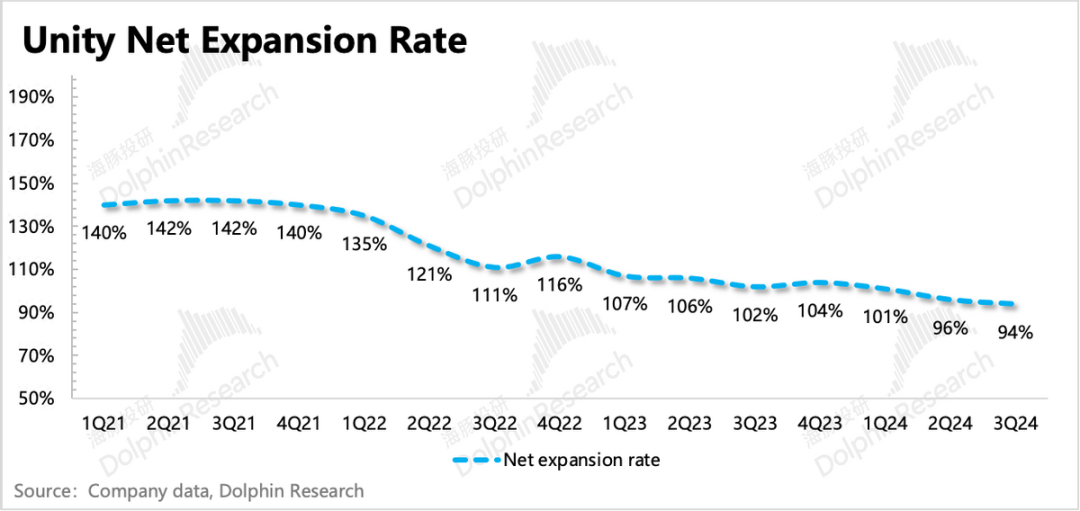

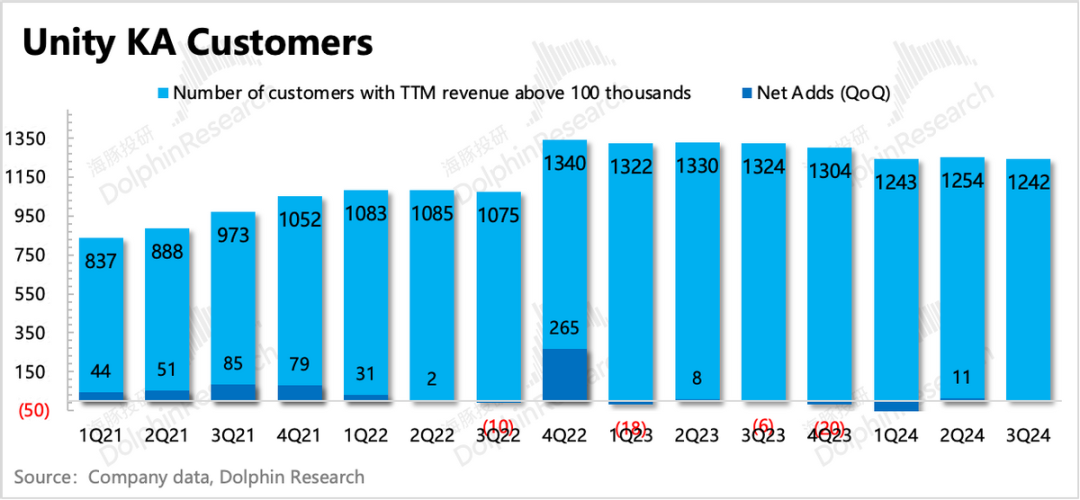

(2) New contracts declined quarter-over-quarter; (3) The number of major customers showed a net loss quarter-over-quarter (but the number of major customers with ongoing business increased quarter-over-quarter, possibly indicating customer return after eliminating Runtime fees); (4) The decline in the remaining non-cancelable contract amount (including deferred and unpaid backlog) accelerated quarter-over-quarter; (5) The net expansion rate continued to deteriorate, falling to 94% in Q3, also lower than market expectations.

Combining the indicators <1-5>, we can actually see an increase in short-term pressure on Grow: Most of the deferred revenue comes from engine subscriptions (with a minimum contract period of one year), and the quarterly growth in deferred revenue confirms the stable growth of core subscription revenue in the engine business.

However, on the whole, there has not been a noticeable positive increase in customer demand. Dolphin believes that, in addition to the expiration of the WETA cooperation and the proactive optimization of Professional services and other business reasons, the main problem lies in the Grow business.

Combining the relevant descriptions from the management earnings call and the performance of peer Applovin, Dolphin believes that it is unlikely to see a significant improvement in the Grow business this year. Whether it's talent introduction or technology investment, their true effectiveness will only be evident in next year's performance.

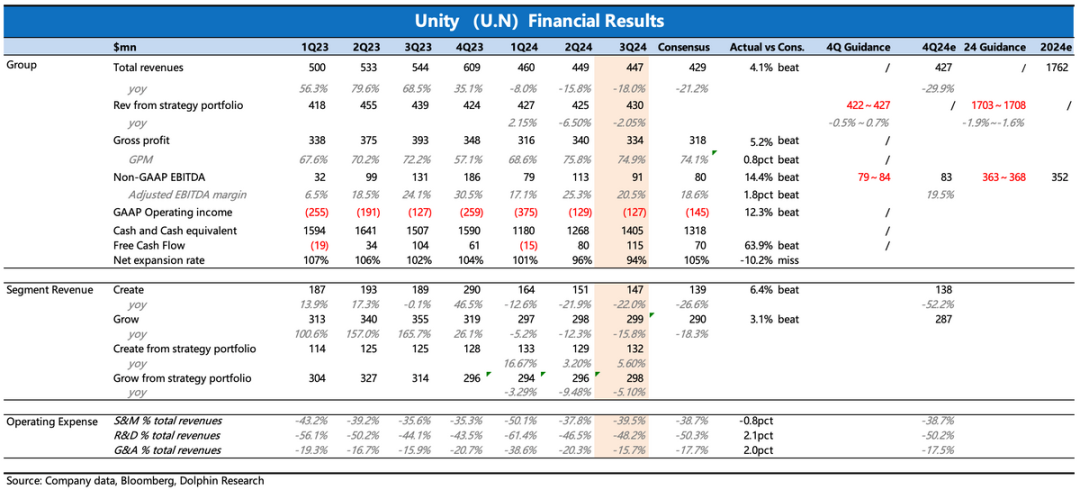

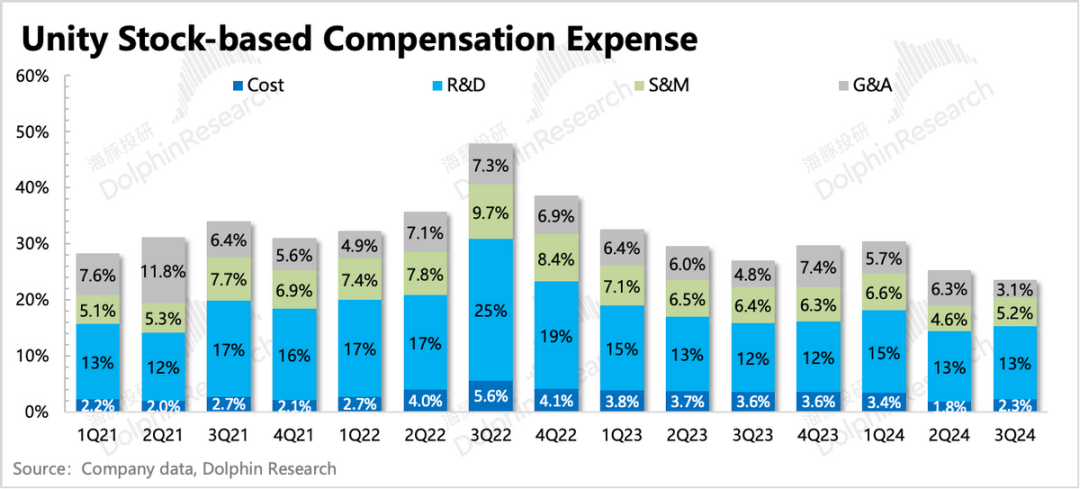

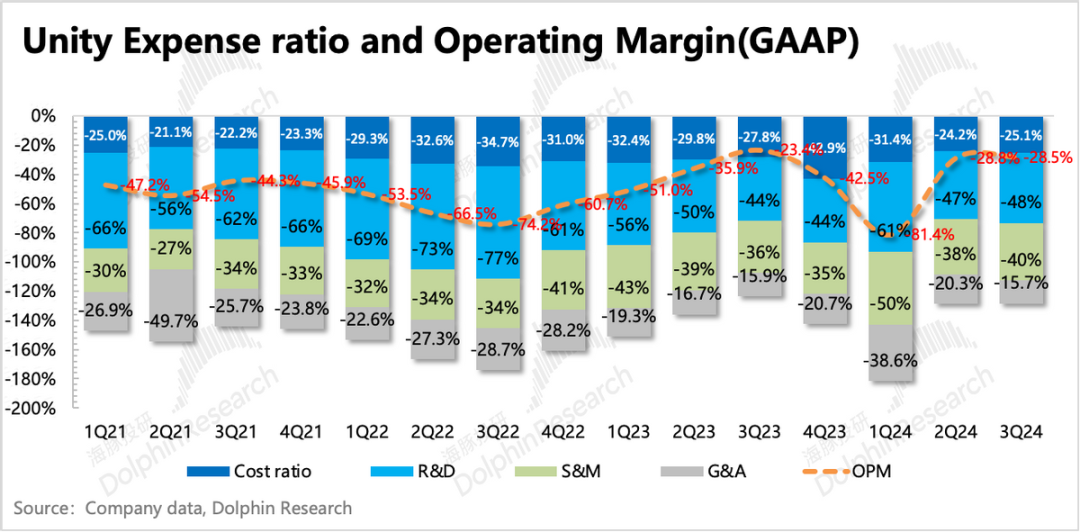

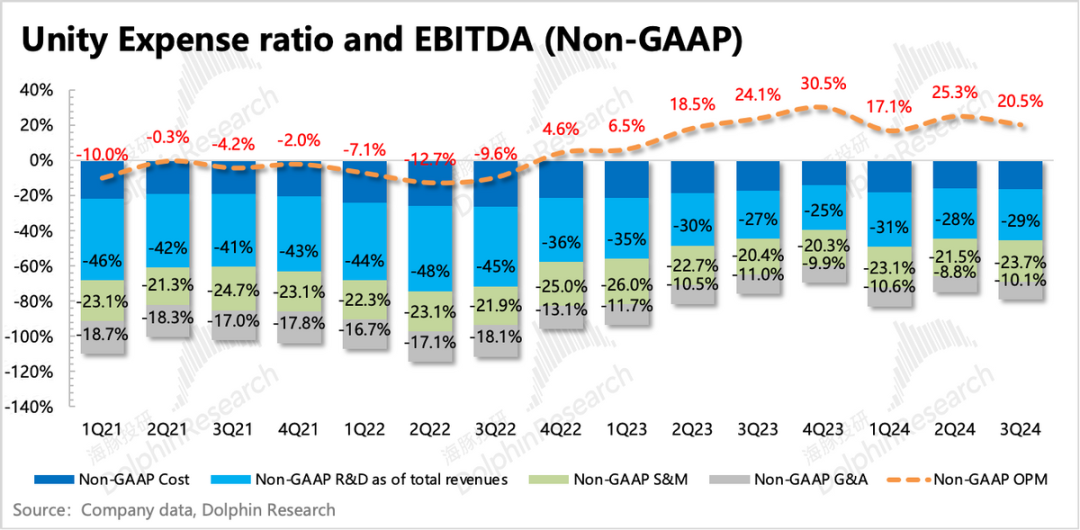

4. "Technology investment" offsets the "layoff dividend": Q3 still had the effect of layoffs (Q3 GAAP operating expenses declined by 11% year-over-year, with SBC equity incentives declining by 28.5%). However, as Dolphin predicted in the previous quarter, the necessary investments made to repair advertising technology (machine learning, data stacks) offset the layoff dividend, slowing down the improvement in profitability (the rate of improvement in Q3 operating loss stagnated quarter-over-quarter)."There was also a quarter-over-quarter decline in gross margin due to the business structure in Q3. It is possible that the weak Grow business led to an increase in the revenue share of Create, which has a lower gross margin, slightly lowering the overall gross margin compared to the previous quarter. Ultimately, the operating loss was reduced to $127 million, flat year-over-year, and adjusted EBITDA was $90 million, exceeding the company's guidance and market expectations."During the earnings call, management repeatedly emphasized the pursuit of efficient investment, and the advertising technology investments themselves are relatively easy to monetize. Therefore, Dolphin believes that it is unlikely to weaken profitability levels in the long term. Of course, this is also based on the expected assumption that Unity's Grow business will eventually achieve a steady recovery."5. Overview of performance indicators

Dolphin's Perspective

Compared to expectations, Q3 performance was generally positive. However, there were also signs of some short-term pressure on key forward-looking indicators. The joining of the founder of Max in the previous quarter and the elimination of Runtime headcount fees in September caused the market to ignore short-term performance pressure and react positively first.

Looking at each business segment, the engine business of Create continued to recover, especially as the number of major customers in "ongoing business" increased quarter-over-quarter in Q3, reflecting positive customer feedback to some extent after eliminating Runtime fees."However, the advertising business of Grow is still facing the dilemma of market share being taken by peers (the slowdown in the Q3 decline was driven by the overall recovery of the industry). The problem is that Grow is precisely the core driver of profitability in the short to medium term. A bearish assumption is that if advertising technology has not been repaired and demonstrated effectiveness simultaneously with investments in machine learning and data stacks, the short-term pressure on profitability will further increase under such expectations."Therefore, consistent with judgments made since the beginning of the year, Dolphin still believes that even though Q3 performance exceeded expectations, whether it's the Create business starting to benefit from price increases next year or the Grow advertising business hoping to regain market share through technology repairs, a truly solid performance recovery and valuation reversal may still have to wait until next year."However, considering the situation in September of the previous quarter, if the market still has the willingness to get a head start in the future, how much reasonable upside potential is there for Unity's valuation in the short term? Here, Dolphin attempts to make a "neutrally positive" assumption."Combining management's guidance for 2024 and market expectations, the implied valuation as of the close on the 7th, with a market capitalization of $8.8 billion, is 4.5x P/S (corresponding to low single-digit year-over-year growth in 2025). If placed among advertising stocks, coupled with the current status of Unity's advertising business, this valuation is on the high side."However, Dolphin also believes that a key change in Q3 lies in Unity's shift in customer attitude, including the elimination of headcount fees and the new iterative approach of real-time testing adjustments under Unity 6. For market funds, when the return to the growth path of "traditional software price increases" familiar to the market from Runtime fees was announced in September, funds also had a clearer view of Create's growth prospects. The stable growth rate of core subscriptions in Q3 also continued to confirm the relatively solid user base in Unity's core engine."This means that when Create gradually digests the impact of restructuring and returns to a double-digit growth channel, based on the original valuation center (7x P/S in 2025) and 4x P/S for the advertising segment, on the whole, before performance reflects a reversal, if the adoption rate of Unity 6 progresses well, or if market liquidity improves and sentiment is positive, there is still hope for it to continue rising to $10 billion. But to go any higher would require Unity to quickly regain the market share it once lost in the advertising market. At least under the current situation where competitors have technologically superior technologies, the difficulty is not insignificant."Detailed Analysis Follows

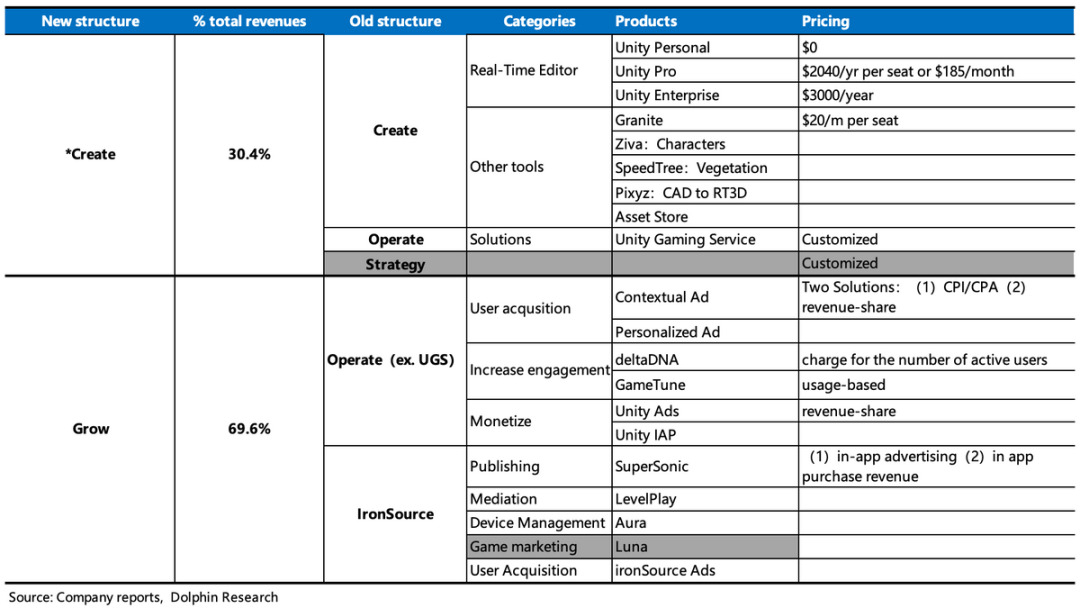

I. Basic Introduction to Unity's Business

Unity incorporated IronSource's operating conditions into its results in Q1 2023 and also adjusted the scope of its business segments. Under the new disclosure structure, the business segments were condensed from the original three (Create, Operate, Strategy) to two (Create, Grow)."The new Create solutions include not only the products under the original Create (the main game engine) but also the UGS revenue (Unity Game Service: a full-chain solution for game companies, helping to solve a package of issues related to game development, publishing, customer acquisition, and operations) and the original Strategy revenue that were previously recognized under Operate, but gradually closed products and services such as Professional service and Weta starting in 2023;"The Grow solutions include the advertising business from the original Operate, as well as the marketing (primarily Aura, with Luna closing in Q1 2024) and game publishing services (Supersonic) from the merged IronSource. Revenue contributions come from seat subscription revenue from the main game development engine and revenue from the advertising platform and game publishing that facilitate bidding.

II. Clear Growth in Create, but Uncertainty in Grow's Future

Unity achieved total revenue of $450 million in Q3, a year-over-year decline of 18%, slightly higher than guidance and market expectations. Excluding the impact of restructuring, looking only at the Strategic Portfolio, revenue declined by 2% year-over-year, with the rate of decline narrowing compared to the previous quarter.

Looking at business segments, the strategic cooperation and professional services within the Create business are still being proactively scaled back, but core engine subscription revenue increased by 12% year-over-year, with growth rates of 13% in Q1 and Q2; on the other hand, Grow is still suffering from the impact of mobile marketing share being taken by competitors.

However, from a forward-looking operational perspective, the overall momentum towards improvement stagnated in Q3. Considering that core subscriptions grew by 12%, with stable growth compared to Q1 and Q2, coupled with the fact that deferred revenue, which mainly reflects subscription demand, did indeed increase quarter-over-quarter and the number of major customers with ongoing business is still increasing, it indicates that short-term pressure is mainly on the Grow business:

(1) Net Expansion Rate

The net expansion rate is a growth indicator that the market generally pays attention to. The net expansion rate is expected to continue to decline to 94% in Q3, indicating that the combined revenue of existing customers over the past 12 months declined year-over-year, meaning that compared to the previous year, existing customers paid less."This may be due to a. Unity proactively closing some businesses, b. existing customers reducing the number of accounts or downgrading their accounts, and c. direct loss of existing customers. "The net expansion rate has continued to decline below 100% in the past year, which should also include the impact of existing customers no longer renewing due to dissatisfaction with the Runtime pricing model. However, after a base period in Q3 and the announcement in September to eliminate Runtime fees, it is expected that the return of engine customers in Q4 will stabilize or even rebound the net expansion rate."

(2) Number of Major Customers (annual spending exceeding $100,000)"The number of major customers is generally for engine business customers (with a minimum contract period of one year), so changes in the number of customers over the past year are mainly affected by business restructuring. For example, some customers of Weta, Professional services, or Luna may have left after the company closed these businesses. Additionally, there may be cases where customers "downgrade" their spending on Unity, with annual spending falling below $100,000.

The number of major customers in the third quarter was 1,242, a decrease of 12 compared to the previous quarter. However, based on comparable ongoing business, the number was 1,230 in the same period last year and 1,227 in the previous quarter (which was also on the decline). This indicates that some customers returned in the third quarter due to the cancellation of the Runtime model, or new customers were attracted. For example, during the conference call, management mentioned new customers in non-gaming areas, such as KLM Royal Dutch Airlines (VR cockpit training) and the German national railway operator.

(3) Remaining unfulfilled contract amount & deferred revenue

In the third quarter, the year-on-year decline in the remaining contract amount widened to 7.1%, and there was also a decline from the previous quarter, but this largely reflected the deferred revenue from engine subscriptions, which continued to increase by a net of RMB 2.1 billion quarter-on-quarter. These two indicators showed opposite trends, with one positive and one negative, reflecting not only the impact of business reorganization but also further indicating the drag on overall performance caused by the Grow business.

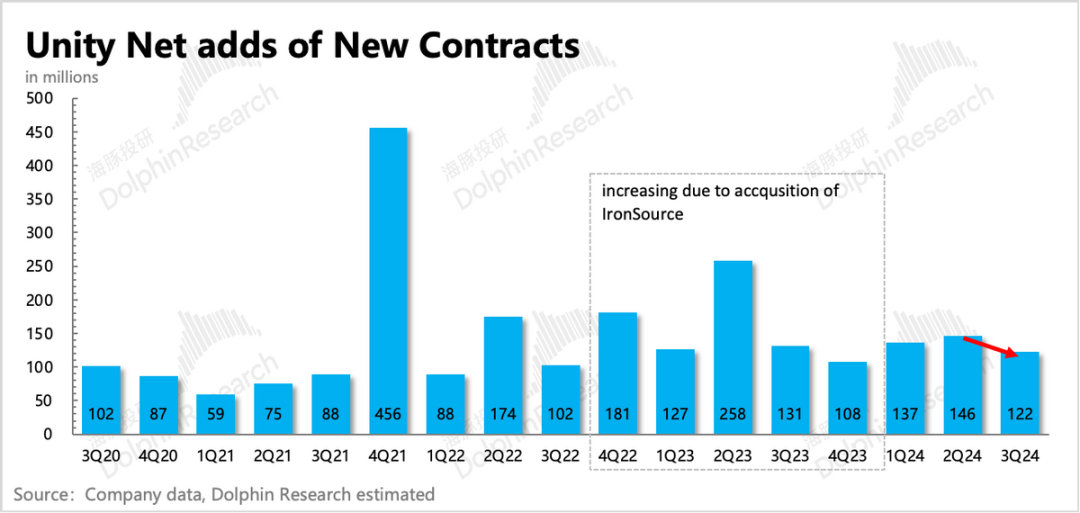

(4) New contract amount

Dolphin Insights' recalculated new contract amount indicator declined quarter-on-quarter in the third quarter, halting the recovery trend since the beginning of the year.

Marginal increases often represent changes in customers' attitudes towards working with Unity. The quarter-on-quarter decline in the third quarter was due to the further closure of professional services, Weta, and other businesses (the proportion of Strategic Portfolio revenue in total revenue increased in the third quarter, reflecting the further closure of other businesses).

In addition, based on some public news reports, Dolphin Insights believes that some customers may have been waiting for the performance of Unity 6, which was launched in October, before deciding whether to continue their subscriptions. Some customers also reported that they did not immediately renew their subscriptions in the third quarter but chose to wait for the official announcement because they had learned in advance that Unity might adjust its pricing model.

As for whether there are negative impacts from price increases (8% for Pro and 25% for Enterprise starting from January next year), Dolphin Insights believes that although theoretically, short-term impacts are unavoidable, compared to the positive feedback from the cancellation of the Runtime model, it is difficult to accurately determine the specific impact on Unity at this time. We need to continue observing the situation in Q4.

Overall, there has been no significant positive increase in customer demand, and there are still fluctuations in the short term. Dolphin Insights believes that, in addition to the expiration of the WETA partnership and the proactive optimization of Professional services, the main issue lies in the Grow business.

Combined with relevant descriptions from management conference calls and the performance of peer company Applovin, Dolphin Insights believes that it is unlikely to see a significant improvement in the Grow business this year. Whether it's talent acquisition or technology investment, the true results will only be known next year based on performance.

Clear guidance from management:

Revenue and adjusted profit in the fourth quarter exceeded expectations. Although the full-year guidance was increased due to the better-than-expected performance in Q3, the increase was not significant due to cautious consideration of the advertising business.

(1) The expected Strategic Portfolio revenue in the fourth quarter is between RMB 422 million and RMB 427 million, with almost flat growth (-0.5% to 0.7%), continuing the recovery trend compared to the third quarter. The median of the guidance range is higher than market expectations.

(2) The expected Strategic Portfolio revenue for the full year 2024 is between RMB 1.703 billion and RMB 1.708 billion, an increase of 1.5% from the previous quarter's expectations. Although the recovery trend remains unchanged, the upward adjustment to the full-year guidance only reflects the better-than-expected performance in the third quarter and does not synchronize with the fourth quarter's guidance.

Dolphin Insights believes that, as with our previous quarter's assessment, this is a relatively cautious and conservative forecast by management, preserving potential upside from improvements in advertising technology and adjustments in the advertising department.

II. Short-term industry recovery, but still losing market share

Although Unity's growth and valuation focus primarily on non-gaming industrial scenarios, gaming market revenue still accounts for the majority of overall engine subscription revenue. Therefore, Dolphin Insights also generally pays attention to the gaming industry.

According to Sensor Tower data, global game downloads and in-app purchases continued to rebound in the third quarter, reflecting an increase in player demand. As we mentioned last quarter, the second half of the year is expected to continue to recover based on the cyclical trend of the base period.

The overall advertising industry was also strong in the third quarter. Unity did experience some recovery in performance due to the overall environment, especially in the Grow business, which currently has relatively weak technological competitiveness but showed signs of quarter-on-quarter recovery in the short term.

However, the issue of competition still seems unsolvable. Unity's top competitor, Applovin, has maintained strong momentum despite Unity's sluggish performance over the past year. In the third quarter, revenue from its software platform providing advertising matching services increased by 66% year-on-year, which has been the main contributor to Applovin's rapid performance growth over the past two years. Two years ago, Applovin even attempted to acquire Unity to strengthen its mobile marketing presence and complement its business chain with upstream game developers.

However, with the popularization of large AI models in the second half of 2023, Applovin integrated AXON technology, significantly improving the ability to precisely match advertisers with advertising platforms and compensating for the impact of Apple's privacy policy IDFA on ad tracking and targeted advertising.

Meanwhile, Unity, which had just acquired IronSource during this period, was struggling with extremely slow team integration and a host of management and organizational issues within the original leadership. The premium acquisition through equity issuance was also widely questioned. In 3Q23, Unity forcibly imposed Runtime fees despite customer preferences. Energy was wasted on improving superficial financial indicators, leading to a lack of focus on improving technology to mitigate the impact of IDFA.

Therefore, the current performance pressure is a backlash of past inaction. Withdrawing customer-repellent fee structures and instead increasing investment in technology and focusing on product improvement are at least steps in the right direction. Although increased revenue pressure and investment may affect the pace of loss reduction, with business growth issues still unresolved, loss reduction is not the immediate priority, as long as it does not involve ineffective investments, extravagance, or employee benefit transfers.

However, Unity does have advantages over Applovin – it has an end-to-end full-industry chain business. This gives Unity the confidence to compete, at least in the mobile game marketing field, as long as its advertising technology is improved.

III. Increased technology investment offsets the benefits of layoffs

There were also layoffs in the third quarter, with GAAP operating expenses declining by 11% year-on-year, including a 28.5% decrease in SBC equity incentives. However, as Dolphin Insights predicted last quarter, the necessary investments in repairing advertising technology (machine learning, data stacks) offset the benefits of layoffs and slowed the improvement in profitability, as evidenced by the stagnation in the quarterly improvement rate of the operating loss rate.

In addition, the gross margin in the third quarter, due to the business structure, may have been slightly lowered overall due to the weaker Grow business, which increased the revenue share of the low-margin Create business compared to the previous quarter.

However, the market's expectations for profits were relatively low due to conservative expectations for the Grow business. Ultimately, Unity's operating loss in the third quarter was reduced to RMB 127 million, flat year-on-year, and adjusted EBITDA was RMB 90 million, exceeding the company's guidance and market expectations.

Management expects adjusted EBITDA in Q4 to be in the range of RMB 79 million to RMB 84 million, with full-year guidance in the range of RMB 363 million to RMB 368 million. Compared to the increase in revenue, the profit increase is more significant, implying that the further recovery of the Grow business will drive an overall increase in profit margins.

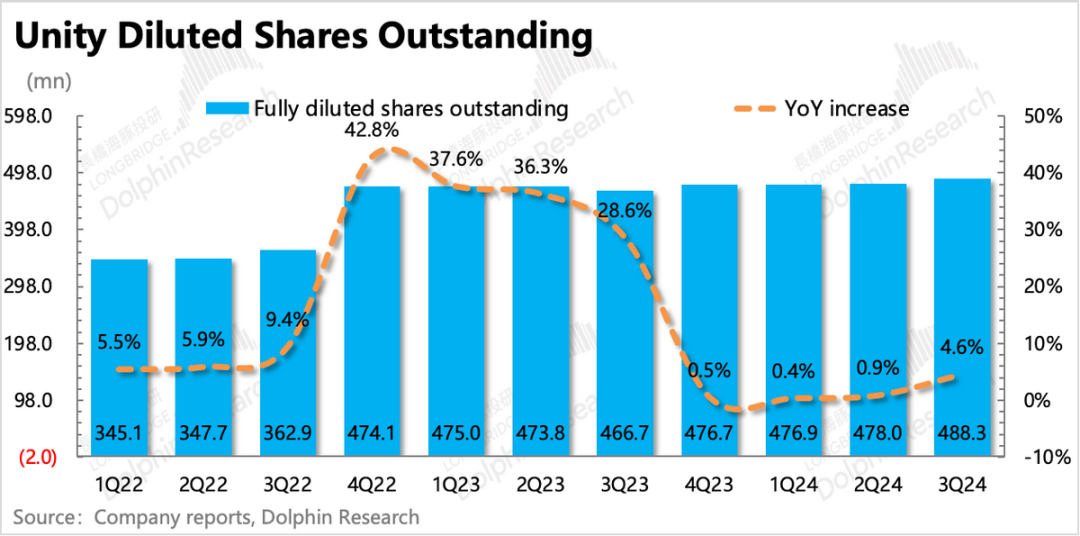

Due to the arrival of several new senior executives in the third quarter, newly granted options increased significantly quarter-on-quarter, which also increased the potential impact of equity dilution. It is likely that the previously guided year-end equity dilution ratio of 2% may also need to be increased accordingly.

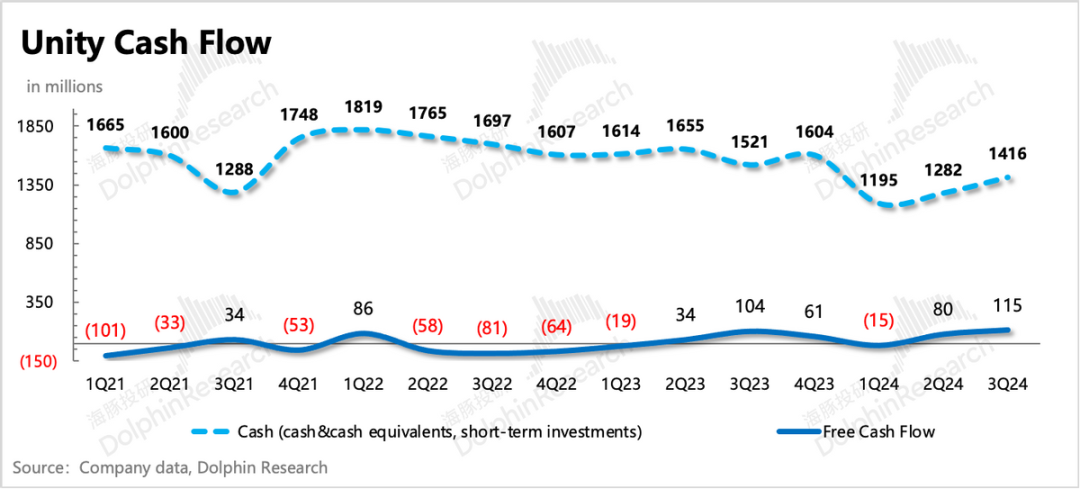

IV. Cash flow: Continued improvement in free cash flow

There were no major issues with cash flow changes in the third quarter. As of the end of the third quarter, the company had cash on hand of RMB 1.42 billion, an increase of RMB 130 million from the previous quarter, mainly due to the improvement in operating performance and the maintenance of low capital expenditures.

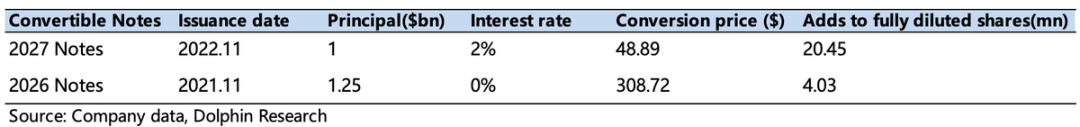

The company has no interest-bearing debt, and financing is mainly through direct share issuances or convertible bond issuances. The total face value at the end of the third quarter was RMB 2.2 billion, with no redemptions or new issuances in this quarter. As performance gradually improves from its worst phase and cash flow stabilizes, there is no need to worry about the impact of financing needs on equity dilution for the time being.

Dolphin Insights "Unity" Related Readings:

Earnings Season

August 10, 2024 Earnings Review "Surging Without Reason, but a 'New' Unity is Expected"

May 10, 2024 Earnings Review "Unity: Is the Painful Healing Process Nearly Over?"

February 27, 2024 Earnings Review "Unity's Plunge? Poor Management, Shoddy Moves"

November 10, 2023 Earnings Review "Non-stop Shenanigans, Unity Rocks and Rolls"

August 3, 2023 Earnings Review "Repeatedly Hyped Unity, Performance Also Impressive"

May 11, 2023 Earnings Review "Unity: Did the Beat Send It Soaring? Wait a Minute..."

February 23, 2023 Earnings Review "Unity: A Powerful Alliance with IronSource, but Still Unable to Withstand the Industry Winter?"

November 10, 2022 Earnings Review "Unity: Accustomed to Plunging? Performance Not That Bad, Not That Good"

August 10, 2022 Earnings Review "Unity's Crazy Capital Moves, MiHoYo's Entry Fails to Alleviate Short-Term Concerns"

May 11, 2022 Earnings Review "Unexpected Bombshell, Metaverse Shovel Stock Unity Also Crashes?"

In-Depth

October 12, 2022 "The Winter of Games Has Arrived, Where Is the Warm Spring?"

March 17, 2022 "Relying on the Imagination of the 'Metaverse' to Boost Valuation? Unity Says It's Possible"

March 9, 2022 "An Unclear Metaverse, but a Clear Unity"

- END -

// Repost Authorization

This article is an original work by Dolphin Insights. For reposting, please add WeChat: dolphinR124 to obtain repost authorization.

// Disclaimer and General Disclosure Notice

This report is for general comprehensive data use only, intended for general browsing and data reference by users of Dolphin Insights and its affiliated organizations. It does not consider the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any person receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person making investment decisions using or referencing the content or information mentioned in this report does so at their own risk. Dolphin Insights shall not be liable for any direct or indirect losses that may arise from the use of the data contained in this report. The information and data contained in this report are based on publicly available information and are provided for reference only. Dolphin Insights strives to ensure but does not guarantee the reliability, accuracy, and completeness of the relevant information and data.

The information or opinions expressed in this report shall not be construed, in any jurisdiction, as an offer to sell securities or an invitation to buy or sell securities, nor do they constitute advice, inquiry, or recommendation regarding relevant securities or related financial instruments. The information, tools, and data contained in this report are not intended for distribution to citizens or residents of jurisdictions where the distribution, publication, provision, or use of such information, tools, and data would violate applicable laws or regulations or result in Dolphin Insights and/or its subsidiaries or affiliates being subject to any registration or licensing requirements in such jurisdictions.

This report only reflects the personal views, opinions, and analytical methods of the relevant creative personnel and does not represent the stance of Dolphin Investment Research and/or its affiliated institutions.

This report is produced by Dolphin Investment Research, and the copyright belongs solely to Dolphin Investment Research. Without the prior written consent of Dolphin Investment Research, no institution or individual may (i) produce, copy, reproduce, replicate, forward, or create any form of copy or reproduction in any way, and/or (ii) directly or indirectly redistribute or transfer to other unauthorized individuals. Dolphin Investment Research reserves all related rights.

// End-of-text bonus

Welcome to scan the QR code in the image to join the Dolphin Investment Research group and discuss investment opportunities with experienced investors.

Research reports are not easy to produce, please click 'Share' to give me a boost!~