Revenue down another 10.36%, performance declines for two consecutive years, how will Gigabit win back the market without relying on user acquisition

![]() 11/13 2024

11/13 2024

![]() 496

496

Recently, Gigabit, the parent company of Leiting Games, released its third-quarter financial report for 2024.

According to the financial report, the company achieved revenue of RMB 2.818 billion from January to September 2024, a decrease of 14.77% year-on-year. Net profit attributable to shareholders of the parent company (net profit attributable to shareholders) was RMB 658 million, down 23.48% year-on-year. Notably, the company's revenue and net profit continued to decline in the third quarter, reaching RMB 859 million and RMB 139 million, respectively, down 10.36% and 23.82% year-on-year.

Looking back at the full year of 2023, Gigabit achieved revenue of RMB 4.185 billion, down 19.02% year-on-year. Net profit attributable to shareholders was RMB 1.125 billion, down 22.98% year-on-year. Net profit attributable to shareholders after deducting non-recurring gains and losses (net profit after deducting non-recurring gains and losses) was RMB 1.119 billion, down 23.79% year-on-year.

Based on the financial data of the past two years, Gigabit's revenue has declined for two consecutive years, and its net profit has declined for three consecutive years, indicating severe challenges facing the company's performance.

The main reasons for the performance decline can be attributed to: "poor market performance of new games and the decline phase of core games entering their life cycle."

At the subsequent performance presentation meeting, Lu Hongyan, Chairman of Gigabit, repeatedly emphasized a view regarding future game production: "(Producers) should create products that move themselves." He explicitly opposed excessive reliance on user acquisition strategies, stating that "overly considering user acquisition costs actually deviates from the original intention of creation, which is to produce compelling products," and warned that this "has placed the project on the verge of error."

But how will Gigabit, which no longer believes in user acquisition, win back the market?

Not relying on user acquisition

A correction in Gigabit's content strategy

Gigabit has a diverse portfolio of game products, which can be mainly divided into three categories by theme: Xianxia (immortal-themed martial arts) series, such as "Ask Tao," "Fighting Immortals," "One Thought, Unrestrained," and "Thousand Foods of the Divine Land"; IP adaptations, including "Mole Manor," "Aobi Island: Dream Kingdom," "One Piece: Dream Compass," "Ultra Evolution Story 2," and the "Underground Castle" series; and unique innovations, such as "Fly, Dragon Rider," "Immortal Family," "Maze of Inconceivable Mysteries," "This Dungeon is a Bit Strange," and "Blade of Abyss."

However, Gigabit's core business actually relies on two pillars. Before 2021, the company primarily relied on its core MMORPG game "Ask Tao." From 2017 to 2019, the combined revenue of "Ask Tao" and its mobile version accounted for over 80% of the company's total revenue. After 2021, the emergence of "One Thought, Unrestrained" with an estimated first-month revenue of over RMB 400 million became Gigabit's new "second growth curve."

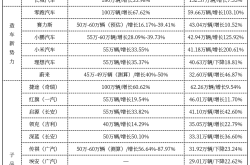

In 2023 and the first half of 2024, the combined revenue of "Ask Tao" PC version, "Ask Tao" mobile version, and "One Thought, Unrestrained" accounted for 71.19% and 68.17% of the company's total operating revenue, respectively.

This highly concentrated revenue structure poses risks of dependency on a few products.

Financial report data shows that from January to September 2024, the total revenue of "Ask Tao" PC version reached RMB 881 million, an increase of 7.71% year-on-year. Meanwhile, the revenue of "Ask Tao" mobile version was RMB 1.612 billion during the same period, a decrease of 14.13% year-on-year. The revenue of "One Thought, Unrestrained" was RMB 479 million, a significant decrease of 46.4% year-on-year. Clearly, the decline in revenue of "Ask Tao" mobile version and "One Thought, Unrestrained" is the primary reason for Gigabit's negative revenue growth.

Although Gigabit has faced the issue of "excessive revenue dependence on a single product" since its listing, its content strategy has evolved in two phases.

Before the launch of "One Thought, Unrestrained," Gigabit's games, whether developed or distributed, had good market reputations despite not generating high revenue. For example, self-developed games "Peculiar Warriors" and "Land of Mutation" received high ratings of 8.5 and 7.1 on TapTap, respectively. Distributed games also performed well, such as the classic IP "Mole Manor" and high-scoring titles "Underground Castle 2: Dark Awakening" and "Maze of Inconceivable Mysteries."

However, after the success of "One Thought, Unrestrained," Gigabit's game development direction deviated, with multiple projects attempting to replicate its success model, leading to malformed designs where "the model is set before the content." In 2021, there were significant changes in Gigabit's selling and research and development expenses. Selling expenses surpassed research and development expenses for the first time, with the expense ratio surging to approximately 28%, double that of the research and development expense ratio. Among them, promotional fees and operation service fees accounted for over 90%.

Taking the recent third-quarter performance presentation meeting as an example, Lu Hongyan, Chairman of Gigabit, candidly expressed dissatisfaction with the current game data regarding the testing and launch arrangements of "Sword of Immortality (Code M72)" and "Legend of the Staff Sword (Code M88)." He bluntly stated that the design of "Sword of Immortality" appeared mediocre, lacking differentiation from the company's star product "One Thought, Unrestrained," and failing to demonstrate sufficient innovation.

Lu Hongyan reiterated the company's core principle for future game development: striving to create products that truly move themselves and resolutely avoiding mediocre designs. This principle was further emphasized in the subsequent Q&A sessions.

When asked how to address the challenge of attracting users in a fiercely competitive gaming industry and how to respond to the impact of the current market's "low unit price, high DAU" model on Gigabit's traditional numerical experience model, Lu Hongyan clearly stated that the company should abandon the design approach that directly focuses on numerical experience and plans to gradually phase out such projects.

This strategic adjustment is not only a correction to Gigabit's past reliance on its content production path but, more importantly, reflects the influence of market pressure on its decision-making. The company has chosen to temporarily prioritize revenue to ensure that game content is competitive and attractive.

This significant shift is not only evident in new products but also in its core profitable product "One Thought, Unrestrained," where Lu Hongyan emphasized, "Revenue is not the top priority; maintaining the product's DAU is crucial."

However, for Gigabit, while it may be decisive to take drastic measures, turning around its content direction may not be easy. The right to produce content is not directly controlled by the company.

Drawbacks of the producer system

Aiming for big returns with small investments but following in others' footsteps

When Lu Hongyan, Chairman of Gigabit, was only 29 years old, he successfully created "Ask Tao" with an elite team of only five or six people. This game quickly became the core pillar of his capital empire.

This achievement also prompted a unique small-team development model led by producers within Gigabit, where producers take full responsibility for the project, and the company provides necessary support and resources while ensuring a reasonable benefit distribution mechanism.

In an interview in September 2023, Lu Hongyan revealed that most of the company's game development teams maintained a size of 20 to 50 people, with 30 to 40 people being the most common configuration. In contrast, industry giants like "Genshin Impact" had an early development team of over 300 people, and NetEase's "Legend of Condor Heroes" project gathered a development team of up to 600 people.

Although this small-team model has successfully nurtured low-cost, high-yield blockbuster products like "One Thought, Unrestrained," it is inevitably accompanied by a large number of projects that have not stood out. As the market environment changes, the limitations of this model have gradually emerged.

From a strategic perspective, the decentralized development model has its rationale to some extent.

Games, as a content industry, do not succeed merely through resource accumulation, as numerous failures attest. Sony and Ubisoft have contributed classic examples this year. Especially with the advancement of AI technology, the success of game creation increasingly depends on the producer's unique creativity. Therefore, dispersing resources into multiple projects in hopes of creating a few blockbusters, a strategy of "not putting all eggs in one basket," is theoretically feasible.

However, reality often falls short of expectations. For the company, even if only two of multiple teams can create blockbusters, it is sufficient to maintain overall profitability. However, for those unsuccessful teams, members' careers may suffer. Due to the benefit distribution relationship between Gigabit and development teams, this mechanism often drives producers to choose more stable business paths rather than risky innovations.

This results in a lack of genuine innovation in many producer teams' projects during development, contrary to Lu Hongyan's emphasis on "creating products that move oneself and avoiding mediocre designs." Instead, they often exhibit a conservative "staleness," tending to imitate the company's past successful products.

Furthermore, this content development system limits Gigabit's pioneering spirit and transformation speed. Although the company has multiple game IPs suitable for mini-game development, it has barely ventured into this field. Lu Hongyan admitted at the performance presentation that this is mainly because producers generally prefer developing mobile and PC games, and the company does not impose mandatory restrictions on this.

Not only in the mini-game sector but also in overseas market expansion and AI-game industry integration research and development, Gigabit lags behind. While this conservative strategy can be interpreted as the company focusing on game development without blindly following trends, it also reflects deficiencies in the company's control over self-developed content and planning of its development direction.

Although focused on research and development, Gigabit seems to be stuck in a comfort zone.