Focusing on the value release of new game IPs, exploring the commercialization potential of WeChat - A Brief Analysis of Tencent's 24Q3 Financial Report

![]() 11/15 2024

11/15 2024

![]() 523

523

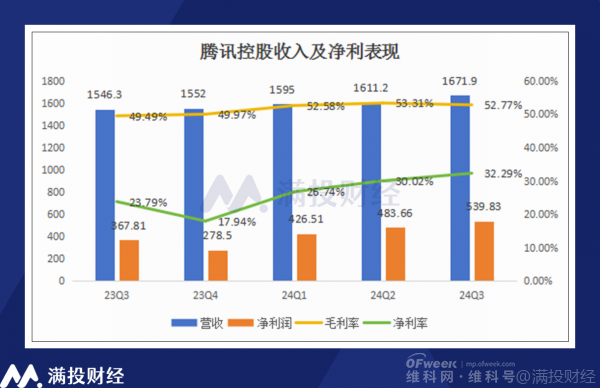

On the evening of November 13, Tencent Holdings (stock code: 00700.HK) released its third-quarter earnings announcement for the period ending September 30, 2024. In conclusion, the third quarter continued the performance of the company's mid-year report, with steady profit growth exceeding market expectations. Although the numbers were not as outstanding as the second quarter, it was still a satisfactory report card for Tencent investors.

Compared to earnings, the recent recovery of Tencent's gaming business and its efforts to tap into the profitability of WeChat Mini Programs are perhaps more anticipated by the market. Additionally, Tencent's renewed expansion in expenditures has also sent a clear signal to investors. Combining these elements, this article will analyze Tencent's third-quarter financial performance.

01

New game potential unleashed, ample supply of heavyweight IPs

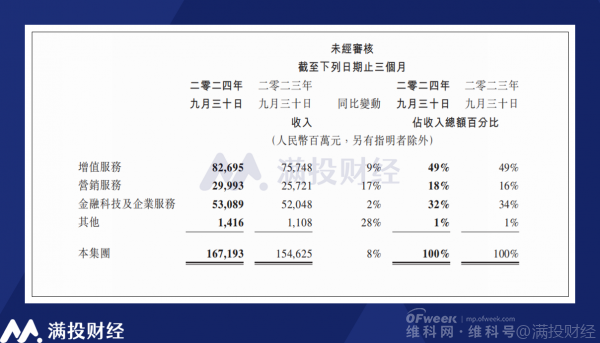

In the third quarter, Tencent achieved revenue of RMB 167.19 billion, up 8.1% year-on-year and 4% quarter-on-quarter. Breaking down the business segments, the company's value-added services, online advertising, and financial technology revenues increased by 9.2%, 16.6%, and 2.0% year-on-year, respectively. Focusing solely on the gaming business, Tencent generated RMB 51.8 billion in gaming revenue in the third quarter, up 12.6% year-on-year, with revenue from the domestic gaming market at RMB 37.3 billion, up 14% year-on-year, and revenue from the overseas gaming market at RMB 14.5 billion, up 9% year-on-year.

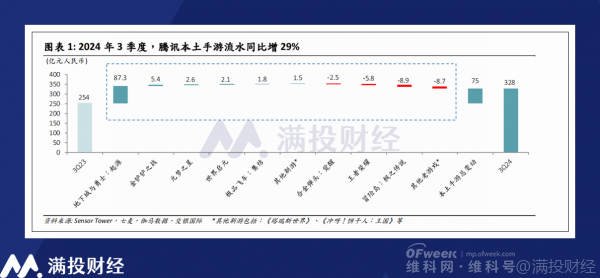

As Tencent's core business, its domestic gaming business has shown promising growth since the second quarter. I believe this is mainly due to the launch of its blockbuster game "Dungeon & Fighter: Origins" (DNF Mobile). As a heavyweight IP in the domestic gaming scene, "DNF Mobile" was launched on May 21st and did not fully unleash its revenue-generating potential in the second quarter, but its revenue growth was fully realized in the third quarter.

According to integrated game revenue data from BOCI Research, "DNF Mobile" generated RMB 8.73 billion in revenue for Tencent in the third quarter, driving Tencent's domestic mobile game revenue growth to 29%. It's worth noting that recently, "DNF Mobile" has gradually slipped down the best-seller rankings. As its revenue potential is realized, the sustainability of "DNF Mobile"'s profitability is being tested by the market, and whether it can become an "evergreen" game is a key concern for investors.

In the international market, the 9% year-on-year growth rate is not bad, but it was a drag on the gaming business in this quarter. In terms of product revenue, the international market still primarily contributes from products like "PUBG MOBILE" and "Brawl Stars". Tencent noted in its earnings call that due to improved retention rates for some games, the company adjusted its revenue deferral period, resulting in a lower growth rate.

Perhaps benefiting from the improving market environment, Tencent has shaken off its previous "difficult childbirth" state in game planning since 2024, with numerous anticipated games on the horizon. These include "Delta Force Action" launched in September, the real-time demo of "Honor of Kings World" disclosed in October, the Pokémon IP MOBA game "Pokémon UNITE" launched in November, and the recently rumored "Monster Hunter: Traveler". Tencent has clearly entered a strong cycle in game development.

It's worth mentioning that following the popularity of the domestic 3A game "Black Myth: Wukong" on August 20th, Tencent specifically cited this example in its post-earnings call, stating that its goal is to discover and invest in more game studios like the developer of "Black Myth: Wukong" and use its own studios to cultivate evergreen games.

In terms of IP reserves, Tencent has anticipated the launch of the popular IP game "One Piece: Ambitions" within the year, with other highly anticipated IPs such as "Dawn of the Breakers" and "NIKKE" to follow. At least in terms of expectations management, my concerns about a "generation gap" in Tencent's games have dissipated. As long as Tencent's game projects progress smoothly, the revenue growth of its gaming business should be guaranteed in the coming quarters.

02

Advertising & Financial Technology may weaken in the short term, while the commercialization value of WeChat remains to be tapped

Beyond the gaming business, Tencent has mostly met expectations. The company's marketing services, financial technology, and enterprise services generated revenues of RMB 29.99 billion and RMB 53.09 billion, respectively. Among them, marketing services maintained a high business growth rate, in line with market expectations for its Mini Programs and Video Number businesses; while the financial technology business fell short of expectations, with a noticeable slowdown in revenue growth.

According to the announcement, Tencent's marketing services revenue growth stems from the vitality of the WeChat ecosystem. Advertisers have strong demand for advertising inventory on Video Numbers, Mini Programs, and WeChat Search, driving rapid growth in the company's related businesses. Specifically, Video Number advertising revenue grew by more than 60% year-on-year, primarily driven by the enhanced commercial transaction capabilities of WeChat, which has led to more advertisers using the company's marketing tools.

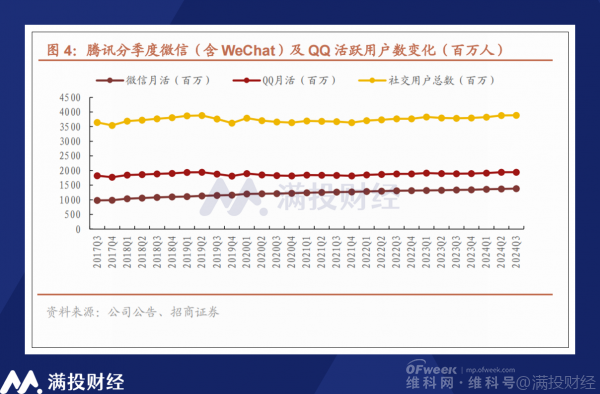

In the third quarter, Tencent built the "WeChat Store" around the original "Video Number Store" to enrich its ecosystem. Together with WeChat Search, Video Numbers, and the creative enhancements brought by the AI large model, its Mini Program transaction ecosystem is active, with transaction volume exceeding RMB 2 trillion within the quarter, encompassing online and offline services in various scenarios such as catering and retail, transportation, and utility bill payments. With the combined monthly active user base of WeChat and WeChat increasing to 1.382 billion, there are still many profit points to be tapped in WeChat.

In terms of financial technology services, the macroeconomic data for the third quarter unfortunately did not show the robust vitality anticipated. At least from my perspective, the macro "policy bottom" began in late September, and as of mid-November, macroeconomic data have not shown significant improvement. The recovery of economic growth needs to be gradual, and the financial technology business, which is closely related to the business environment, is naturally hampered by the sluggish market environment and shows poor growth.

Looking ahead to the fourth quarter, neither Tencent's financial technology nor advertising and marketing businesses have given positive outlooks. Affected by the unsatisfactory macro consumption environment, the growth rate of the advertising business in the fourth quarter may not continue at a fast pace.

In the long run, the growth potential of Tencent's Video Numbers has been verified. With a huge user base roughly equivalent to the country's total population, Tencent has the right to expand any business - as long as it's not too greedy. With the acceleration of commercialization initiatives based on the WeChat user base, Tencent's growth trend will remain positive for a long time.

03

Investment income continues to grow, capital expenditures resume expansion

Combining the expense and profit ends, Tencent's profitability in the third quarter was in a state of "slightly exceeding expectations". The company achieved a net profit of RMB 53.2 billion in the third quarter, up 47% year-on-year. Excluding non-IFRS items, net profit was RMB 59.8 billion, up 33% year-on-year. Behind this unexpectedly high growth rate, Tencent's investment layout continues to play a crucial role.

Specifically, in the three months ended September 30, Tencent's share of profits from associated and joint ventures amounted to RMB 6.02 billion, accounting for 9.6% of pre-tax profit, compared to only 4.4% in the same period of 2023. Similar to the second quarter, with the recovery of consumer confidence, the company's investment income increased significantly in 2024, becoming a significant contributor to the company's profitability.

On the expense side, Tencent deviated from its previous "cost reduction and efficiency enhancement" measures in terms of marketing and administrative expenses in the third quarter. Its expenses increased by 18.9% and 10.53% year-on-year, respectively, and by 2.79% and 5.7% quarter-on-quarter, respectively. This was seen by the market as a sign that Tencent was "turning defensive to offensive" and resuming capital expansion. Combining the aforementioned commercialization of WeChat and the explosion of game IPs, this speculation may not be far-fetched.

As supplementary data, in the third quarter of 2023, Tencent's total number of employees reached 108,800, an increase of 3,317 from the same period last year. After a year of integration, Tencent appears to have stopped mass layoffs. In terms of investments, as of September 30, the company's total investments in associated/joint ventures amounted to RMB 273.17 billion, an increase of approximately RMB 11.5 billion from the beginning of the year. The resumption of expansion in both areas has bolstered market confidence in the above speculation.

As mentioned in the previous article, as a conglomerate with diverse businesses, Tencent's performance itself reflects the outlook of the macro market to a certain extent. With Tencent "turning defensive to offensive" and showing enthusiasm for investment expansion, its signaling significance may be even more noteworthy.