Did Ni Fei hold back Red Magic?

![]() 11/18 2024

11/18 2024

![]() 642

642

Looking back at Nubia, its changing fate is quite typical. During its development, there have been at least three strategic missteps by Ni Fei, the main operator.

Author|Gu Xiao

Editor|Liu Shanshan

On September 1, 2020. Dressed in a black T-shirt and bright blue jeans, 44-year-old Ni Fei appeared at the launch event for the new ZTE Axon model.

This was his first public appearance since being promoted to head of ZTE's mobile phone business in June.

During the highlight moment of the event, he confidently yet cautiously stated that he aimed to bring ZTE's mobile phone brand back into the public eye within three years.

Although Ni Fei's goal was not aggressive, it still sparked controversy in the industry context at the time. While some were skeptical, others still believed in Ni Fei's chances of success.

Four years later, on the evening of November 13, 2024, at the JDG Esports Center in Yizhuang, Beijing. Dressed in a dark long-sleeved shirt and dark blue jeans, Ni Fei unveiled the Red Magic flagship new product—the 10 Pro series on stage.

At this point, Ni Fei had added several identities: dual president of ZTE's Terminal Business Unit and Nubia Technology Co., Ltd., as well as the actual operator of Nubia's sub-brand Red Magic.

Currently, the Red Magic 10 Pro series, which Ni Fei has high hopes for, is Nubia's most influential product in the consumer market.

Unfortunately, due to the niche gaming market it targets, the launch of the new Red Magic product barely caused a ripple in the broader consumer market. Even online discussions and media coverage were scarce.

More regrettable than the lackluster product response is that it seems few people care about Red Magic's future fate anymore—Ni Fei, who has yet to prove himself at ZTE, has also held back Red Magic over the years.

01

Unfulfilled Promises

Today's Nubia is as sunken as it was once glorious in the past.

2012 was an extremely special year for both Nubia and Ni Fei.

That year, according to statistics from iiMedia Research, ZTE smartphones accounted for 8.9% of market sales, ranking among the top five smartphone sales in China. Along with Lenovo, Huawei, and Coolpad, they formed the powerful alliance known as "Zhonghua Kulian" (China Mobile, Unicom, Coolpad, and Lenovo), with Samsung in the lead.

At that time, internet phone brands represented by Xiaomi, though nascent, had already demonstrated strong offensive power.

Seeing the situation was not right, traditional manufacturers took action, adopting a defensive offensive stance and successively launching their own internet brands to counter the offensive of emerging forces.

Ni Fei

Among them, ZTE was the quickest to react, deciding to be the first to launch an internet brand in 2012 and ultimately selecting a core team of 13 people, including Ni Fei, to establish Nubia.

From then on, Ni Fei's story with Nubia officially began.

Throughout the development of China's smartphone market, amidst nearly brutal competition and several rounds of technological change, the technology truly presented to consumers, excluding the competition for core technologies like chips, is actually quite similar.

Because all brands share a complete supply chain, and the links within it are transparent and interconnected.

Therefore, in this competition, the decisive factor is not technical but strategic, related to consumer insight, channels, and brand power. If these decisive factors are combined, it essentially boils down to one sentence: leadership decisions.

From this perspective, looking back at Nubia, we can see that its changing fate is quite typical. During its development, there have been at least three strategic missteps by Ni Fei.

The first was in photography.

In fact, Nubia was one of the earliest brands to focus on mobile phone photography. This consumer insight is said to have come from Li Qiang, Nubia's founding president. Li Qiang himself is said to love documenting life, has won awards for his photography, and has served as a director of the Entrepreneur Photography Association.

Li Qiang noticed that there were no phones on the market dedicated to photography, so he led this strategy.

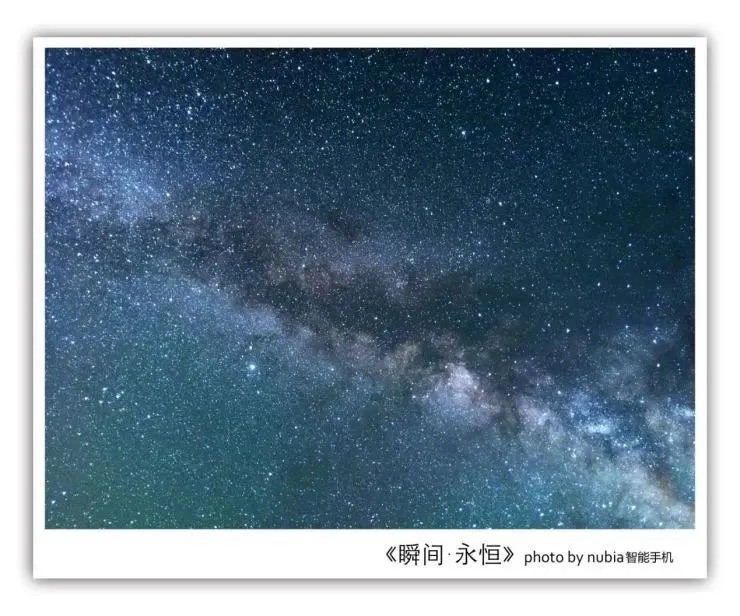

Therefore, Nubia's earlier products performed better in imaging than contemporaneous products. To this day, the first galaxy photo taken by a mobile phone in human history, titled "Moment of Eternity," captured by the Nubia Z7 Max, is still displayed at the National Astronomical Observatory.

With such a favorable start, it is unfortunate that it was Huawei and vivo that truly pushed the labels of photography and high-end into the mass market in the future.

Looking back at the strategies of several brands in promoting camera phones with hindsight, it is evident that there are differences in decision-making between their leadership teams.

Starting in 2013, vivo made imaging its core long-term strategy and collaborated with Zeiss on imaging research and development. Huawei, upon entering the scene, brought in the world-renowned imaging brand Leica for strong endorsement and brand enhancement.

In promoting applications to market users, Huawei chose moon photography as a featured application, while Nubia chose star photography. Years later, Ni Fei himself admitted that urban pollution is too severe to capture stars, and there are too many stars, making photography difficult; whereas the moon only faces people with a fixed side, which is highly abstract and has past data to reference, leaving much room for maneuver.

The second misstep was in offline channel selection.

In 2016, internet phone brands suddenly lost speed, and there was discussion about whether the "internet model was no longer working?" At the same time, OV (OPPO, vivo) shone brightly relying on their deeply ingrained offline channels, with verifiable data showing that the shipment growth of these twin stars both exceeded 100% that year.

At the same time, internet brands, including Xiaomi, began to realize the limitations of online channels and the vast and substantial potential of offline markets, prompting them to increase their offline presence.

Nubia was naturally among them.

However, unlike Xiaomi, which actively established its own channels such as Xiaomi Homes, Nubia was extremely cautious. Unfortunately, its cautious bet on offline partners was Suning, which later fell into its own existential crisis.

From limited information, it seems that Ni Fei was reluctant to invest too many resources in channel development, preferring a light-asset cooperation model. In Ni Fei's view, large-scale offline investment was risky without proper product and brand layout and enhancement.

This statement conveys a rather subtle meaning, seemingly related to product confidence?

The third misstep was misjudging the 5G trend.

ZTE has deep technical accumulations in the 5G field, so Nubia also had high hopes for 5G terminal products.

During the 5G promotion process, Ni Fei placed undue hope in operator channels. Even in 2020, Ni Fei was still anticipating an explosion in operator channels.

In a 2020 media interview, Ni Fei stated, "Although the volume of 5G phones through domestic operator channels has not yet exploded on a large scale, I think it will come. When 5G base station construction reaches a certain scale, I believe operators will invest more to drive 5G consumption."

Looking back now, the explosion in operator channels did not arrive as scheduled. Unlike the operator channel dividends a decade ago, the mobile phone market has long since moved beyond the dividends of feature phone upgrades, transforming into stock competition in mature channels and market structures. The notion of operator channel dividends no longer exists.

Therefore, considering these factors, looking back at the promise Ni Fei made in 2020, the difficult-to-achieve outcome of his goal may have already foreshadowed its fate.

02

Still Niche Nubia

Relying on Red Magic phones, Nubia has focused on the gaming market and indeed brought some reputation to the brand. For example, Red Magic is now the top-selling gaming phone globally.

Although Nubia seems reluctant to disclose the exact sales figures of Red Magic, at least this inspiring label has been secured.

But frankly speaking, relying solely on the niche gaming market may not be enough to support Nubia's ambitions.

Take the newly released Red Magic flagship product, the 10 Pro, for example. As a gaming phone, its biggest highlights are the full screen and the long battery life provided by the large battery.

Without discussing the compromise in photography quality due to the under-screen camera used for the full screen or the emphasis on battery size at the expense of body thickness and weight, just considering the core aspect of gaming performance, there seems to be a series of embarrassing talking points.

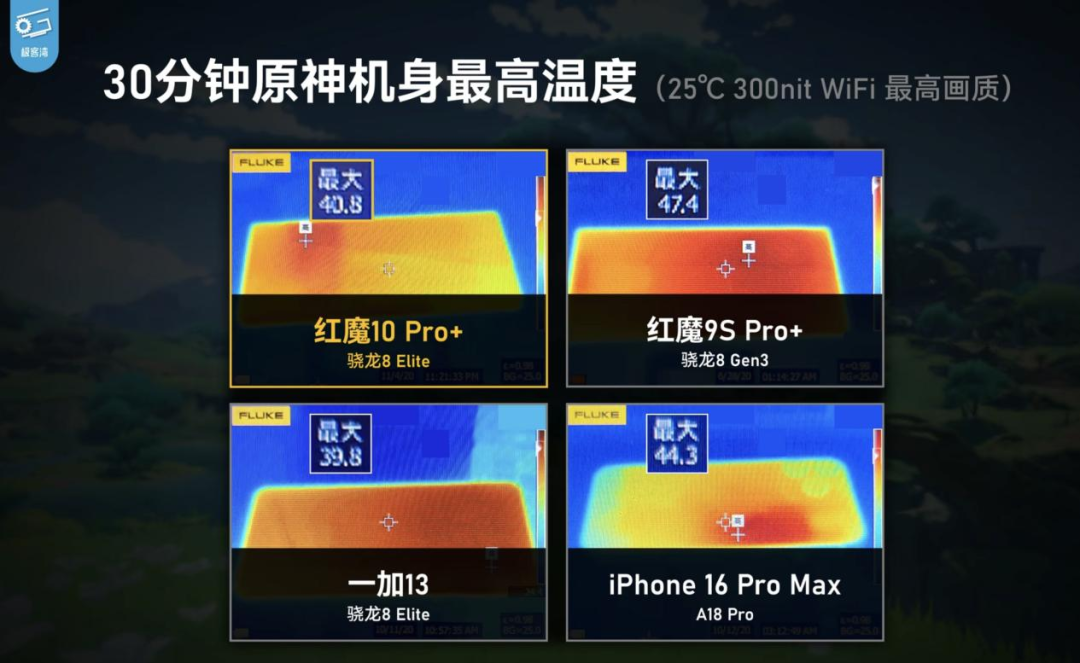

Simply put, there is almost no difference in gaming experience between gaming phones and flagship phones. In fact, in some gaming heat tests, flagship phones have even surpassed gaming phones.

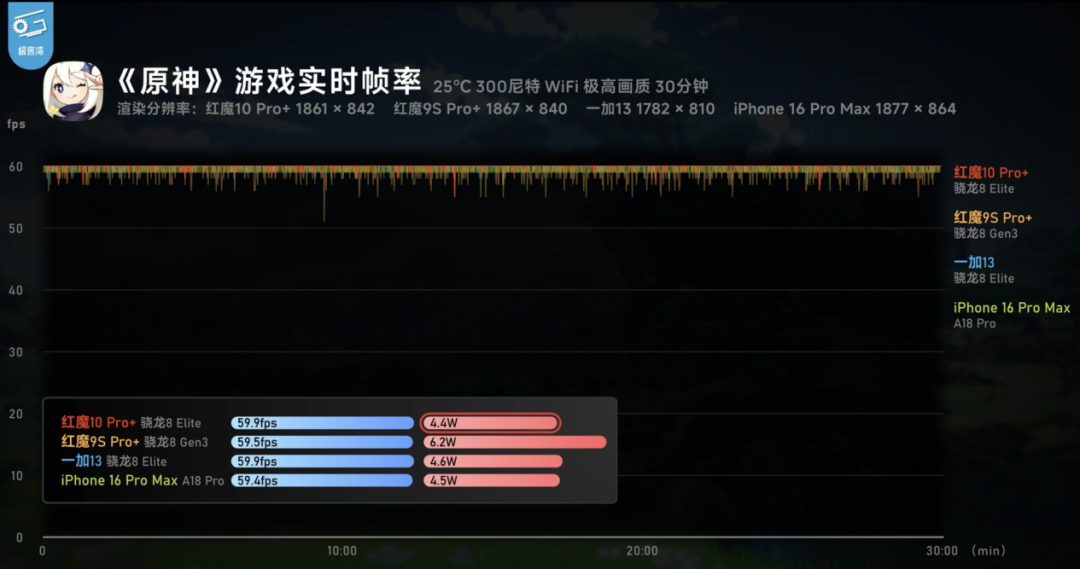

For example, according to tests by Geekerwan, under the same environment and settings, when playing "Genshin Impact," the frame rate was identical to that of other flagship phone brands tested. Identical.

Image source: Geekerwan

Even more surprisingly, the industry's first composite liquid metal PC-grade cooling technology, specifically mentioned by Ni Fei at the launch event, seems to show little noticeable difference in real-world usage.

According to Geekerwan's tests, the maximum temperature of the new Red Magic phone after running "Genshin Impact" for 30 minutes was actually 1 degree higher than that of the OnePlus 13.

Image source: Geekerwan

Seeing these data points, one cannot help but recall an ancient discussion: Is a gaming phone a pseudo-proposition?

Now, cautiously speaking, in terms of playing "Genshin Impact," the Red Magic 10 Pro has likely been proven false.

As a compromise of comprehensive performance, mobile phone manufacturers make the utmost balance during the design process to preserve the overall experience. For example, to increase battery life, the most direct method is to add more battery, but this also increases the phone's weight and thickness. Therefore, the flagship phones ultimately presented in the market have very similar specifications.

Gaming phones, targeting a highly segmented user group, must make significant design compromises, inevitably sacrificing some important factors in the process and excluding more general consumers.

Especially as mobile phone manufacturers' software optimization capabilities continue to improve today. Factors such as battery life, heat dissipation, and frame rate have become increasingly stable and mature through software optimization and adjustment. As a result, the advantages of gaming phones brought about by stacking hardware are gradually being eroded. Moreover, since flagship phones have larger shipments, they have more robust corporate resources to mobilize team software optimization and research and development, forming a positive enhancement loop. These factors continuously enhance the gaming experience of flagship phones, exerting positive pressure on gaming phones.

03

Difficult to Sustain in a Niche Market

Initially, the gaming phone market was far from as desolate as it is today.

There were also players like Black Shark, iQOO, and Lenovo Legion. However, gradually, players in this market either closed down or transformed, leaving only Red Magic as the "heavyweight" contender.

The so-called "survival of the fittest" made Red Magic the world's largest gaming phone brand.

However, considering the fate of transformed brands, such as iQOO, which, after shedding its gaming phone label, now achieves quarterly sales of over 1.5 million units and is thriving, it raises the question of why Red Magic chooses to persist in this market.

Actually, from an objective perspective, the only card Nubia can play at present is being the world's number one gaming phone brand. Although it is the number one in a niche market, it is still the number one.

If they were to transform, would they still have confidence in rising to the top from other markets? And if they were to fade into obscurity, would it subtly affect team morale? Who could afford to take this risk?

For Ni Fei, these are very real issues that must be considered repeatedly.

Moreover, transformation requires great courage, but from the clues available, it seems that Ni Fei prefers a steady approach. Take his attitude towards channel construction, a crucial factor affecting sales. Just because of the high investment cost and heavy assets, Ni Fei openly expressed caution and did not adopt a must-win attitude. In 2020, he also stated that he would consider large-scale offline expansion if the opportunity arose, but based on the current situation, the opportunity has yet to come. These factors may all be important reasons for Red Magic's continued perseverance.

Even with its current perseverance, we can see that Red Magic is facing increasing pressure.

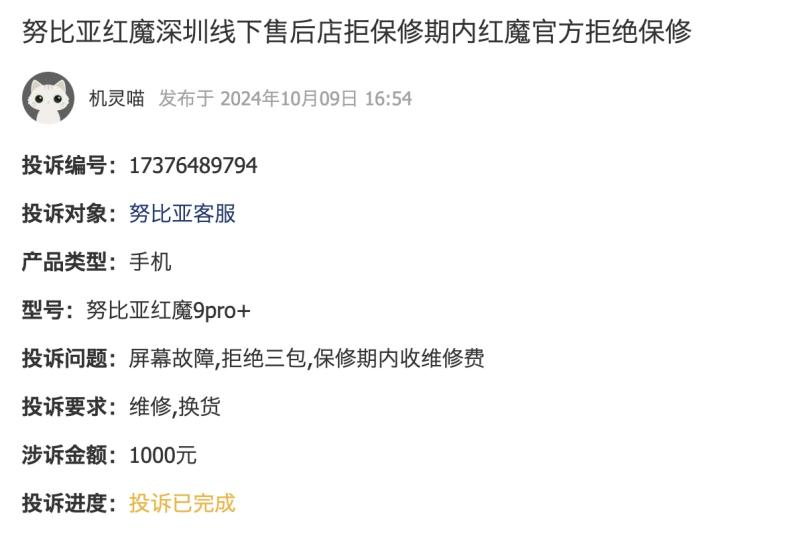

Setting aside external market competition factors, even the after-sales issues indirectly caused by its focus on online sales and insufficient offline channels have become a concern for consumers considering Red Magic.

Image source: Hei Mao Complaints

Various signs indicate that for Nubia to rely on Red Magic for a stunning turnaround may still be a long way off.

But in the end, we have to point out that in Ni Fei, we can see a rare kind of perseverance. Hmm. As long as we don't leave the table, perhaps there is still a chance.

END

Produced by: Huang Qiangqiang