Trump Trade Fading: An Opportunity or a Pitfall?

![]() 11/19 2024

11/19 2024

![]() 564

564

Recently, asset volatility has surged amid the upheaval caused by Trump's election. The Trump Trade began to decline after peaking last week. Before delving into trading, let's first examine the current fundamentals. The U.S. has mainly released October's inflation and retail sales data.

I. October Inflation - Stabilizing or Soft Landing

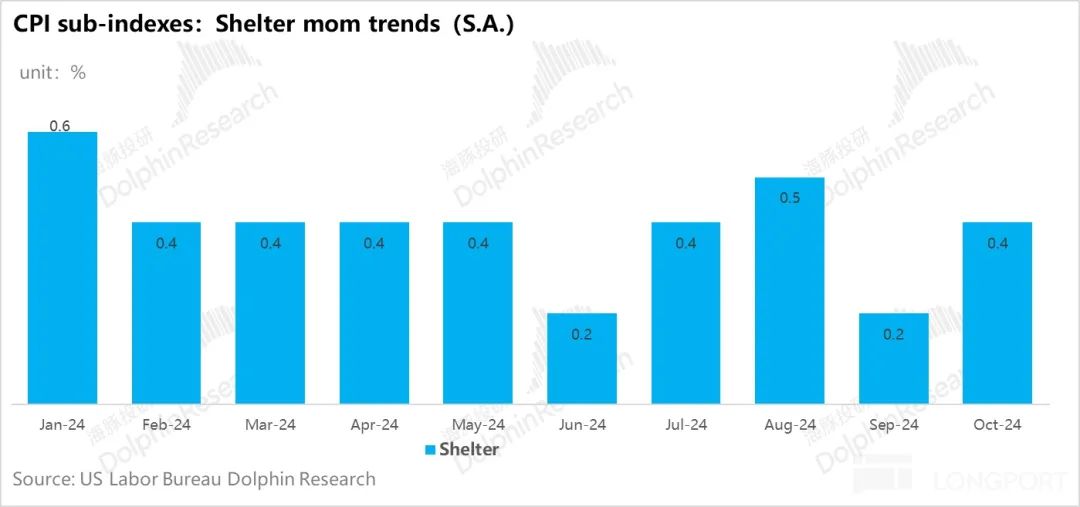

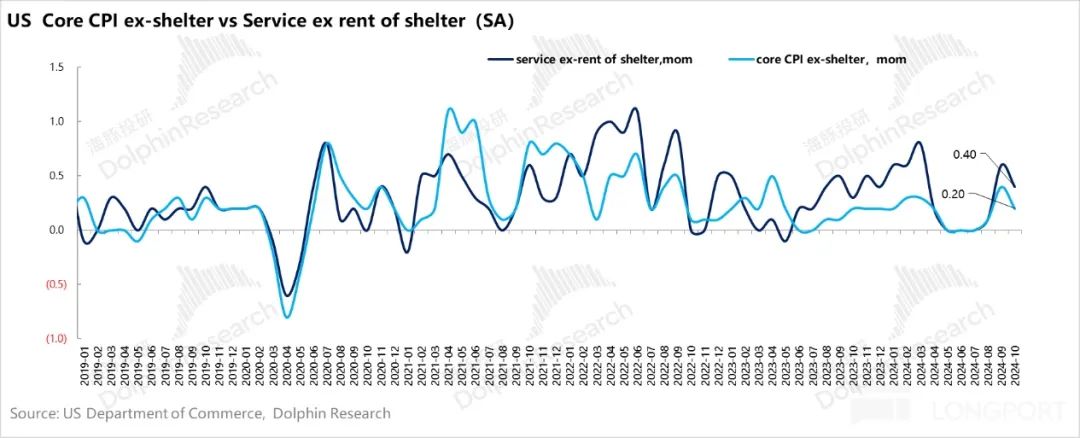

U.S. core CPI grew at a monthly rate of 0.28% in October, slightly lower than the previous month's 0.31%. However, this includes the impact of rising housing costs. Excluding housing costs and focusing on core services, a clearer downtrend can be observed.

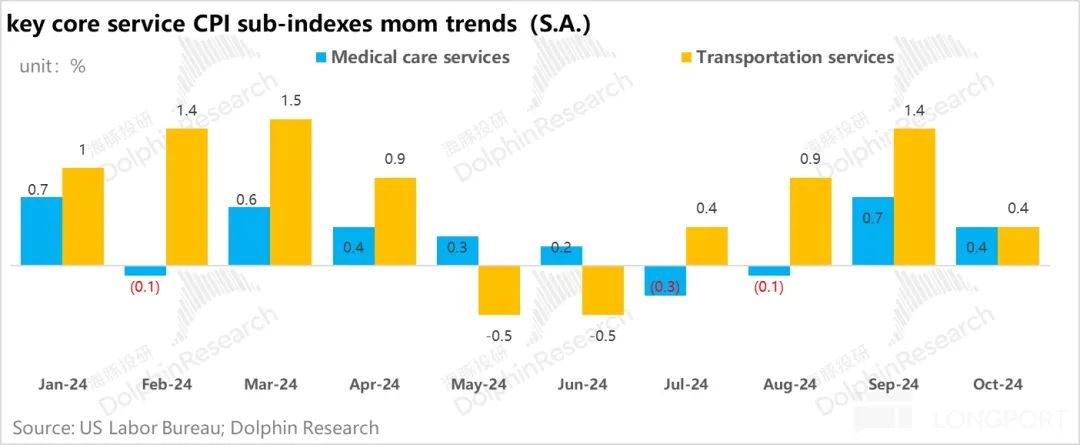

The main contributors to this downtrend are the significant declines in healthcare and transportation services, which had risen sharply the previous month. Specifically:

a. The cost of specialist physician services declined slightly in healthcare.

b. The more significant decline in inflation (falling from a monthly growth rate of 1.4% to 0.4%) is mainly due to the sharp drop in motor vehicle insurance costs, which fell from a 0.9% monthly growth rate to a 0.1% decline.

As motor vehicle insurance costs are primarily based on premiums, there is a lag in the transmission of insurance costs. Insurance companies consider their costs and profitability before adjusting prices, which requires approval from state regulatory bodies. Essentially, this adjustment also depends on the profitability trends of vehicle insurance companies.

Overall, the October CPI data indicates that while the U.S. disinflation process is slow, inflation is indeed subsiding, and prices are approaching normal levels. It is estimated that the inflation trend reflected in October will not significantly influence the Fed's assessment of inflation trends or the market's judgment on the pace of interest rate cuts.

II. U.S. Retail Sales - Overall Stable, Structurally Weak

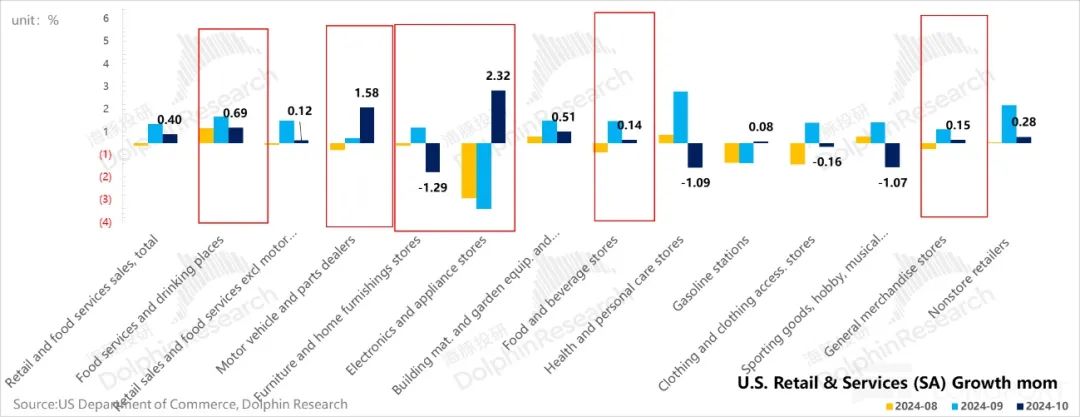

In October, U.S. retail sales, although appearing weaker on a seasonally adjusted monthly basis (from 0.84% to 0.4%), were still relatively robust. The 0.4% monthly growth rate equates to a 5% year-on-year growth, indicating solid performance.

This month's growth was primarily driven by sales of motor vehicles and building materials/garden supplies, which are cyclical goods. Excluding these categories, core retail sales (excluding motor vehicles, gas stations, restaurants, and building materials) recorded a slight negative growth rate, indicating weaker performance.

Therefore, while overall U.S. retail sales remain stable, there are underlying issues within the structure, with core retail sales showing weakness, suggesting a gradual slowdown in consumer trends.

Combining the macroeconomic data for October (I-II), the U.S. economy appears to be experiencing a soft landing with slowing growth.

II. Fading of the Trump Trade

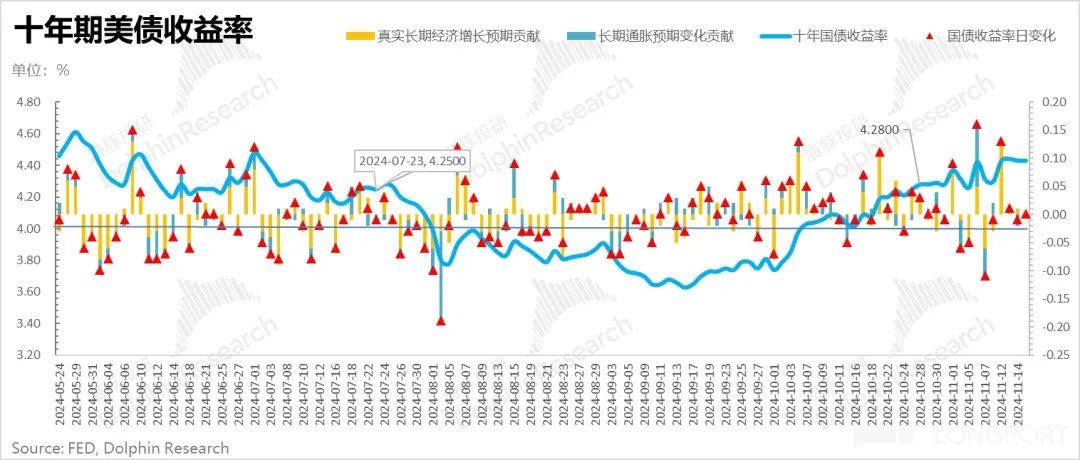

The economic fundamentals are solid, and Powell's statements imply that the pace of interest rate cuts will be based on fundamentals rather than predetermined amounts. These factors have led to an interesting situation: the 10-year U.S. Treasury yield is almost back to 4.5%.

Moreover, during this increase from 4% to 4.5%, the main driver has been expectations of long-term real economic growth rather than rising long-term inflation expectations.

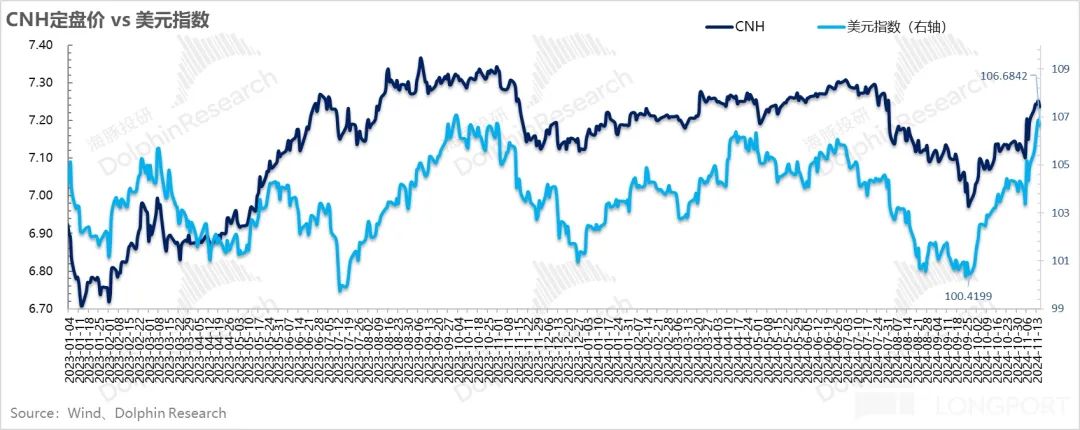

With robust economic fundamentals, the market has raised long-term economic growth expectations. Coupled with the Fed's emphasis on not predetermining the magnitude of interest rate cuts, the U.S. dollar has continued to strengthen.

Alternatively, the market is speculating that the U.S. economy under Trump will exhibit strong dollar characteristics. The U.S. Dollar Index has risen to nearly 107, a level last seen in 2022 when post-pandemic demand surged and supply was tight in the U.S.

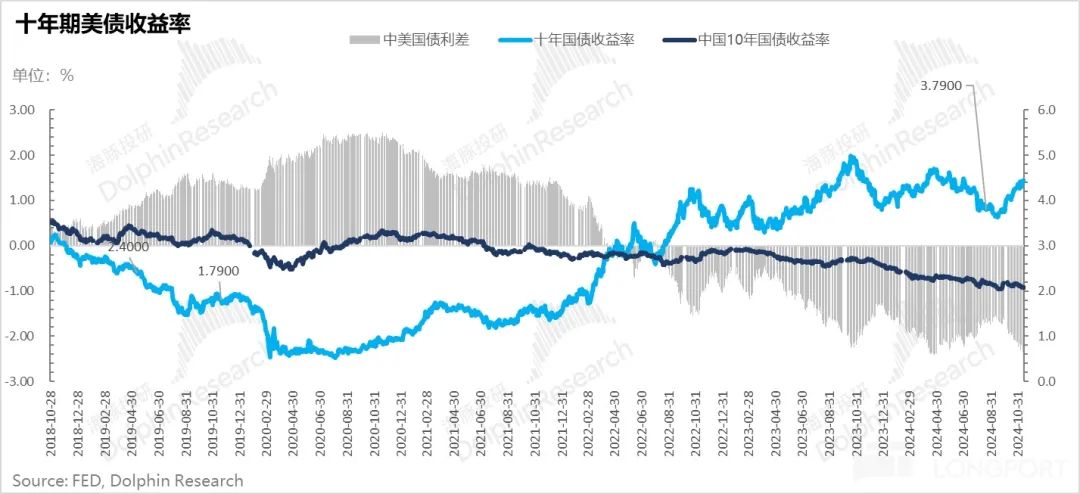

The strengthening of the U.S. dollar and the widening of the China-U.S. yield curve inversion are clearly attracting capital towards U.S. dollar assets, which is not favorable for emerging markets. For markets like Hong Kong, which are invested in by U.S. dollars, there is a clear liquidity drain effect.

Given Hong Kong's already low valuations, economic fundamentals are crucial for the market to rally. However, based on Dolphin's coverage of Chinese consumer staples in Q3, confidence is not high. Among leading companies:

a. Tencent's payment business revenue, representing commercial payment scenarios, declined year-on-year in Q3.

b. Alibaba's CMR revenue grew by 2-3% year-on-year in September.

c. JD.com's retail sales grew by approximately 5% in Q3, benefiting from device replacement subsidies.

While Q3's poor performance is widely acknowledged and the market has moved on, the focus now is on policy expectations and outcomes. However, companies seem hesitant to discuss Q4, with most only noting improvements in payment and platform transaction data after increased subsidies in October.

Companies remain cautious and conservative in their outlook for Q4, reluctant to express overly optimistic expectations. Clearly, most companies are taking a prudent approach.

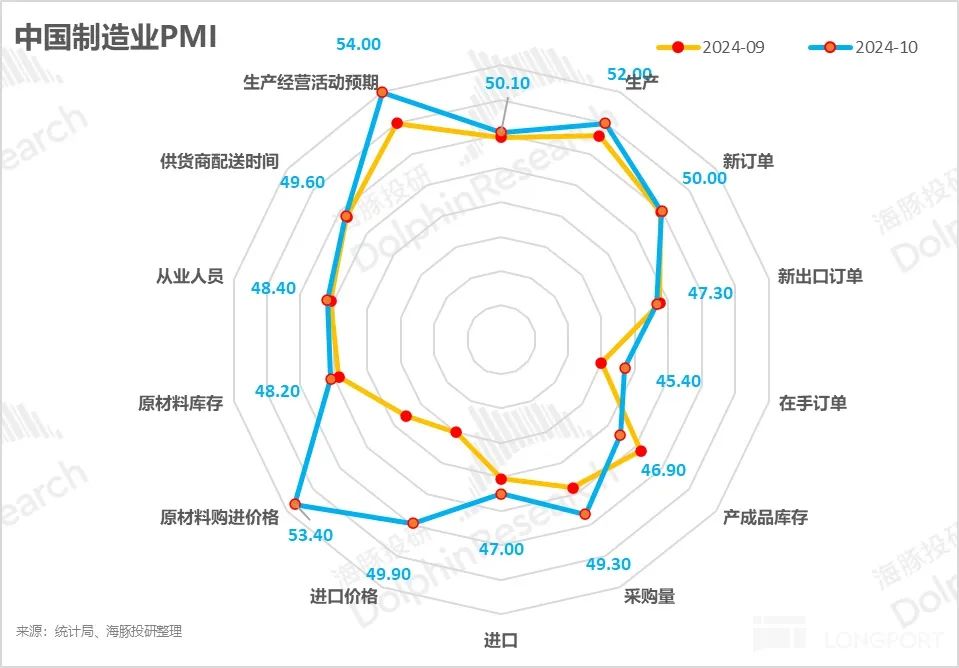

Nevertheless, from a macro perspective, signs of macroeconomic improvement are gradually emerging. While credit data remains weak, the manufacturing PMI showed a slight recovery in October, crossing the 50-point threshold for the first time since April. Hiring and labor costs began to recover in October, PPI's monthly decline narrowed, and retail sales grew by 4.8% year-on-year (partly due to the advancement of Singles' Day promotions to mid-October).

Currently, with the U.S. dollar and Treasury yields at relatively high levels, and more than half of China's earnings season completed, most risks have already been priced in. Companies are reluctant to provide outlooks for Q4.

The key now lies in the effectiveness of Q4 economic policies and how the year-end Central Economic Work Conference will set GDP and deficit targets for 2023.

At this juncture, as we observe policy effectiveness and anticipate further economic policies for 2025, Dolphin still believes there are trading opportunities in Chinese stocks after the recent correction.

III. Portfolio Adjustments and Returns

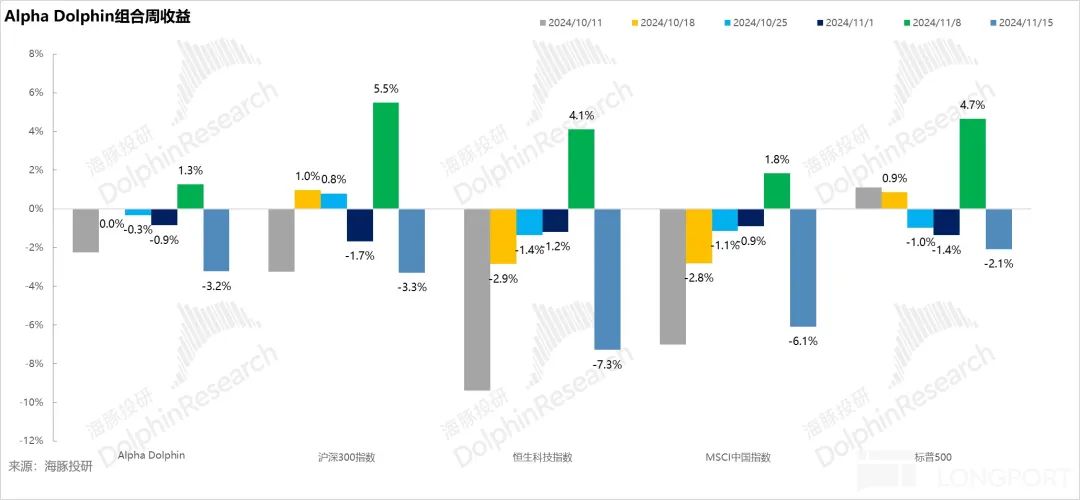

There were no adjustments to the Alpha Dolphin portfolio last week. The portfolio's return fluctuated by -3.2%, underperforming the S&P 500 (-2.1%) but outperforming MSCI China (-6.1%), Hang Seng Tech (-7.3%), and CSI 300 (-3.3%).

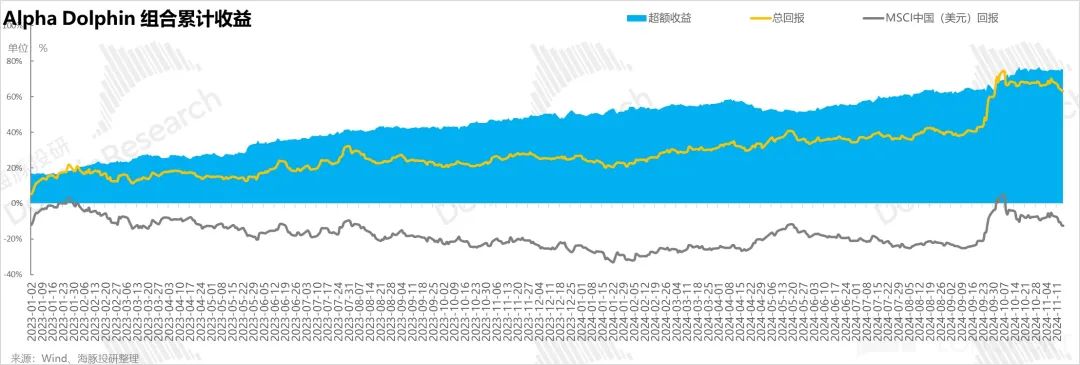

Since the portfolio's inception (March 25, 2022) to last weekend, the absolute return was 63%, with an outperformance of 75.5% compared to MSCI China. In terms of net asset value, Dolphin's initial virtual assets of $100 million have exceeded $166 million as of last weekend.

IV. Individual Stock Performance Contributions

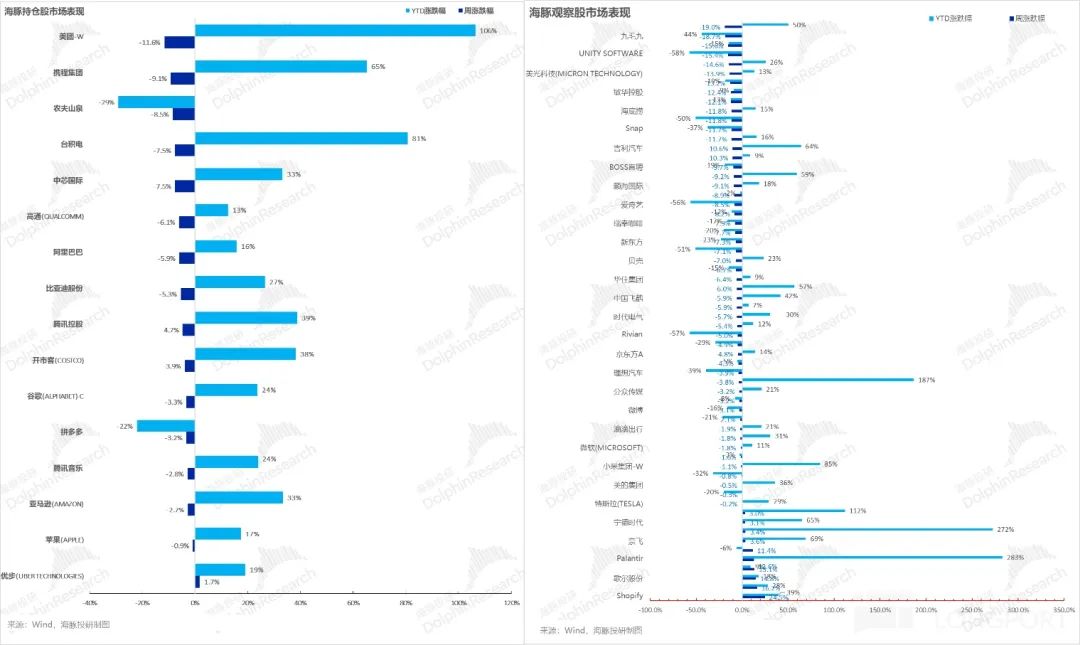

Last week's underperformance compared to the S&P 500 was primarily due to the rise in the U.S. dollar and disappointing earnings results from most Chinese stocks, leading to significant share price corrections.

From the price movements of companies covered by Dolphin last week, except for SaaS concept stocks driven by earnings, most other stocks, both Chinese and American, experienced corrections. Chinese stocks fell more due to the withdrawal of U.S. dollar liquidity. Meanwhile, the declines in U.S. tech stocks appear to be normal pullbacks after previous gains.

Dolphin's analysis of the top-performing and underperforming stocks is as follows:

V. Asset Allocation

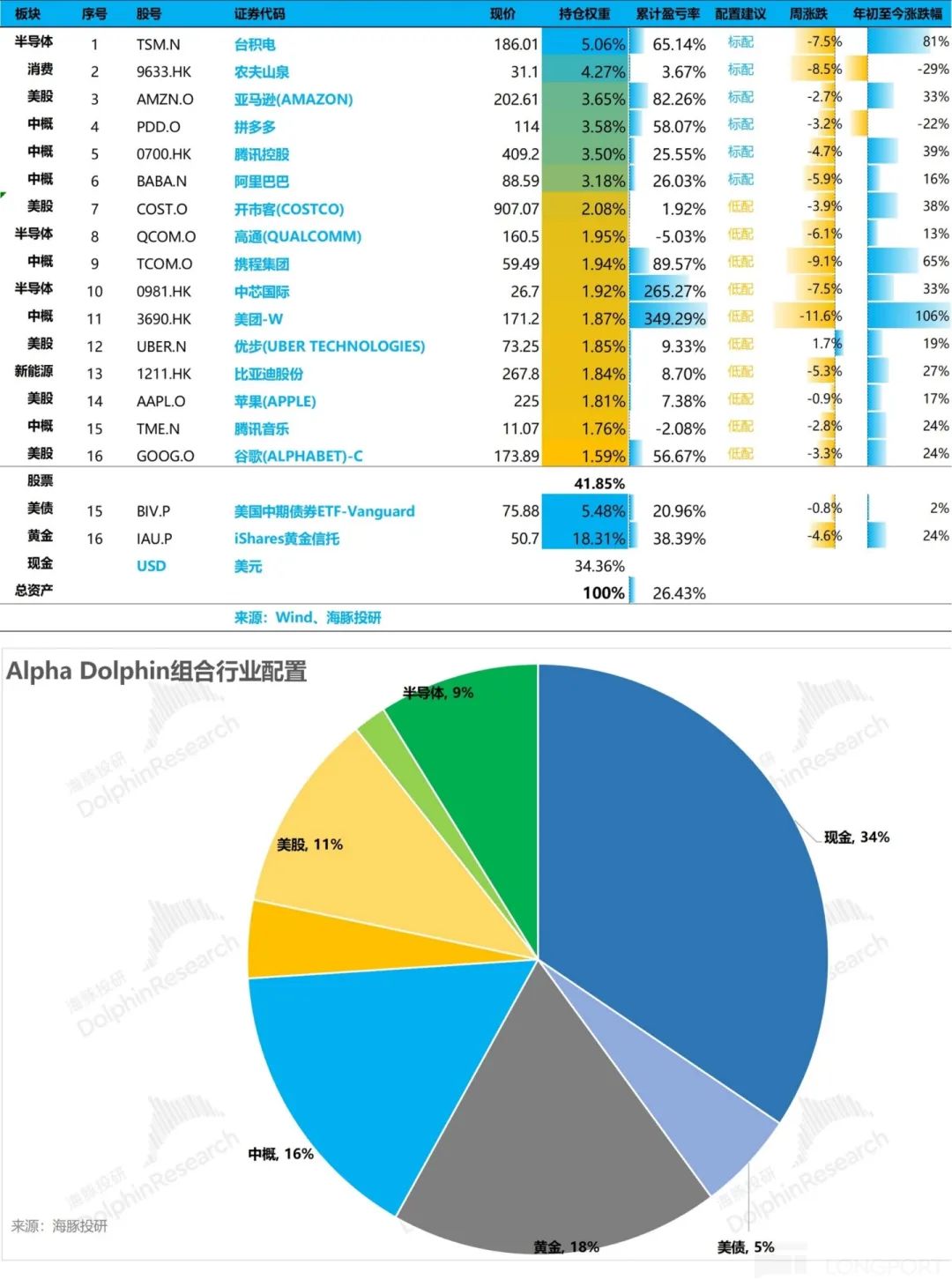

The Alpha Dolphin virtual portfolio holds 16 stocks and equity ETFs, with 6 at standard allocation and 10 underallocated. The remaining assets are allocated to gold, U.S. Treasuries, and U.S. dollar cash. As of last weekend, the asset allocation and equity holdings of the Alpha Dolphin portfolio were as follows:

VI. Key Events This Week

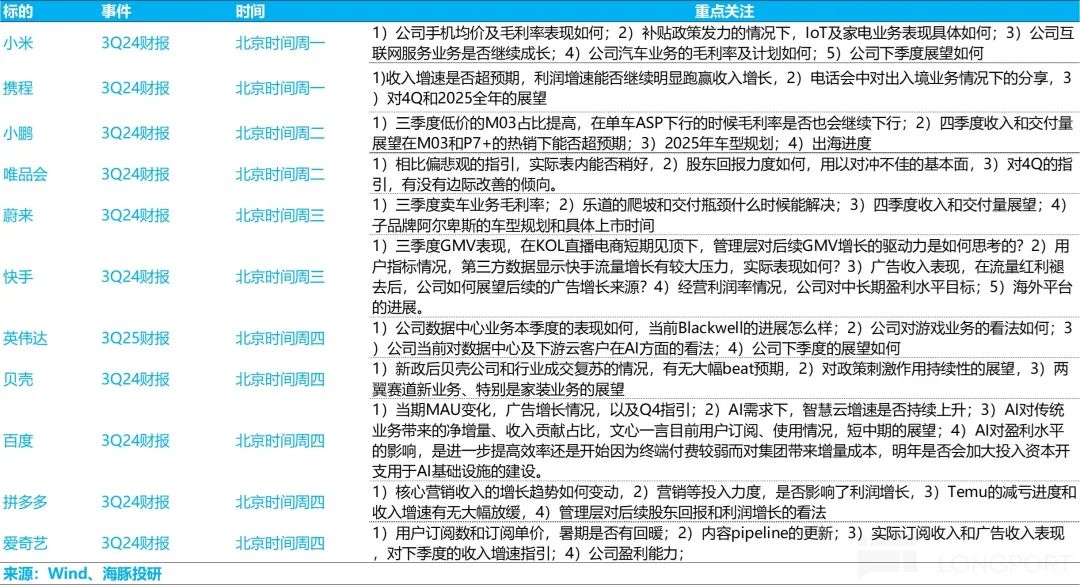

This week, the peak of the U.S. earnings season has passed, and the Chinese earnings season is in full swing. Key companies to be covered by Dolphin, including Tencent, Alibaba, JD.com, NetEase, Bilibili, and Sea, will release their earnings. Dolphin's coverage and core focus areas are as follows:

- END -

// Reprint Authorization

This article is originally created by Dolphin Research. For reprints, please obtain authorization.