Kuaishou: As KOL e-commerce matures, where does the future path lie?

![]() 11/21 2024

11/21 2024

![]() 575

575

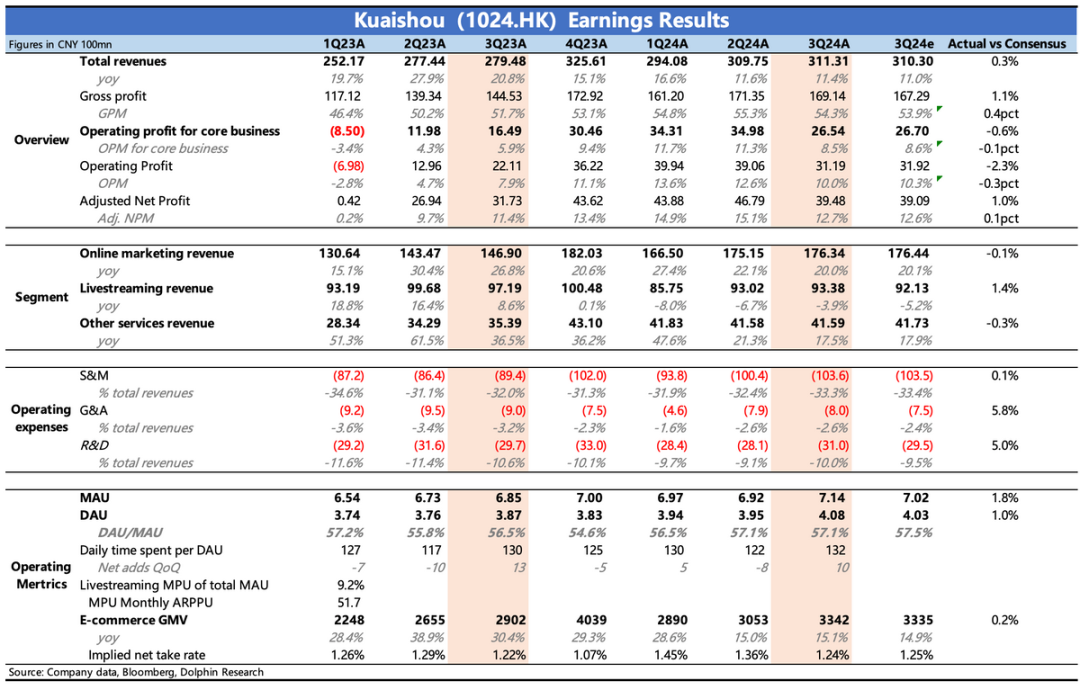

Kuaishou's third-quarter financial report was released after the Hong Kong stock market closed on November 20, Beijing time. Since the company had previously communicated well with the market, its actual performance was largely in line with expectations, representing a smooth and unremarkable landing.

Specifically:

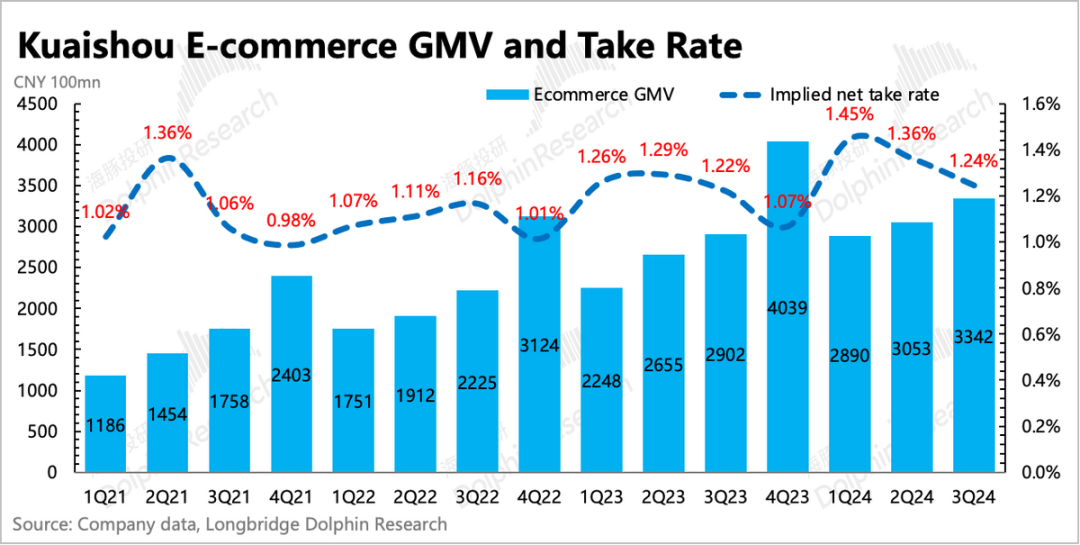

1. The pressure on live streaming e-commerce growth has arrived: Third-quarter GMV grew at a year-on-year rate of 15%, the same as the previous quarter, but the overall slowing trend is irreversible, and growth is expected to continue to decline in the fourth quarter due to a high base.

Beyond macroeconomic factors and the e-commerce off-season, Kuaishou also faces competition from traditional e-commerce platforms that offer discounts to merchants and subsidize users. The third-quarter commission rate was 1.24%, a quarter-on-quarter decline, reflecting the platform's increased concessions to merchants.

Attention is recommended for the management's discussion of Singles' Day performance and fourth-quarter performance so far, especially the effectiveness of government subsidies on Kuaishou's e-commerce.

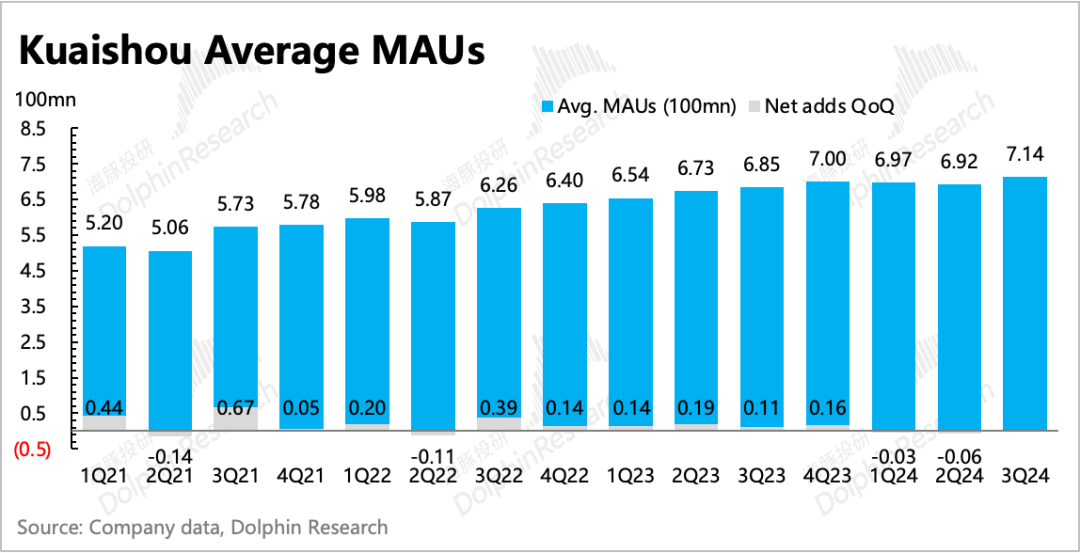

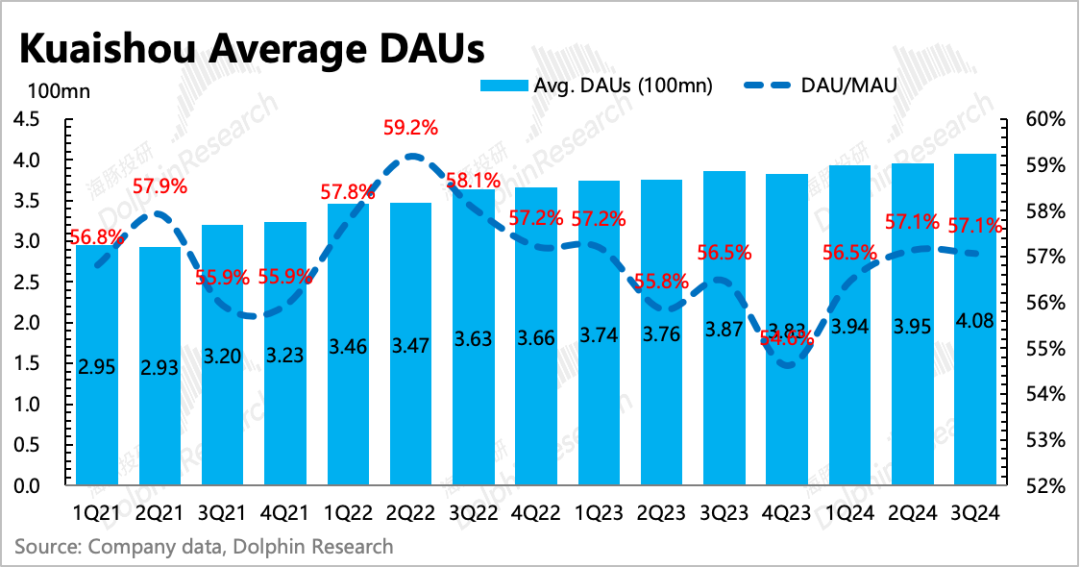

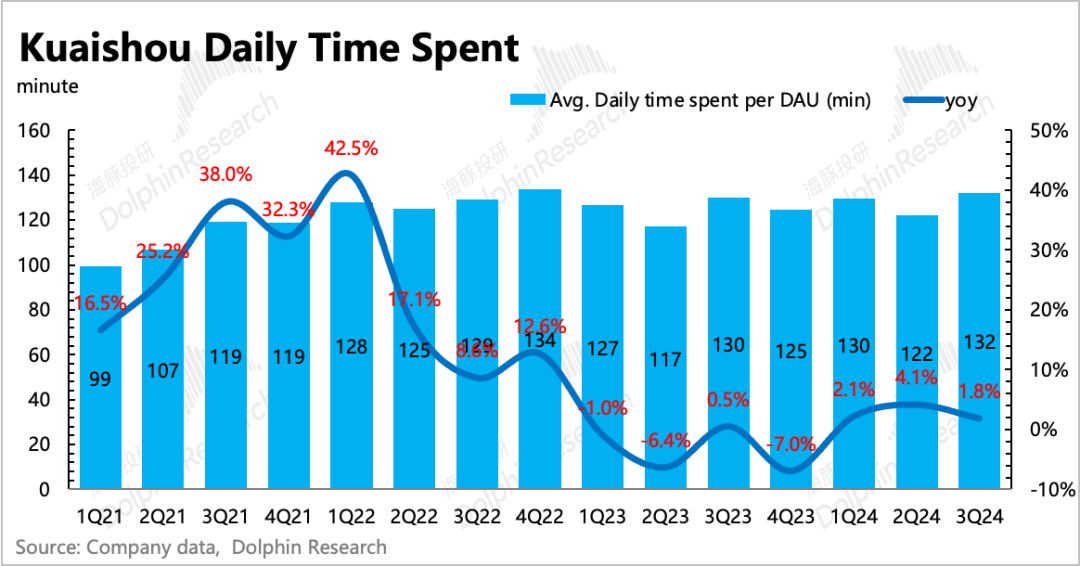

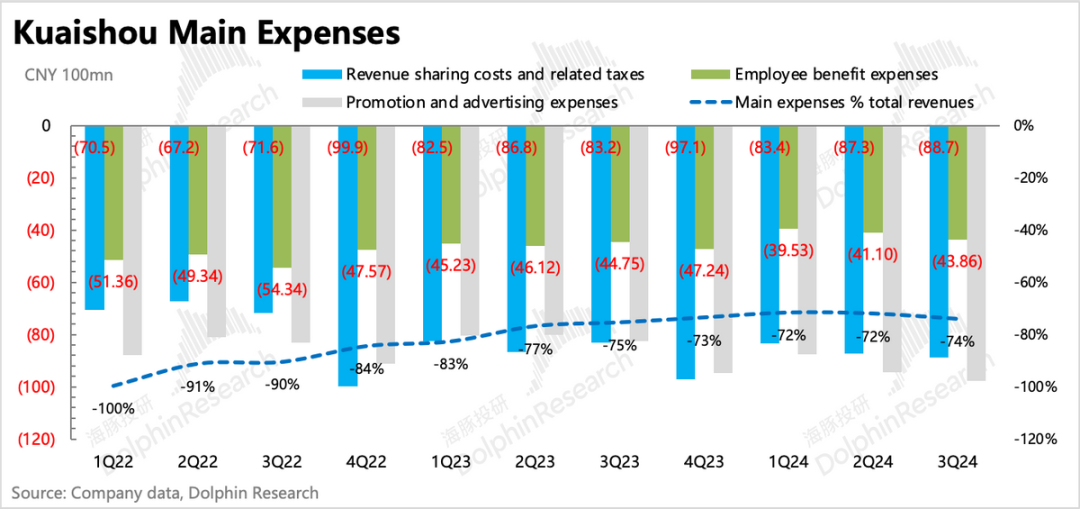

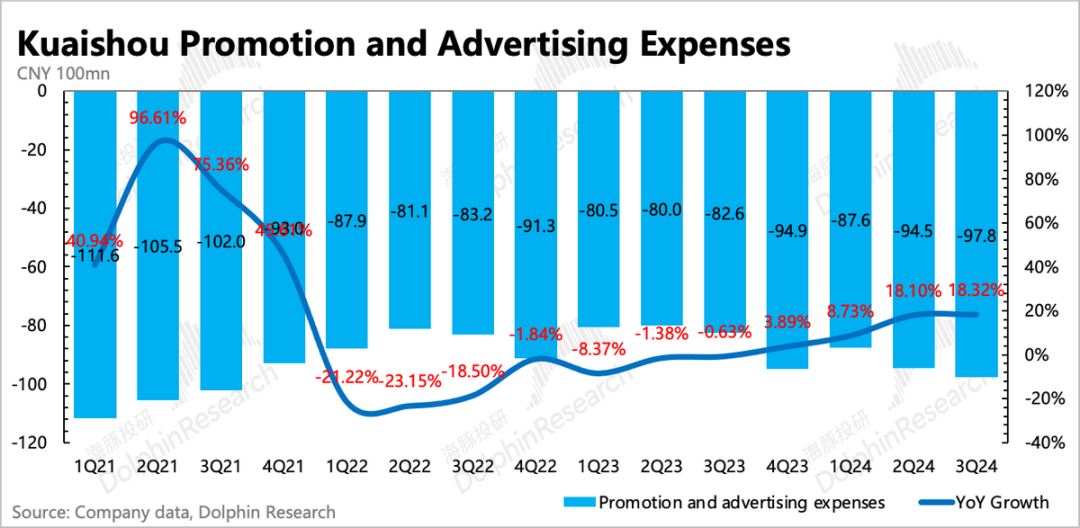

2. User metrics slightly exceeded expectations: Third-quarter MAU increased to 714 million, an increase of 22 million from the previous quarter, with DAU exceeding 400 million, achieving this year's user acquisition target. Although sales expenses continued to grow at a high rate (marketing expenses +18%, used for user retention and expansion into local services), reflecting the platform's proactive user acquisition efforts. However, other user engagement metrics also performed well in the third quarter, with user stickiness remaining high after new traffic was added, with average daily usage time per user reaching 132 minutes, an increase of 10 minutes.

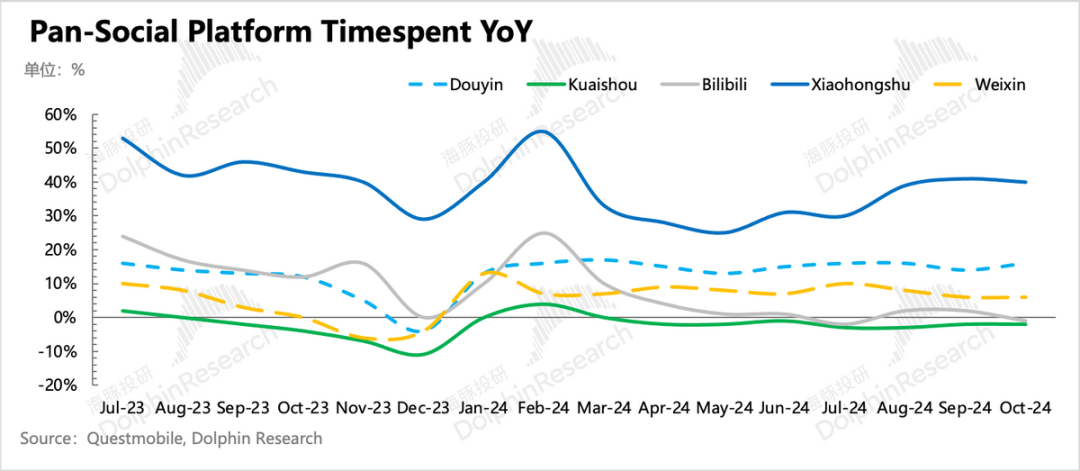

The actual user performance in the third quarter differed somewhat from external third-party tracking trends. Therefore, if the market primarily uses external data as a reference, Kuaishou's actual performance can be considered a pleasant surprise.

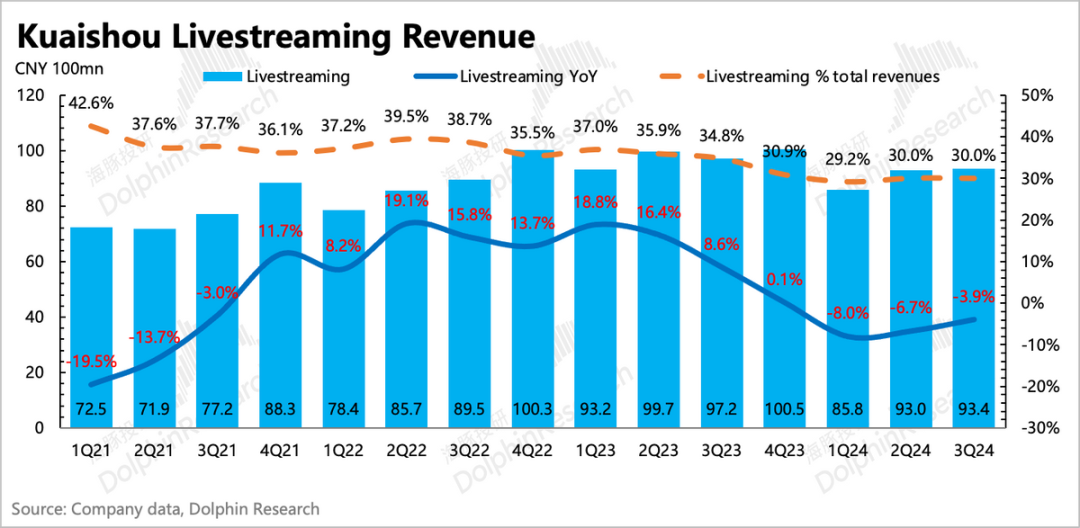

3. The impact of live streaming is rapidly converging: Although live streaming revenue continued to decline in the third quarter, the trend of slowing decline remained unchanged. Starting from the next quarter, the impact of the base effect will wane, and live streaming revenue is expected to resume growth.

Compared to live streaming businesses on platforms like Tencent Music and Netease Cloud Music, Kuaishou's rapid adjustment is attributed to its efforts to rectify non-compliant live streams while actively introducing high-quality live streams and fairly admitting them to the platform, thereby offsetting the impact. For example, the number of agencies signed by Kuaishou's guilds increased by 40% year-on-year at the end of the third quarter, and the number of signed anchors increased by over 60% year-on-year.

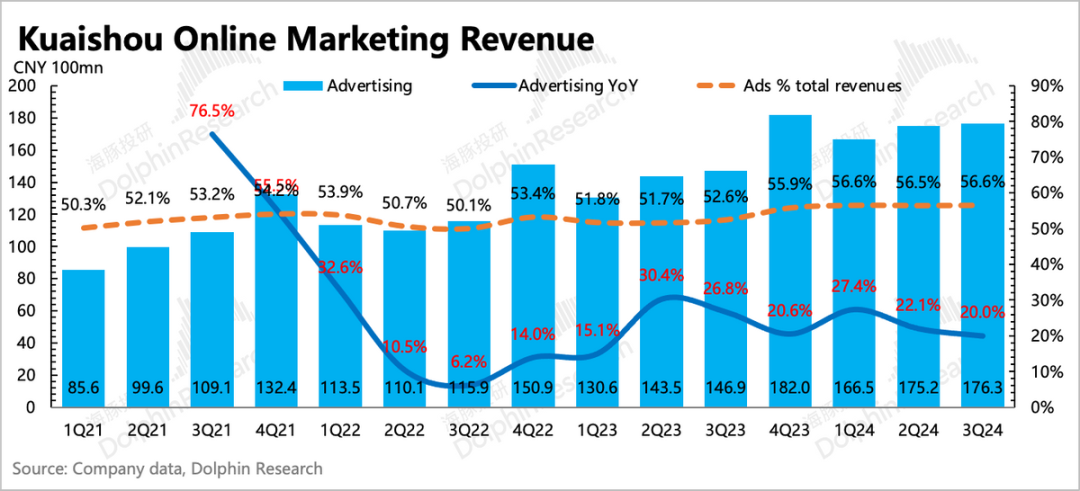

4. External circulation continues to recover: Third-quarter advertising revenue increased by 20% year-on-year, primarily driven by external circulation advertising. Incremental areas brought by external circulation advertising include short dramas with high industry prosperity, fiercely competitive e-commerce, and local services. Changes in internal circulation advertising mainly follow GMV and are realized based on the platform's ability to "actively adjust" the depth of monetization in the current period.

Although Kuaishou introduced many investment tools for e-commerce merchants in the third quarter, we believe that in the relatively difficult macroeconomic and competitive environment of the third quarter, these efforts had limited short-term benefits for improving Kuaishou's monetization rate. Therefore, it is expected that the growth rate of internal circulation advertising will remain the same as that of GMV, at 15%. This means that the growth rate of external circulation advertising will be above 25%, a strong recovery in the current environment.

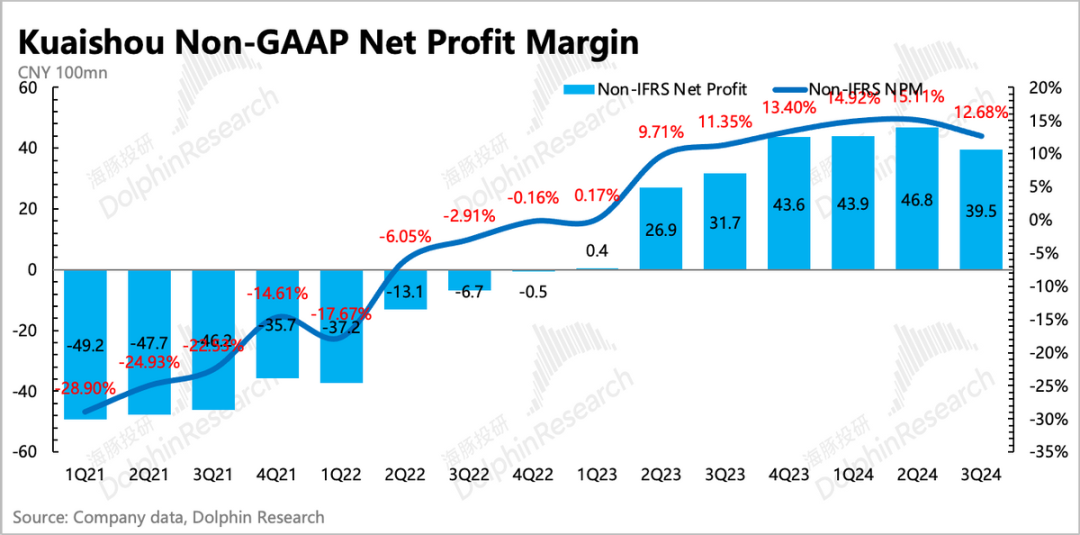

5. Profit margin improvement is temporarily suspended: The quarter-on-quarter decline in gross margin in the third quarter was related to the content costs of the Olympics, the increased revenue sharing from the recovery of live streaming, and increased server costs due to the development needs of the AI business.

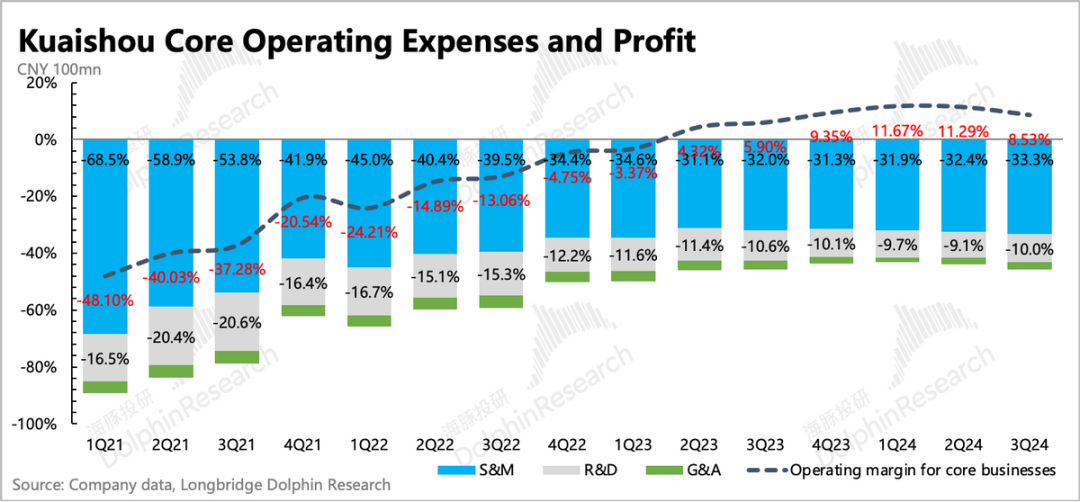

The increase in actual investment is also reflected in sales expenses. While compensation for sales personnel decreased, marketing expenses (used for user acquisition and retention, expansion into local services, and user shopping subsidies) continued to grow at a high rate of 18% in the third quarter, an increase of 1.5 billion yuan compared to the previous year. As a result, the operating profit margin of the core business was 8.5%, a quarter-on-quarter decline of 2.7 percentage points.

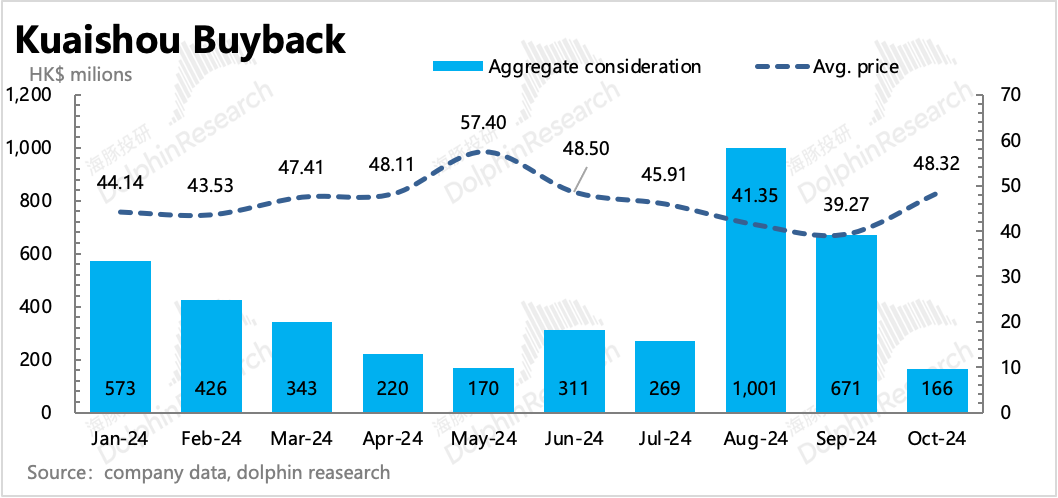

6. Shareholder repurchases have not yet increased: Facing market value pressure in August and September of the third quarter, Kuaishou increased its repurchases, spending 1.9 billion Hong Kong dollars to repurchase 47 million shares. The company's share repurchase plan, announced at the beginning of the year, involves 16 billion Hong Kong dollars over 36 months. As of September, 4 billion Hong Kong dollars had been spent, representing 25% progress, basically following the pace of repurchasing just enough to cover the three-year period. Therefore, based on the annual repurchase strength of 5.3 billion Hong Kong dollars, the current shareholder return is calculated to be 2.3%, which is not high compared to other Chinese concept assets with returns.

Since the company currently has limited foreign currency and needs it for the expansion of overseas businesses such as Brazil, there are no dividends for the time being. Perhaps when the Brazilian business becomes profitable next year and consistently contributes foreign currency cash flow, dividends will be considered to increase shareholder returns.

As of the end of the third quarter, Kuaishou had cash and deposits totaling 23.4 billion yuan. Including short-term investment financial assets, the total was 50.8 billion yuan, with net cash of 41.8 billion yuan after deducting long-term borrowings. The company's main business has long been profitable, and cash flow has turned positive, not consuming too much cash. Therefore, there are no absolute obstacles to increasing repurchases if desired.

7. Overview of detailed financial report data

Dolphin Insights

The third-quarter performance was in line with the company's previous quarter guidance, reflecting trends within expectations. What surprised us was the user data, but conversely, old problems remain to be solved—compared to peers, the transition to a broader shelf model is still slow.

Although the company is actively exploring multiple growth curves, including local services, short dramas, games, online recruitment, and more, Kuaishou's e-commerce attributes are still relatively heavy in the short term, and its performance is more susceptible to trends in the e-commerce industry, especially KOL live streaming e-commerce. With third-quarter results fully anticipated, the outlook for the fourth quarter is crucial.

Since the third quarter, competition in the e-commerce industry has not eased, and KOL live streaming has frequently encountered issues, which may make merchants more cautious about KOL live streaming. Fortunately, a series of government policies, including national subsidies, have been issued, and the national subsidy effect has been good. Although Kuaishou is not a mainstream platform for 3C digital products, it is expected to benefit to some extent.

Therefore, with both good and bad news offsetting each other, it is essential to pay attention to management's responses on the conference call regarding Singles' Day and the current fourth-quarter e-commerce transaction guidance.

Beyond revenue, short-term profit margins also seem to have stagnated at around 13% due to the end of the cost reduction and efficiency enhancement cycle, as well as the expansion of new businesses such as local services, e-commerce competition, and the recognition of costs such as AI. If short-term new businesses cannot provide effective growth and total revenue remains at a 10% growth rate, the current market capitalization of 226.7 billion Hong Kong dollars corresponds to 2025 performance with an adjusted P/E ratio of only 10x.

If this valuation is considered reasonable, it indicates that the market either views Kuaishou purely as an e-commerce stock or still lacks confidence in its medium- to long-term growth. Therefore, as KOL live streaming e-commerce "ripens," in addition to transitioning to a broader shelf model, it is urgent to find the next growth curve. Judging from current progress, Kuaishou is betting on local services (in cooperation with Meituan) and short dramas. It will be interesting to see if management reveals more progress, especially in local services; otherwise, the company will need to step up efforts to increase shareholder returns and boost long-term confidence.

Detailed Analysis Below

I. Peak Season + Olympics: The Market Heats Up Again

Kuaishou's monthly active users reached 714 million in the third quarter, a quarter-on-quarter increase of 22 million, outperforming market expectations. Market expectations are generally based on a comprehensive judgment combining company guidance and trends tracked by third-party data platforms. However, Kuaishou's performance was much better than the trends shown by third-party platforms.

In the third quarter, not only did traffic expand, but the activity of existing users on the platform was also impressive. This was mainly reflected in:

1) Average daily usage time of 132 minutes, an increase of 2.3 minutes year-on-year;

2) DAU/MAU ratio remained flat quarter-on-quarter. Generally, when there is a sudden influx of new users, their lower stickiness can lower the overall value. However, it not only did not decline but also remained at a historically high level.

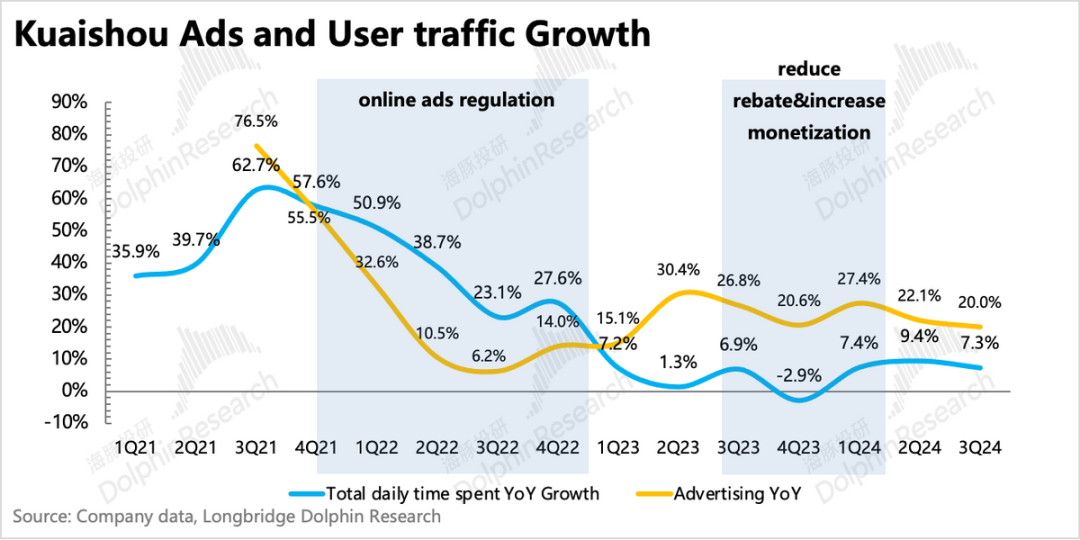

3) Based on average daily usage time and DAU, the total daily user time increased by 7.3% year-on-year. This increase in total traffic will significantly boost external circulation advertising for the current period.

However, as mentioned above, the trends in Kuaishou's user base shown by third-party data platforms are not as optimistic. Therefore, if the market primarily uses third-party platform data as a reference, there may be a small expectation gap.

II. E-commerce: Double Pressure from Off-season and Competition

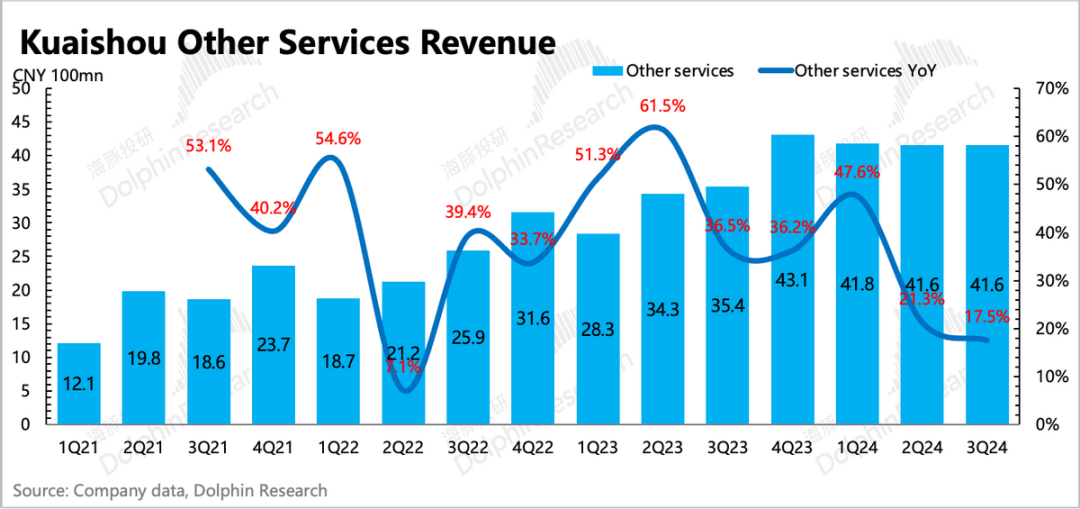

Third-quarter e-commerce revenue grew at a year-on-year rate of 17.5%, experiencing some marginal pressure as expected. Breaking it down, GMV was 334.2 billion yuan, growing at a year-on-year rate of 15%, with a commission rate of 1.24%, a quarter-on-quarter decline.

The decline in the commission rate indicates that the platform offered more concessions to merchants than during the 618 shopping festival in the previous quarter (rebate subsidies), highlighting the intense competitive pressure in the industry.

Amid economic pressure and insufficient consumer spending power, more subsidies are needed to stimulate a return to previous shopping demand. At the same time, due to insufficient consumer spending power and intense price competition, merchants' profit margins are also compressed, also requiring subsidies.

Therefore, this year's internal competition initiated by traditional e-commerce platforms has highlighted the disadvantages of KOL live streaming e-commerce, with commission rates and slot fees often ranging from 20% to 50%, resulting in losses on each sale. As Dolphin Insights previously mentioned, the high commissions of KOL live streaming e-commerce can actually be considered as marketing expenses for merchants, with commissions equivalent to KOLs' "endorsement fees." Therefore, when the environment deteriorates, it is understandable that this portion of the merchants' budget is the first to be cut.

Facing the aggressive advance of traditional e-commerce, Kuaishou is also on the path to transitioning to a broader shelf model. In the third quarter, the proportion of broader shelf GMV was 27%, an increase of 1-2 percentage points from the previous quarter's estimate.

Dolphin Insights discussed in detail the reasons for the slow progress of the broader shelf transition in the previous quarter and will not elaborate further here. For those interested, you can review "As Anchors Recede, Kuaishou Also 'Slows Down'?"

III. Advertising: External Circulation Continues to Recover

Third-quarter advertising revenue was basically in line with expectations, increasing by 20% year-on-year to reach 17.6 billion yuan. The growth in the third quarter was primarily driven by external circulation advertising, especially from advertisers in areas such as short dramas with high industry prosperity, fiercely competitive e-commerce, and local services.

Excluding internal circulation advertising (expected to grow by 15% year-on-year), Dolphin Insights estimates that the growth rate of external circulation and alliance advertising revenue exceeded 25%. In the current macroeconomic environment, this growth rate is remarkable.

Specific growth drivers include the intelligent marketing solution (UAX) for external circulation advertising launched in the previous quarter and the successful implementation of the IAA business model for short dramas in this quarter. Currently, the primary business model for most short dramas is paid content supplemented by product placement ads. Kuaishou tested the model of unlocking short dramas by watching ads in the previous quarter and has now successfully implemented it, which is expected to contribute to advertising growth in the long term.

The 7% continued growth in total user daily usage time in Q3 was driven by the year-on-year increase in DAU traffic and average daily usage time, which is expected to provide some support for accelerated advertising growth.

IV. The Impact of Live Streaming Adjustments is Coming to an End

As the one-year base period passes, the live streaming reward business is poised to resume positive growth. Third-quarter live streaming reward revenue was 9.3 billion yuan, a year-on-year decline of only 3.9%, continuing to converge. This is primarily due to Kuaishou's active efforts to introduce more live streaming guilds, with the number of signed guilds increasing by 40% year-on-year and the number of anchors increasing by 60% in the third quarter.

Beyond accelerating the introduction of guilds, Kuaishou is continuously expanding live streaming scenarios (job recruitment, real estate agency). Third-quarter growth:

1) The average daily resume submissions on KuaiPin increased by 100% year-on-year (previous quarter year-on-year growth rate of 130%).

2) The Ideal Home business is inevitably affected by the environment. Since the third quarter, relevant policies have continued to be issued, and public attention has remained high, with the average daily search volume in Q3 increasing by four times year-on-year.

V. Profit Margin Declines Quarter-on-Quarter: Short-term Disturbances and Medium-term Trends

In the third quarter, Kuaishou achieved a net profit of 3.27 billion yuan under GAAP, continuing to decline quarter-on-quarter. Even after adding back SBC adjustments, the Non-GAAP net profit was 3.95 billion yuan, less than the 4.68 billion yuan in the previous quarter, with the profit margin declining by over 2 percentage points quarter-on-quarter.

That is to say, with the increase in revenue, the absolute value of profits declined month-on-month, indicating that the company is in an expansion cycle.

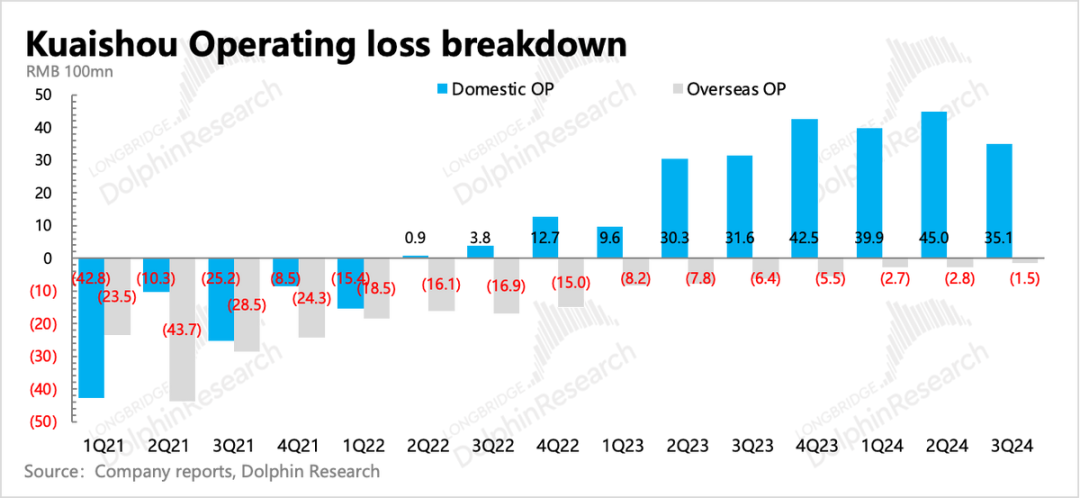

As Kuaishou's net profit includes gains from revenue (government subsidies, investment income, etc.), when focusing solely on the performance of the main business, Dolphin Research generally pays attention to core operating profit indicators (revenue - cost - operating expenses). In the third quarter, core operating profit reached 2.65 billion yuan, with a profit margin of 8.5%, which also declined rapidly month-on-month.

The decline in profit margins in the third quarter stemmed from various factors. On the one hand, there were short-term disruptions, such as the recognition of content costs for the Olympics, which were mainly reflected in the gross profit margin. On the other hand, there was a trend that would last at least medium-term, which involved expenses for new business initiatives, such as promotional expenses and user subsidies for developing local life services, server costs associated with the development of AI businesses, and promotional expenses for expanding overseas platforms and e-commerce businesses.

Looking at different regions (domestic and overseas), the overseas platform based in Brazil progressed smoothly in the third quarter. On the one hand, traffic continued to grow, and on the other hand, e-commerce drove advertising revenue, which also maintained a growth rate of 100%, reaching 1.3 billion yuan.

- END -

// Reprint Authorization This article is an original piece by Dolphin Investment Research. For reprints, please obtain authorization.