CEO's hands-off approach leads to stagnation in Kuaishou's e-commerce

![]() 11/21 2024

11/21 2024

![]() 594

594

Author|Xue Xingxing

Editor|Wang Bin

Cover|'Silicon Valley'

One year after Cheng Yixiao stepped away from overseeing Kuaishou's e-commerce business, the platform still struggles with growth. On November 20, Kuaishou Technology released its third-quarter financial report for 2024. The report showed that the platform's GMV in e-commerce grew at a year-on-year rate of 15.1%, flat compared to the previous quarter, indicating a lackluster performance.

In September 2022, Cheng Yixiao, co-founder and CEO of Kuaishou, personally took charge of the e-commerce business. During the Kuaishou E-commerce Gravity Conference in May of the following year, Cheng explained that his direct involvement as CEO reflected the company's utmost priority and high expectations for the e-commerce sector.

In 2023, Kuaishou's e-commerce GMV grew at quarterly rates of 28.2%, 38.9%, 30.4%, and 29.3%, respectively. By the end of that year, Kuaishou's GMV surpassed the trillion-yuan mark for the first time, making it the fifth e-commerce platform to reach this milestone after Taobao, JD.com, Pinduoduo, and Douyin. In December of that year, Cheng Yixiao stepped down as the head of the e-commerce business, and Wang Jianwei took over, also concurrently serving as the head of Kuaishou's Commercialization Business Department, leading both the e-commerce and advertising divisions.

However, one year later, the synergy between e-commerce and advertising anticipated by Kuaishou's management has yet to materialize. This year, apart from the first quarter, when Kuaishou's e-commerce GMV maintained a year-on-year growth rate of 28.2%, the second and third quarters saw stagnant growth rates of around 15%, nearly halving compared to last year's rates.

In its third-quarter financial report, Kuaishou cited various reasons for the sluggish growth in e-commerce, such as the third quarter being a traditional off-season for e-commerce and ongoing challenges in consumer demand. They described their e-commerce performance using the adjectives 'differentiated' and 'resilient'.

Kuaishou also showcased an array of dazzling e-commerce strategies, including the Doujin Plan, Qihang Plan, Fuyao Plan, Shopping Group, Ten Thousand People Group, Xinxing Plan, and Popular Product Plan, aiming to demonstrate their innovative explorations in the e-commerce business.

These flashy and high-profile plans, coupled with the passionate cries of anchors in Kuaishou's live streams, collectively outline the current predicament of Kuaishou's e-commerce business.

01|Slow transition to a broader shelf model, relying heavily on top influencers like Xinba

In recent years, Kuaishou's e-commerce strategy has primarily focused on content-driven e-commerce and a broader shelf model. According to Wang Jianwei, the current head of Kuaishou's e-commerce business and Senior Vice President, who spoke at this year's Kuaishou E-commerce Gravity Conference, e-commerce is synonymous with content. His presentation included a formula: 'Kuaishou E-commerce = Good Content X Good Products'.

Kuaishou E-commerce Gravity Conference / Source: Kuaishou

Content-driven e-commerce is not a novel concept; nearly all social platforms today emphasize content, and e-commerce platforms are also actively engaging in live streaming and integrating short video feeds within their apps.

Kuaishou's advantage lies in its broader user base, with a significant portion hailing from lower-tier cities. Data highlighted in previous Kuaishou events indicates that nearly 60% of its user base comes from cities below the third tier, implying that these users have both disposable income and leisure time. Their shopping needs are unmet, and when quality content is paired with high-quality products, their consumption potential is immense.

However, this advantage has become increasingly difficult to leverage amidst the price wars among e-commerce platforms in recent years. Pinduoduo, which also originated in the lower-tier market, shares a higher user overlap with Kuaishou. A 2021 research report by Debon Securities noted the highest user overlap between Pinduoduo and Kuaishou. In the face of direct price reductions, high-quality content alone may struggle to maintain its appeal.

The broader shelf model is a new strategy proposed by Kuaishou at the end of last year, aiming to identify new growth opportunities beyond live streaming. According to multiple media reports, Kuaishou opened traffic inlets for broader shelf scenarios in the fourth quarter of last year, with the Mall tab fully accessible in December.

Starting from the first quarter of this year, the broader shelf model accounted for approximately 25% of Kuaishou's e-commerce GMV. However, this proportion has remained largely unchanged in the subsequent two quarters, with the second-quarter report indicating 'above 25%' and the third-quarter report showing 27%. Over the past year, the proportion of GMV generated by the broader shelf model has remained virtually unchanged from the beginning of the year.

During the 6.18 and Double 11 shopping festivals this year, media attention on Kuaishou's e-commerce business was not focused on the business itself but rather on its top influencer, Xinba. Before each shopping festival, Xinba would generate a significant amount of 'good content' that attracted media attention. Before this year's 6.18 festival, it was the emerging top livestreamer 'Taiyuan Laoge' who criticized the platform, while during Double 11, it was 'Xiaoyangge' who repeatedly attacked Douyin.

Without exception, Xinba's account would be suspended by the platform following a series of statements but would be reinstated just before the official start of the shopping festival.

Cheng Yixiao's opening remarks during the earnings call largely reiterated the content of the financial report, offering no new insights. When responding to analysts' questions, he emphasized his 'considerable satisfaction' with the performance during this year's Double 11 festival. He noted that their e-commerce sales during Double 11 achieved robust year-on-year growth, setting a new record. He did not mention his views on the slowdown in e-commerce growth during the third quarter.

During last year's third-quarter earnings call, he stated that China's e-commerce industry had not yet reached a zero-sum game stage and that the ceiling for growth would continue to rise. Thanks to Kuaishou's differentiated user base, which is more mass-market and sink -oriented, the platform plays a significant role in this growth.

02|Daily active users surpass 400 million, marketing expenses surge

A more notable highlight of Kuaishou's latest financial report is the platform's user activity. During the quarter, Kuaishou's average daily active users reached 408 million, and average monthly active users hit 714 million, representing year-on-year growth rates of 5.4% and 4.3%, respectively, and quarter-on-quarter growth rates of approximately 3.3% and 3.2%.

Part of this growth can be attributed to the direct boost from the 2024 Paris Olympics in August. As an authorized broadcaster of the 2024 Paris Olympics, Kuaishou reported that during the Games, the exposure of Olympic-related content on the app reached 316 billion views, with 640 million users watching and interacting with the Olympics on the platform, generating 15.9 billion interactions. This also led to a 15.9% year-on-year increase in Kuaishou's sales and marketing expenses, reaching 10.4 billion yuan for the quarter.

Jin Bing, CFO of Kuaishou, explained that the increase in sales and marketing expenses was mainly due to increased investments in online marketing services and the e-commerce business. The former is related to user subsidies for paid short dramas, while the latter is linked to e-commerce subsidies. He emphasized that although Kuaishou's e-commerce subsidy amount had increased, the proportion of subsidies to GMV remained low compared to the industry. They anticipate seasonal increases in marketing expenses similar to previous years due to the upcoming e-commerce shopping festivals in the fourth quarter.

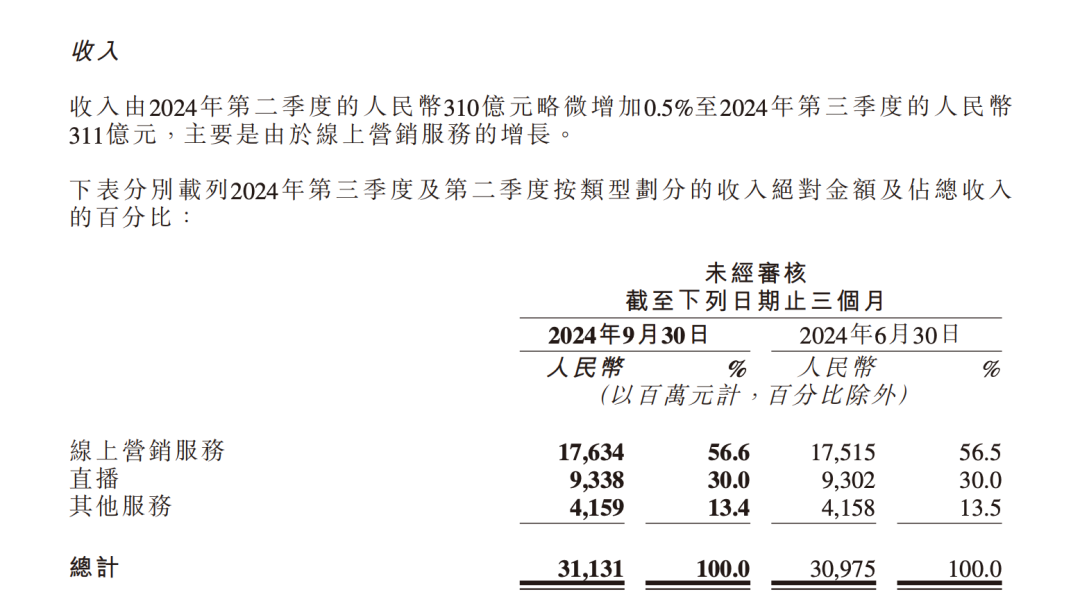

Among Kuaishou's three primary revenue streams, online marketing services increased by 20% year-on-year to 17.6 billion yuan. Similar to the previous quarter, Kuaishou's external advertising performed better, particularly in the media and information, e-commerce, and local lifestyle industries. Within media and information, short dramas stood out, with Cheng Yixiao noting that paid short drama marketing consumption increased by over 300% year-on-year, accounting for a double-digit percentage of overall external consumption and recently peaking at over 40 million in a single month.

Kuaishou E-commerce, Douyin Live, Taobao, Tmall, Private Traffic, Short Video Shopping