JD.com's 7FRESH goes crazy! The fierce battle for fresh food behind rock-bottom prices

![]() 11/21 2024

11/21 2024

![]() 652

652

The renewed emphasis on the front-end warehouse strategy is largely due to insights into the profitability of mainstream companies in the industry.

"If competitors follow our prices, 7FRESH will continue to lower them!"

On November 15, JD.com's 7FRESH published another article on its official WeChat account, stating that its platform's 'Rock-Bottom Prices' section has been completely refreshed, with products being 10% cheaper on average than other instant retail platforms, covering Beijing, Tianjin, Langfang, and other areas in northern China.

Housewives are the first to notice changes in grocery prices. During the Double 11 shopping festival, Wang Lin started placing frequent orders for groceries at JD.com's 7FRESH supermarket due to more favorable prices.

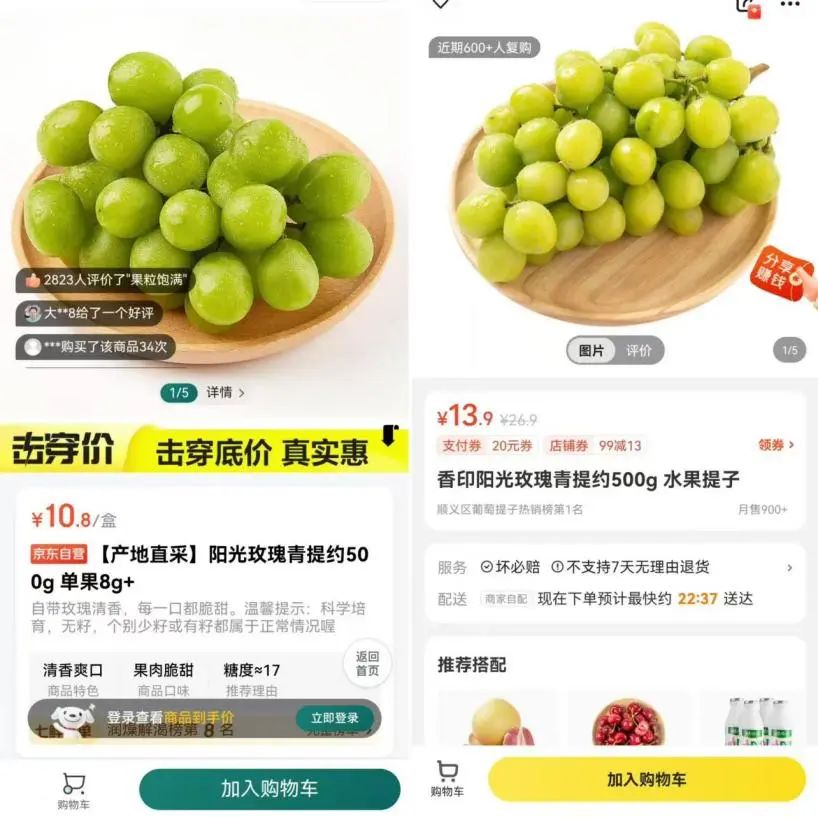

For example, both platforms sell 500 grams of Sunny Rose grapes, but while Meituan's Little Elephant Supermarket sells them for 13.9 yuan, 7FRESH's rock-bottom price is only 10.8 yuan. Even for some rice, flour, oil, and daily necessities, Wang Lin can save a few to several dozen yuan compared to other instant delivery platforms.

Indeed, the prices are attractive. Wang Lin remarked that they previously used Meituan's Little Elephant and Pinduoduo's community group buying services more often, with the former offering instant delivery of fresher produce and the latter delivering the next day at cheaper prices. They didn't have a strong impression of JD.com's 7FRESH until recently when they discovered its promotional activities. "They seem to be engaging in a price war. I hope they continue it to benefit consumers like us."

The rock-bottom prices that Wang Lin finds truly attractive are part of an event launched by 7FRESH on November 1. On that day, 7FRESH officially tweeted "Rock-Bottom Prices! Not Afraid of Comparison" and announced that over a hundred popular products could be purchased at a 50% discount or even for as little as 0.99 yuan. This move was seen by the outside world as directly targeting Little Elephant Supermarket and Hema Supermarket, signaling the start of a price war.

Under the low-price offensive, JD.com's 7FRESH has seen its performance soar.

On November 4, the official WeChat account released a 72-hour battle report, stating that the number of transacting users and online orders had increased by three digits year-on-year, with deliveries within three kilometers being very swift, averaging only 27 minutes. They also vowed to "continue to offer rock-bottom prices" and reiterated that "they are truly cheap and not afraid of comparison."

Interestingly, as early as November 1, JD.com's 7FRESH officially responded to the media, saying that they were not targeting anyone with a price war and asking for no overinterpretation. Additionally, they officially announced the integration of 7FRESH supermarkets and front-end warehouses.

What is JD.com aiming for by launching a low-price offensive and focusing on front-end warehouses at this time?

01 Continuing the Price War with Rock-Bottom Prices

The name "Rock-Bottom Prices" of 7FRESH has sparked much speculation. However, this is not the first time JD.com's 7FRESH has introduced such a concept. As early as last October, they shouted the slogan "True Bargains at Rock-Bottom Prices" and defined rock-bottom prices as the lowest sales price in the past 30 days for selected products on the 7FRESH platform during the promotional period.

Over the past year, 7FRESH has launched several rock-bottom price events and announced an upgrade in February this year, expanding coverage from select products to all categories such as meat, poultry, eggs, vegetables, fruits, and snack foods. The slogan also evolved from "Good and Affordable" to "Truly Cheap, Not Afraid of Comparison."

Compared to previous rock-bottom price events, 7FRESH's current discounts are indeed more significant. According to observations by "Finance New Knowledge," JD.com's 7FRESH Double 11 event page clearly states "Over 100 products with buy-one-get-one-free deals, truly affordable rock-bottom prices," with many products available for as little as 0.99 yuan in super flash sales.

In addition to the vegetables and fruits mentioned by Wang Lin above, Su Yu, who has lived in Beijing for over a decade, has noticed even greater discounts on some daily necessities. For example, a 1.8-liter bottle of Dettol disinfectant costs only 59.9 yuan at 7FRESH, which is 30 yuan cheaper than other platforms. A 5-kilogram bag of Wudeli eight-star snowflake wheat flour also costs only 24.9 yuan at 7FRESH, saving over ten yuan.

Although some products at 7FRESH are cheaper than those at Meituan's Little Elephant, the minimum order amount for free delivery is higher. In Beijing, customers need to spend at least 59 yuan to qualify for free delivery at 7FRESH, compared to only 39 yuan at Meituan's Little Elephant. In Guangzhou, the threshold is 29 yuan at Little Elephant and 39 yuan at 7FRESH.

Regarding delivery speed and product freshness, both Wang Lin and Su Yu felt that they were comparable to other platforms.

However, despite the fierce low-price offensive by JD.com's 7FRESH, its coverage is still limited. "Finance New Knowledge" found through research on the 7FRESH mini-program that there are currently 69 stores nationwide, with over 20 located in Beijing, followed by Guangzhou, Shenzhen, Tianjin, and other cities.

Since opening its first store in Beijing in 2018, 7FRESH has expanded relatively slowly, with the number of stores still not exceeding 100. In contrast, as of the second quarter of this year, Meituan's Little Elephant Supermarket had opened over 680 front-end warehouses, Hema Supermarket had over 400 stores nationwide, and Dingdong Maicai had nearly 1,000 front-end warehouses.

Despite the significant difference in the number of stores, 7FRESH's low-price initiative has still prompted a rapid response from Meituan. After 7FRESH launched its "Rock-Bottom Prices" event, "Finance New Knowledge" found that Meituan's Little Elephant Supermarket also adjusted prices downwards for daily high-frequency and rigid demand categories such as food, beverages, and condiments, with prices comparable to those of 7FRESH's "Rock-Bottom Prices."

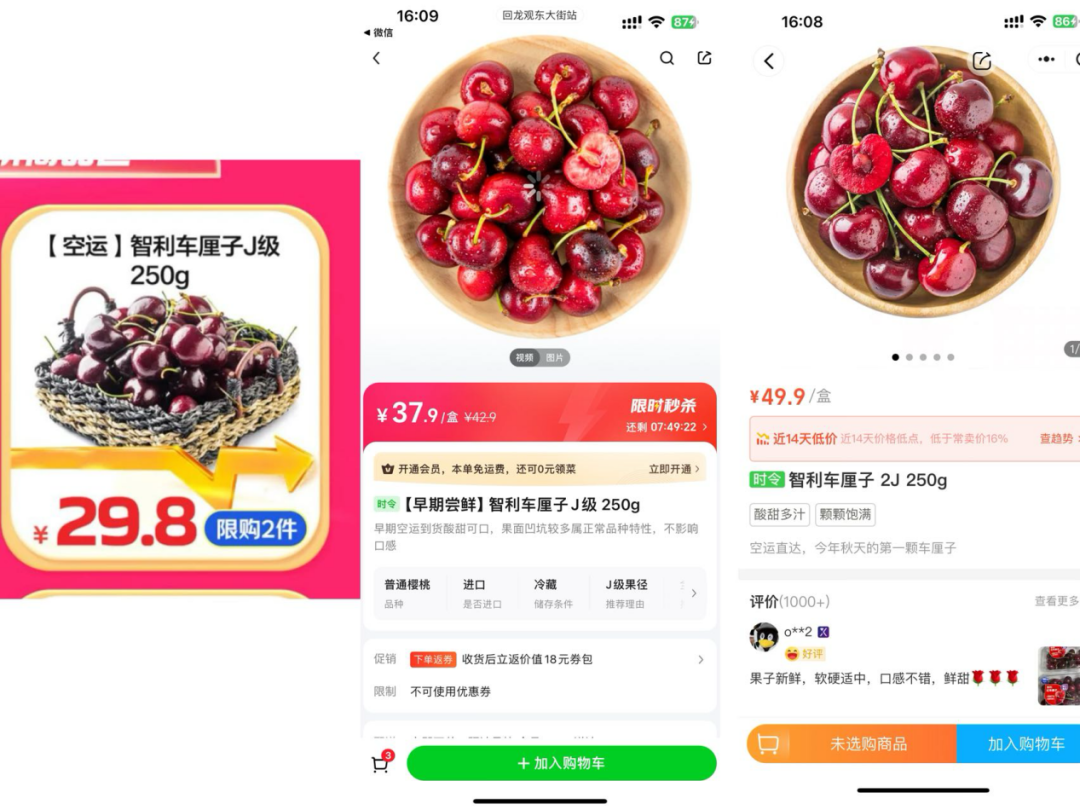

For example, the previous flash sale price for 1 kilogram of beef brisket at Meituan's Little Elephant Supermarket was 42.9 yuan, while 7FRESH's rock-bottom price was 39.9 yuan. Later, Meituan's Little Elephant Supermarket also reduced its price to 39.9 yuan.

The price war has not stopped and escalated again on November 15.

From left to right: 7FRESH price, Meituan's Little Elephant Supermarket price, and Hema Supermarket price. 7FRESH tweeted directly that products in the rock-bottom price section would be 10% cheaper on average than those on other instant retail platforms. "If competitors follow our prices, 7FRESH will continue to lower them," with 300 grams of Dandong strawberries reduced to 35.5 yuan and 250 grams of cherries reduced to 29.8 yuan, indeed offering discounts of over 10% compared to other instant retail platforms during the same period.

02 Focusing on Front-End Warehouses to Compete with the Big Players

Looking back at its development history, JD.com has repeatedly re-entered the fresh food e-commerce sector.

In 2017, JD.com established its self-operated fresh food supermarket "7FRESH" and began nationwide expansion. However, due to external factors and strategic decisions, it began scaling back and closing some stores in 2022, with the number of stores still not exceeding 100 to date. Its community group buying brand "Jingxi Pinpin" launched in 2021 was also disbanded the following year due to poor market performance.

Nevertheless, in early 2024, JD.com launched "JD Buy Groceries" on the homepage of its JD Daojia platform for platform-based operations. It also elevated the strategic position of instant retail internally, calling it one of the "Three Must-Win Battles" and later integrated its front-end warehouse business with 7FRESH, showing no signs of giving up.

With front-end warehouses, delivery efficiency will be significantly improved, undoubtedly enhancing the user experience.

In the view of Li Chengdong, a former e-commerce strategy analyst at Tencent and JD.com, this is a good move. Since 7FRESH operates with an integrated store-and-warehouse model that overlaps with front-end warehouse business, integration can improve efficiency and reduce operating costs. At the same time, being the first to establish a low-price brand impression in the instant retail sector can attract more users.

Zhang Chenyong, with over 20 years of retail experience and previous roles as an operations expert and brand strategy director at leading enterprises, told "Finance New Knowledge" that the front-end warehouse model has more obvious advantages than the integrated store-and-warehouse model. When market demand reaches a certain level, specialized operation is a more efficient choice.

"The front-end warehouse model is better in terms of order fulfillment cost and batch management of short-shelf-life fresh produce. For order fulfillment, front-end warehouses are relatively small, usually less than 1,000 square meters, allowing for a one-person picking and packing process to reduce costs," Zhang Chenyong further explained.

The actions are understandable, but how can the strategy be explained? Especially since JD.com's founder Liu Qiangdong once stated that fresh food categories are difficult to handle.

This may be closely related to the growth potential of instant retail. According to the "White Paper on the Development Trends of Instant Retail in 2023," China's instant retail market exceeded 590 billion yuan in 2022, with an average annual compound growth rate of 51.6% over the past four years. It is expected to grow to 3.6 trillion yuan by 2030.

This lucrative market is not just being targeted by JD.com. In August this year, it was reported that Hema was also restarting its front-end warehouse model, and both Miniso and Meituan have announced plans to launch flash warehouses.

Zhang Chenyong believes that the core reason for JD.com's recent focus on front-end warehouses through 7FRESH may be its observation of the profitability of mainstream enterprises, especially as Dingdong Maicai has achieved profitability for eight consecutive quarters.

It's worth noting that Daily-Youxian was previously dragged down by the high construction costs of the front-end warehouse model and significant fresh food waste, leading to its abandonment by the industry until it regained popularity this year.

As for why there is now a resurgence of low-price competition?

Zhang Chenyong believes that most instant retail platforms currently have relatively high prices, while JD.com's market share is relatively small. Initiating a price war involves lower operational costs and is more effective. By offering low prices, JD.com can attract more users. Once it reaches a certain scale, JD.com may stop the price war.

Yan Yuelong, a well-known technology commentator in the industry, believes that this is also related to JD.com's consistent low-price strategy. He once served as the Marketing General Manager and PR Director of JD.com's Consumer Goods Business Unit and noted that JD.com has engaged in price wars with competitors in almost every category in the past, often emerging as the victor.

"JD.com's low prices are also sustainable because they are not simply achieved through promotions or squeezing suppliers. Instead, they are realized by eliminating intermediaries in the product distribution chain and reducing supply chain costs. Take JD.com's 7FRESH supermarket as an example; many products are sourced directly from their origin, such as some of the products in this rock-bottom price promotion, including Sunny Rose grapes sourced directly from Rudong, Nantong, Jiangsu," Yan Yuelong explained.

03 Catching Up Late but Aiming for a Turnaround Victory

Various measures indicate that by integrating front-end warehouses with 7FRESH and launching rock-bottom prices, JD.com's objective is clearly to secure a larger market share.

However, can JD.com, which is once again "catching up late," realize its ambitions?

From a market perspective, competition in the instant retail sector is fiercely intense, but there is currently no monopoly, leaving ample opportunities for exploration.

In Yan Yuelong's view, JD.com's move will inevitably have a significant impact on the market, especially in the instant retail sector, where the main pain point for users currently focuses on price. "By offering rock-bottom prices, JD.com's 7FRESH is conveying an important message to users: instant retail is not only 'fast' but also 'affordable.' If the price war continues, other platforms are expected to follow suit."

In addition to its supply chain advantages, another significant advantage of JD.com's 7FRESH is its high compatibility with JD.com's main site in terms of instant and convenient purchasing methods, allowing it to enjoy some traffic from the main site to a certain extent.

However, the current number of 7FRESH's front-end warehouses still needs to be increased.

Yan Yuelong analyzed for "Finance New Knowledge" that the crux lies in whether rock-bottom prices can accelerate inventory turnover, forming a positive cycle. If rock-bottom prices can attract more users and increase turnover, JD.com's 7FRESH can build more front-end warehouses, further enhancing the user experience and achieving a positive cycle.

It is evident that all instant retail enterprises face the challenge of balancing scale and efficiency costs. While the front-end warehouse model offers advantages such as fast delivery and reduced transportation costs, it also faces challenges such as high construction costs, high fulfillment costs, and difficult inventory management.

Therefore, whether JD.com's 7FRESH can carve out a niche in the future depends crucially on achieving a profit balance, which is a severe test of the enterprise's supply chain management and inventory turnover.

"Currently, instant retail is at a stalemate. Although the sector is growing rapidly, it is unlikely that any one player will completely defeat another, nor is it easy for anyone to undergo significant changes quickly," Zhang Chenyong said. "With current technological conditions and environmental variables remaining unchanged, everyone can only make quantitative changes for now."