Pay after use, that's how we can break the deadlock

![]() 11/21 2024

11/21 2024

![]() 626

626

Even though no payment was made, orders were placed. This Double 11, many consumers found themselves backstabbed by e-commerce platforms.

The root cause lies in the "Pay after use" service offered by various platforms, where consumers can make purchases without immediate payment and only pay after receiving and confirming the satisfaction with the product.

Although this service is conditional, many consumers are increasingly dissatisfied with "Pay after use" due to its "unintentional" activation.

On Little Red Book, a netizen complained, "When I woke up, my grandfather had used 'Pay after use' to buy 54 items. So far, I know he bought 9 watches, 3 pots, and 4 electric kettles."

Another netizen helplessly said, "My daughter accidentally opened and bought a bunch of chicks on a certain platform using my phone through 'Pay after use'. By the time I found out, they were already being delivered."

Bank transfers, digital wallets, installment plans, and the recent interconnectivity between Taobao and JD.com have indeed brought greater convenience to consumers. However, the "overreaching" "Pay after use" service has left a different impression on them.

Behind this lies the desperation of e-commerce platforms to retain users amidst fierce competition and a saturated market. They are resorting to desperate measures in terms of consumer services for their existing user base.

01

Significant Slowdown in Growth

To understand "Pay after use", we must first consider the current situation faced by e-commerce platforms.

Currently, competition among e-commerce platforms is intensifying. With the proliferation of e-commerce formats, emerging platforms like Douyin and Kuaishou have rapidly risen in recent years, constantly challenging the traditional e-commerce landscape.

Data shows that in 2014, the combined GMV of Alibaba and JD.com alone accounted for 80% of China's total e-commerce industry, representing a significant lead. However, by 2023, the companies comprising the top 80% of the total GMV had expanded to five - Alibaba (32%), Pinduoduo (17%), JD.com (15%), Douyin (11%), and Kuaishou (5%).

Of course, the overall scale is also incomparable. According to the National Bureau of Statistics, China's online retail sales reached 15.42 trillion yuan in 2023, with all five companies mentioned above exceeding the trillion-yuan mark in GMV. In contrast, the annual online retail sales in 2014 were only 2.79 trillion yuan, a fraction of the 2023 figure.

Meanwhile, e-commerce platforms are generally encountering growth bottlenecks.

From an overall perspective, according to Tianyancha, China's online retail sales reached 10.9 trillion yuan in the first three quarters of this year, a year-on-year increase of 8.6%. Over a longer period, online retail sales in the first three quarters of 2023 reached 10.8 trillion yuan, with a double-digit year-on-year growth rate of 11.6%.

If we look back annually, from 2017 to 2023, China's online retail sales were 6.89 trillion yuan, 9.01 trillion yuan, 10.63 trillion yuan, 11.76 trillion yuan, 13.09 trillion yuan, 13.79 trillion yuan, and 15.42 trillion yuan, respectively, with year-on-year growth rates of 39.1%, 21.8%, 16.5%, 10.9%, 14.1%, 4.0%, and 11%. This indicates a downward trend in online retail sales, excluding the years significantly impacted by the pandemic. Given the 9.8% and 8.6% year-on-year growth rates in the first half and first three quarters of this year, respectively, it is likely that the growth rate of online retail sales in 2024 will not exceed that of last year.

A deeper understanding can be gained from the financial reports of individual platforms. Over the past six quarters (Q2 2023 to Q3 2024), the revenue growth rates of Taobao-Tmall Group and JD Retail, two giants, were 12%, 4%, 2%, 4%, -1%, 1%, and 4.85%, 0.06%, 3.37%, 6.8%, 1.5%, 6%, respectively. Pinduoduo's growth rates over the same period were 66.29%, 93.89%, 123.21%, 130.60%, 85.85%, and (Q3 figures have not been disclosed yet this year).

It is evident that unlike previous double-digit growth rates, the growth of Taobao-Tmall Group and JD Retail has significantly slowed down. Although Pinduoduo is still experiencing high growth compared to its peers, it fell short of expectations, as stated after its second-quarter financial report this year.

The same is true for short video platforms. Kuaishou and Douyin have not yet announced their GMV for the third quarter of this year, but Kuaishou's GMV in the second quarter was 305.3 billion yuan, a year-on-year increase of 14.99%, significantly lower than the 28.17% growth rate in the first quarter. According to public information, Douyin's GMV grew by 66% in the first quarter and slowed to 41% in the second quarter.

A key reason for this situation is that as competition in the e-commerce industry intensifies, traffic dividends are also declining rapidly. Behind this lies the fact that with the saturation of internet penetration, the growth rate of online shoppers has significantly slowed down.

This also means that in the second half of the internet era, the model of relying on massive user growth and low-cost traffic acquisition has become a thing of the past. Even emerging e-commerce platforms have to face this issue.

02

Enhancing Services to Break the Deadlock

Under the pressure of sluggish growth, promoting transactions among existing users has become the core of competition. This is evident from the descriptions of various e-commerce platforms regarding their Double 11 performance.

For example, Tmall stated at the end of Double 11 that its total transaction volume had grown robustly, with a record number of buyers. During the entire Double 11 period, 589 brands achieved transaction volumes exceeding 100 million yuan, a 46.5% year-on-year increase.

JD.com reported a year-on-year increase of over 20% in the number of shoppers, a 3.8-fold year-on-year increase in live streaming orders, and more than a 5-fold year-on-year increase in transaction volumes for over 17,000 brands, as well as a more than 2-fold year-on-year increase for over 30,000 small and medium-sized merchants.

Data from Douyin's Double 11 Shopping Festival showed that the transaction volumes of over 33,000 brands doubled year-on-year, nearly 17,000 brands experienced growth rates exceeding 500%, and more than 2,000 individual products exceeded 10 million yuan in transaction volume.

As seen above, the focus on total transaction volume (GMV), which was highlighted in previous years, has disappeared, replaced by the growth in the number of shoppers and brand transaction volumes.

With stagnant traffic and slowing growth, platforms aiming to promote transactions must focus on enhancing users' shopping experiences.

Taking membership services as an example, in the book "Super Users", author Edie Yin argues that "although super users account for only 10% of a company's total customer base, they can increase sales by 30% to 70%." For e-commerce platforms, their top priority is naturally their core existing users, i.e., members. To attract and retain these "prized possessions", platforms continuously upgrade membership benefits.

For instance, in April, Taobao-Tmall launched unlimited free return shipping for 88VIP members. Earlier in March, JD.com also announced an upgrade to its PLUS membership benefits, offering discounts with no minimum purchase requirement, covering all categories, and stackable with other promotions.

As a result, Tmall disclosed in its latest quarterly financial report that the number of its 88VIP members has continued to grow at a double-digit year-on-year rate, reaching 46 million. During this Double 11, the average spending per 88VIP member increased by over 30% year-on-year.

Although specific figures for PLUS members were not mentioned, JD.com recently stated in its financial report that its quarterly active user count and user purchase frequency have maintained double-digit year-on-year growth for three consecutive quarters, driving a more than 30% year-on-year increase in order volume.

In addition, before Double 11, several former rivals took the initiative to "tear down walls and break the ice" -

On September 27, WeChat Pay was fully integrated into Taobao, allowing consumers to directly purchase Taobao products within the WeChat app. On October 16, JD.com and Taobao announced their cooperation, with JD.com Logistics fully integrated into Tmall, enabling merchants to choose JD.com Logistics as their service provider. Cainiao will also access JD.com's third-party platform to provide services to merchants. On October 29, Alipay announced that JD.com payments would be accepted on its platform, and JD.com Pay's integration into Tmall is also underway.

It can be said that both payment interoperability and logistics barriers being broken have greatly enhanced users' service experiences.

03

Winning Over Consumers' Hearts

Returning to "Pay after use", the initial intention of this payment method is to allow consumers to decide whether to pay or return a product after experiencing it, thereby lowering their decision-making threshold and shopping risks. If consumers are dissatisfied with the product, they can return it directly, bypassing the payment and refund process.

There is also an ulterior motive. To a certain extent, "Pay after use" can increase sales conversion rates. In September, Tmall announced that during Double 11, it would provide the "Pay after use" service free of charge to all participating merchants, along with exclusive resource exposure to boost their sales conversions. Upon successful registration, products priced at 500 yuan or less in the digital and electronics category, and 1,000 yuan or less in other categories, that meet the "Pay after use" criteria will automatically activate the service.

It is worth noting that there is a threshold for "Pay after use", and only consumers with good credit records can enjoy this exclusive service provided by the platform. For example, to use Pinduoduo's "Pay after use", a certain WeChat score is required, while Taobao's "Pay after use" service "evaluates" the user's Alipay credit score.

So, why do many consumers feel "backstabbed" by this seemingly convenient and high-quality "Pay after use" service?

One reason lies in its "unintentional activation". "During Double 11, I bought a lot of clothes and snacks, but after receiving them, I found some items that I didn't even remember ordering. Upon checking, I realized they were purchased using 'Pay after use'." Shortly after Double 11, Ms. Tao in Beijing complained to 7 Caijing that she didn't bother returning some items due to their low value, while others, like snacks, couldn't be returned because her family had already consumed them.

She was unsure when this feature was activated. "I thought I was the only one, but when I searched online, I found that many others didn't know when it was activated either. I think the platforms bear a lot of responsibility for this."

Some users also had their Double 11 full-subtraction strategies disrupted by "Pay after use".

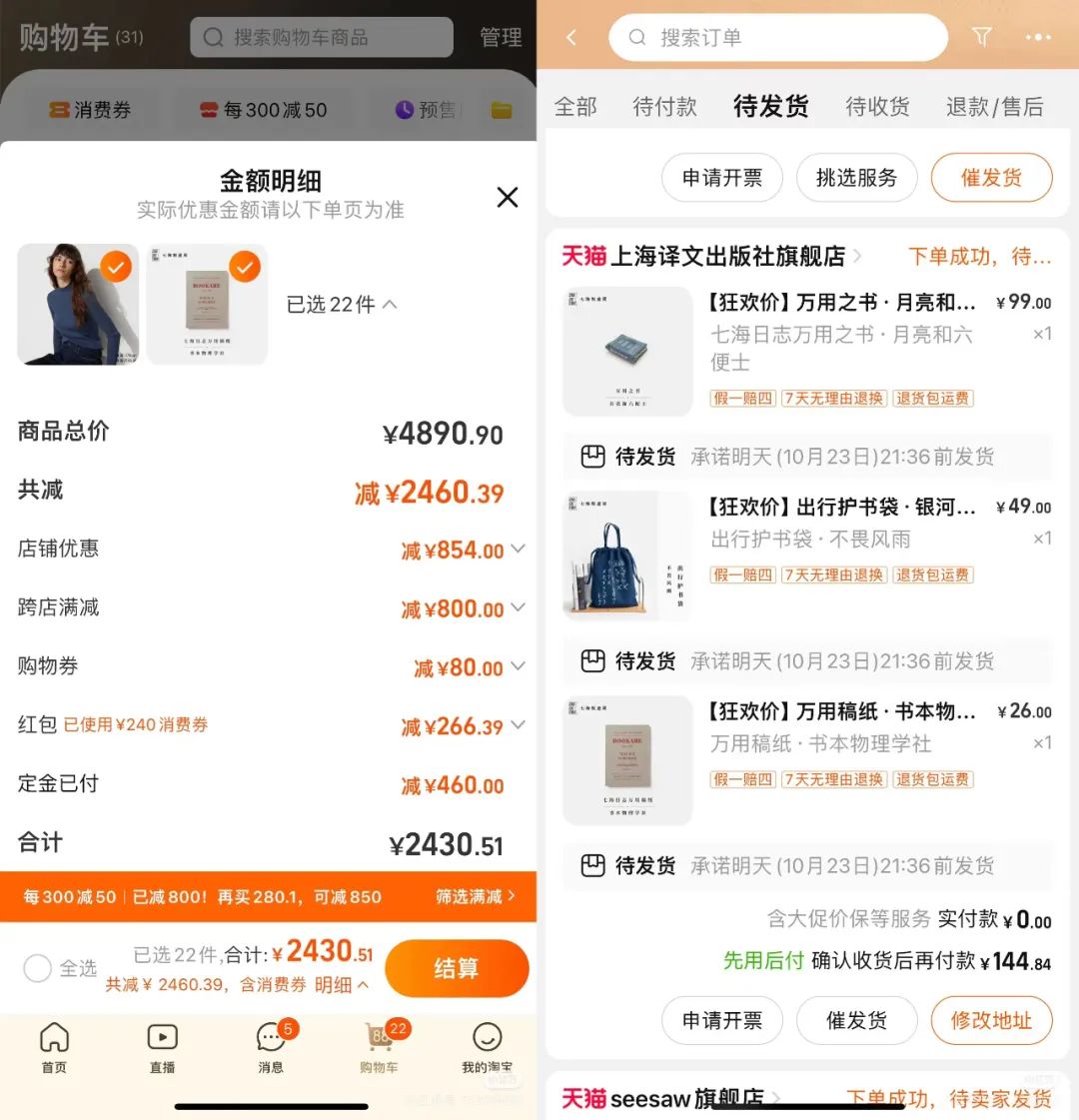

▲A user missed out on using some coupons due to an order containing items purchased through "Pay after use".

A user on Little Red Book said that as a member, she had already reached a total paid amount of 3,000 yuan on a certain platform. However, after payment, she suddenly discovered that two orders had been processed through "Pay after use" without any deduction, causing her to lose out on two coupons - one for a 240 yuan discount on a total paid amount of 3,000 yuan and another for a 50 yuan discount on a total paid amount of 300 yuan. This was her first time using this feature. After reporting the issue to customer service, she received only an apology but no satisfactory solution.

7 Caijing's experience revealed that multiple platforms are vigorously promoting the "Pay after use" feature, with it ranking prominently in payment options. After using it, purchases can be completed smoothly without entering a password, and the entire process takes only a few seconds. Precisely because no password is required, as in the aforementioned case of chicken purchases, some children can easily place orders using their parents' phones, and some elderly people may also go on a "crazy" shopping spree due to their unfamiliarity with smartphone operations.

On the other hand, after unintentionally placing orders through "Pay after use", some users end up with overdue payments due to the use of credit payment channels for final settlement. According to Morning Post, Mr. Shi recently received a call informing him of a 64 yuan overdue payment on a certain platform. Upon further investigation, he discovered it was for dog food purchased the previous month.

"I only realized later that 'Pay after use' was automatically selected during payment. Since I had missed a previous call, I immediately repaid the amount but was still deducted credit points."

Additionally, while "Pay after use" is easy to activate, many users find it difficult to deactivate. 7 Caijing noticed that on multiple mainstream e-commerce platforms, there is no text prompt indicating where to deactivate the "Pay after use" feature. Some consumers who found the deactivation path couldn't deactivate it due to uncompleted "Pay after use" orders.

This has also attracted the attention of consumer protection agencies. The Jiangsu Consumer Protection Committee proposed that "Pay after use" should allow for "one-click activation" as well as "one-click deactivation". Merchants who hide the deactivation button like a game of hide-and-seek are effectively depriving consumers of their right to choose and to be informed.

As traffic peaks and growth significantly slows, e-commerce platforms must engage in more refined management of the consumer experience to win over users.

However, the highly controversial "Pay after use" has also sounded the alarm for platforms - "enhancing services" must win over consumers' hearts.