Overnight, Xiaohongshu is everywhere

![]() 12/03 2024

12/03 2024

![]() 625

625

Author|Xiaoman

Statement|The cover image is sourced from the internet.

Original article by Jingzhe Research Institute. Please leave a message to apply for whitelisting if you wish to reprint it.

Since its launch in June 2013, the Xiaohongshu APP has been around for 11 years, but the footsteps of 'imitators' have not stopped.

Not long ago, the launch of 'NetEase Bee' stirred up the relatively stable seeding sector, sparking public discussion about NetEase's true intentions in exploring the seeding community. Prior to this, Alibaba's WangWang and WeChat's 'Xiaolvshu' had already attempted to deploy seeding applications, and even apps like NetEase Cloud Music and Dianping have launched 'notebook' functions strikingly similar to Xiaohongshu.

It's not hard to understand that the seeding sector, as a rare treasure trove of traffic in today's internet ecosystem, has attracted the ambition of many major companies to participate. However, it cannot be ignored that few products among the many latecomers have been able to truly threaten Xiaohongshu, and even Xiaohongshu, due to its own commercialization dilemma, is often passively sounded the alarm when faced with the emergence of 'imitators'.

With Xiaohongshu-like environments everywhere and a commercialization dilemma at a loss, does the competitive seeding sector still have a future?

The seeding community is not an easy endeavor

With images and texts combined with videos, displayed in a double-column waterfall layout, along with a content positioning focused on sharing and communicating daily life... If Xiaohongshu is dissected as an APP sample, it will be discovered that the threshold for creating a seeding community does not seem high.

In fact, the concept of 'seeding' did not truly become popular until after 2019. Prior to that, so-called seeding apps and content communities were essentially social apps. For example, during the Weibo era, comedians and big V influencers soared together, becoming the first batch to taste the 'crab' of seeding. However, at that time, there was no distinction between KOLs and KOCs, and advertisers' placement behavior was not called seeding but rather influencer marketing.

In the era of APP wars when internet giants scrambled to 'encircle land', social apps built around content were abundant, and even today, they have many highlights when compared to Xiaohongshu.

For example, NetEase launched the light blog product LOFTER in 2011, two years earlier than Xiaohongshu, which debuted in 2013. Moreover, unlike Xiaohongshu, which initially focused on sharing overseas shopping experiences, LOFTER centered on hobbies from the outset, creating an interest-based social platform for young people. Therefore, soon after its launch, LOFTER quickly attracted a large number of photographers, fashion enthusiasts, fitness enthusiasts, and foodies.

According to the 'Secondary Creation Industry Report - 2021' released by EntGroup Data, as of the end of 2020, 88% of LOFTER's registered users were post-95s. In 2021, when NetEase LOFTER celebrated its 10th anniversary, it revealed through its official Weibo that the platform had over 80 million active users.

From today's perspective, LOFTER not only has a high concentration of Generation Z users but also forms relatively precise interest circles centered on hobbies, much like Xiaohongshu, and should rightfully be a favored seeding community for brands. However, to date, few users are aware of or have used LOFTER. As a result, three years later, with LOFTER still operational, NetEase has launched the Bee APP to rejoin the competition in the seeding sector, facing the challenge of 'building from scratch'.

The stark contrast between the phenomenon of 'Xiaohongshu everywhere' and LOFTER's 'silence' reflects, on the one hand, the unique value of the 'seeding economy' in the current social network and, on the other hand, exposes the issues of low thresholds and high commercialization difficulties for seeding apps.

Simply put, for social apps with content as their core carrier, Xiaohongshu's mature double-column waterfall layout and compatibility with image-text and video content can be considered the most suitable content presentation form at present. Because it not only caters to social users' preferences for different types of content but also strikes a balance between recommendation algorithms and users' active choices.

However, for seeding communities, there is no direct correlation between these efficient content presentation forms and sales conversions, and the disconnection between content operation and seeding conversions is the most vexing problem for most seeding apps.

Seeding communities are 'trapped' by content

Attracting users through original content and guiding users to discuss and generate trending topics is the most common operational method for social apps. The most typical example is Weibo, where a trending list can continuously provide topics for over 400 million monthly active users. But when the platform takes on commercialization goals, content operation encounters the inherent contradiction of 'left vs. right boxing'.

For instance, when commercial content appears on the trending list, users may initially participate in discussions out of curiosity. But when users start to notice that original topics are frequently mixed with more commercial content, and when the proportion of pre-embedded advertising content exceeds that of original discussions, the community atmosphere and user experience begin to deteriorate.

As seen in Weibo's case, the result of mixing original and commercial content is that some users choose to remain silent or quit, leading to platform inactivity and a sharp decline in traffic, and this negative impact is often irreversible.

In dealing with the conflict between original and commercial content, platforms often can only intervene and regulate through themselves. The most common method is to provide official advertising channels to effectively control the quantity and frequency of commercial content. At the same time, platforms can also restrict suspected commercial and low-quality content by strengthening content review efforts.

However, these governance methods are not perfect. Due to the massive amount of original content generated at all times, which varies greatly, social platforms need to invest significant human and material resources in review and control. Meanwhile, issues with review standards can also affect user experience and dampen users' enthusiasm for sharing daily creations.

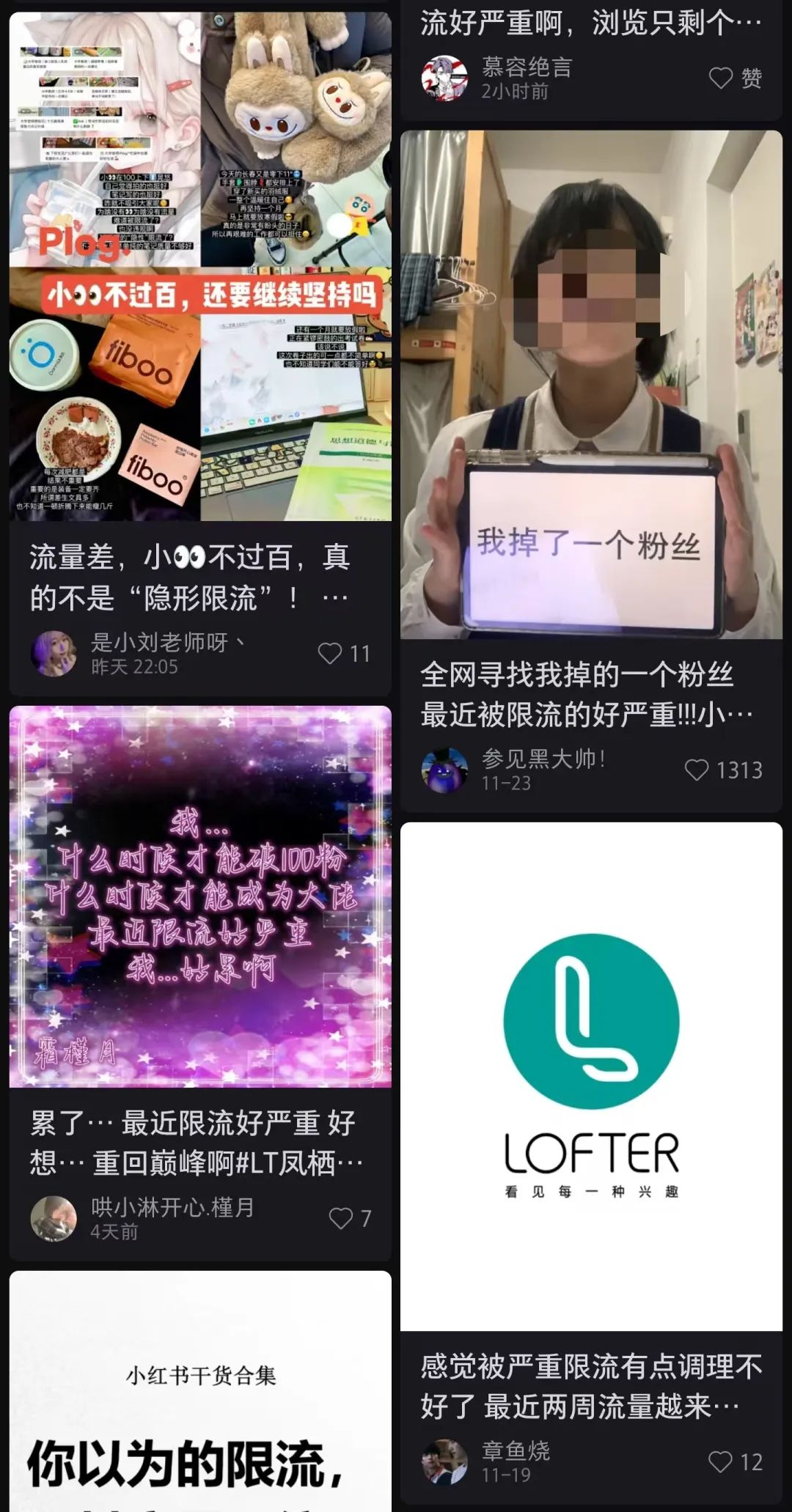

On LOFTER and Xiaohongshu platforms, users often discuss how their posted content has been throttled by the platform. From a positive perspective, this shows that the platform has not relaxed its control over content, but from the user's perspective, content review inevitably has a negative impact on the community atmosphere. Ultimately, it tests the platform's trade-off between content quality and traffic.

In addition to the challenge of content control, the transformation of social apps into seeding communities also presents a development paradox and thus faces another trade-off: Content communities need sufficient interest tags to expand user base and divide user segments, while also requiring continuous content operation to cultivate and screen heavy users. In most cases, the breadth and depth of user segments are like fish and bear's paws, which cannot be had at the same time.

Therefore, the most common forms of social apps are 'big and comprehensive' and 'small but beautiful'. The former is represented by Weibo, which has become a 24/7 topic plaza by closely following social hotspots, with large traffic but not necessarily precision. The latter is similar to Douban, with a large number of heavily vertical users but also hindered by a higher usage threshold for new user growth, while becoming increasingly distant from commercialization.

The reality is that even though Xiaohongshu is considered the leading app in the seeding sector by the public, its core revenue source is not 'seeding' but advertising.

According to 21st Century Business Herald, 80% of Xiaohongshu's revenue in 2022 came from advertising, and while the proportion of advertising revenue declined in 2023, it still accounted for 70%-80% of total revenue. Xiaohongshu's advertising business includes brand advertising and performance advertising, covering various forms of advertising resources such as splash screen ads, trending topic ads, and commercial topics.

Therefore, most brand 'seeding' still achieves the purpose of brand communication by purchasing advertising resources or spaces. The phenomenon that Xiaohongshu's revenue is highly dependent on the advertising business also indicates that a 'seeding' community that only attracts people with content is still selling traffic and working for others, failing to achieve the ideal internal cycle of 'from seeding to conversion'.

How far are the 'Little X Books' from conversion?

The challenges faced by seeding communities in terms of 'conversion' are largely related to their own positioning.

Social apps such as Weibo and LOFTER, which emerged or flourished during the internet entrepreneurship boom, may not have had clear commercialization goals at their inception. They simply accumulated users through operational means in line with internet thinking and then attempted to monetize in the capital market. Additionally, since content is the foundation of social apps, the business logic of user-centric and content-first has led most of these platforms to later adopt commercialization methods that monetize traffic.

In reality, the most direct path from seeding to conversion is e-commerce.

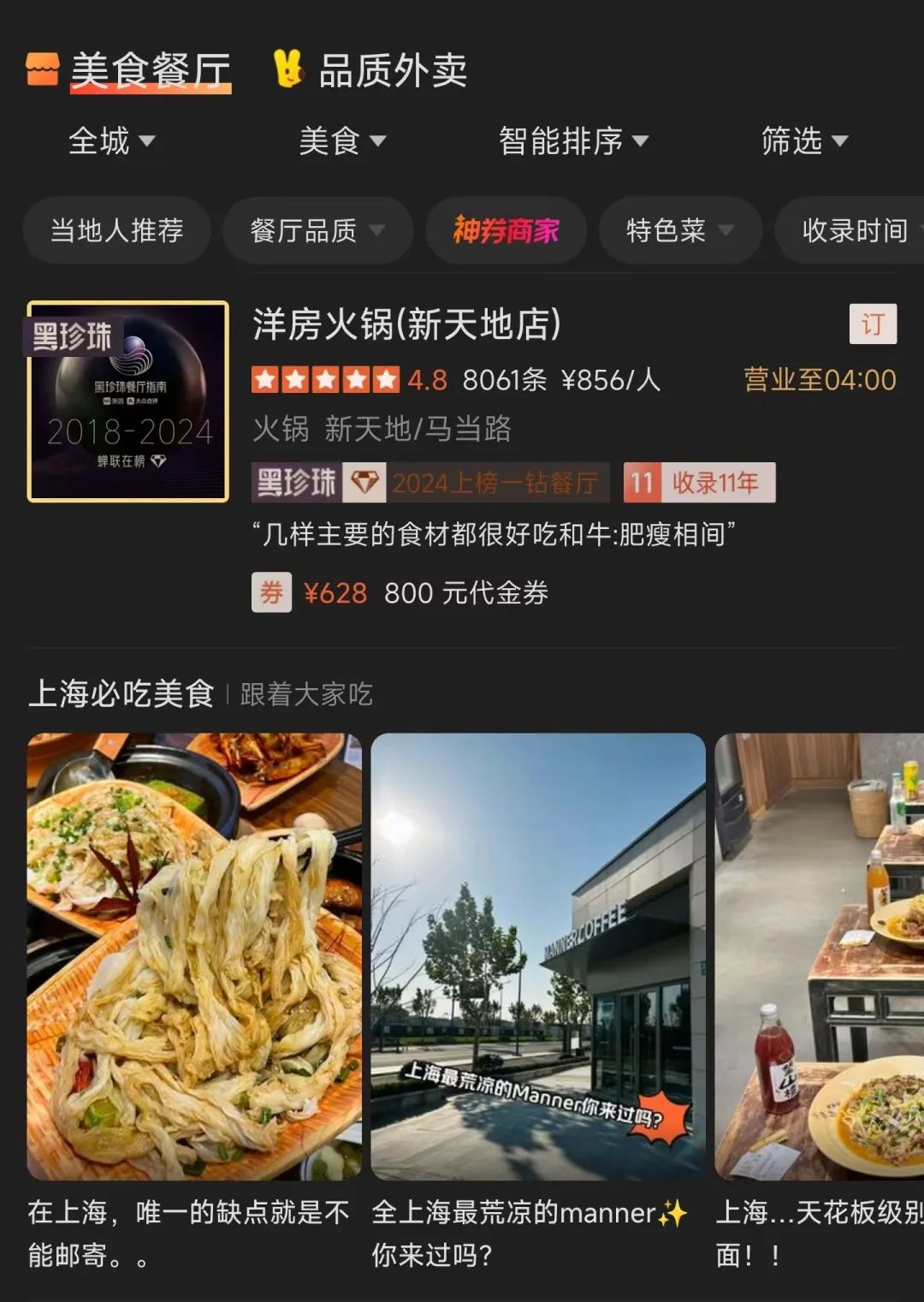

For example, when users of Dianping search for content related to food restaurants within the app, the platform not only recommends suitable restaurants based on meal categories, business hours, and location services but also displays note content related to those restaurants. This not only provides users with effective reference information but also helps high-quality merchants 'seed' and allows for one-click access to merchant stores for direct order placement and group-buying coupons.

Another common and illustrative example of 'from seeding to conversion' is short video e-commerce. For users, browsing short videos was originally just a content consumption behavior. However, when users encounter product-placement short videos and are attracted by the content, they can directly place an order or enter the merchant's store by clicking on the product link. In short video application scenarios, content is integrated with e-commerce functions and consumption scenarios, achieving a seamless switch from seeding to conversion.

From the above cases, it can be seen that apps with strong e-commerce attributes and well-established conversion paths are more likely to achieve 'seeding and conversion'. Interestingly, Xiaohongshu is not lacking opportunities to strengthen its e-commerce capabilities.

On May 31, 2018, on the 5th anniversary of its establishment, Xiaohongshu announced that it had received a $300 million investment led by Alibaba. Six months later, Taobao Mobile launched a new round of internal testing, enabling products to be integrated with Xiaohongshu content. According to media reports at the time, merchants could add Xiaohongshu content related to current products in the decoration backend, but they did not have the final say on the content presented, which was recommended by an algorithm.

However, to maintain its independence, Xiaohongshu did not officially join the Alibaba ecosystem and thus lost the fastest means of seeding conversion. It was only in recent years, after Xiaohongshu introduced the concept of 'buyer's market e-commerce' and began experimenting with live streaming, that it found its own path to seeding conversion by continuously improving its e-commerce infrastructure.

In fact, the reason why Xiaohongshu has been able to become a leading app in the seeding sector is partly due to its early product positioning focused on sharing overseas shopping experiences, attracting a group of seed users with overseas shopping needs and abilities. As its focus later shifted more towards content, Xiaohongshu accumulated a sufficiently precise user base and relied on platform operation and natural content updates to continuously create hot topics related to daily life, thereby influencing consumption trends and providing users with highly integrated functional value and community atmosphere for social and consumer information.

Frankly speaking, Xiaohongshu's lead is entirely based on its first-mover advantage, making it difficult for other platforms to catch up. However, in the seeding sector, Xiaohongshu is not unbeatable - which is why companies like Alibaba, Tencent, and NetEase have since entered the seeding community layout.

For the newly launched NetEase Bee APP, Jingzhe Research Institute also downloaded and experienced it. From the user experience, it is still a social app rather than a seeding community.

Although in terms of basic product functions, NetEase Bee and Xiaohongshu both have a double-column waterfall layout and support images, texts, and short videos. However, in terms of details, the Bee APP emphasizes identity verification functions such as occupation and education level, while also supporting users to tip content, realizing direct monetization of content, reminiscent of Weibo.

In addition, in terms of content operation, NetEase Bee supports users to freely add rating topics and provides content lists tailored for young people, such as 'Which internship is the best for bulls and horses?', 'MBTI personality ratings', and 'Chinese singer rankings', which bear some resemblance to Hupu.

While it is unclear what expectations NetEase has for the Bee APP's performance in the seeding sector, it is evident from the operational details that NetEase Bee, like other content communities, still has a long way to go.