Policies Unveiled for Industrial 5G Standalone Private Networks Amidst Growing Enterprise Adoption

![]() 12/31 2024

12/31 2024

![]() 587

587

On December 26-27, the National Conference on Industrial and Information Technology was held, outlining key tasks for 2025, including the proposal to "promote the construction of industrial 5G standalone private networks." As the regulatory body for the information and communication industry, this initiative signifies that relevant policies, particularly on frequency allocation, for large industrial enterprises to build their own 5G private networks are imminent, heralding new opportunities for the 5G+Industrial Internet.

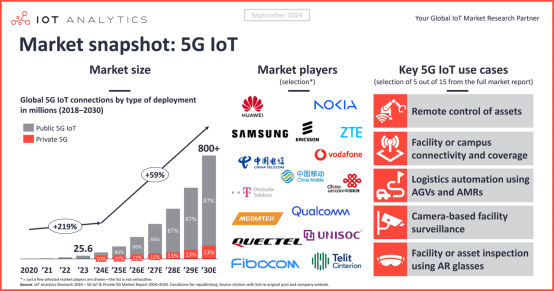

5G Standalone Private Network: A Cornerstone of Private Network Deployment

Since the commercialization of 5G, 5G private networks have garnered significant industry attention. Numerous vendors have entered the market, offering 5G private network products and solutions, achieving substantial deployment. According to IoT Analytics, by the end of 2023, the global number of cellular IoT connections surpassed 3.5 billion, with 5G IoT connections accounting for 0.7% or 25.6 million. Driven by the readiness of 5G infrastructure and the increasing demand for 5G IoT applications, the number of 5G IoT connections is projected to grow at a compound annual growth rate (CAGR) of 59% from 2024 to 2030, reaching over 800 million connections by 2030. In comparison, overall cellular IoT connections will grow at a CAGR of 15% during the same period.

Among these, IoT connections based on the 5G public network dominate, accounting for 95% of total 5G IoT connections as of the end of 2023, with an expected CAGR of 58% in the coming years. In contrast, 5G private networks accounted for 1.28 million IoT connections, or 5% of the total, in 2023. However, IoT Analytics predicts faster growth for 5G private networks, anticipating a CAGR of 65.4% from 2024 to 2030, reaching 13% of global 5G IoT connections by 2030, totaling 107 million.

From a regional perspective, China and Europe are expected to witness rapid growth in 5G private networks in the coming years, driven by non-industrial sectors such as ports, offices, and parks. However, the two regions have adopted different approaches: China favors 5G virtual private networks, while Europe embraces 5G standalone private networks. As of November 2024, China had constructed over 40,000 5G industry virtual private networks. Globally, 17 countries have allocated dedicated frequencies for 5G standalone private networks, nine of which are in Europe, including Belgium, the Netherlands, Croatia, Norway, Finland, Poland, France, the United Kingdom, and Germany. Germany, as the first country to issue 5G private network frequencies to industrial enterprises, has achieved widespread deployment.

Regarding expenditures, IoT Analytics categorizes them into three main areas: network infrastructure (55%), managed services (26%), and management software (19%). This indicates that the 5G private network market is still nascent, with a low proportion of expenditures on managed services and application software. However, by 2030, the shares of managed services and management software are anticipated to increase significantly.

While industrial manufacturing is a natural fit for 5G private networks, non-industrial facilities and parks have been the primary growth drivers to date. In 2023, ports, stadiums, commercial buildings, government offices, warehouses, and airports accounted for 75% of the global 5G private network market, while industrial and manufacturing sites accounted for 23%. By 2030, the industrial manufacturing sector is expected to grow to 28%, while the non-industrial sector will maintain a dominant position at 71%.

Intense Competition Among Various Stakeholders

The global 5G private network ecosystem is gradually evolving, particularly in equipment and systems. New players have been exploring this market for years, with telecommunication operators, communication equipment vendors, IT vendors, internet giants, manufacturing giants, and Open RAN enterprises all vying for a share. Despite the limited market space compared to the public network market, the intense competition ensures ongoing innovation and adaptation.

Telecommunication operators and communication equipment vendors, with their expertise in mobile communication construction and operation, are natural providers of 5G private network solutions. However, new entrants like internet giants and manufacturing giants, leveraging their advantages in vertical industry knowledge, cloud computing capabilities, and low-cost equipment, have significantly lowered the threshold for 5G private networks.

Siemens, a manufacturing giant, launched a 5G private network product in 2023, comprising a complete system including core network and radio access network components. Renowned for its OT-grade performance and SME-friendliness, Siemens' solution is designed for harsh industrial environments, emphasizing compactness and user-friendliness.

Internet giants such as AWS, Microsoft Azure, and Google Cloud have also entered the fray. AWS, for instance, offers AWS Private 5G, an end-to-end 5G private network solution that integrates network planning, integration, deployment, management, and expansion. Its pre-integration feature allows customers to deploy the network immediately upon equipment power-up, significantly reducing deployment time and complexity.

Frequency Policy Deregulation: The Key to 5G Standalone Private Network Development

Early in the 5G commercialization phase, Germany led the way by releasing frequency policies for enterprise private networks. Since then, many countries have accelerated spectrum liberalization, with regulators issuing or approving licenses for shared and locally dedicated spectrum.

Key frequency policies supporting 5G standalone private networks include the Citizens Broadband Radio Service (CBRS) in the US, Canada's Non-Competitive Local (NCL) licensing framework, the UK's shared and local access licensing model, Germany's 5G factory campus network licenses for 3.7-3.8 GHz and 28 GHz, France's vertical spectrum and sub-leasing arrangements, and more. These policies have fueled the growth of 5G private networks globally.

Market research firm SNS Telecom & IT projects global spending on dedicated LTE and 5G network infrastructure in vertical industries to grow at a CAGR of approximately 18% from 2023 to 2026, reaching over $6.4 billion by 2026. Of this, 40% will be invested in standalone dedicated 5G networks, poised to become the dominant wireless communication method supporting the ongoing manufacturing and industrial digitization and automation revolution.

In November 2022, China's Ministry of Industry and Information Technology issued the first national frequency license for a corporate 5G private network to the Commercial Aircraft Corporation of China, Ltd. (COMAC), marking a milestone in China's 5G private network development. The ministry's recent proposal to "promote the construction of industrial 5G standalone private networks" hints at the potential introduction of dedicated 5G frequency policies, paving the way for further growth in this sector.

This year, foreign media reported that Tesla was deploying a 5G private network at its Shanghai Gigafactory, raising questions about the network's form—virtual or standalone. If Tesla obtains a 5G private network frequency license, it would signify another important milestone in China's 5G private network development, hinting at more licenses to come.

Navigating the Implementation of 5G Standalone Private Network Policies

Standalone private networks are not new in China, with certain industries like railways, civil aviation, and public security already operating dedicated wireless communication networks. However, unlike these specialized sectors, industrial 5G private networks are more of a technological and commercial endeavor, requiring a different operational approach focused on fixed input-output, market competitiveness, and technological innovation.

Regulatory bodies have been cautious about dedicating frequency policies to different industrial enterprises due to potential frequency fragmentation and management challenges. However, as the industrial ecosystem matures, risks are declining, and it is anticipated that some industrial 5G standalone private networks will be implemented in 2025, further enriching cases of 5G empowering the real economy.