December CPI Release: Market Pressure Eases, Trump Trade Enters New Phase

![]() 01/16 2025

01/16 2025

![]() 513

513

Text & Image | Tangjie

The latest CPI release marked the best day for markets since the fourth quarter of 2023, with the below-expectation figure providing a much-needed reprieve amidst the ongoing downtrend.

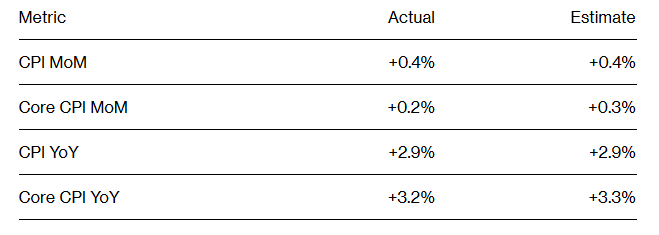

According to the US Bureau of Labor Statistics, the annual rate of unadjusted CPI for December stood at 2.9%, aligning with market expectations. The core CPI, excluding food and energy, was slightly lower than anticipated. Overall, the report indicated a resurgence in US inflation, but the small deviation from expectations spurred gains in the stock market.

There is a prevalent misconception across the Atlantic regarding the Fed's decision-making process: that 'data is everything' and can dictate market opportunities. However, the truth is that only the Fed knows its true intentions. When data supports their conclusions, they emphasize its importance; when it doesn't, they downplay its significance, be it employment, economic growth, or inflation.

On December 11, 2024, the Nasdaq surpassed its historic high of 20,000 points, accumulating a 30% gain for the year, necessitating a correction. Consequently, the market declined as employment data heated up, with significant adjustments in small tech stocks and Bitcoin stocks, which are more interest rate-sensitive. However, the drivers behind these stocks' rise remained unchanged, leading to a rebound from the bottom on January 13, even before the release of PPI and CPI data.

Reversals often commence when panic reaches its peak, which is currently the case with US stocks. Therefore, it's unnecessary to take this month's or next month's releases too seriously. On January 20, Trump will officially take office, and how he fulfills his election campaign promises and the impact of these fulfillments on the macroeconomy will be the real focus.

With these major factors yet to be determined, US stocks are likely to continue their current pattern of fluctuations. Individual themes, such as quantum computing, AI applications, and Bitcoin, have performed well this year. However, the broader market's performance will hinge on how Trump stirs things up.

01 CPI Unexpectedly Falls

Let's delve deeper into this CPI data:

The annual rate of unadjusted CPI for December was 2.9%, meeting market expectations and rising from 2.7% the previous month. This marked the third consecutive month of rebound and a new high since July 2024. The seasonally adjusted monthly CPI rate was 0.4%, higher than the expected 0.3% and equal to the previous month. The core CPI, excluding food and energy costs, rose 3.2% year-on-year, lower than the market expectation of 3.3%, a figure that had remained at 3.3% since September 2024.

Source: US Bureau of Labor Statistics

It's evident that the core CPI, excluding energy and food, significantly diverged from expectations, with housing making a 'significant contribution.' Housing costs, comprising about one-third of CPI, increased by 0.3% month-on-month, similar to the previous month. Additionally, recent international oil price fluctuations have been more dramatic, with larger increases. Without this factor, the overall CPI would likely have been lower than expected.

In the face of these inflation figures, even if future data shows inflation rising beyond expectations, it's unlikely to disrupt the current trend of US stocks rebounding from their decline. Furthermore, the December core PCE index, to be released at the end of this month, is highly likely to continue falling below expectations, following the core CPI's footsteps.

According to foreign economists' comments post-CPI release, several anticipate the December core PCE, due at the end of this month, to rise by 0.2% and decline slightly over the next two months, supporting the Fed's easing of policy at the March interest rate meeting. Simultaneously, data released alongside inflation showed that real hourly earnings increased by 1% year-on-year, the smallest annual increase since July 2024.

In the current macroeconomic context, a CPI report that is 'generally in line with expectations but slightly lower' is indeed a 'relief' for the market. Traders have swiftly acted, significantly advancing their bets on Fed rate cuts from September to July. At the very least, concerns about the Fed shifting to rate hikes can be allayed, and based on current data, the probability of another rate hike is almost nil.

However, we caution against over-optimism, as US stock volatility remains strong. Here are three factors to note:

First, individual data, even if it directly reflects inflation, won't immediately influence the Fed's decisions. Therefore, whether it's January or March, the Fed will likely adopt a cautious approach in the short term, leaving room for future fluctuations. Moreover, the market's pessimistic sentiment about a recession was vivid just over three months ago, so it's unwise to overly bet on one direction.

Second, this CPI report is the last inflation figure under the Biden administration, reflecting the 'last era,' irrespective of its merits. Trump, who will soon take office, is strongly associated with 'trade wars,' providing robust support for interest rates and the US dollar. The main market impact in the next stage will stem from him, with inflation figures perhaps not significantly disturbing the market.

Finally, such inflation figures aren't sufficient to make the Fed forget the job market's strong momentum. Conversely, they aren't enough to make the market anticipate more rate cuts in 2025. A series of subdued figures are needed to convince the market that 'the Fed believes inflation progress has resumed.'

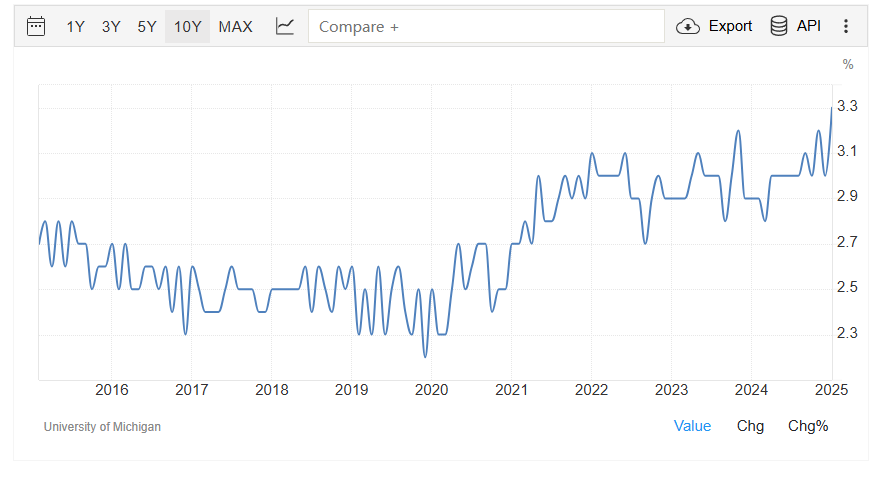

University of Michigan Consumer Inflation Expectations for the Next Five Years

A salient point is that if consumers anticipate future inflation to rise, they'll bring forward their consumption, adhering to the adage 'buy on the rise, not on the decline.' The University of Michigan's survey of US consumers' five-year inflation expectations recently reached a decade-high, even surpassing levels during the rapid inflation period in 2022, which isn't good news for inflation.

Therefore, not overly betting on one direction or expectation is the wisest choice for the coming period.

02 New Phase of Trump Trade

Over the past two months, the most crucial factor determining US stock direction has been the 'Trump Trade,' roughly divided into two phases.

The first phase was from Trump's official election as president to the Nasdaq hitting 20,000 points in early December. During this time, the theme centered more on the power transition itself, encompassing Musk's Tesla, Bitcoin themes supported by new financial system officials, and small and medium-sized enterprises favored by Trump. The market emphasized the positive rather than negative factors of Trump's ascension.

The second phase was from early December to Trump's inauguration, focusing more on the broader impacts of his ascension. In particular, the potential for Trump to implement widespread tariff increases and increased friction with global trading partners after taking office is likely to exacerbate US inflation, thereby suppressing both US stocks and bonds.

The third phase will commence after January 20, ushering the market into a new phase of 'Trump Trade.' During this phase, the market will pay closer attention to the specific implementation of Trump's policies and their actual economic impact.

First, fiscal policy will be the market's focus. The Trump administration may continue implementing large-scale fiscal stimulus plans, including tax cuts and increased infrastructure investment. These policies may stimulate economic growth and push stock markets up in the short term but may lead to a further fiscal deficit expansion in the long run, putting pressure on the US dollar and bond markets. It's crucial to monitor the details of Trump's fiscal policy and its impact on different industries.

Second, trade policy will also significantly impact the market. The Trump administration may pursue trade protectionist policies, increase tariffs, and restrict imports. Industries and companies reliant on exports may face greater challenges, while those gaining a larger domestic market share may benefit. It's essential to keep an eye on Trump's trade policy dynamics and its impact on related industries and companies.

Finally, another area requiring special attention is Trump's technology policy. During his term, he's likely to strengthen antitrust regulation of large technology companies while continuing to increase 'decoupling' in the technology sector, lifting restrictions on technology areas related to national security, such as drones, quantum computing, AI applications, energy technology, and autonomous driving, thereby fostering a rapid rise in 'American technological competitiveness.'

It's crucial to remember that unlike 2016, Trump is inheriting a vastly different America in 2025. In 2016, the country was at the beginning of a growth cycle; now, it's at the end, making direct comparisons or simply applying Trump 1.0 policy inclinations to the 2.0 era unfeasible.

For instance, compared to the 1.0 era, political divisions in the US are even more severe during Trump's 2.0 era. Even on the same issue—inflation (with a strict factual basis for judgment)—there are significant differences between the two parties.

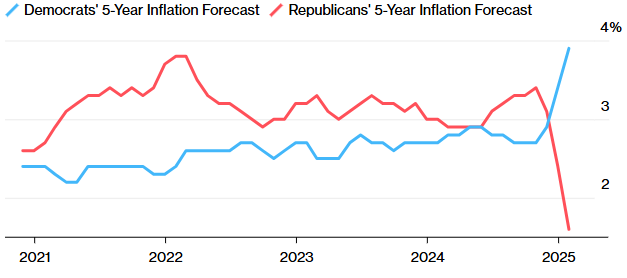

University of Michigan Republican and Democratic Inflation Expectations for the Next Five Years

This trend has one clear reason: politics. According to Democratic predictions, if prices rise by 4% over the next 12 months, it will mean interest rate hikes and the failure of Trump's growth agenda. Republican predictions, on the other hand, are outrageous—the last time inflation fell to 0.1% without a significant oil price crash (which has no basis now) was almost 70 years ago.

It's conceivable that under such divisions, expecting any economic coordination between the two parties is futile.

As another example, Trump is perceived as a decisive figure who means what he says, especially regarding tariffs and trade policy. However, recent reports indicate that Trump's economic team is discussing gradually raising tariffs month by month, a measured approach aimed at increasing bargaining chips while helping to avoid inflation surges. The specific measure involves setting a schedule of progressive tariffs increasing by about 2% to 5% each month.

Obviously, this is a product of compromise and a moderate plan. In line with Trump's boisterous demeanor, tariffs are merely a means, not an end. Trump aims to build a new America without the help of Europe and China, a distant goal.

03 Conclusion

On the day the inflation data was released, Israel and Hamas reached a ceasefire agreement, temporarily halting the Gaza Strip war. Qatari and US officials stated that the ceasefire would commence on Sunday and last for six weeks, with both sides releasing each other's hostages. Undoubtedly, though he hasn't yet taken office, Trump has demonstrated considerable influence in the negotiations between the two sides, evident from past negotiation histories between Israel and Hamas.

However, it's crucial to remember that, like US employment and inflation data, Trump's face also changes quickly, increasing the unpredictability of the macroeconomy and US stocks. For broad asset classes with hedging properties, such as US bonds, gold, and Bitcoin, Trump's unpredictability is generally good news. For US stocks, it depends on specific issues and ultimately on fundamentals and market sentiment.

Disclaimer: This article is for learning and exchange purposes only and does not constitute investment advice.