2025: E-commerce Rises Above the Shadows

![]() 01/24 2025

01/24 2025

![]() 529

529

In the enigmatic marine ecosystem, barnacles rank among the top fouling organisms.

They adhere in vast numbers to whales, sea turtles, and the undersides of ships and aquaculture cages. As barnacles accumulate, sea turtles' swimming speed declines, and the specter of mortality looms larger. When a ship's hull is targeted, barnacles transform into "fuel consumption assassins," further slowing down the vessel.

These images easily evoke memories of the "wool parties" in the e-commerce industry. They proliferate like "barnacles," exploiting loopholes in platform rules, such as unconditional refunds and freight insurance, causing immense distress to merchants. Especially from late 2023 to mid-2024, e-commerce entered a phase of chaotic internal competition, with the "user first" platform philosophy maliciously manipulated by wool parties, narrowing merchants' living space.

Some e-commerce platforms are not oblivious to this issue, but in an industry tending towards zero-sum games, consensus is hardest to achieve. Only when the industry begins to pursue sustainable development and a healthy business environment can merchants' rights be practically protected.

Signs of this consensus emerged in the second half of last year, and by early 2025, they had largely taken shape: nearly simultaneously, Taobao, Douyin, and Pinduoduo all announced plans to enhance mechanisms for protecting merchants' rights. If we examine the pace of progress and the level of detail in the measures announced, Taobao Tmall led the way in building this "defensive line."

This is understandable. Rather than attributing it to Taobao's platform consciousness, it is more accurate to say that merchants have always been the foundation of Taobao Tmall, and their fates are intertwined.

From an industry perspective, e-commerce platforms are accelerating their exit from the "shadows" and returning to the right path. Emphasizing merchants' demands and protecting their rights is poised to become the greatest certainty for e-commerce in 2025.

01

Taobao Tmall Intensifies Measures

The "Wool Party" Blacklist Finally Arrives

At the dawn of 2025, the relationship between e-commerce platforms and merchants entered a phase of humble listening—

Douyin E-commerce revealed plans to regularly hold merchant talks and exchange meetings to gather feedback; Pinduoduo announced the establishment of the "Merchant Rights Protection Committee" to comprehensively study merchant needs and gather feedback; Taobao Tmall went a step further by setting a goal to hold over 100 merchant opinion talks in 2025, engaging in extensive and detailed communication with merchants on advertising, marketing activities, industry rules, traffic mechanisms, and more.

Communication is not the goal; the crux lies in e-commerce platforms re-evaluating how to balance merchants' and consumers' interests and how to more effectively protect merchants' rights.

In the past, driven by the "user first" philosophy, various e-commerce platforms implemented measures like unconditional refunds and strengthened freight insurance. Some professional wool parties exploited loopholes in platform rules, using unconditional refunds for "zero-yuan purchases" and "discount purchasing agents," or systematically abusing freight insurance. These chronic industry issues were artificially amplified in a short period, intensifying conflicts between merchants and users, as well as between merchants and platforms.

Last year, some merchants complained to "Noise Reduction NoNoise" that for unconditional refunds where the logistics status showed the goods had not yet arrived, the platform provided instant refunds. Encountering wool parties exploiting the time difference, "there was no way to get angry."

Another chronic issue plaguing merchants is the loophole in freight insurance. In January 2024, police in Yongxing County, Chenzhou City, Hunan Province, solved a case of online insurance fraud. The suspects used five online shopping accounts to apply for reimbursement of freight insurance over 30,000 times within half a year, earning at least an 8-yuan profit per return, illegally obtaining over 200,000 yuan.

Just like ships with moderate barnacle accumulation, which consume over 30% more fuel to reach their destination, the losses caused by wool parties ultimately translate into operating costs for merchants and purchase costs for end consumers. A Shanghai merchant once revealed that for the clothing category their store is in, freight insurance was around one yuan in 2023 but surged to four and a half yuan by August 2024.

Considering the macro situation where the year-on-year growth rate of online retail sales of physical goods fell from 8.4% the previous year to 6.5% in 2024, wool parties undoubtedly increased merchants' operating pressure and may have been the final straw.

E-commerce platforms have also recognized the risks posed by disorder. In July last year, Taobao took the lead in unbinding "unconditional refunds" for stores with high experience scores and, in September, introduced the "Refund Guarantee" to reduce after-sales costs in response to the high freight insurance issue.

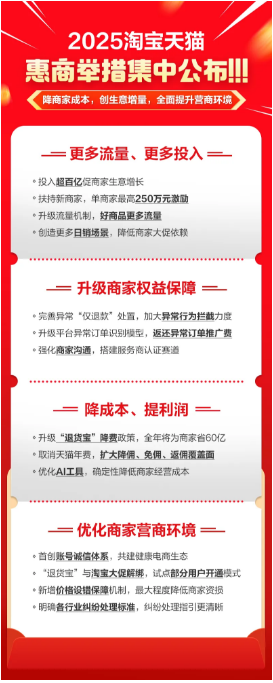

On January 20th of this year, Taobao Tmall announced 12 merchant-benefiting measures for 2025 all at once. Among these, protecting merchants' rights emerged as one of the most critical directions. From the refined specific measures, we can glimpse the general approach of mainstream e-commerce platforms to tackle chronic industry issues and improve the business environment—

Improve the handling mechanism for abnormal "unconditional refunds": For good service merchants, it does not proactively intervene to support unconditional refunds, but allows the seller to negotiate with the consumer first; for all merchants, Taobao Tmall provides a quick appeal channel, and after the merchant's appeal is approved, the platform will compensate the merchant for the loss; increase the interception of abnormal behavior, and for abnormal orders, Alimama will automatically return the promotion fee.

Establish the first account integrity system in the e-commerce industry (Note: in simple terms, it is the "wool party" blacklist): For behaviors such as abnormal unconditional refunds, return substitutions, false returns, and using online/Photoshopped images, merchants can record them into the account integrity system through complaint feedback, and the platform will reject after-sales service, impose purchase restrictions on a single store or the platform, etc., based on the situation. The platform will also provide one-click early warning for return risks.

Pilot the "Refund Guarantee" where merchants can choose to provide return freight coverage for some users. The "Refund Guarantee" is unbound from Taobao promotions.

Behind each small point in the new measures, there corresponds a specific pain point for merchants. For example, regarding the definition, interception, punishment of abnormal unconditional refunds, and merchant appeals, the latest handling mechanism is clearly more flexible and fair, minimizing merchant losses; the account integrity system is responsible for blocking the fraud space of wool parties; the option to pilot the "Refund Guarantee" is given to merchants, meaning merchants have the right to reduce freight discount services for users with high return rates or marked as abnormal.

It is worth noting that the binding of promotions and freight insurance (upgraded to "Refund Guarantee" last year) has also been significantly optimized this time.

From a consumer perspective, having freight insurance during promotions allows for worry-free shopping; from a platform perspective, platforms use promotional traffic to nurture merchants and naturally hope that consumers have a better service experience; but in the current situation of increasing return rates across the industry, binding the two may also mean that merchants, especially small and medium-sized merchants, have to pay higher costs.

From the changes in the above rules, it is evident that Taobao Tmall has more considerations in balancing the interests of merchants and consumers. It now seems that wherever merchants complain, the platform makes changes accordingly. Duan Chuchu, President of the Taobao Platform Business Department, stated before the 2024 Double 11 that there were not many constraints in solving problems, "We will do what consumers and merchants think is good."

The demands of e-commerce platforms are also clear: to create a healthier business environment, ultimately reducing costs for merchants and driving business growth. According to Taobao Tmall's estimates, just upgrading the "Refund Guarantee" fee reduction policy alone can save merchants 6 billion yuan throughout the year.

02

The Entire Industry Focuses on Value Return

This movement to add a "defensive line" for merchants' rights started with Taobao but is not limited to Taobao.

Led by top platforms, as other e-commerce platforms successively refine measures to protect merchants' rights, the industry has begun to transition from a period of unbridled internal competition to a new stage of value return, shifting from the pursuit of extreme low prices and absolute order volumes to the pursuit of long-term operation and high-quality development, and from one-sided emphasis on user experience to balancing merchant satisfaction and merchant experience.

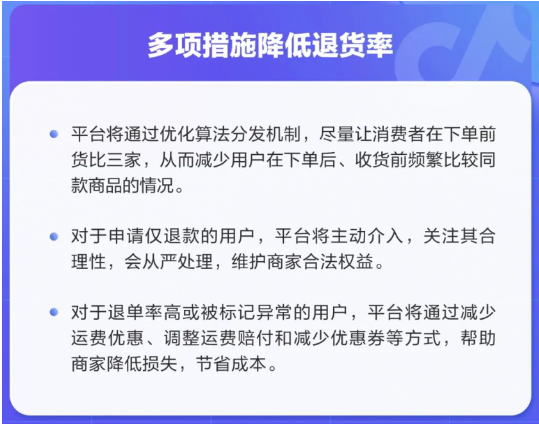

For example, Douyin E-commerce plans to reduce the return rate by optimizing the algorithm distribution mechanism, trying to allow consumers to compare prices before placing an order, thereby reducing the frequency of consumers comparing the same products after placing an order and before receiving them. For users with high return rates or those marked as abnormal, the platform will reduce coupons and adjust freight compensation.

Image source: Douyin E-commerce official public account

Pinduoduo, which pioneered the unconditional refund strategy in China, has also begun to no longer limit the number of appeals that merchants can make for abnormal orders and malicious complaint orders.

It is crucial to note that during the industry's collective shift, e-commerce platforms need to proactively assume the responsibility of ecological leaders. While continuously introducing and upgrading rules and measures to realign the relationship between users and merchants and resolve conflicts between merchants and platforms, we observe that top platforms are also providing merchants with growth guidance to escape low-price internal competition.

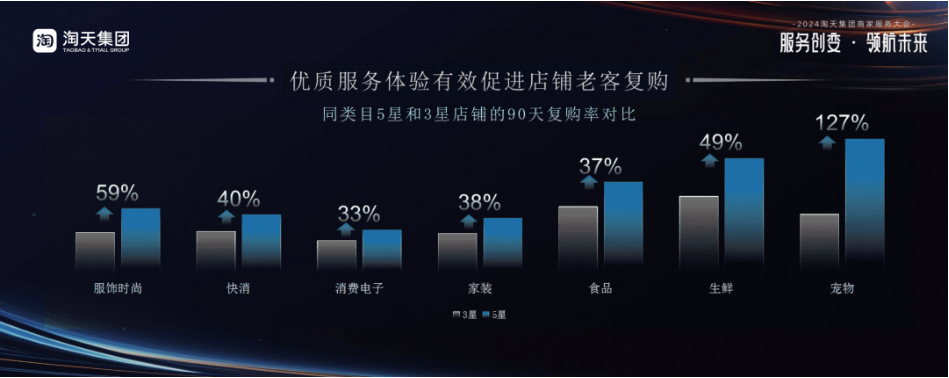

For example, in addition to planning to invest over 10 billion yuan to help merchants grow their businesses, Taobao Tmall continues to strengthen the logic that good service equals good business, providing more traffic support to merchants with high-quality services by linking store experience scores with traffic; upgrading search, recommendation, and traffic mechanisms to optimize the matching of "people and products," allowing good products to directly obtain better and more traffic.

The design intent of these two traffic distribution strategies is apparent—to make quality and service the core competitiveness of merchants again. After all, in the "human, product, place" framework, products and people are Taobao's strengths.

According to the latest data, in the pet category on Taobao Tmall, the repurchase rate of 5-star stores can be 127% higher than that of 3-star stores.

Additionally, according to Mr. Hou, the owner of a 12-year-old Taobao store specializing in gift boxes and packaging bags for enterprises, with its products and services, even without participating in promotions, the store's repurchase rate from regular customers can stably remain above 50% throughout the year. The return rate is also low, with returns after shipment accounting for only 1% to 5% of the total number of cancellations.

These operating data constitute a positive signal: on the basis of optimizing the business environment, some merchants can achieve sustainable growth through good service.

Business growth, in turn, brings platform increment. According to Tmall's 2024 annual merchant store opening report, the number of new merchants joining Tmall last year increased by 83% year-on-year. Within one year of joining Tmall, 32 brands achieved transaction volumes exceeding 100 million yuan, 733 brands exceeded 10 million yuan, and 1,600 brands exceeded 5 million yuan.

In fact, as early as the second half of 2024, a primary market investor revealed that based on feedback from several consumer brands during the 618 period, they judged that Tmall was bottoming out and rebounding because merchants found that growth on Taobao Tmall was not bad, better than other platforms, "the customer profile is there," and some brand merchants' confidence in growth trends increased.

Looking back now, individual business growth cannot be divorced from the strategic guidance of platforms returning to long-term value. Taobao Tmall took the lead in reflecting on and adjusting its platform positioning, which also has a demonstrative effect on the entire e-commerce industry. From initially building infrastructure for the e-commerce industry and establishing industry operating norms, to now leading the way in optimizing the business environment and formulating detailed rules to benefit merchants, the role of top platforms is akin to a coordinate system, guiding the industry back on track.

At the dawn of 2025, within the domestic e-commerce landscape, a consensus is crystallizing amidst the confluence of regulatory pressures and stakeholder dynamics. The game of relentless internal competition yields no winners, and a zero-sum mindset falls short of addressing the imperative for growth quality, let alone aligning with consumers' aspirations for a superior quality of life.

Rather than blindly indulging in homogeneous rivalries, it is prudent to revert to our core principles. By offering merchants a sense of certainty, bolstering their operational confidence, and amplifying the distinctive value of our ecosystem, we can ultimately achieve the philosophy of "user first".

After all, as everyday consumers, we yearn not only for seamless and convenient shopping experiences but, more fundamentally, for products that offer excellent value for money and services of the highest caliber. These aspirations are deeply intertwined with merchants' commitment to sustainable operations. Consequently, platforms must strive to provide avenues for growth, fostering a virtuous cycle.

As the industry collectively embraces value-driven competition, the new year heralds anticipation that more brands and merchants will harness platform initiatives to their advantage, capitalizing on the developmental opportunities that lie ahead.