2025: E-commerce Strives for a "New Equilibrium"

![]() 01/25 2025

01/25 2025

![]() 589

589

Taobao Leads by Example in Protecting Merchant Rights and Tackling Refund Fraudsters

As the Chinese New Year approaches, e-commerce merchant Wu Tianling is inundated with work, striving to stockpile sufficient inventory for the festive season. Reflecting on 2024, he finally feels a sense of relief.

"During the first half of last year, it was incredibly tough. Many people are aware of the 'Refund Only' option, but they don't realize how excessive some can be. Not to mention those who deliberately scam; some even boldly tell the store's customer service, 'Just give me a pack of cigarettes, and I won't cause trouble for your store.' Isn't that extortion?" Wu Tianling recalls the precarious situation from the first half of 2024, which was on the brink of collapse.

In the second half of the year, Taobao spearheaded the easing of the "Refund Only" policy, followed by JD.com, Douyin, and Pinduoduo. As more attention was paid to issues like "Refund Only" and shipping insurance abuse, e-commerce platforms successively implemented measures, gradually alleviating the situation. By Double 11, many merchants expressed gratitude, as the situation had significantly improved. "Fortunately, we made it to Double 11. Although there are still some refund fraudsters, it's much better than before."

However, when discussing expectations for 2025, Wu Tianling admitted that he still hopes the platform can further address the remaining issues related to refund fraudsters.

Entering 2025, Taobao and Tmall have collectively announced 12 merchant-friendly measures, including refining the handling mechanism for abnormal "Refund Only" cases, refunding promotional fees for irregular orders, and initiating an account integrity system to protect merchant rights and tackle the issue of "refund fraudsters".

In an era of resilience, survival is paramount. Having weathered the challenging year of 2024 for e-commerce merchants, those still standing are the "winners". Will e-commerce perform better in 2025 after platforms find a new equilibrium between merchants and users?

01

2024: A Rocky Start but a Robust Finish

As Lao Tzu said, "Those who are content are rich; those who persevere have ambition." For merchants who once rode the wave of rapid e-commerce growth, maintaining high growth rates and past glories in the difficult e-commerce landscape of recent years has proven to be an uphill battle.

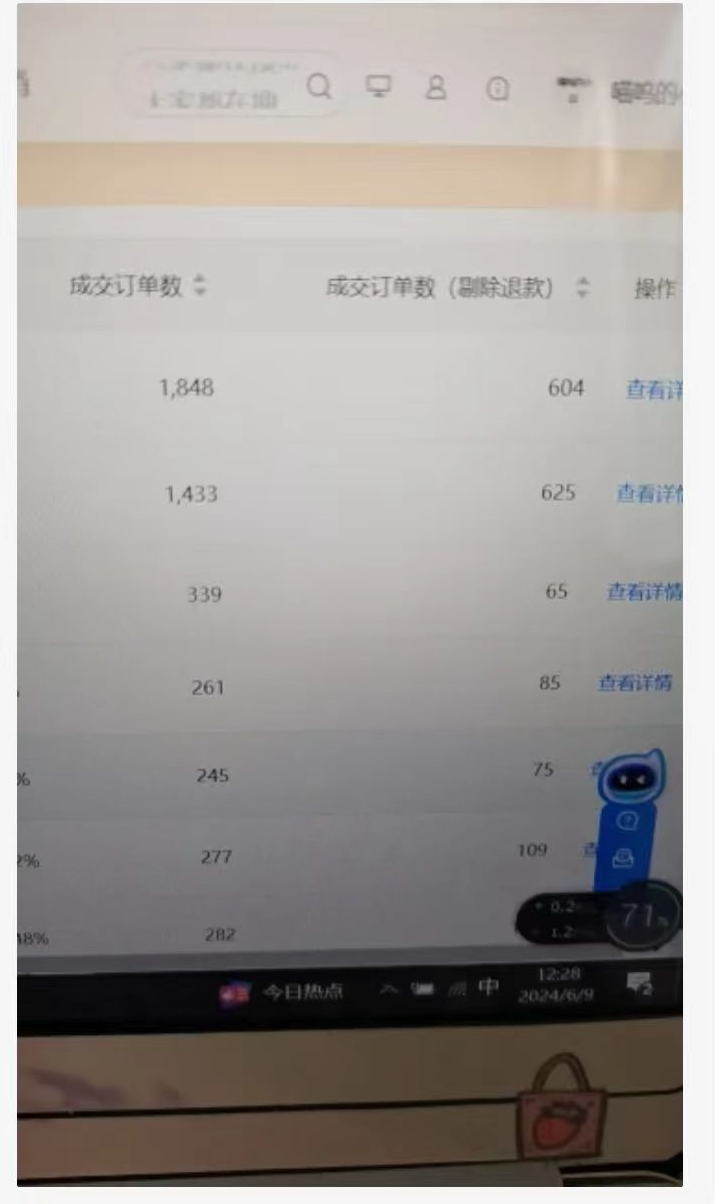

Like Wu Tianling, Jin Hanyu recalls the first half of 2024 as a lingering "nightmare" for his women's clothing online store, which experienced a surge in "Refund Only" cases.

According to his description, "The store's refund rate was often 70% or even 80%, with 'Refund Only' cases sometimes accounting for half." Throughout the first half of the year, if it weren't for his savings, his women's clothing store would have closed down long ago.

Image Source: Xiaohongshu

"Even if it's not just a refund, the shipping insurance for returns is enough to make you want to despair," he said, feeling helpless and frustrated every time a customer requested a return and applied for shipping insurance compensation.

The difficulties encountered by these merchants are just a microcosm of the broader merchant community. Platform rules such as "Refund Only" and "Shipping Insurance" have been exploited by a large number of refund fraudsters. Some have even formed communities with tens or hundreds of members, creating a "refund fraud industry chain" through courses.

In September 2024, the People's Court of Huyi District, Xi'an, heard a case involving a user who requested a "Refund Only" without returning the goods after an online purchase. Zheng Yu (pseudonym) purchased a water pump on an online shopping platform and requested a refund only due to "model mismatch," which was successfully processed by the platform. The merchant, Wang, repeatedly requested that Zheng Yu return the water pump, but received no response. In frustration, Wang sued Zheng Yu in court.

One of the considerations of the court in this case was that, from a moral perspective, the "Refund Only" approach not only undermines the principle of honest and trustworthy transactions but also adversely affects the business environment of the online market.

Moreover, incidents such as "a washing machine worth 1,400 yuan being refunded without return," "clothing purchased online for 11 yuan requiring the merchant to compensate 800 yuan after a refund," and "20,000 merchants jointly resisting unreasonable refund-only requests" occurred frequently.

This situation persisted until 618 in 2024.

The "coldest 618 in history" arrived. Not only did the sales volume feel bleak, making e-commerce merchants and platforms feel the true sense of desolation, but the continuous "Refund Only" cases and high rates of return refunds during the promotional period also led to product damage, making merchants feel overwhelmed. The continuous imbalance between users and merchants was accompanied by internal competition and distortion within the overall e-commerce ecosystem.

Changes emerged in July when Taobao and Tmall took the lead in easing the "Refund Only" policy. For merchants with a store experience score of 4.8 or above, Taobao granted them the autonomy to handle returns and refunds. The better the merchant's service quality, the less likely they are to need to offer "Refund Only." For high-value "Refund Only" cases such as the "1,400-yuan washing machine refund," Taobao also proposed a solution involving manual review by customer service.

After Taobao took the lead, JD.com, Douyin, and Pinduoduo eventually followed suit. They either eased the "Refund Only" policy or "abolished" the original policy, intensifying shipping insurance for refunds to continue pleasing users while shifting towards a more balanced approach that optimizes the service and quality of the business environment for both buyers and sellers.

Jin Hanyu felt that "starting from around September, the pressure of 'Refund Only' cases in the store gradually eased."

Zixu, a 1998-born entrepreneur who experienced a dramatic rise and fall from annual transactions exceeding 100 million yuan to millions of yuan in debt, shares a similar sentiment. Having witnessed the explosive growth of the e-commerce bonus era and experienced the glory of monthly earnings of millions, his experiences from 2023 to the first half of 2024 taught him the business secrets of the era of resilience.

"This year has been tough. Due to fabric issues, the return rate and product return rate for custom shark pants were alarmingly high. Promotional fees were like a bottomless pit, with constant investments leading to losses exceeding one million yuan. The pressure was too great, causing me to suffer from insomnia all night."

This Double 11, Zixu sacrificed some profit to improve the overall ranking and attract new customers to his store. Instead of competing on price, he focused on "enhancing service," resulting in his Taobao store experience score rising from 4.4 to 4.8, with a 200% increase in store traffic, achieving overtaking in a curve.

Triggering large-scale traffic through the experience score and reducing operating costs have attracted much attention in Zixu's merchant circle, "Many peers have come to me for advice, and I've met some new friends."

02

From 40 to 70: Merchants Crave More "Benefits"

Although e-commerce platforms are striving to improve the business environment for merchants, many feel there are still areas worth optimizing.

In the first half of last year, Xiao Ye, the head of a men's wear brand, discovered that the return cost of his store had increased from an initial 0.9 yuan per order to a maximum of 4.4 yuan per order. "It's simply impossible not to buy shipping insurance. The sales revenue minus the shipping cost can't even cover it."

However, with Taobao's introduction of Refund Assurance for shipping insurance in the second half of the year, Xiao Ye also joined the "trial group." "My return cost dropped from 4.4 yuan to 3.4 yuan per order, saving about a quarter of the shipping cost."

The improvement is tangible. As a result, he has higher expectations for 2025. After all, compared to 0.9 yuan per order, the burden of 3.4 yuan per order is still considerable. In his opinion, "If I had to score it, I'd say it's gone from 40 to 70, but it should be even better."

Image Source: Xiaohongshu

Li Weisong said that the few yuan of shipping insurance is "dwarfed" compared to the frequent return losses he experiences in his e-commerce business. He provides custom tile services on the platform, typically shipping after confirming the model. Sometimes customers receive the goods but don't like them. Under the return rules in the first half of last year, returns were easy, and the platform often deemed it the merchant's fault, requiring them to bear the shipping cost.

In one of his experiences, "The total payment was only 2,900 yuan, but the shipping cost I had to bear for the return was 3,600 yuan. It would have been better to just give it to the customer." Li Weisong hopes that in the new year, measures for refunds and returns for some extreme customers can be more "stringent".

For Zhuang Mei, who only entered the e-commerce industry in the second half of the year, being in an industry with a lower return rate, joining "Refund Assurance" reduced her costs by about 2 yuan per order. Although she didn't experience the "darkest" moments of the first half of the year, she also feels there's plenty of room for improvement in the current e-commerce business environment.

"Sometimes, even though we know it's an abnormal order, we still have to ship it. If we don't, we'll be penalized, and we're afraid of making a mistake and offending the customer." She once lost several hundred yuan due to a mispriced order. When she contacted the user, they completely ignored her.

In August last year, "Xiaotian'e Dongshan Exclusive Store" issued a notice stating that due to insufficient understanding of platform activity rules by the new operation personnel, all washing machine products in the store were sold at prices far below market value. Within 20 minutes of discovering the issue, nearly 40,000 orders were placed, involving an amount of nearly 40 million yuan and a goods value exceeding 70 million yuan, resulting in direct economic losses of over 30 million yuan. What's more, some consumers placed orders four to five times and sought to resell them, further exacerbating the losses. Many stores could not bear the burden, and remedial measures were insufficient, leading to the sad closure of stores.

03

2025: Platforms Seek a New Equilibrium for Users and Merchants

In recent years, participants in e-commerce have generally felt that the input-output ratio is not as good as it used to be. On the surface, the contradiction mainly focuses on users and merchants. From the merchant's perspective, the emergence of "Refund Only" seems to satisfy consumers' "bullying" demands. From the user's perspective, complex discount and return processes seem like obstacles intentionally set by merchants.

However, from the perspective of industry integration mechanisms, the root of industry difficulties lies neither in unreasonable users nor in merchants who are struggling but unwilling to give up profits. Instead, it is the deterioration of e-commerce operating rules and ecological logic under the changing overall economic environment.

Image Source: "Provisional Regulations on Combating Unfair Competition on the Internet"

Changes in the e-commerce ecosystem are ongoing, and the relationship between platforms, merchants, and users is also finding a new equilibrium.

When chatting with many merchants, their common sentiment is, "If it's really the store's fault, we have no problem taking responsibility. But in the past, platform rules unduly favored users, and some picky and malicious users were condoned, which is truly upsetting."

In addition to refining the handling mechanism for abnormal "Refund Only" cases and strengthening the interception of abnormal behavior, granting merchants more autonomy is also an important aspect for platforms to improve the overall e-commerce ecosystem and re-establish a balance between buyers and sellers.

Among them, Taobao has set up an experience score threshold system. For merchants with a comprehensive store experience score of 4.8 or above, the platform no longer actively intervenes to support consumers' "Refund Only" requests after receiving the goods, instead adjusting it to be handled first through negotiation between the merchant and the consumer. Starting in June last year, Taobao and Tmall completely replaced the DSR (Detailed Seller Ratings) with the PXI (Product Experience Index) as an indicator affecting search weight. Previously, store scores were directly linked to GMV, but now various indicators of merchant service to consumers have been added, such as logistics timeliness, positive review rate, and return and refund rate.

Subsequently, JD.com also chose to follow suit, replacing the "Store Star Rating" with the "Comprehensive Experience Score," with Pinduoduo and Douyin following in succession.

In 2025, Taobao and Tmall further intensified their efforts by piloting the option for merchants to provide return shipping services for some users within "Refund Assurance." At the same time, "Refund Assurance" was decoupled from promotional events, allowing merchants to choose whether to use the "Refund Assurance" product during platform promotions. This gives merchants more diverse options.

On the user side, the platforms do not seem to be in a hurry to reduce the various services that have made users happy for a long time, and they are more cautious in adjusting user rules.

However, caution does not mean inaction. Some e-commerce platform rules have begun to distinguish between different types of users, and platform rules have been formulated in more detail.

What particularly garnered industry attention was Taobao and Tmall's announcement, in a centralized manner, that they would establish the first user account integrity system within the e-commerce industry. Specifically, merchants on the platform can report and provide feedback on behaviors such as abnormal "Refund Only" requests, return swaps, false returns, and the use of online/photoshopped images. These users will then be included in the account integrity system. Depending on the severity of the situation, the platform may reject after-sales service requests, restrict purchases in individual stores or across the platform, among other measures. For professional fraudsters, Taobao and Tmall will also cooperate with relevant authorities to refer them to the judicial system.

By severely punishing typical fraudsters and granting merchants the right to clearly mark and report malicious user behavior, this initiative will not hinder the consumption and shopping experience of ordinary e-commerce users but will effectively deter user-side violations. This allows the relationship between users and merchants to evolve into a virtuous cycle of interaction.

From a broader industry perspective, detailed user type divisions and minimizing the impact of violations like "fraudulent behavior" on merchants should be a crucial strategy for major e-commerce platforms to enhance the user-side business environment in 2025.

04

Conclusion

The evolution of the overall e-commerce ecosystem towards a healthier trajectory does not happen overnight. Nor can platforms instantaneously achieve a new balance between merchants and users through rule adjustments alone.

Leading platforms like Taobao have taken the initiative to correct deviations, prompting other platforms to follow suit in governance efforts. Against the current backdrop, improvements in the merchant business environment will not be swift and dramatic but are valuable for their consistency and meticulousness.

The sentiments of both merchants and users will shift subtly over time.

According to the "2022 Double 11 E-commerce Financial Services Report," small and medium-sized merchants account for over 80% of China's e-commerce market. With the growing popularity of the "personal store" concept in the past two years, this percentage is expected to increase further.

Whether merchants or users, the vast majority are ordinary individuals. Fraudsters and illegal merchant users represent a small minority. Under more robust and reasonable platform rules and a legal market environment, illegal and gray industries will eventually fade away.